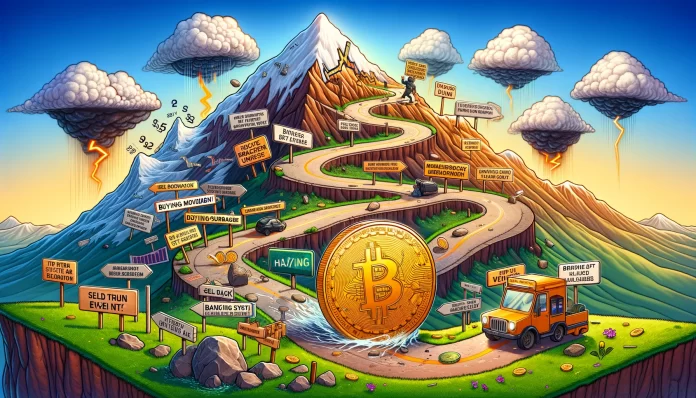

DecenTrader, a widely known buying and selling platform, lately shared an replace on Bitcoin’s future trajectory on February 2nd. BTC 0.79% (BTC) worth subsequent yr. In line with their evaluation, Bitcoin is on observe to succeed in an all-time excessive in 2024, following the sample of the earlier yr when the block subsidy was halved. Nonetheless, on the best way to this stage, chances are you’ll encounter obstacles that may check the resilience of buyers.

Evaluation reveals that Bitcoin worth could expertise a interval of sideways fluctuations this month because the market adjusts and prepares for the upcoming block subsidy halving. . This occasion is anticipated to happen round April 18, 2024. Traditionally, it has influenced the worth of Bitcoin. Filbfilb, CEO and co-founder of DecenTraders, predicts a surge in shopping for exercise two months earlier than the halving, which is in line with the tendencies noticed within the cycle.

This anticipated improve in shopping for stress may very well be adopted by a “information promoting occasion” paying homage to what occurred when the Spot Bitcoin Trade Traded Fund (ETF) was launched in January of this yr.

FilbFilb gives particulars on a timeline that implies Bitcoin could undergo a 30-day correction interval earlier than FOMO (concern of lacking out) causes demand to surge because the halving approaches.

Regardless of short-term challenges, there are prospects for Bitcoin post-halving. Historic patterns point out that Bitcoin may enter a worth discovery part that might attain all-time highs in the direction of the top of 2024. This development is in line with what was noticed throughout the 2020 halving, when Bitcoin took roughly 220 to 240 days to peak.

The evaluation additionally takes under consideration components that affect Bitcoin's worth, resembling geopolitical circumstances that may trigger volatility available in the market. These components and considerations inside the US banking system spotlight how complicated it’s to foretell Bitcoin's short-term actions.

Filbfilbs' commentary gives a well-founded perspective amid hypothesis about how Bitcoin will fare within the lead-up to the halving.

He advises towards expectations and warning, reminding buyers of Bitcoin's cyclical market dynamics, which have traditionally been influenced by each investor sentiment and exterior components.

The subsequent few months are anticipated to be necessary for Bitcoin because the cryptocurrency group takes discover. Halving occasions are notably necessary as they’ll affirm or query established market tendencies.