Hong Kong, Hong Kong, February 6, 2024, Chainwire

After a interval of calm, the Ethereum ecosystem is slowly regaining momentum with the rise of re-staking. As an skilled DeFi participant, DeSyn has constantly targeted on growing the Ethereum community. Beforehand, DeSyn introduced that primarily based on his eager market insights he created the 3x ETH Leveraged ETF with the goal of selling the range of Ethereum community merchandise and serving to customers maximize their income inside the Ethereum ecosystem. We’ve began the launch.

In the present day, DeSyn publicizes the launch of the DeSyn ETH Restake Fund I (3x Factors), devoted to becoming a member of this business revolution and collectively shaping the way forward for DeFi alongside ecosystems like Eigenlayer and Renzo. Masu.

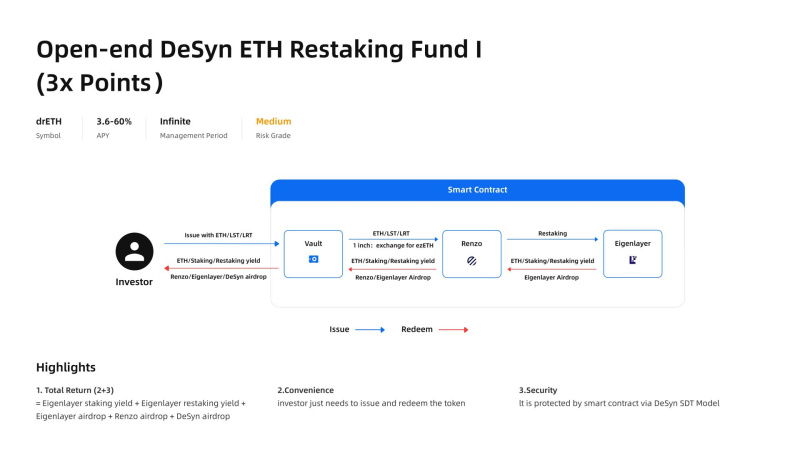

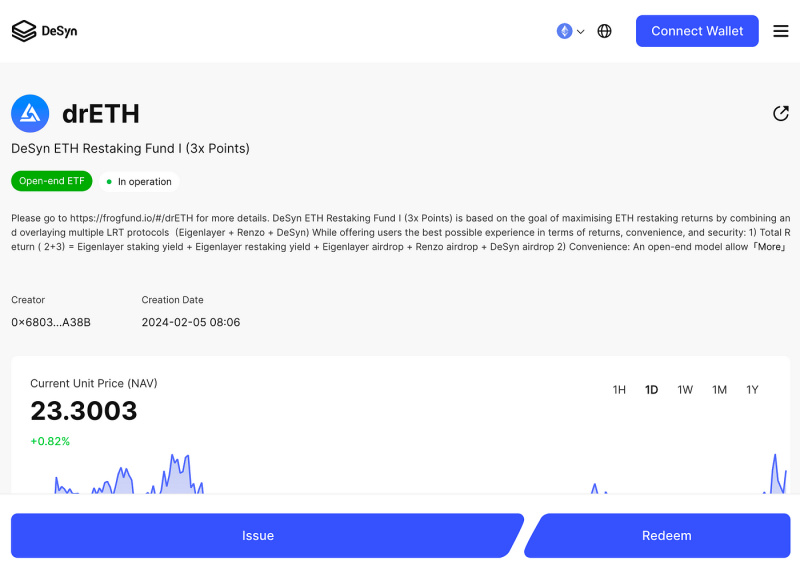

DeSyn ETH Restake Fund I (3x Factors), abbreviated as drETH, is an open-end fund product launched by Little Frog, an expert decentralized asset administration DAO group primarily based on the infrastructure of the DeSyn platform. This product integrates DeSyn and his two different extremely acclaimed restaking platforms, Eigenlayer and Renzo. Customers can stake ETH, stETH, wETH, and ezETH by their DeSyn platform. The fund helps on-demand withdrawals and presents the present APY of LST and LRT and 3x yield expectations of Eigenlayer, Renzo, and DeSyn. At the moment, the APY for this fund ranges from 3.6% to 60%. Relating to safety, DeSyn solemnly declares that each one contract codes have undergone safety audits to make sure the security of person property.

https://little-frog.gitbook.io/little-frog/merchandise/open-end-desyn-eth-restaking-fund-i-3x-points

How do I do a retake?

Customers can entry the DeSyn ETH Restaking Fund I (3x Factors) issuance by going to the Desyn web site and choosing the “Restaking” possibility. As soon as chosen, the person could have the chance to acquire drETH with the potential for her 3x revenue.

https://www.desyn.io/#/pool/0x8F92265FE1F875d1985cD9D4275dd4Cfec9eb1E7

Enhanced incentives with triple level staking by DeSyn

As talked about earlier, in the event you select this fund, you not solely have the potential to earn fundamental LST and LRT returns, however you additionally get 3x factors from Eigenlayer, Renzo, and DeSyn.

DeSyn is dedicated to maximizing incentives for staking customers. From February 6, 2024 onwards, customers collaborating on this fund will have the ability to earn corresponding factors relying on their staking quantity and period.

- DeSyn Factors Calculation Method: DeSyn Factors = (Quantity of LST) * Variety of Staking Days * 10,000

- The Eigenlayer Factors Information may be discovered right here.

- You possibly can view the Renzo Level Information right here.

EigenLayer: Bettering Ethereum Safety with Restaking

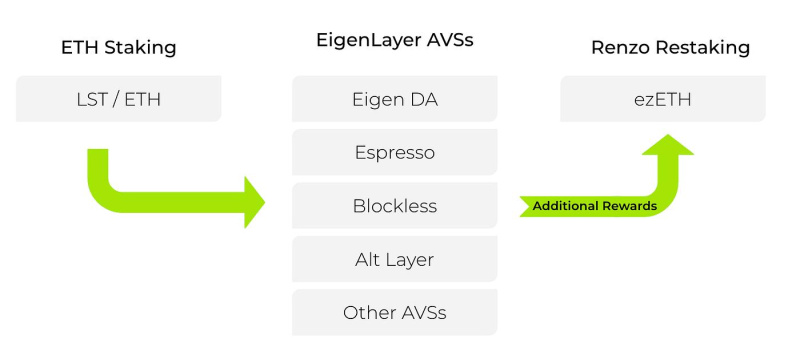

EigenLayer is a protocol constructed on Ethereum that introduces a brand new elementary in cryptoeconomic safety: restaking. This primitive permits the reuse of his ETH within the consensus layer. Customers who stake ETH natively or with Liquid Staking Tokens (LST) can opt-in to EigenLayer sensible contracts to re-stake ETH or LST and lengthen and add crypto-economic safety to extra purposes on the community. You possibly can earn rewards.

Customers can go to EigenLayer's official web site to be taught extra.

Renzo: Pioneering retaking on EigenLayer mainnet

Renzo is the primary native re-staking protocol to be launched on the EigenLayer mainnet. EigenLayer won’t start defending Actively Validated Companies (AVS), or EigenDA, till mid-2024, however it’s accepting deposits. Liquid Staking Tokens (LST) deposits are capped. Nonetheless, whereas native ETH deposits haven’t any cap, they’re very tough to entry for many customers. A person should personal his 32 ETH and run his Ethereum node built-in with EigenLayer with a view to run EigenPods.

Customers can go to Renzo's official web site to be taught extra.

About Desine

The DeSyn Protocol is an modern decentralized asset administration infrastructure on the Internet 3 that enables customers to create personalized pool-based property utilizing varied on-chain property (tokens, NFTs, derivatives, and many others.) through sensible contracts. Lets you create and handle your portfolio securely and transparently.

For extra info, please go to DeSyn.

contact

Decin staff

DeSyn protocol

(electronic mail protected)

Comments are closed.