EigenLayer, an Ethereum-based restaking protocol, has surged previous Uniswap, probably the most dominant decentralized alternate (DEX) on the Ethereum community, by way of whole worth locked (TVL).

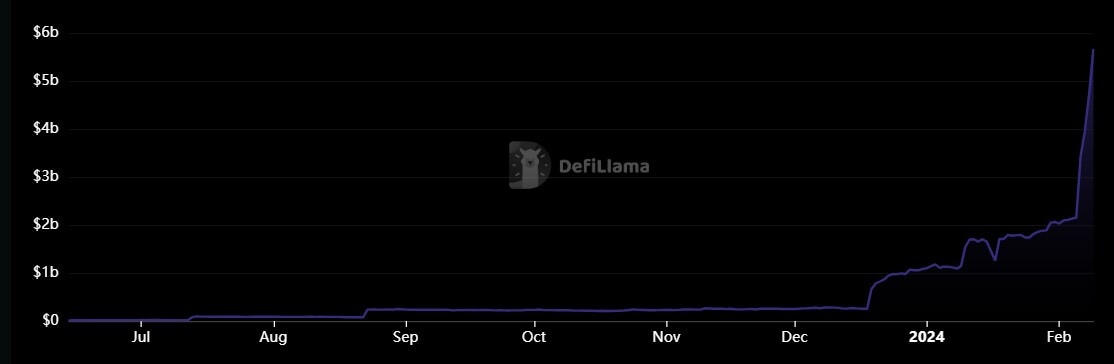

EigenLayer has emerged because the best-performing decentralized finance (DeFi) protocol over the previous month, in accordance with information from DeFillama. Its TVL has soared 171% up to now seven days alone, reaching $5.67 billion, solidifying its place because the fifth largest DeFi protocol.

In distinction, Uniswap's TVL elevated by simply 6% to $4.31 billion over the identical interval. Different outstanding HeFi protocols resembling Lido, Aave, and Maker additionally recorded comparatively modest development charges of lower than 10%.

In the meantime, EigenLayer's speedy improve comes as staked ETH elevated to an all-time excessive of over 29 million tokens regardless of a latest sale by defunct crypto financier Celsius. In accordance with information shared by Nansen, crypto slate.

Why is AigenLayer TVL rising quickly?

The rationale for Eigenreyer's sharp rise could be attributed to the reopening of depositories on February fifth.

Since then, ETH holdings on the platform have surged from 941,000 to 2.3 million inside every week, marking a big improve. This influx represents roughly 2% of the overall circulating provide of Ethereum at the moment staked by means of the platform.

Blockchain evaluation agency SpotOnChain experiences that the highest 4 gamers in EigenLayer are Puffer Finance, Tron community founder Justin Solar, Eigenpie, and Kelp DAO. Puffer Finance leads the group with 233,600 ETH restaked, adopted by Solar with roughly 109,300 ETH. Eigenpie and Kelp DAO observe intently, restaking 88,600 ETH and 75,300 ETH respectively.

What’s Eigenlayer?

EigenLayer is dominating the restaking market and has acquired lots of consideration from the cryptocurrency group. Since June 2023, his DeFi protocol has progressively elevated the deposit restrict by means of a phased launch technique.

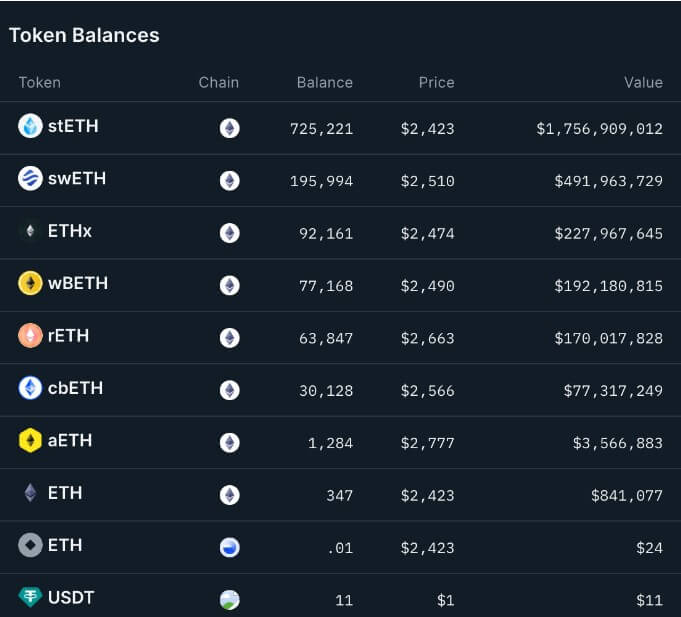

ETH restaking has emerged as one of many main tales within the cryptocurrency market because it permits buyers to earn extra rewards on their staked ETH. The protocol helps in style liquid staking tokens resembling Lido Staking ETH (stETH) and Rocketpool ETH (RETH) restaking by means of its platform.

Murasan, a contributor to the DeFi collective, famous the rising recognition of native restaking amongst ETH validators. He mentioned:

“One in 4 validators within the Ethereum validator queue set their withdrawal credentials to EigenPod.”

Nonetheless, some group members warn that this mannequin might create a Ponzi scheme that might rapidly collapse.

Comments are closed.