- Bitcoin re-entered the $50,000 stage for the primary time after falling in 2021.

- Analysts have noticed a bearish sign amid the market's bullish frenzy.

- BTC’s present value is reportedly concentrating on $45,500, which isn’t a great entry.

Prior to now 24 hours, Bitcoin (BTC) reached an essential milestone for the cryptocurrency market, reclaiming the $50,000 stage. This return to the $50,000 stage marks the primary time Bitcoin has re-entered the vary after dropping it in 2021.

Furthermore, this surge marks a notable restoration from latest lows of round $38,700 hit final month. As anticipated, Bitcoin's trajectory has boosted the broader crypto market, with different outstanding initiatives comparable to Solana (SOL) and Ethereum (ETH) gaining 9.4% and seven.62%, respectively, on the time of writing. It has recorded exceptional weekly income.

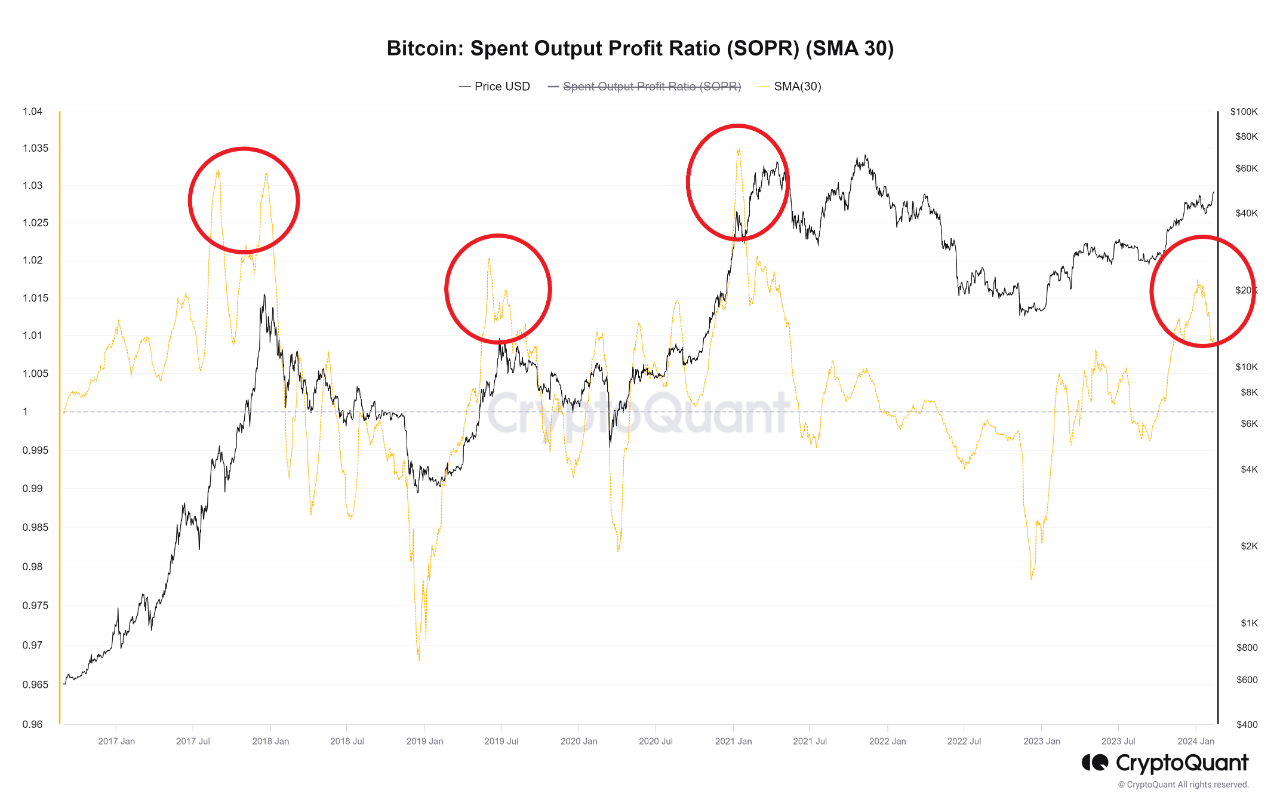

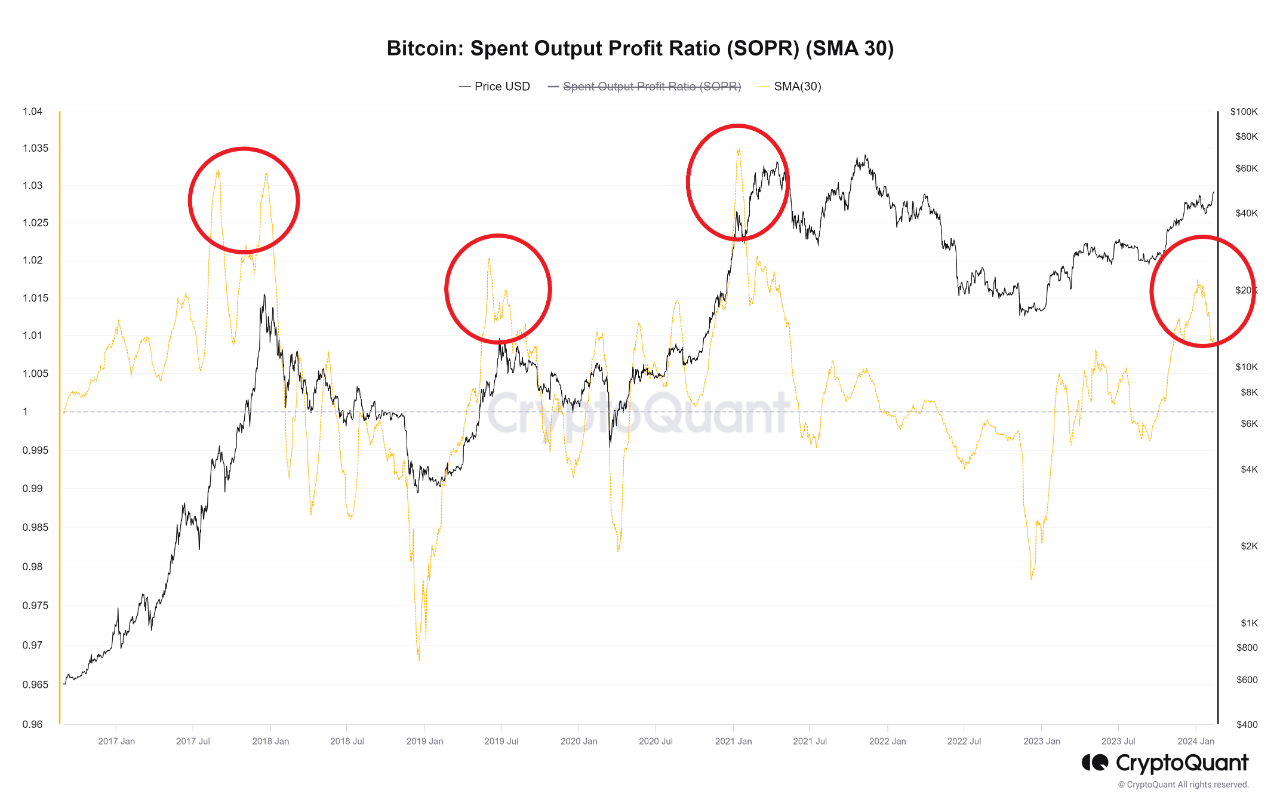

In the meantime, analysts have noticed bearish indicators because the Bitcoin-led bullish frenzy shakes up the market. Woominky, a licensed writer and neighborhood supervisor for on-chain analytics platform CryptoQuant, just lately highlighted the potential course of the market.

Wu Mingyu identified that Bitcoin's 30-day transferring common expense return ratio (SOPR) is above 1. In keeping with the disclosure, this indicator exhibits that BTC holders are primarily making income.

The analyst stated these holders, often known as “good cash,” haven’t ignored latest beneficial properties. Particularly, Wu Mingyu argued that the SOPR indicator means that these BTC holders are selecting to appreciate income by promoting, basically taking income. .

Moreover, the analyst argued that Bitcoin's present place isn’t the optimum entry level based mostly on historic knowledge. Wu Mingyu stated that given the excessive chance indicated by the SOPR ratio, there’s a suspicion {that a} value correction is “any minute” from BTC's present value level.

In consequence, analysts urged to observe for a decline within the SOPR ratio. He steered {that a} decline beneath 1 would sign a shift to FOMO-driven shopping for, adopted by promoting at a loss. Woomingyu believes there shall be a possibility to enter the market at that time.

Wu Mingyu didn’t say how low Bitcoin would hit if a correction happens, however one other analyst has a goal value of $45,500. On the time of writing, Bitcoin is buying and selling at $49,981, up 16.65% over the previous week.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t answerable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.