- Quick-term BTC has generated over $4 billion in earnings by crypto exchanges.

- The big-scale decline occurred in two waves from Thursday by the weekend.

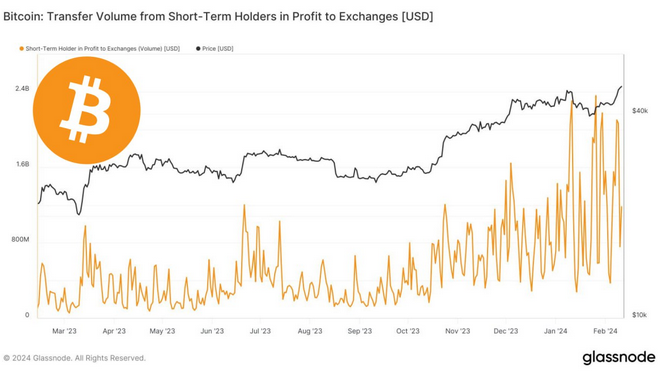

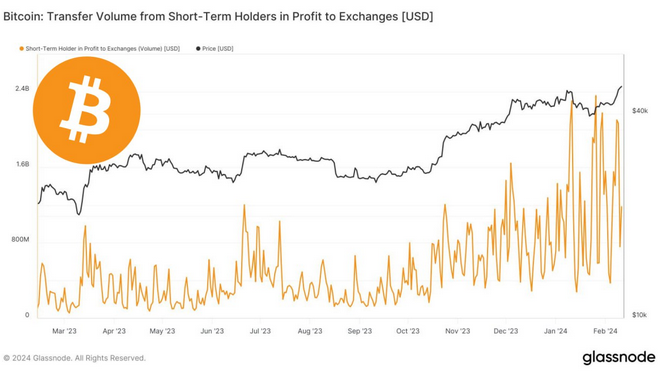

- Glassnode knowledge proves that the alternate is seeing a rise in capital inflows from BTC merchants.

Knowledge from distinguished market intelligence platform Glassnode reveals that Bitcoin merchants have taken important profit-taking throughout the current market rally. Market members known as for consideration to the pattern in quite a few posts relating to X.

Citing knowledge from Glassnode, they claimed that short-term Bitcoin holders have generated greater than $4 billion in earnings by crypto exchanges. The big-scale decline is claimed to have occurred in two waves. The primary batch occurred between Thursday and Friday final week, adopted by his second batch over the weekend.

In line with knowledge from CoinMarketCap, BTC entered the $44,000-$45,000 vary from Thursday to Friday, marking a brand new threshold since final month's drop to $38,740. BTC merchants reportedly cashed out $2 billion this quarter.

Apparently, Bitcoin maintained its momentum and rose additional into the $47,000 vary by the top of the week, with merchants cashing out one other $2 billion. Primarily, these important will increase in worth prompted short-term holders to promote their positions rapidly to stop potential losses in case of a market correction.

Moreover, Glassnode’s charts verify a rise in funds transferring from short-term Bitcoin holders to exchanges. The graph confirmed that from late 2023 onwards, the rise in Bitcoin costs carefully follows the sample of funds being transferred to exchanges for liquidation.

Regardless of the reported important decline that has occurred lately, Bitcoin value continues to rise to even increased ranges. Notably, Bitcoin has crossed the $50,000 threshold. That is the worth level that cryptocurrency market members final witnessed throughout the peak of the earlier bullish season, particularly in 2021.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be liable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Comments are closed.