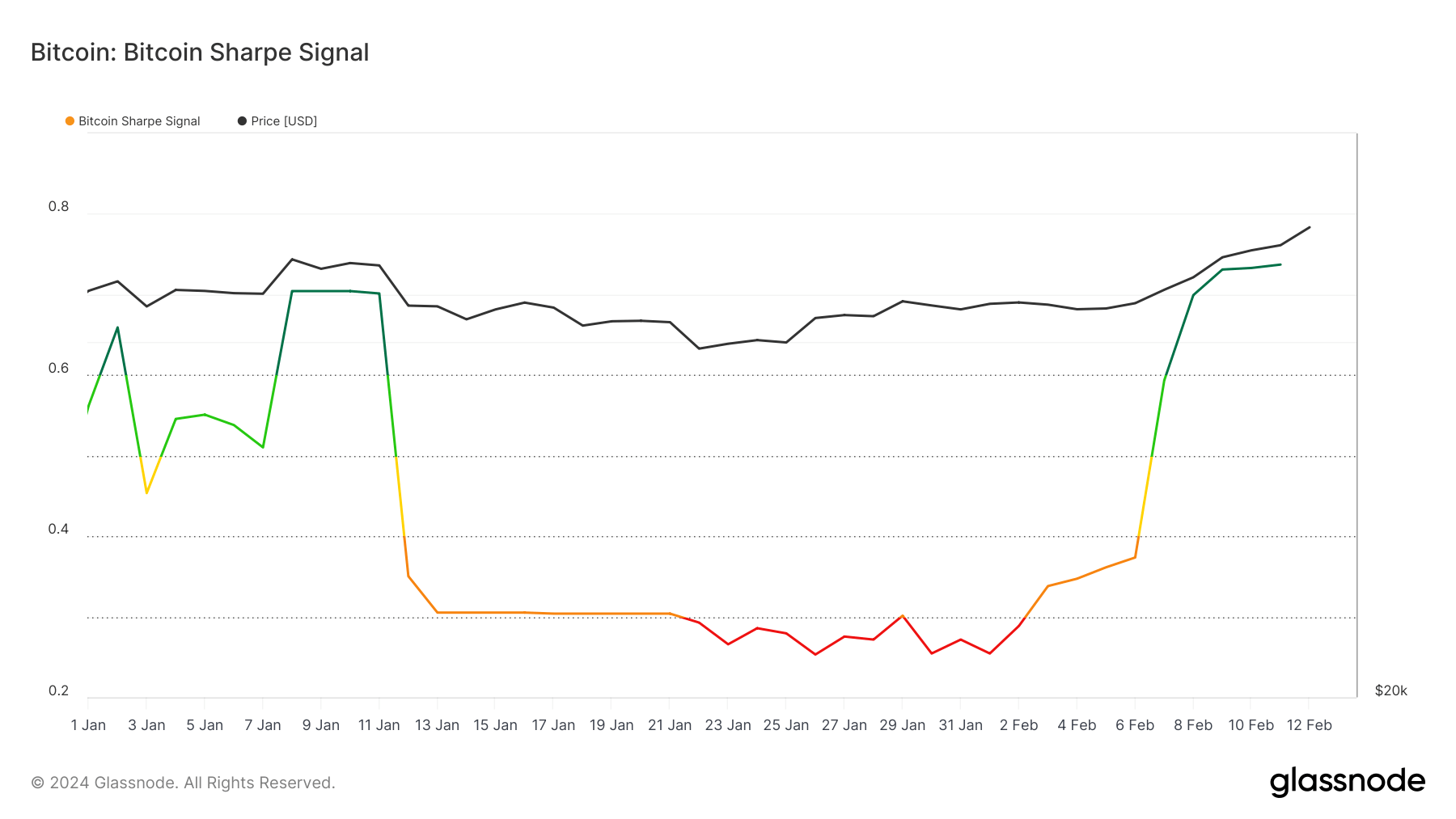

On January twenty sixth, Glassnode's sharp sign hit its lowest stage since March 2020. It has fallen to 0.2531 from a excessive of 0.7042 on January tenth.Nevertheless, by February eleventh, as a result of Bitcoin value crossing $48,000the sharp sign elevated to 0.7371.

This sharp rise in Sharp Sign has important implications for the crypto market and alerts a probably advantageous section for traders delicate to risk-adjusted metrics.

To completely perceive the importance of sign variation, it’s important to grasp the Sharpe ratio.

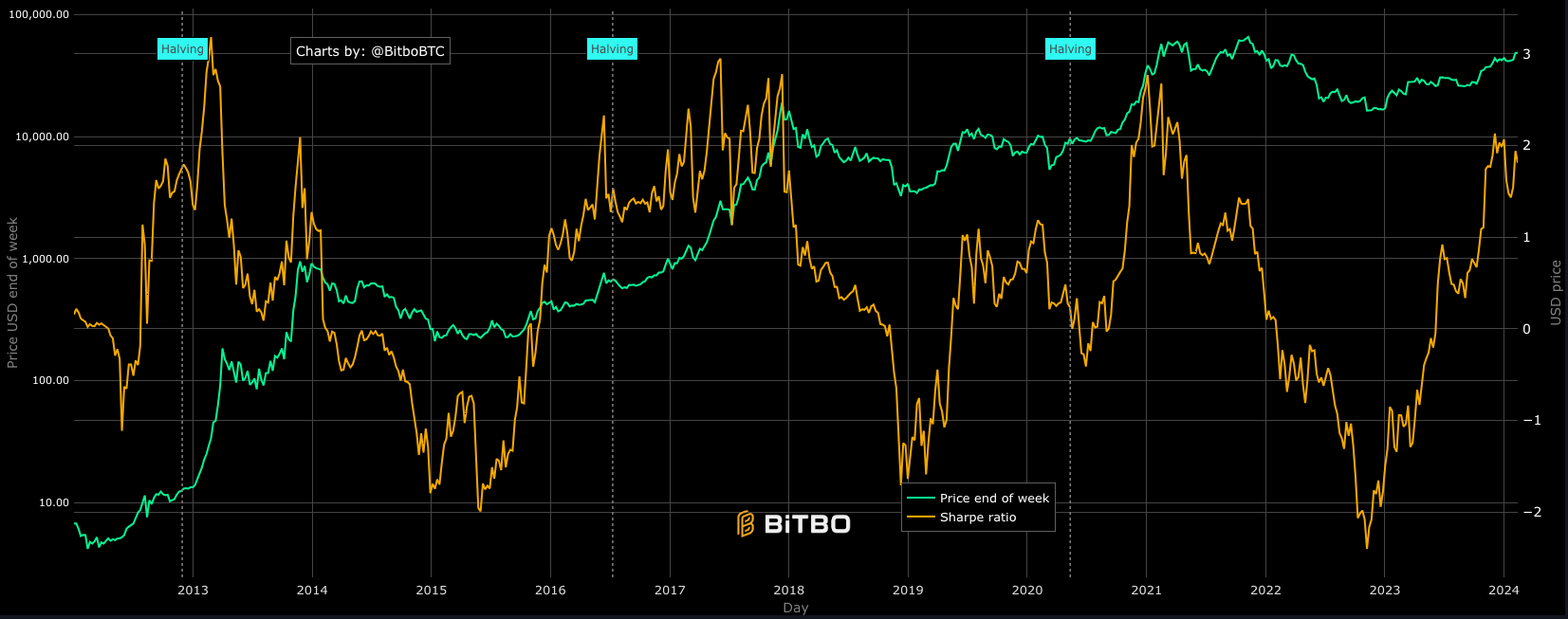

Created by Nobel Prize winner William F. Sharpe, this index measures the efficiency of investments relative to threat. The Sharpe ratio compares an funding's anticipated return to its risk-free fee of return, adjusting for the funding's volatility. This ratio thereby gives a standardized measure of extra return per unit of threat. Merely put, it measures how rather more you’ll be able to earn on riskier property than authorities bonds.

The Sharpe ratio skilled its personal fluctuations, dropping to 1.43 on January twenty second, then leaping to 1.94 on February fifth, and settling at 1.74 as of February eleventh. These strikes present perception into the altering risk-reward profile of Bitcoin, with the ratio growing. This means a extra favorable risk-adjusted return.

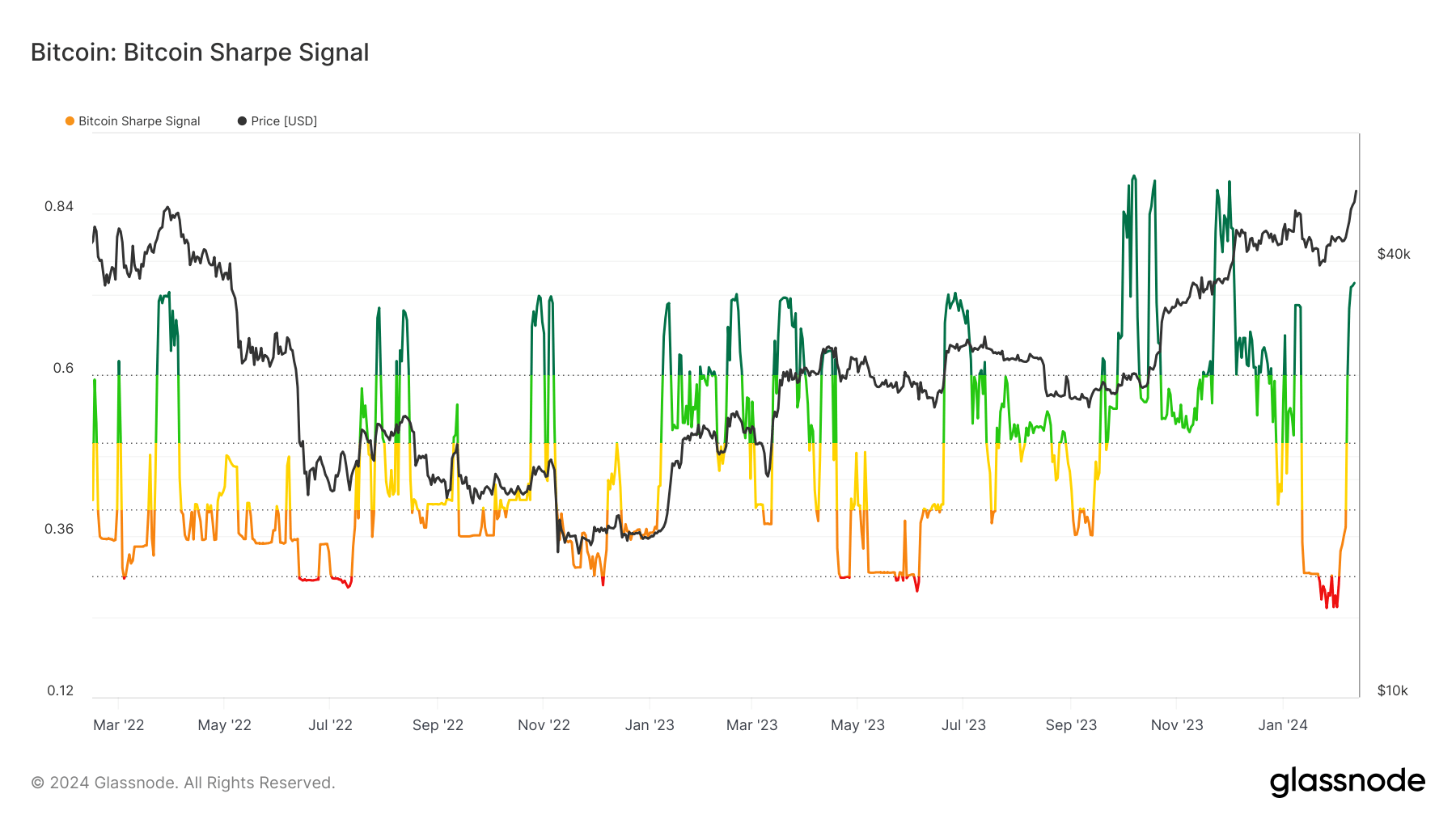

Derived from Glassnode's proprietary mannequin, Sharpe Indicators builds on this idea by incorporating machine studying and on-chain knowledge to foretell Bitcoin's risk-adjusted return potential. This sign is calculated by analyzing historic knowledge, market tendencies, and on-chain exercise to measure the present risk-reward stability. A rise in sharp alerts means that risk-adjusted returns are bettering, which is a bullish indicator for Bitcoin. Conversely, a lower signifies elevated draw back threat or decreased return relative to threat, which ought to alert traders.

Sharp Sign's latest actions, notably the rebound from 0.2531 to 0.7371 as Bitcoin's value has risen, point out a major turnaround in market sentiment and Bitcoin's risk-adjusted return outlook.

The late-January decline, attributable to a market downturn following the launch of the US Spot Bitcoin ETF, confirmed traders had been seeing elevated threat. Nevertheless, the restoration since then reveals a powerful restoration in confidence, supported by lowered draw back dangers and expectations for an upward pattern in costs.

This improve in sharp alerts signifies that traders see comparatively low threat relating to investing in Bitcoin. A rise on this ratio as costs rise additionally signifies that the market is gearing up for additional value will increase.

A restoration of this sign from the January lows would usher in a section of considerably improved risk-adjusted returns, making a compelling case for merchants guided by these indicators of their strategic funding in Bitcoin. there’s a chance.

The put up Bitcoin’s risk-adjusted return potential soars as Sharp Indicators soars appeared first on currencyjournals.

Comments are closed.