International digital asset funding merchandise noticed vital inflows totaling $2.45 billion final week.

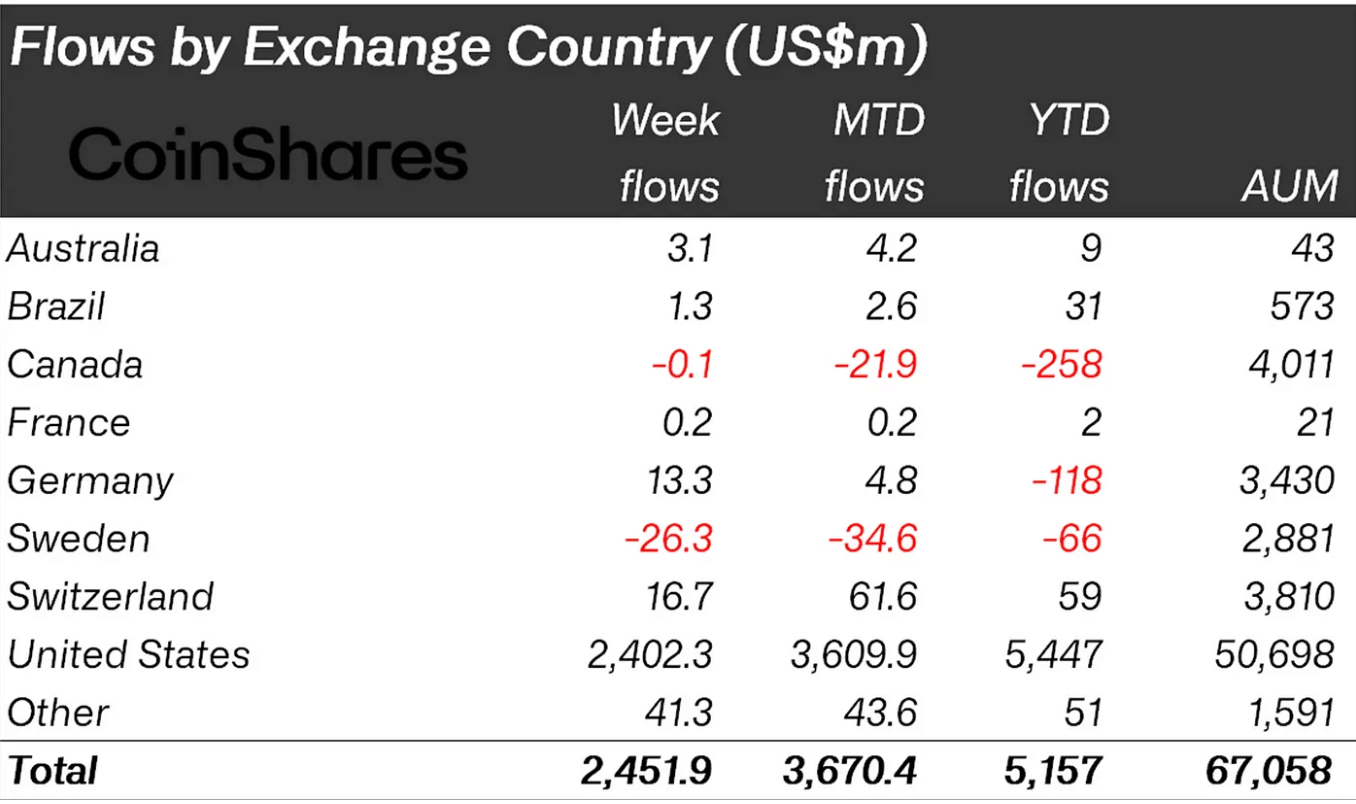

CoinShares' newest weekly report confirms that inflows into digital asset funding merchandise have surged, with belongings beneath administration reaching their peak since early 2022, now reaching $67 billion. The US spot ETF market has performed a pivotal position on this improvement, receiving $2.4 billion in inflows final week.

Bitcoin stays the clear market chief, receiving round 98% of whole inflows final week. The elevated confidence has additionally permeated Ethereum, which noticed an influx of $21 million. Altcoins akin to Litecoin and XRP noticed small however sustained inflows all through the interval.

The report additionally highlights regional traits in these inflows. Whereas the US is main the best way, different areas have seen combined responses. For instance, Switzerland and Germany reported inflows of $16.7 million and $13.3 million, respectively, in distinction to outflows from Canada and Sweden. This geographic distribution of inflows and outflows highlights the nuances of world views on digital asset investing.

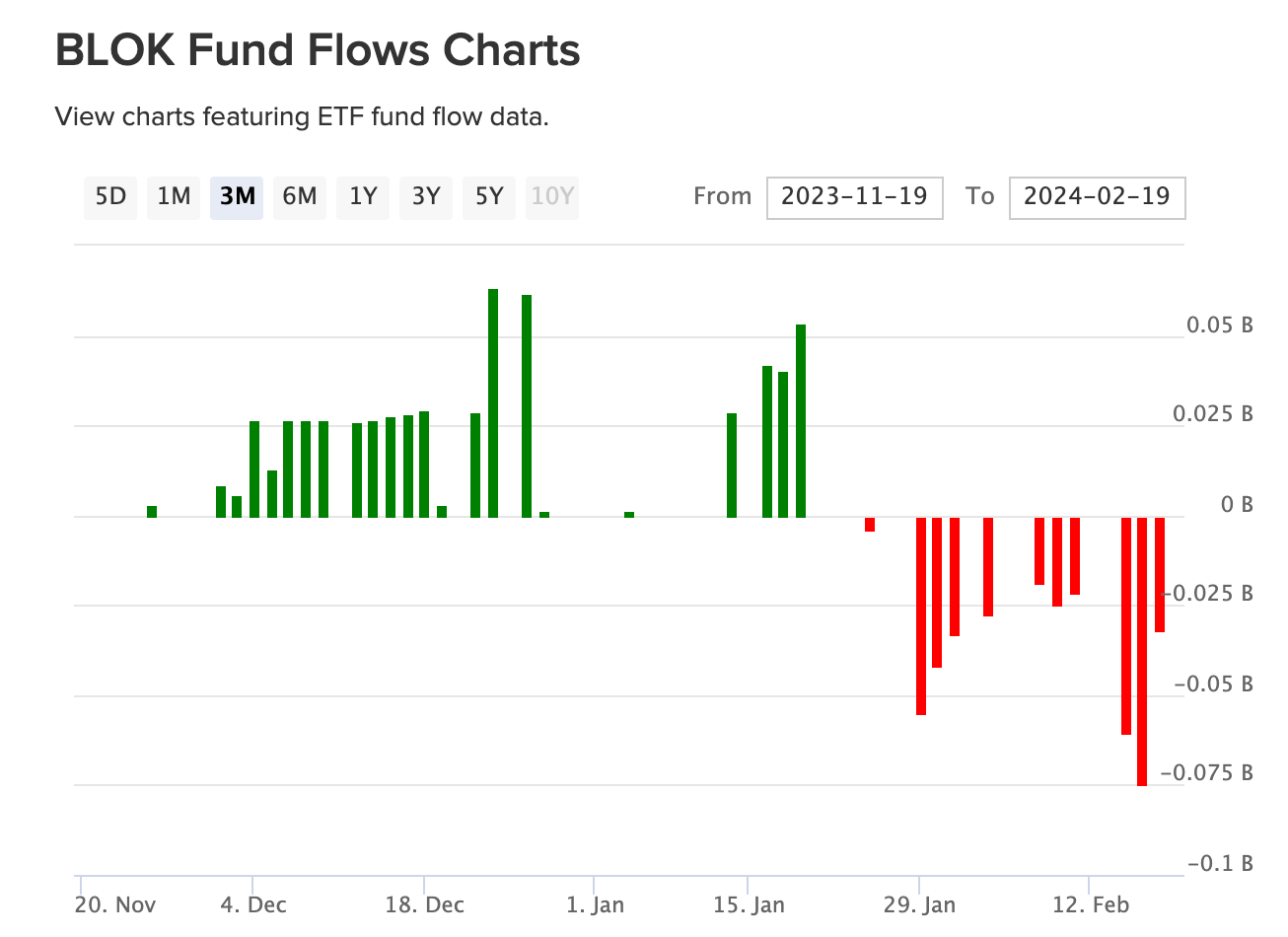

The general development for digital asset funding merchandise is constructive. Nonetheless, blockchain shares had been combined, with the Amplify Transformational Knowledge Sharing ETF (BLOK) seeing whole outflows of $171 million, whereas different shares noticed a complete web outflow of $4 million. An inflow was seen. This distinction illustrates the completely different investor sentiments and methods at play throughout the broader crypto and blockchain funding panorama. In line with the VettaFi ETF database, BLOK has recorded steady outflows since his mid-January.

In abstract, the newest CoinShares report highlights strong inflows of capital into digital asset funding merchandise, with continued concentrate on Bitcoin. Vital inflows, highest AuM since peak in December 2021, and regional dispersion in funding flows mirror the maturity and growing complexity of the cryptocurrency funding house.

Correction: Up to date AuM that missed the newest influx.

(Tag translation) Bitcoin