Ethereum (ETH) value approached $3,000 on February nineteenth amid anticipation of developments anticipated to happen within the coming months.

As of 8:35 PM UTC, the value of ETH is $2,937, market capitalization $352.96 billion. This transformation represents a 4.12% progress in 24 hours, which is considerably bigger than Bitcoin's 0.4% rise over the identical interval and bigger than the general cryptocurrency market's 1.2% rise.

Lido Stake Ether (STETH) recorded a comparable improve of three.88% in 24 hours. Ethereum 2.0 staking tokens as a class recorded a 5.4% improve, based on CoinGecko information.

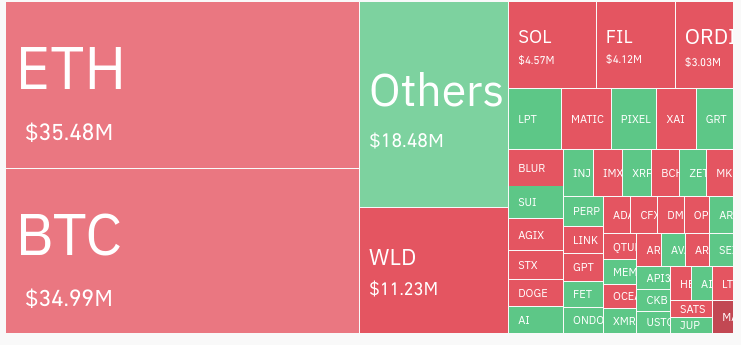

Ethereum was chargeable for a comparatively small portion of 24-hour clearing. The belongings amounted to $35.48 million, together with $8.43 million in long-term liquidation and $27.05 in short-term liquidation.

Progress could also be on account of ETF expectations, Dencun upgrades

Ethereum’s current rally could also be associated to the chance that the U.S. Securities and Alternate Fee (SEC) will approve a spot Ethereum trade traded fund (ETF).

Though there have been no vital regulatory developments surrounding Spot Ethereum ETFs as we speak, a associated report from brokerage agency Bernstein was broadly reported. The agency's analysts predicted a 50% probability of a Spot Ethereum ETF being permitted by Might, and a close to certainty that such a fund can be permitted inside a 12 months. Mixed with different comparable predictions over the previous few months, this report could have influenced investor sentiment and market exercise.

There has additionally been some backlash over the outlook for Ethereum ETFs. Apollo co-founder Thomas Farrar urged Coinbase's main function as ETF administrator may compromise Ethereum's proof-of-stake mannequin by permitting the corporate to “management the complete community.”

In keeping with information from Dune Analytics, Coinbase is at present chargeable for round 15% of all ETH staking, whereas one other staking platform, Lido, is chargeable for over 31%. It’s unclear how a lot crypto is held in Spot ETH ETFs, so it’s unclear whether or not Coinbase will acquire a bonus by holding funds on behalf of those ETFs. Moreover, it’s unclear whether or not the SEC will permit staking of ETH held in Spot Ethereum ETFs, though some candidates goal to take action.

Other than these ETF prospects, there are additionally excessive expectations for Ethereum’s Dencun improve scheduled for March thirteenth. That improve will embrace protodunk sharding, a characteristic that’s anticipated to enhance ETH's transaction prices and scalability, amongst different issues.

Ethereum market information

On the time of press February 19, 2024, 10:39 PM UTCEthereum ranks second in market capitalization, and the value is Up 2.69% Over the previous 24 hours.The market capitalization of Ethereum is $356.82 billion The buying and selling quantity for twenty-four hours is $15.44 billion. Be taught extra about Ethereum ›

Overview of the digital forex market

On the time of press February 19, 2024, 10:39 PM UTCthe worth of the complete cryptocurrency market is $1.99 trillion in 24 hour quantity $68.83 billion. Bitcoin dominance is at present 51.35%. Be taught extra in regards to the cryptocurrency market ›

(Tag translation) Ethereum