Bitcoin soared above $60,000 in a exceptional single-day candlestick on February twenty eighth, marking a 20% acquire in simply three days. Nonetheless, the brief stint at this degree means you need to wait a further 24 hours for significant on-chain knowledge to develop into obtainable.

Nonetheless, given the quantity of unrealized beneficial properties presently out there, the chance of a correction inside the subsequent 24 hours could be analyzed.

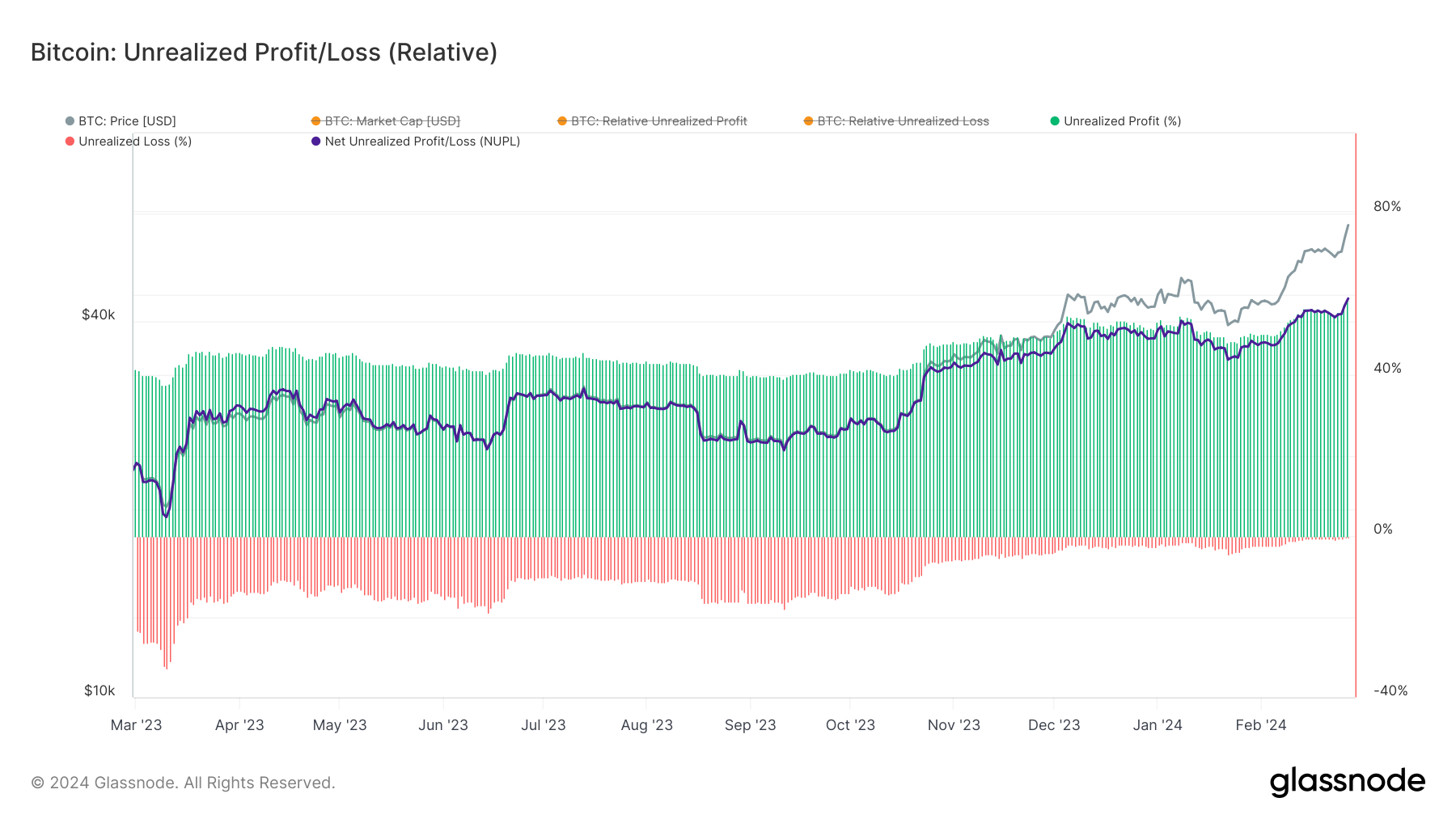

Unrealized beneficial properties seek advice from beneficial properties on Bitcoin holdings that haven’t but been bought or transformed into fiat forex or different belongings. These are calculated by the distinction between the present market value and the acquisition value of the Bitcoin (if the present value is larger).

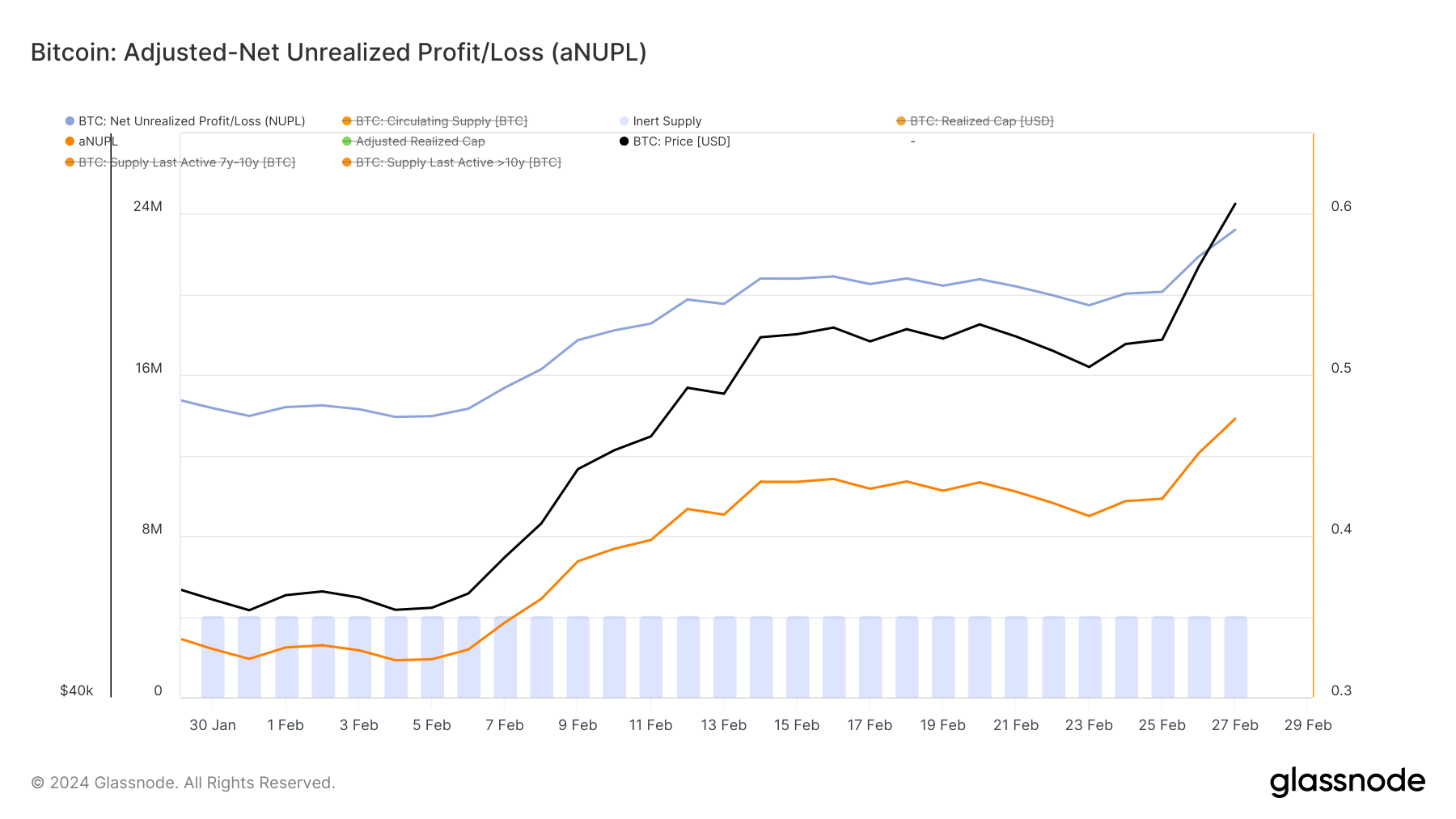

The Internet Unrealized Achieve/Loss (NUPL) indicator supplies perception into general market sentiment by mapping the distinction between unrealized beneficial properties and losses throughout the Bitcoin provide as a proportion of market capitalization.

Adjusted NUPL (aNUPL), however, improves on this evaluation by bearing in mind inactive provide (misplaced cash, or cash which were dormant for greater than 7 years), thereby making the lively market extra worthwhile. Present clearly.

The aNUPL values noticed over the previous three days (0.4232 on February twenty fifth, 0.4515 on February twenty sixth, and 0.4729 on February twenty seventh) point out a rise within the worthwhile portion of Bitcoin provide. is proven.

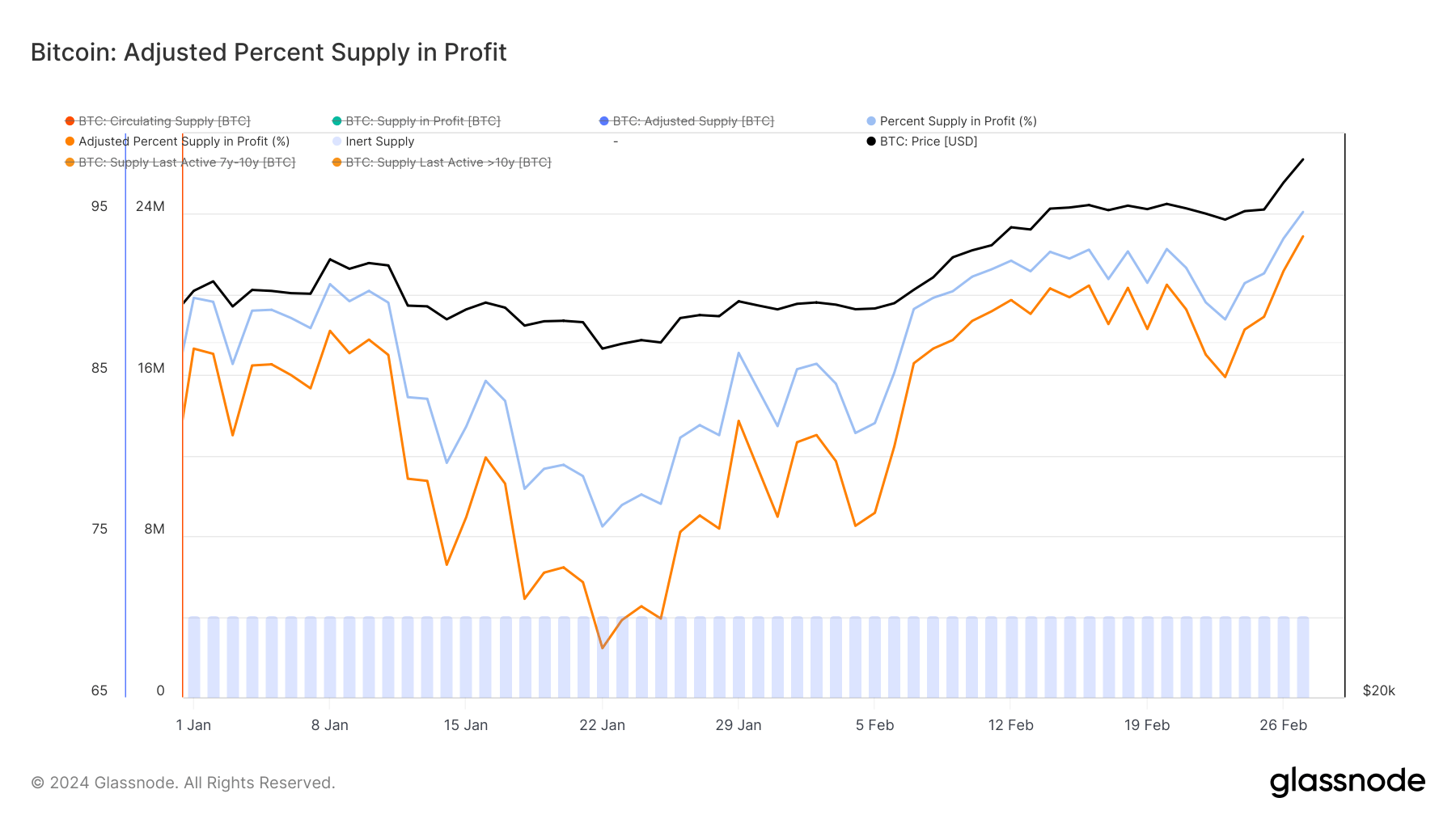

This may be seen from the rise in revenue margin from 55.795% to 59.174% and the lower in loss ratio from -0.682% to -0.155% over the identical interval. Just like aNUPL, this indicator reveals that almost all of Bitcoin's provide stays worthwhile and losses are minimal.

The revenue supply ratio, which reached 95.12% on February 27, and the adjusted revenue supply ratio of 93.6% illustrate this profitability from a barely completely different perspective.

If Bitcoin continues to rise within the coming weeks, this widespread profitability scenario might result in decreased promoting strain. In anticipation of additional development, holders could also be much less inclined to promote their belongings, which can lead to decrease volatility and a extra secure basis for value appreciation.

Given the present profitability scenario, additional value will increase might additional strengthen buyers' bullish sentiment. Vital inflows into U.S. spot Bitcoin ETFs, significantly BlackRock's IBIT, are pushed by a section of the market made up of institutional and complicated buyers, pushed by constructive traits and concern of lacking out (FOMO). This indicators that buyers are able to put cash into Bitcoin. .

Nonetheless, unstable and sideways value actions can result in elevated volatility. With a good portion of the market in income, the temptation to comprehend these income is massive, particularly if issues come up {that a} market peak or unfavorable information will emerge within the coming days. This might result in a robust sell-off.

Whereas common sentiment is bullish resulting from widespread profitability and institutional curiosity, the market wants to beat potential challenges posed by unrealized beneficial properties. His subsequent 24 hours shall be essential in figuring out whether or not Bitcoin can preserve his $60,000 foothold or whether or not the strain to comprehend income will trigger volatility.

The put up Bitcoin market faces important second with hovering unrealized beneficial properties appeared first on currencyjournals.