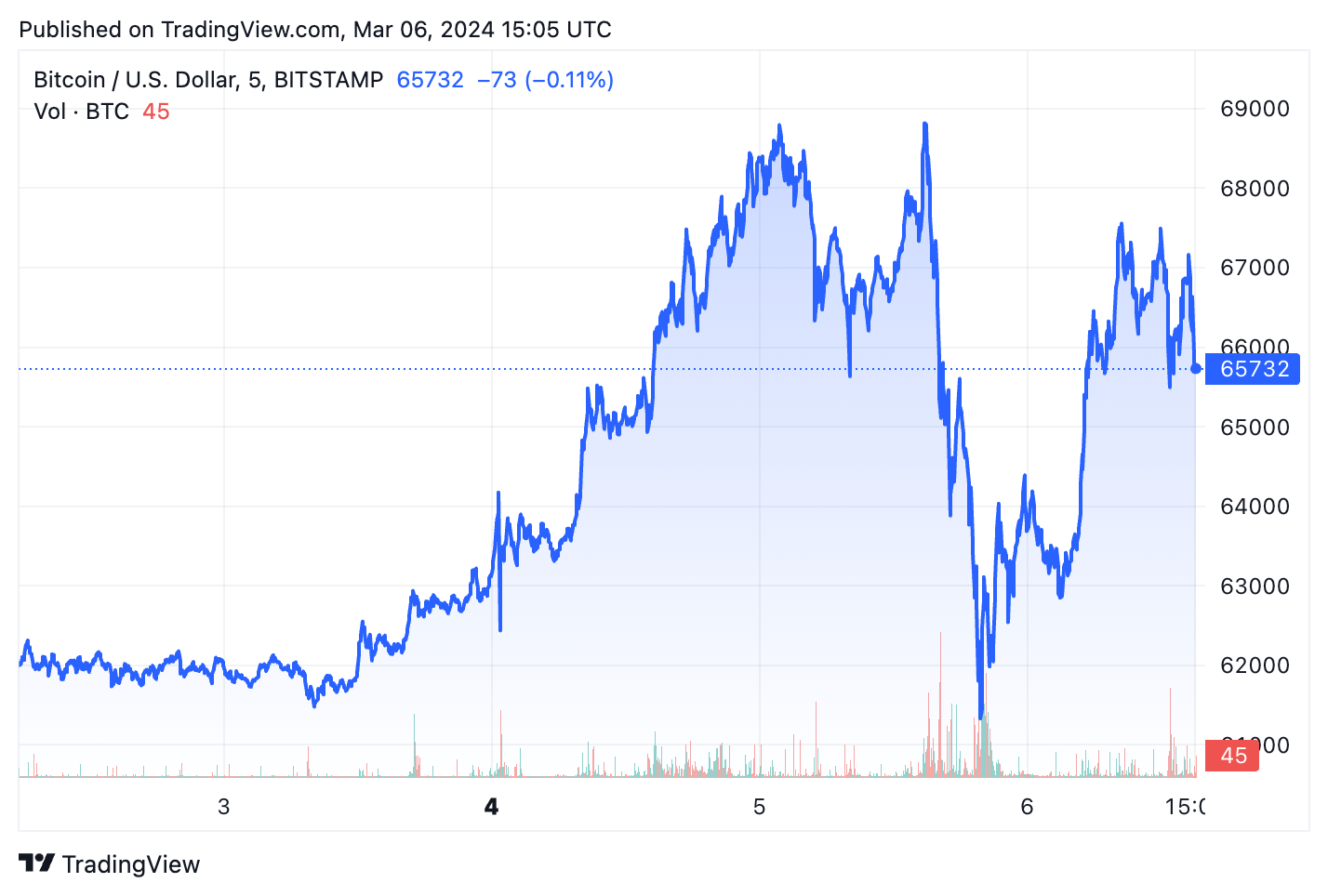

On March 5, Bitcoin reached its all-time excessive set in November 2021, topping $69,000 within the late afternoon UTC. Nevertheless, Bitcoin's interval at ATH was very brief, and a pointy 14% correction occurred quickly after, sending the worth all the way down to $59,300. Within the early morning hours of March sixth, BTC regained some misplaced floor however struggled to stabilize at $66,000.

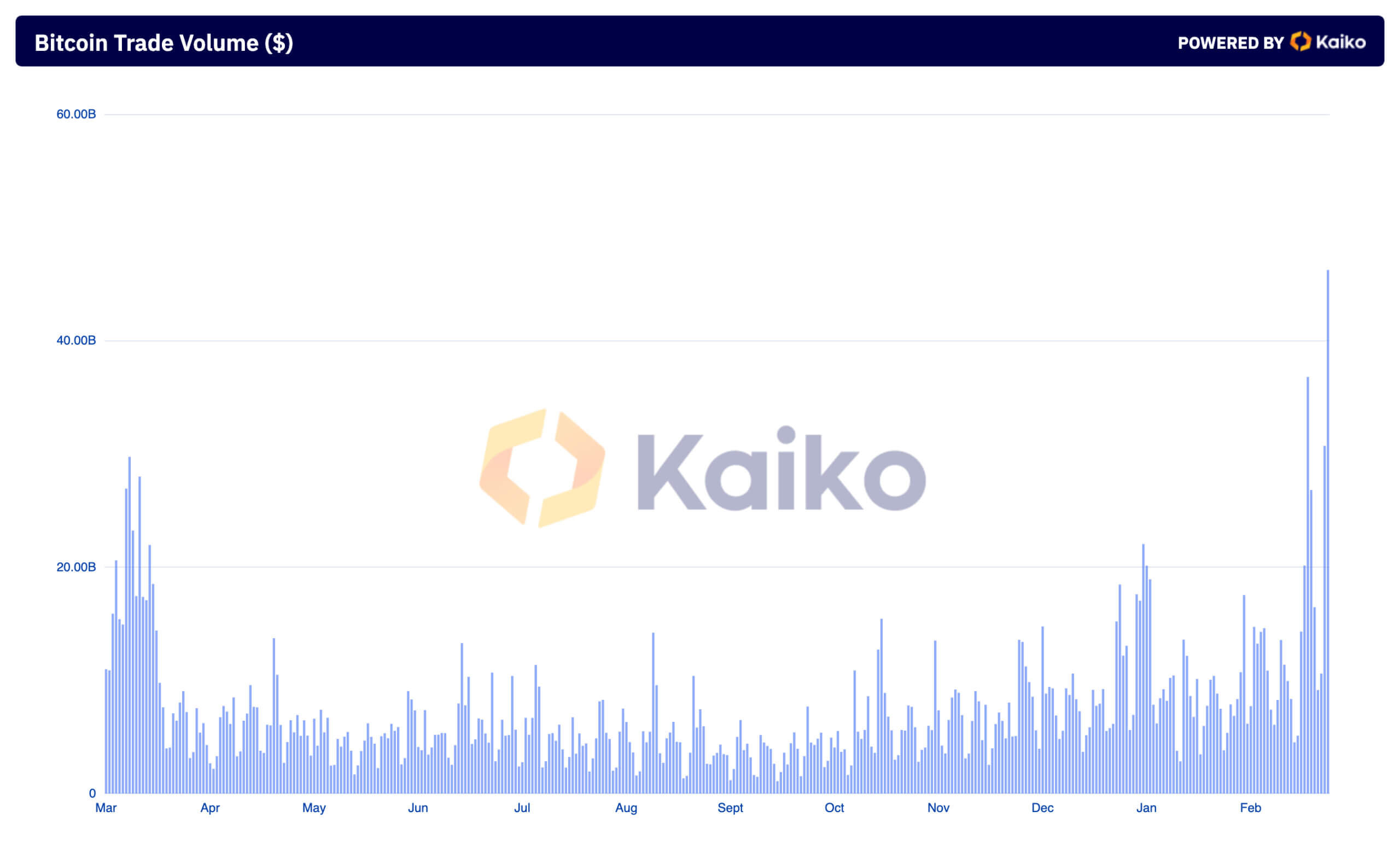

Wild value actions out there on Tuesday, March fifth resulted in file buying and selling volumes throughout centralized exchanges. CEX quantity serves as the perfect barometer of market exercise in terms of Bitcoin, as OTC desks have little knowledge on quantity and knowledge from spot ETFs is delayed.

Evaluation of Kaiko knowledge by currencyjournals revealed that buying and selling quantity from March 2nd to March fifth elevated by 405% from $9.15 billion to $46.25 billion. This surge adopted Bitcoin's unstable value motion and confirmed merchants' aggressive response to cost fluctuations.

The rise in transaction quantity displays a rise within the variety of transactions, which elevated from 10.12 million to 32.79 million over the identical interval. This means elevated involvement out there and maybe a rise within the inflow of retail and institutional buyers.

The noticed adjustments in common commerce measurement additional assist this. Between March 2 and March 5, common commerce measurement elevated by greater than 55%, leaping from $904 to $1,410, as capital moved throughout the market as merchants rushed to benefit from value actions. was proven to be rising.

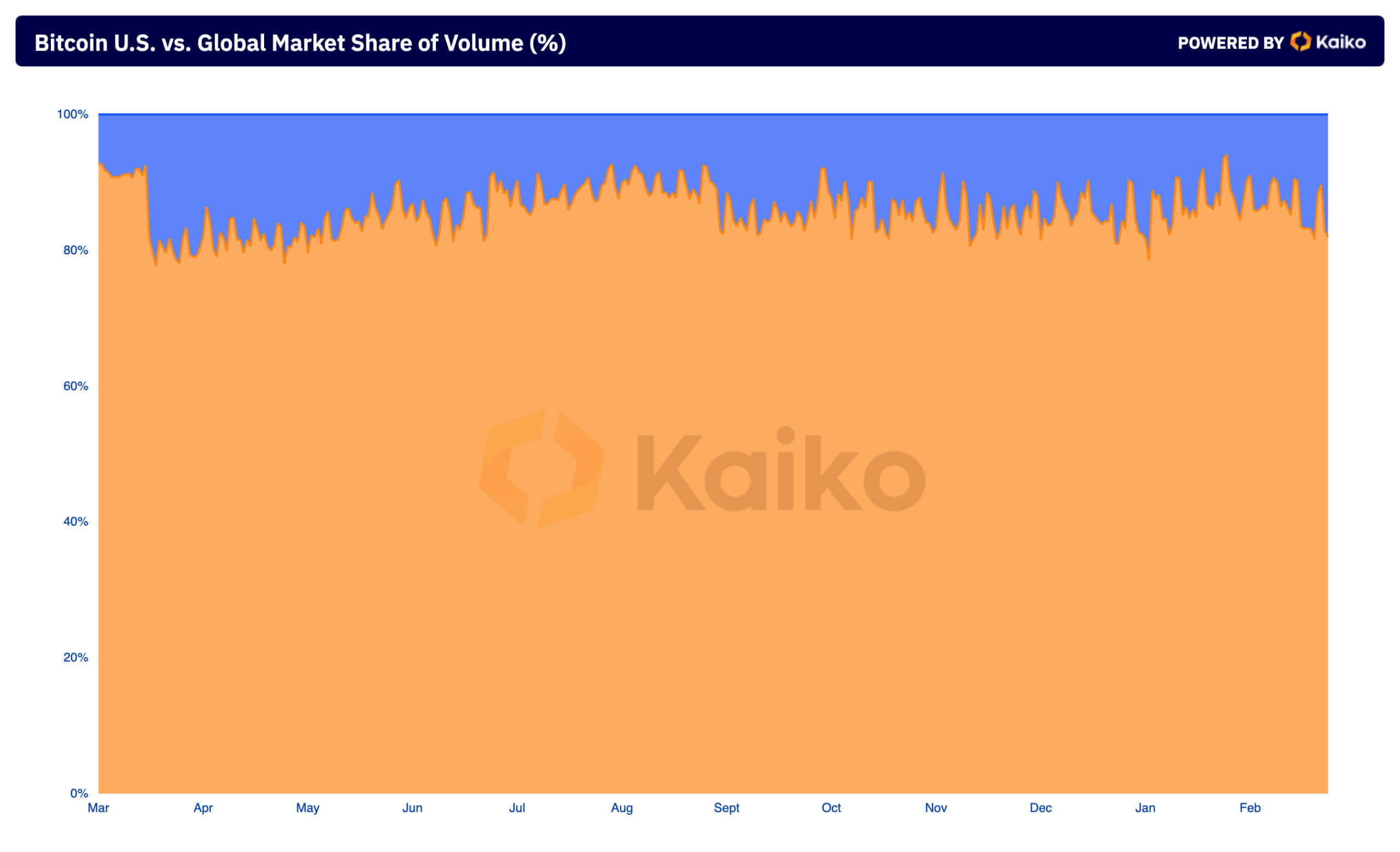

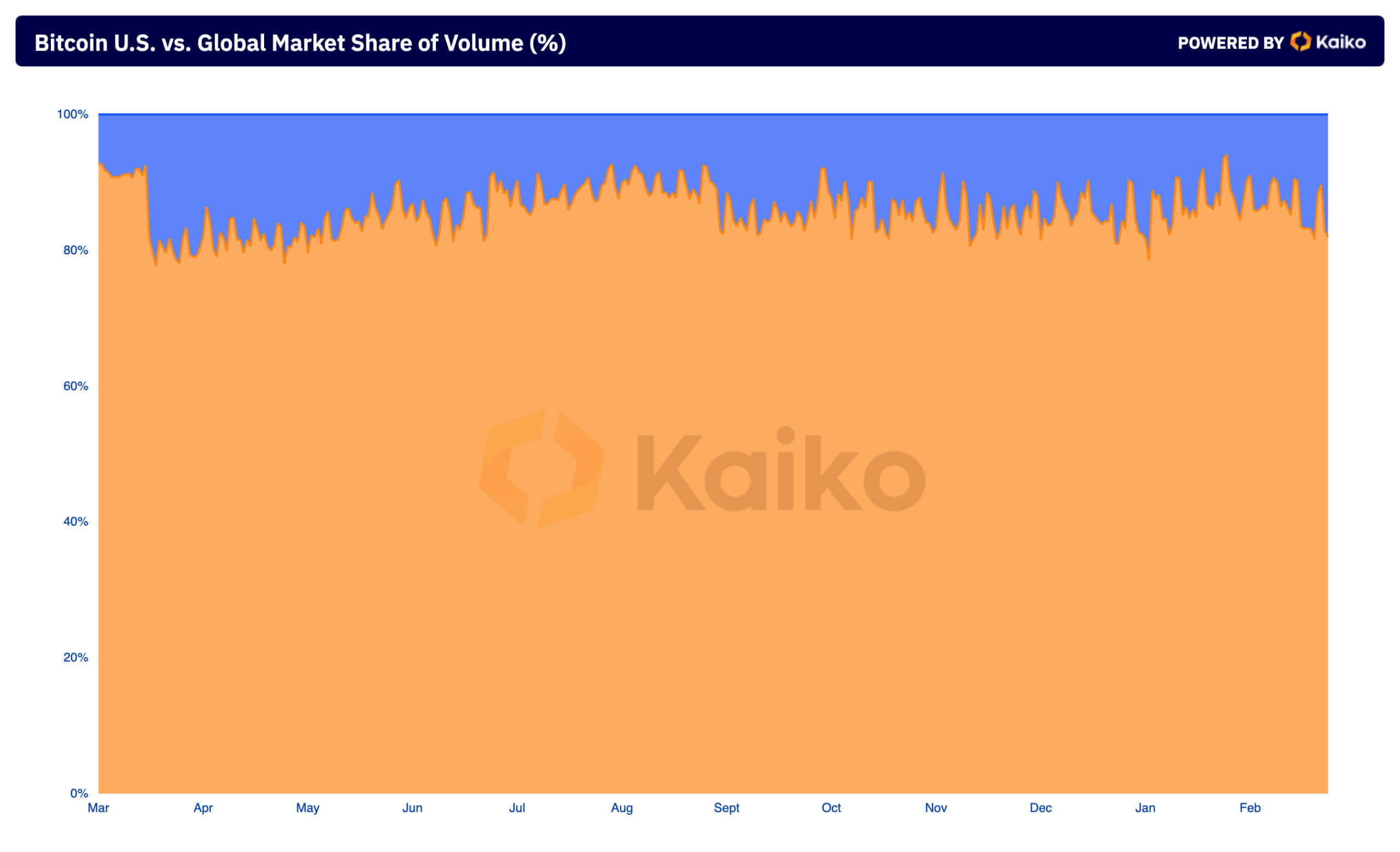

Analyzing the distribution of buying and selling quantity between the US and world markets reveals the place most of this buying and selling quantity comes from. As currencyjournals has beforehand coated, world markets have persistently dominated Bitcoin buying and selling quantity. Nevertheless, the amount share of the US market elevated from 11.6% on March 2nd to 18.05% by March fifth, indicating a major improve in curiosity from US-based buyers throughout this unstable interval. It has been proven.

Persevering with with long-term traits, Binance accounted for almost all of worldwide buying and selling quantity with 51.54%, whereas Coinbase led the US alternate market with a 57.89% share. Binance and Coinbase's dominance within the cryptocurrency market has been well-known for years, with each exchanges persistently accounting for a good portion of worldwide buying and selling exercise. The focus of trades on the 2 exchanges reveals that merchants choose to stay to well-known platforms with extra liquidity, particularly throughout this week's excessive volatility.

Latest points with Coinbase account balances have affected the variety of trades carried out by the platform, resulting in a major outflow of BTC from the alternate. Nevertheless, the affect on general alternate quantity seems to have been minimal, as evidenced by Coinbase's dominance within the US market.

The wild value actions skilled in the course of the week introduced collectively present and new market members, leading to vital buying and selling exercise. The spike in quantity, variety of trades, and commerce measurement signifies that merchants have been actively participating out there by rising commerce measurement in response to Bitcoin's surge. This measure demonstrates the vital position of centralized exchanges in facilitating liquidity and offering value discovery, particularly throughout occasions of serious market volatility.

(Tag translation) Bitcoin