Bitcoin hitting a brand new all-time excessive and topping $72,000 is a major milestone for the market. Using the wave of elevated institutional curiosity in Spot Bitcoin ETFs, the ETF broke by means of the $68,000 cap set in November 2021 after a quick correction to $59,000, and this week Plainly the inventory is getting ready for additional rise.

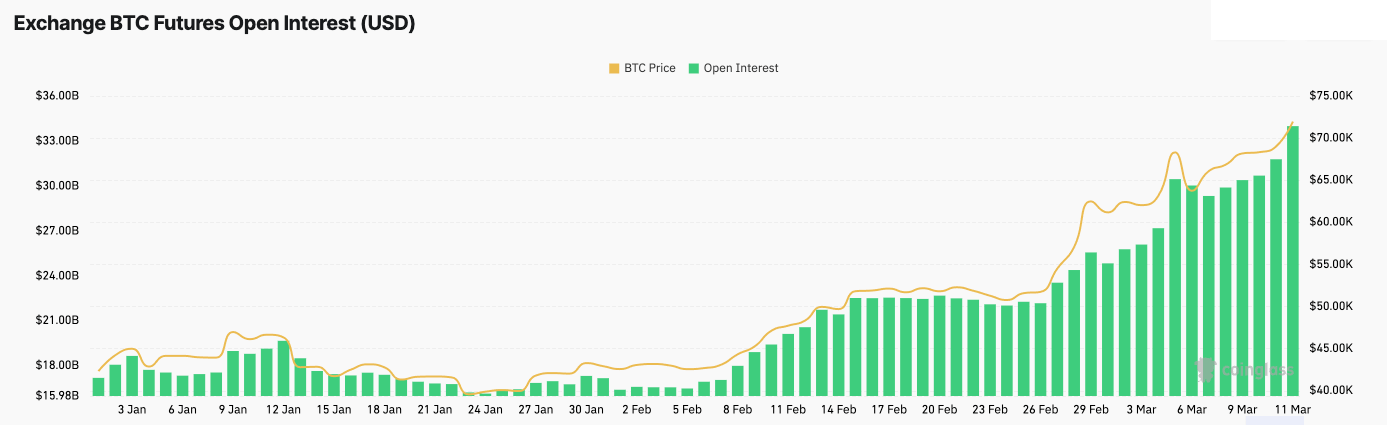

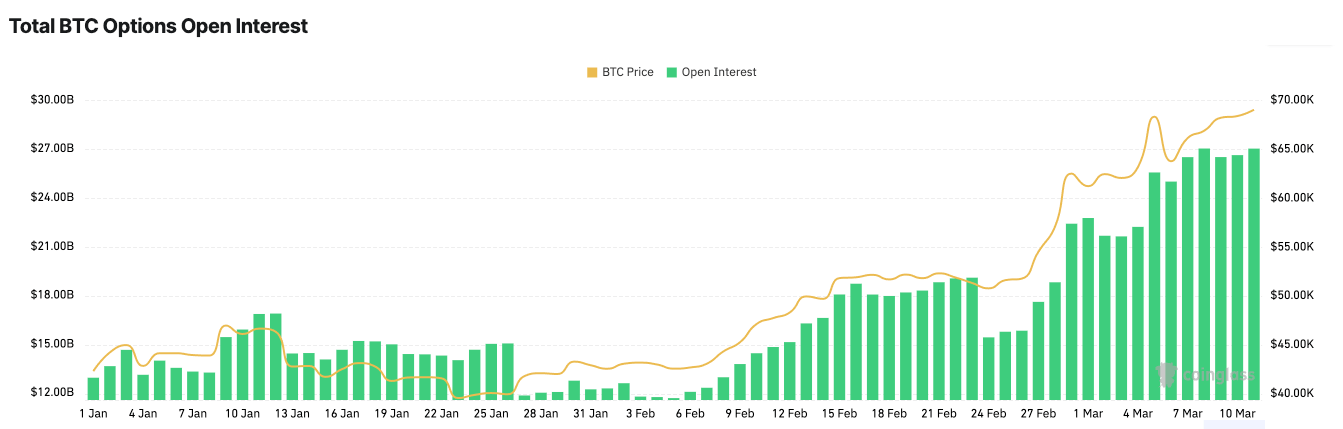

This week noticed the potential for additional volatility within the derivatives market, which peaked when Bitcoin hit $71,400. Because the starting of the yr, the Bitcoin futures and choices market has skilled unprecedented development, with open curiosity reaching a brand new excessive on March eleventh. Analyzing open curiosity is important to understanding market well being and dealer expectations. Spikes in open curiosity at all times accompany worth actions, however the depth of the spike could be a telltale signal of how leveraged the market is.

Futures open curiosity hit a document excessive of $33.48 billion within the early hours of March 11, practically double the $17.2 billion on January 1.

Open curiosity in choices hit a document excessive of $27.02 billion on March eighth. It seems to have established a foothold above $27 billion, with open curiosity steady at $27.01 by means of March eleventh. It is a important enhance from $12.93 billion in open curiosity at the start of the yr.

A rise in open curiosity signifies that demand for derivatives is quickly growing. Futures and choices provide merchants refined methods that enable them to hedge positions and speculate on worth actions.

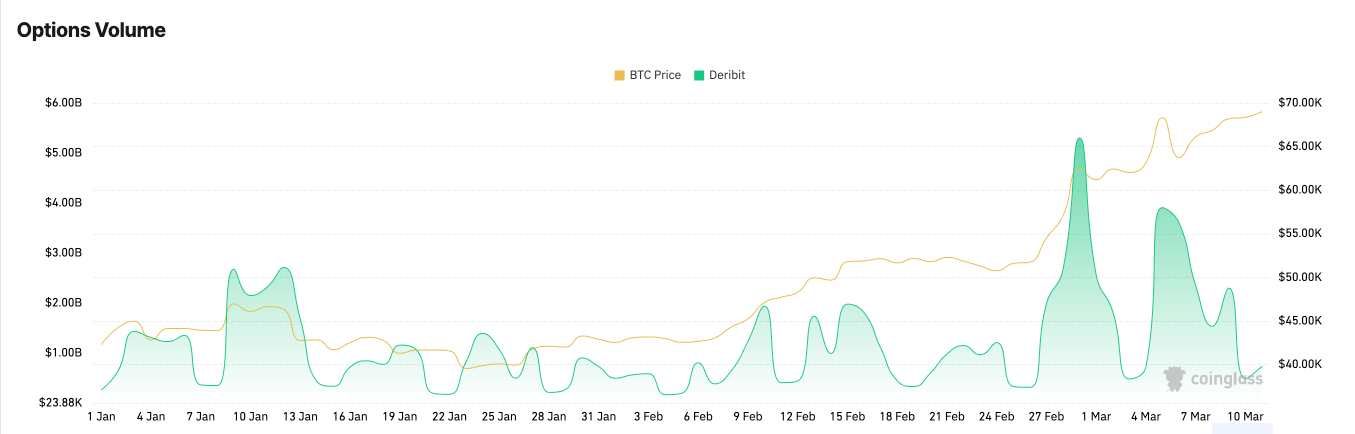

The dominance of name choices, the place the ratio of open curiosity to quantity persistently favors calls over places (61.66% vs. 38.34% for open curiosity and 59.43% vs. 40.57% for quantity), displays the overwhelmingly bullish sentiment amongst merchants. It exhibits the outlook. Because of this a big portion of the market expects additional worth will increase.

The numerous spike in choice buying and selling quantity round Deribit's key dates exhibits the responsive nature of the Deribit market to Bitcoin worth fluctuations. CoinGlass knowledge exhibits a notable spike in buying and selling quantity between February twenty ninth ($5.3 billion) and March fifth ($3.91 billion), correlating with durations of excessive worth volatility. .

Bitcoin’s breakout of key resistance ranges performed a pivotal function on this rally. Every resistance level crossed new heights of market optimism, inflicting a rise in buying and selling exercise as markets adjusted positions to capitalize on bullish momentum or shield in opposition to potential declines.

Quickly growing curiosity in derivatives has led to a focus of open curiosity in futures and choices. Though his OI for futures and choices has not but reached parity, the distinction between the 2 is unprecedentedly low in the meanwhile. Traditionally, futures open curiosity has been considerably increased than choices open curiosity as a result of futures present a simple mechanism for hedging and hypothesis with out the necessity for the complexity of choices methods.

Nevertheless, Bitcoin's efficiency this yr seems to have attracted many superior merchants on the lookout for a extra versatile buying and selling technique than futures. Choices are thought of a extra refined buying and selling instrument, permitting merchants to hedge positions, restrict draw back threat, speculate on worth actions, and generate income by means of methods similar to lined calls and guarded places. As traders develop into extra educated and assured about utilizing choices, demand for these merchandise will increase, resulting in elevated open curiosity.

Moreover, present market situations (excessive volatility and document costs) make choices notably enticing. Choices can present leverage much like futures, however with the additional advantage of predetermined purchaser threat. In quickly appreciating markets, choices enable traders to take a position on continued development or shield in opposition to a possible recession with out having to commit the mandatory amount of cash to a futures place. can.

The stability between open curiosity in futures and choices additionally means that the market is at a crossroads and traders have combined outlooks. Whereas some might view present worth ranges as sustainable and counsel additional development, it’s overkill and warning is required and choices for threat administration should be used. Some individuals might imagine so.

The influence on future worth actions is two-fold. In the meantime, sturdy derivatives exercise signifies a wholesome market with considerable liquidity and complicated members, doubtlessly supporting additional worth appreciation. Alternatively, excessive leverage considerably will increase the danger of market corrections. With tens of billions of {dollars} value of derivatives being traded, even a small drawdown can translate into important volatility.

The submit Bitcoin hits $72,000, open curiosity reaches all-time excessive appeared first on currencyjournals.