There are numerous methods to quantify market sentiment. Observing worth tendencies gives a really crude however efficient measure of market sentiment. If costs are falling, the market is probably going bearish and vice versa. Nonetheless, analyzing sentiment in regards to the future is extraordinarily complicated, particularly in relation to Bitcoin, and on-chain knowledge may help perceive the numerous layers of market sentiment.

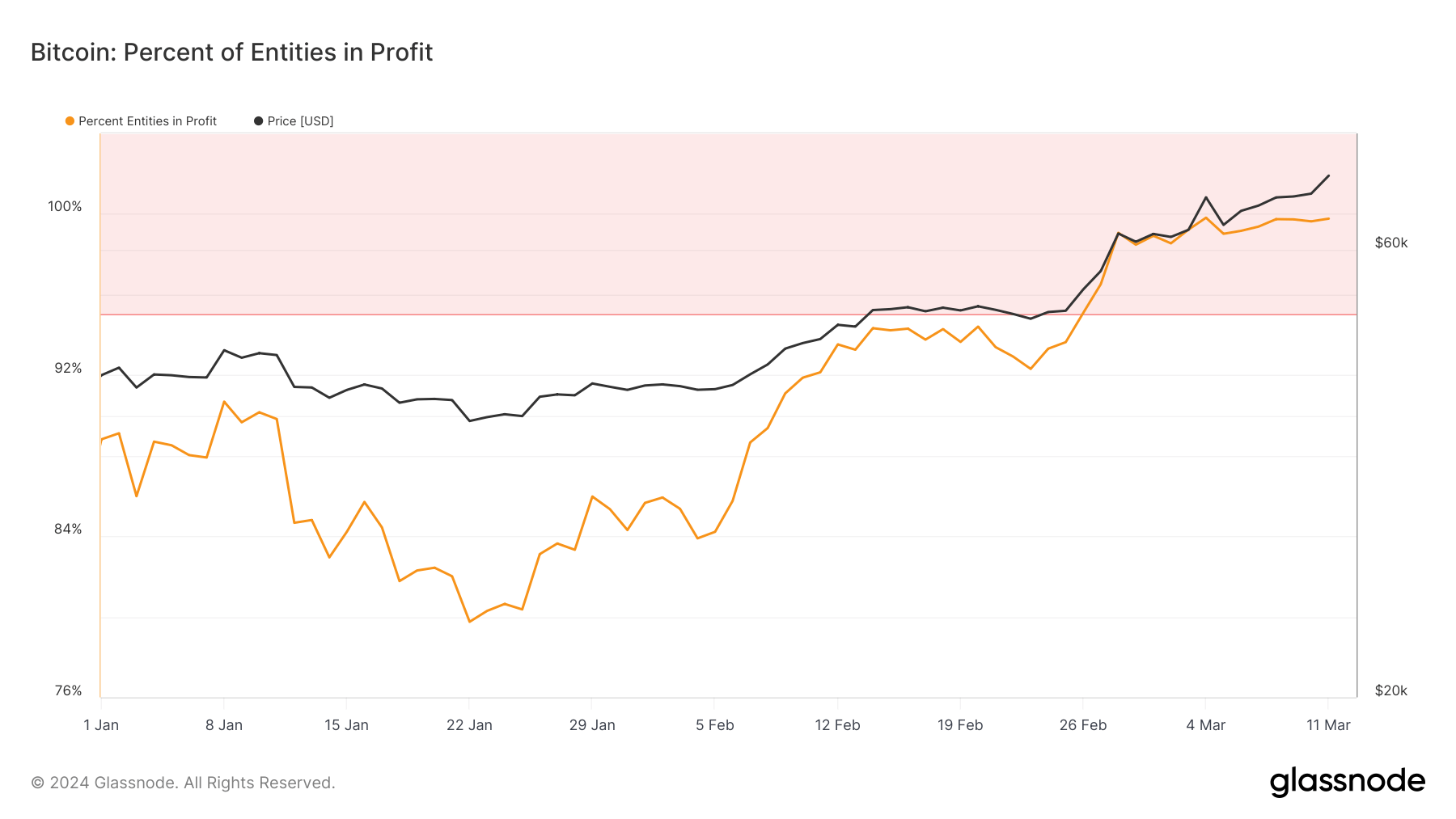

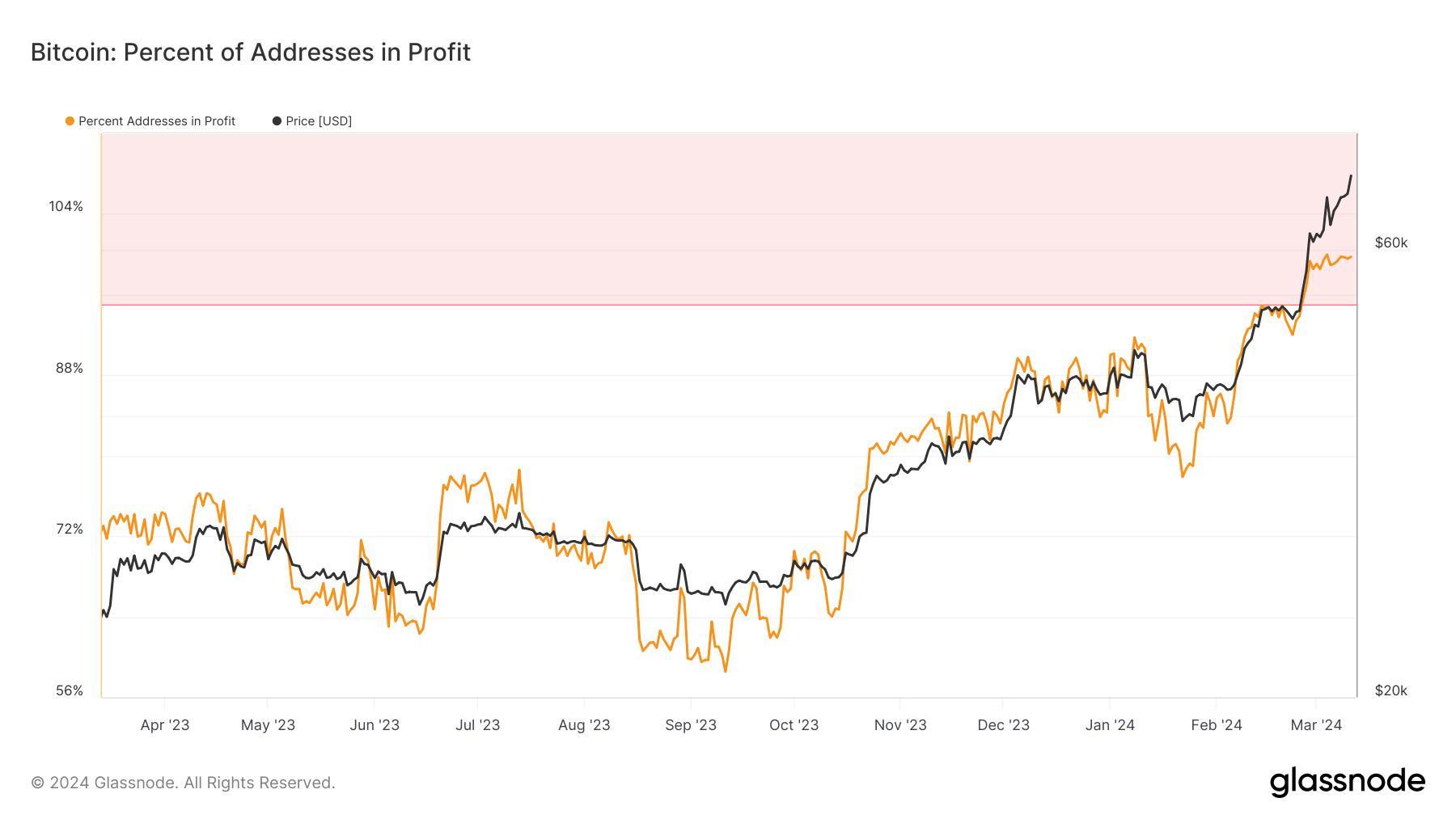

Few on-chain metrics measure market sentiment higher than the address-to-entity ratio of earnings. These metrics have a look at the proportion of distinctive addresses and entities the place the fund's common buy worth is decrease than Bitcoin's present worth. Glassnode defines “Buy Worth” as the value at which the coin is transferred to an deal with or entity.

The excellence between entities and addresses right here helps present a extra nuanced market evaluation. Entities that handle a number of addresses present a extra correct illustration of investor sentiment and habits, as specializing in particular person addresses doesn’t present an entire image of market profitability.

In keeping with Glassnode knowledge, by no means in Bitcoin's historical past have so many addresses and entities profited. This morning, the value of Bitcoin is simply above $72,000, with 99.76% of entities and 99.74% of addresses making earnings. The US market open as soon as once more created some volatility and worn out leverage, with Bitcoin now buying and selling between $72,920 and $70,145.

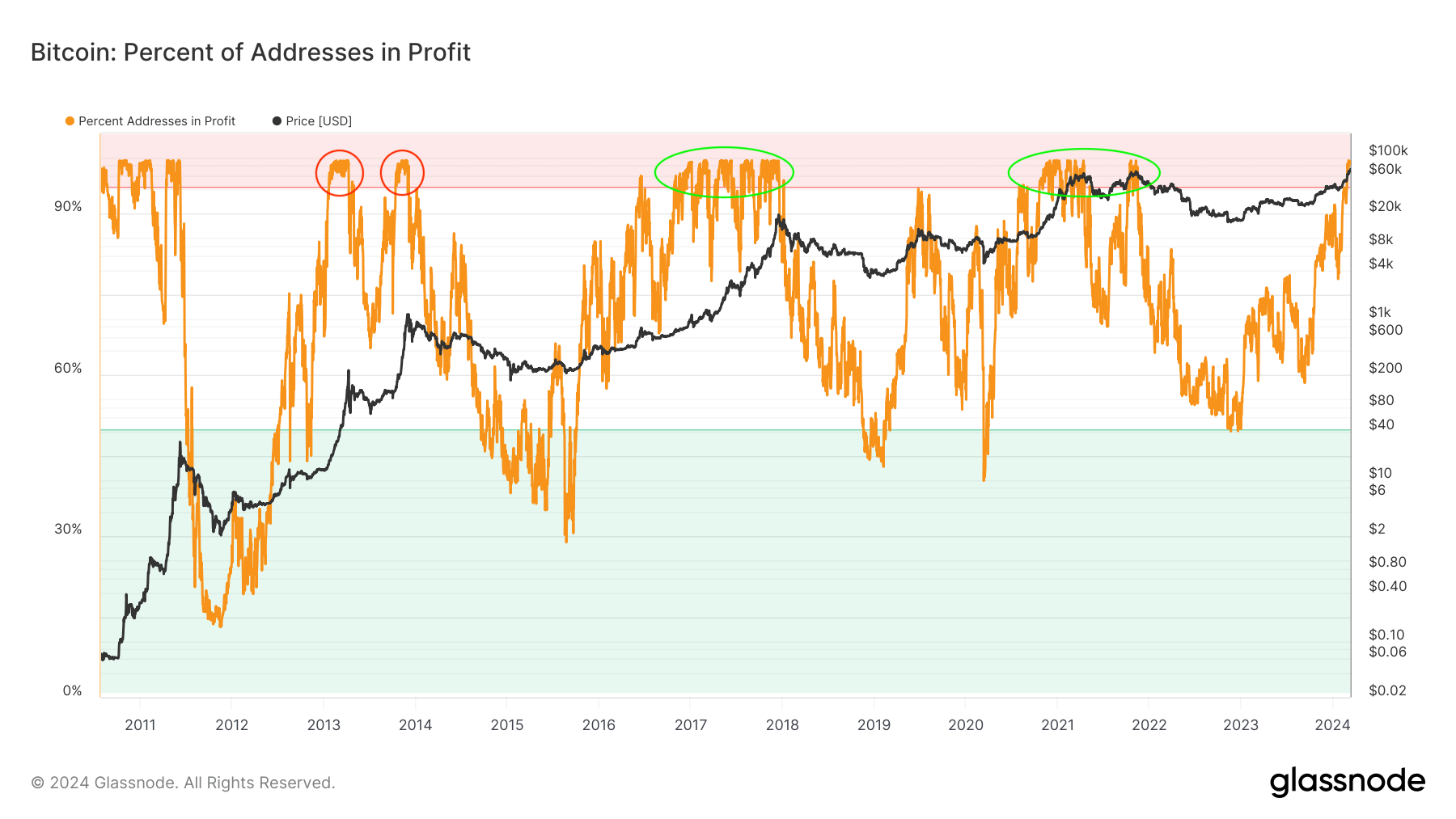

Traditionally, when the proportion of worthwhile entities and addresses exceeds 95%, it marks the start of a mature bull cycle, with the overwhelming majority of market contributors accumulating earnings. Glassnode's historic knowledge reveals that this profitability metric was usually maintained for a few month earlier than a correction occurred. This implies a sample through which a peak in profitability precedes a market withdrawal, per a typical bull market drawdown. Corrections usually happen after a speedy worth enhance to encourage important traders to appreciate earnings, thereby rising promoting strain.

Nonetheless, if we zoom out and have a look at the previous two bull cycles, we are able to see that regardless of the correction, the proportion of worthwhile addresses and entities has remained above 95% for a few yr. These long-term profitability might have contributed to establishing stronger perception in Bitcoin's long-term worth and inspired merchants and traders to carry on to Bitcoin regardless of short-term volatility. .

Present market circumstances present there is no such thing as a scarcity of bullishness, with the proportion of worthwhile entities and addresses at document highs. Nonetheless, contemplating that it has been about three weeks because the return price exceeded 95%, there may be room for warning. Historic patterns point out that such ranges of profitability can by no means be sustained for lengthy with out correction.

It stays to be seen whether or not the present cycle will replicate the prolonged return intervals seen up to now two bull cycles or return to shorter spans. Nonetheless, market maturation, coupled with elevated institutional adoption of Bitcoin by way of Spot Bitcoin ETFs, may disrupt the historic sample.

99.76% of corporations made earnings after Bitcoin soared to $73,000, indicating the maturity of the bull market first appeared on currencyjournals.