As drivers of community safety and transaction verification processes, Bitcoin miners have a major impression on the provision of BTC available in the market.

That is why no market evaluation could be accomplished with out analyzing modifications in miner balances and exercise. First, modifications in miner stability and exercise present perception into the financial well being and operational stability of the sector. Second, miners' choices to promote or maintain BTC mirror their confidence in its future worth and may point out modifications in market sentiment. Moreover, since miners are the primary supply of latest BTC getting into the market, their promoting and holding patterns can straight impression Bitcoin's value volatility and liquidity.

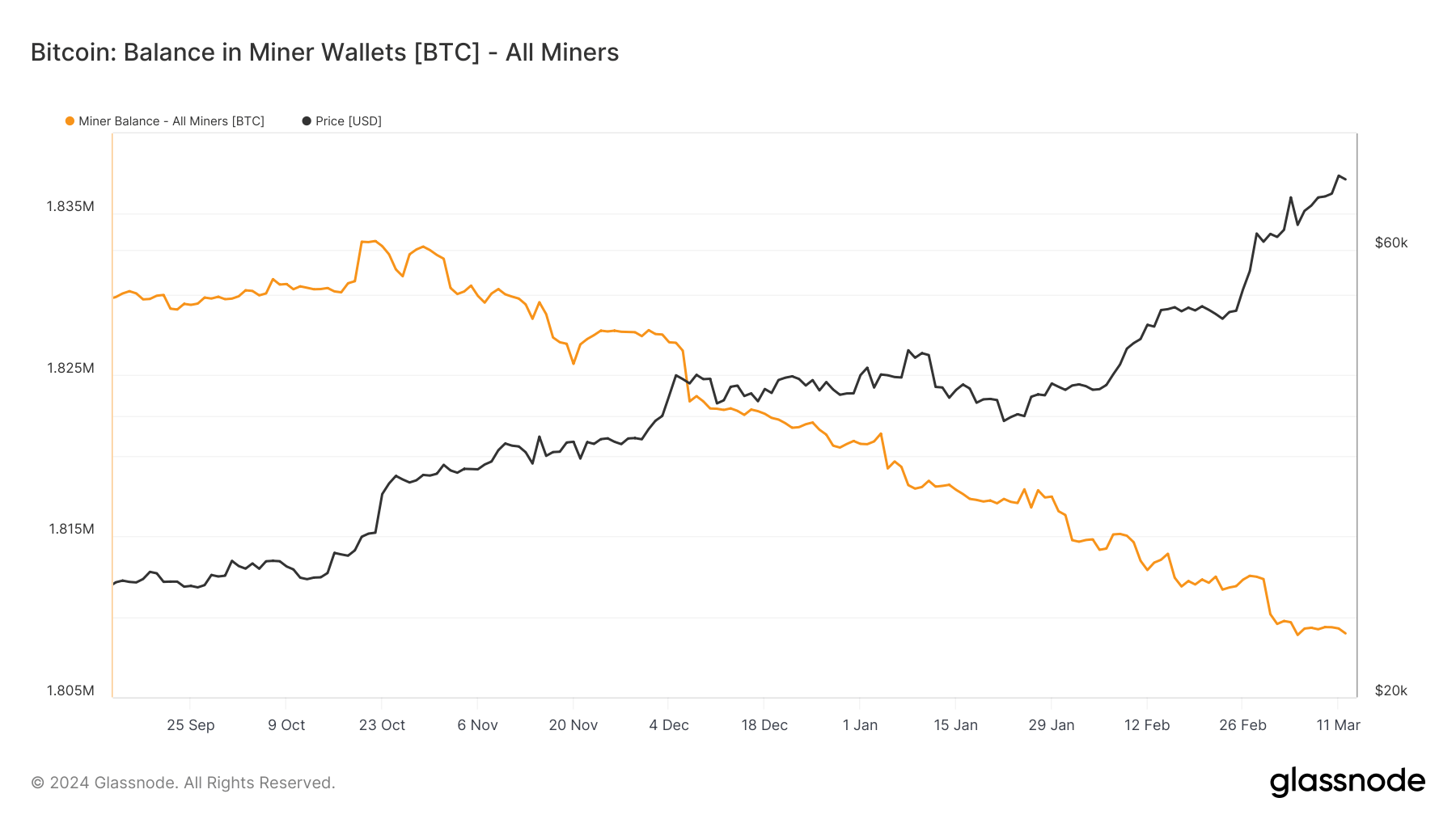

In accordance with knowledge from Glassnode, the stability of BTC held in miner wallets has been steadily reducing for the reason that fall of 2023. The stability decreased from 1.833 million BTC on October 22, 2023 to 1.808 million BTC by March 12.

Greater than 4,000 BTC remained in miner balances since early March. This decline, which seems to have accelerated considerably this month, signifies constant promoting stress from miners who could also be decreasing their holdings to cowl working prices or reap the benefits of rising costs. .

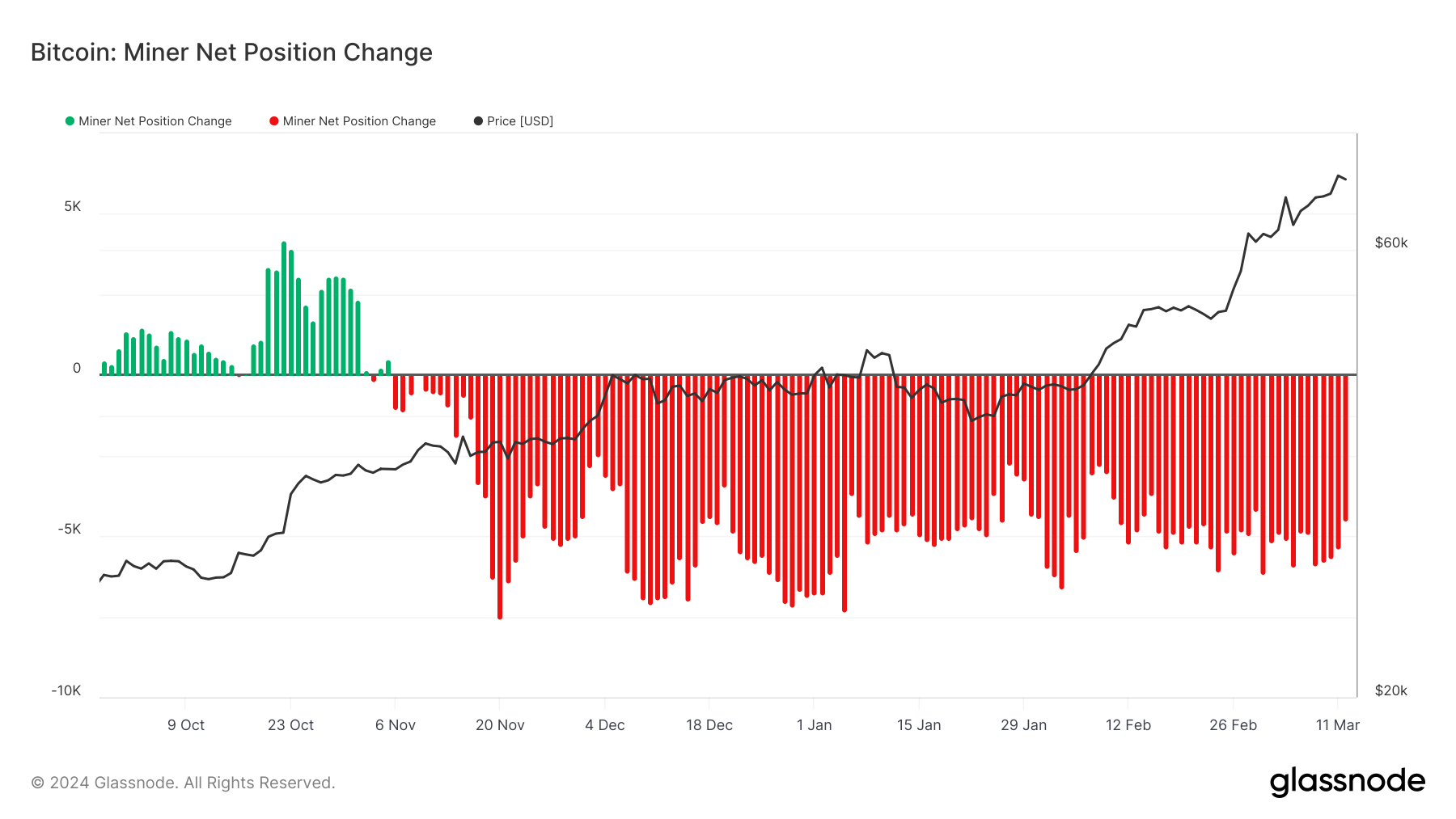

The web change in miner balances, which has been constantly unfavourable since November 2023, signifies the depth of this promoting development. The most important outflow of seven,310 BTC was recorded on January fifth, and a fair bigger outflow of 6,165 BTC was seen on March 1st.

These outflows occurred upfront of essential market occasions (such because the launch of the Spot Bitcoin ETF within the US and the aggressive rally that pushed Bitcoin costs above $70,000), permitting miners to reap the benefits of massive market features. This exhibits that he was anticipating the transfer.

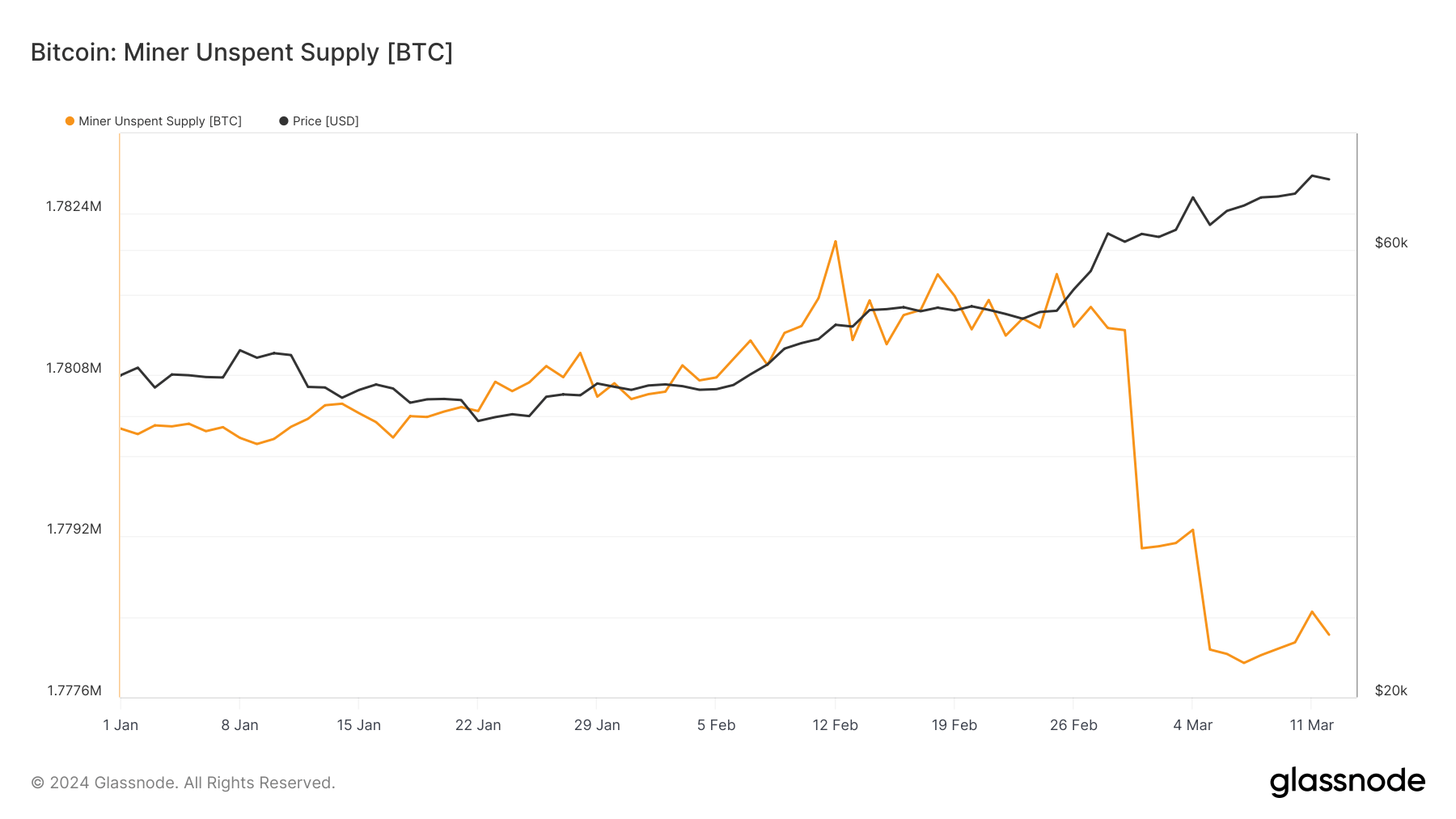

Curiously, regardless of the sell-off, miner unused provide (BTC mined by miners however not but bought) remained comparatively steady, growing from 1.78 million BTC in the beginning of the yr to 1.778 million BTC by March twelfth. It fluctuates barely. This implies the next. Whereas miners are promoting, the proportion of newly mined BTC held is roughly offset by the BTC bought.

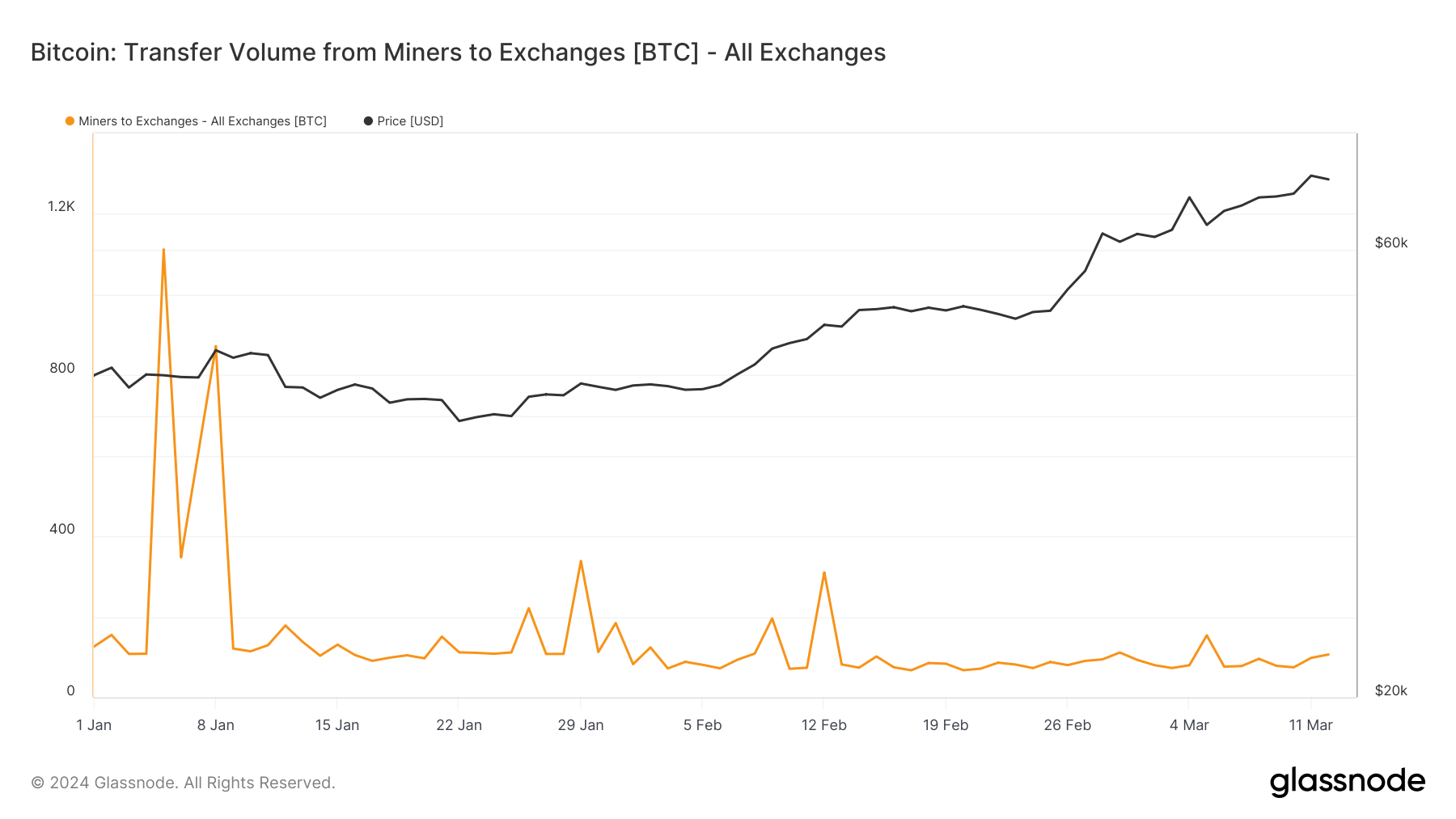

Transfers of cash from miners to trade wallets peaked particularly across the launch of the Spot Bitcoin ETF, indicating miners are profiting from alternatives and managing liquidity wants. Masu.

The typical switch quantity in Q1 2024 ranged from 67 BTC to 150 BTC, with a notable peak of 106 BTC on March twelfth, indicating that miners are actively managing their holdings, however suggesting mass liquidations. It's not on a scale like that.

Whereas Bitcoin miners have been web sellers over the previous six months, the introduction and adoption of spot ETFs within the US has injected important liquidity and shopping for stress into the market. Though the promoting by miners was important, it was absorbed by the market with out disrupting the bullish momentum established for the reason that starting of the yr.

The article Bitcoin Stays Value Resilient Regardless of Elevated Miner Gross sales appeared first on currencyjournals.