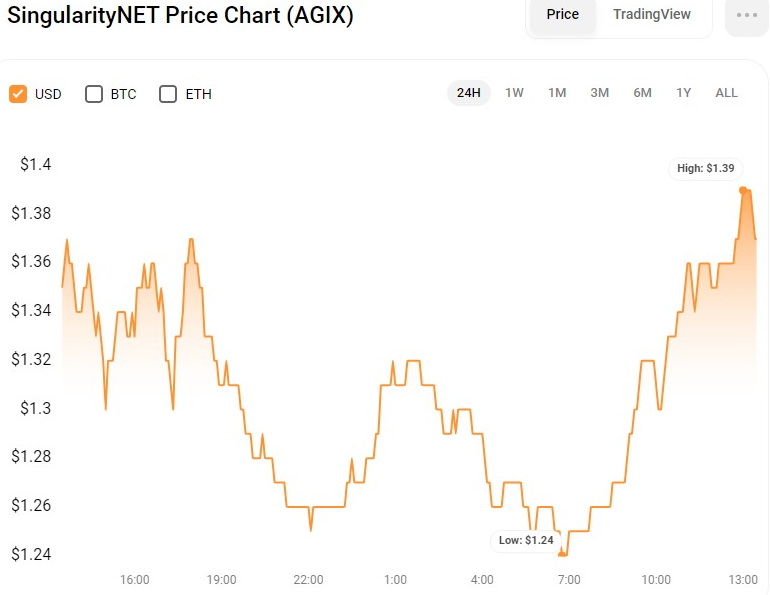

- AGIX inventory rose 28% this month on the information of the merger, hitting a seven-day excessive of $1.39.

- AGIX’s buying and selling quantity surged 97.27%, pushing its market cap to $1.78 billion.

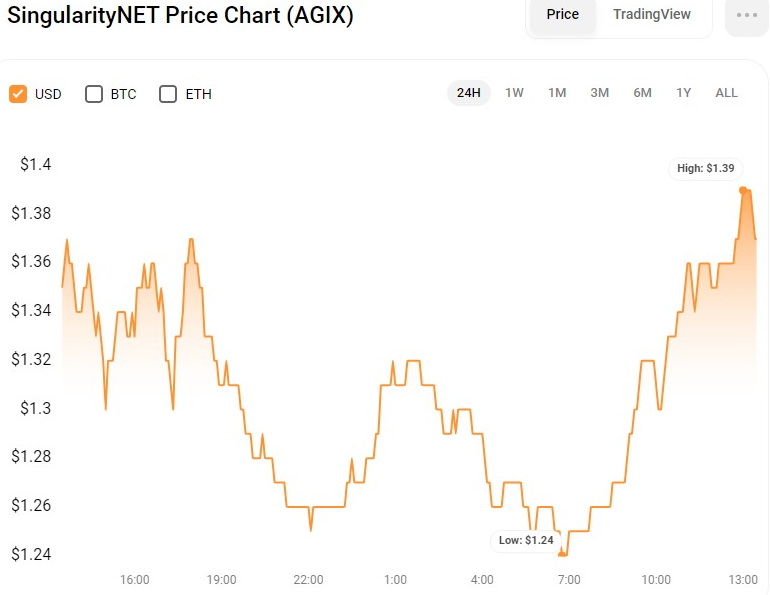

- On the AGIX chart, the Bollinger Bands are widening, indicating elevated volatility.

AGIX has been on an upward pattern because the information that SingularityNET (AGIX), Fetch.ai (FET), and Ocean Protocol (OCEAN) might be merged into AltSignals (ASI) Token for a diluted valuation of $7.5 billion. Consequently, AGIX’s bullish momentum regained momentum and the worth rose to a 7-day excessive of $1.39 after discovering assist on the intraday low of $1.20. On the time of writing, AGIX is buying and selling at $1.39, up 7.98% prior to now 24 hours and 28% over the previous month.

As traders proceed to imagine within the potential of the AltSignal (ASI) token, if the constructive momentum breaks by the $1.39 resistance, the subsequent resistances to look at are $1.50 and $1.60. Nevertheless, if the worth fails to interrupt out of $1.39, it might briefly fall to the $1.20 assist degree earlier than making an attempt one other constructive transfer greater.

Through the rising interval, AGIX's market capitalization and 24-hour buying and selling quantity elevated by 7.595% and 97.27%, respectively, to $1,775,791,076 and $544,730,216. This rally displays elevated curiosity and funding within the AGIX token and will result in additional good points if the bullish pattern continues.

AGIX/USD Technical Evaluation

On the AGIXUSD 4-hour worth chart, the Bollinger Bands are increasing, with the higher and decrease bands touching $1.3686 and $1.07931, respectively. This pattern signifies elevated volatility within the close to future, and the higher and decrease bands might act as resistance and assist for worth actions.

Nevertheless, the uptrend might proceed within the brief time period because the bullish candle broke above the Bollinger Bands. Quite the opposite, this means an overbought place, which might result in a fall in worth.

The Cash Circulation Index (MFI) ranking of 78 lends legitimacy to the overbought scenario, indicating that the asset's present upward momentum might have reached its restrict. Due to this fact, merchants ought to at all times rigorously monitor market actions for indicators of reversals or corrections. Nevertheless, because the Stochastic RSI stays above the sign line at 42.89, there may be nonetheless room for additional upside earlier than a correction happens.

Moreover, Chaikin Cash Circulation (CMF), at present in adverse territory with a ranking of -0.06, has risen, indicating that promoting strain has eased and patrons might quickly regain management of the asset's worth actions. It exhibits. This implies that whereas warning is suggested, extra constructive momentum might emerge within the close to time period.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.