- Coinbase analyst David Han believes the USDe stablecoin has now change into a formidable competitor to DAI.

- USDe gained market capitalization versus DAI attributable to excessive yields and airdrop incentives.

- USDe added $500 million in two days, whereas DAI remained comparatively stagnant.

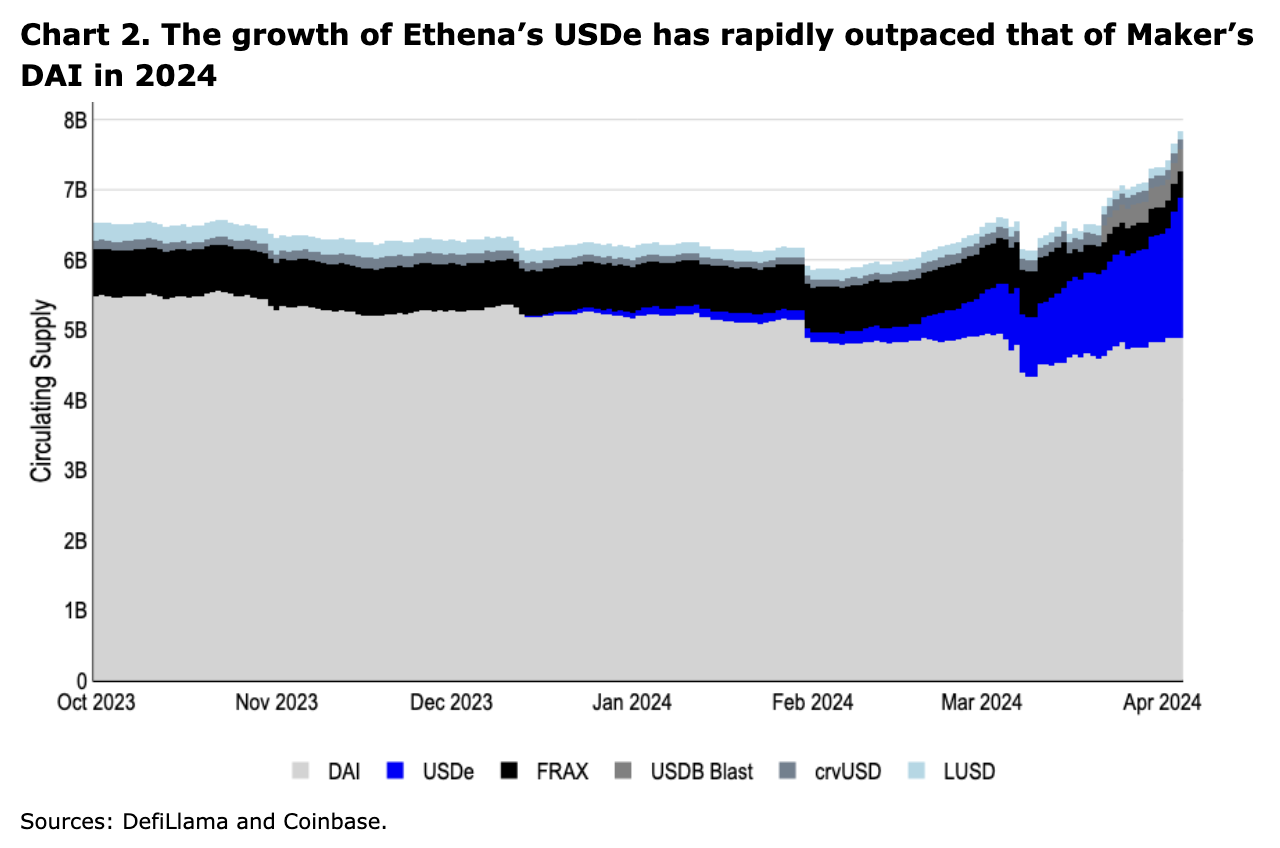

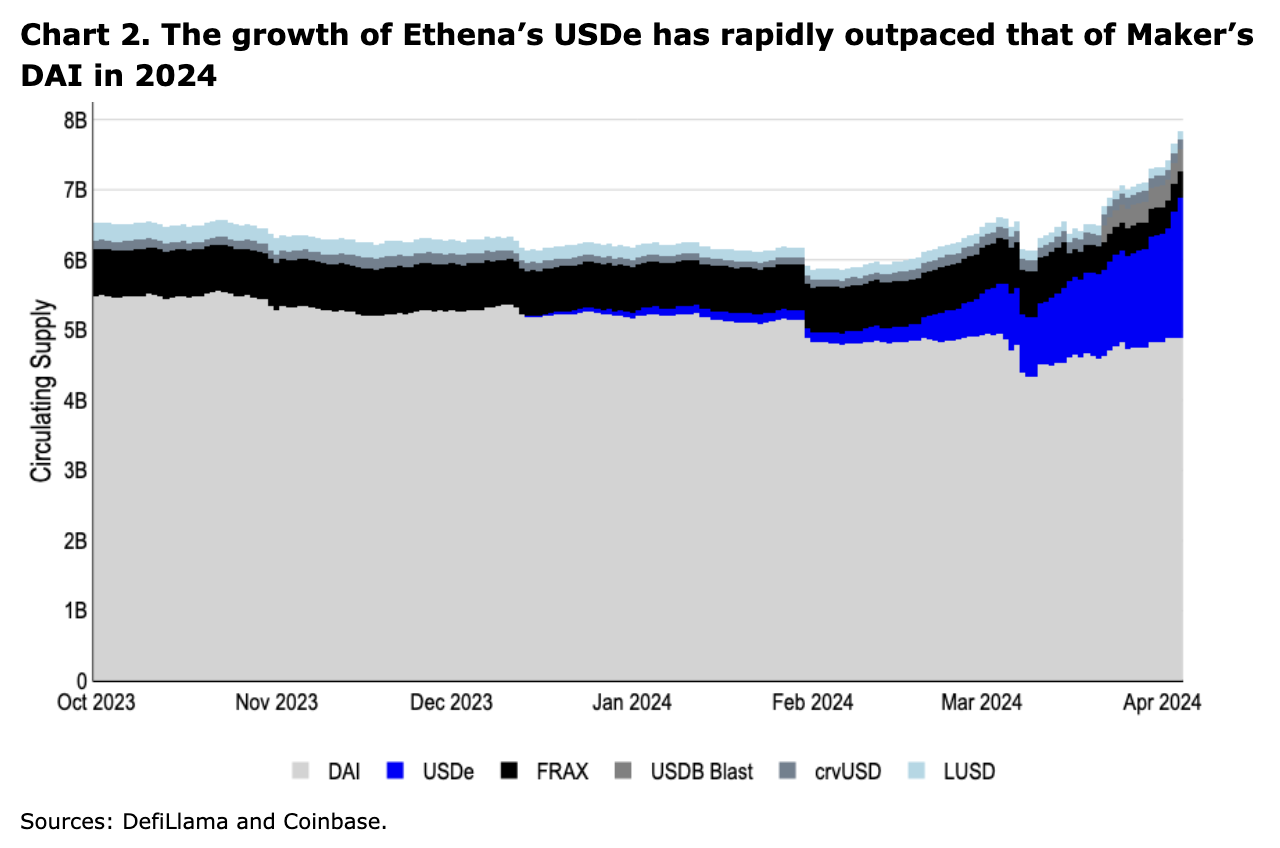

Coinbase analysis analyst David Han highlighted that Ethena's newly launched USDe stablecoin is a formidable competitor to MakerDAO's DAI stablecoin. In Coinbase's newest market tendencies report, analysis analyst David Han highlighted that USDe development has up to now considerably outpaced MakerDAO's DAI in 2024.

In accordance with researchers, USDe gained market share in comparison with DAI attributable to enticing yields and airdrop incentives. He additional attributed this spike to controversial governance modifications inside MakerDAO and ongoing discussions inside the DeFi neighborhood relating to the attainable elimination of DAI as collateral from the Aave market.

On the time of writing, the USDe stablecoin has a market capitalization of $2.05 billion, whereas DAI nonetheless has a major lead at $5.35 billion. In the meantime, USDe has gained a good portion of the market share prior to now seven days.

As of April 2nd, USDe's market capitalization was $1.58 billion. There was a notable improve from April third to April 4th, reaching $2 billion for the primary time and persevering with to carry that place. Apparently, as of late February, USDe's cap was lower than $350 million. All through these durations, DAI's stablecoin market capitalization remained comparatively stagnant.

Though USDe has outperformed DAI, a extra established participant available in the market, Coinbase analysts acknowledge that each stablecoins have comparable limitations. He identified that DAI and USDe have restricted issuing capability. Particularly, DAI depends on overcollateralization, whereas USDe's means to subject is restricted by the dynamics of the futures open curiosity market.

Moreover, trade consultants like Ki Younger Ju, CEO of knowledge analytics platform CryptoQuant, have expressed issues about USDe's construction. Younger Ju mentioned Ethena's choice to make use of Bitcoin as collateral displays the scenario at Terra Luna UST, the place the Terra Luna crew regularly bought BTC to take care of the steadiness of the UST peg. declare.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t answerable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Comments are closed.