Singapore, Singapore, April 10, 2024, Chainwire

April 4th, Binance Web3 Pockets companions with BEVMthe main Bitcoin Layer 2 and its ecosystem venture, Satoshi Protocol, launches an airdrop marketing campaign value hundreds of thousands of {dollars}.

Customers who bridge BTC to BEVM through Binance Web3 pockets and borrow no less than $10 SAT (USD-stablecoin) will likely be eligible to share within the pool of 500,000 OSHI and 10.5 million BEVM tokens. The marketing campaign attracted greater than 30,000 members in simply three days after its launch.

The SATOSHI protocol is the primary CDP protocol constructed on BEVM and will likely be launched on BEVM mainnet on March twenty eighth. Along with the Binance marketing campaign, there may be additionally a referral program the place early members can earn factors by borrowing her SAT and welcoming associates.

What is exclusive about BEVM?

BEVM is an EVM-compatible Bitcoin layer 2 answer that stands out in a crowded market. By leveraging Taproot consensus, Schnorr signatures, MAST, and Bitcoin SPV, BEVM offers the very best stage of decentralization and safety of any BTC layer 2 answer.

Essential options of BEVM:

- Native BTC Layer 2: BEVM makes use of BTC as community fuel and shops transaction knowledge on the BTC mainnet to make sure compatibility with the unique Bitcoin protocol.

- EVM compatibility: Builders can seamlessly migrate their Ethereum-based dApps to BEVM, extending the attain of those functions to the Bitcoin ecosystem.

- Decentralized and safe: BEVM employs Musig2 multi-signature aggregation and Bitcoin Lite nodes to offer a trustless and safe atmosphere.

Satoshi Protocol: Unlocking Bitcoin Liquidity

The Satoshi Protocol is the primary Collateral Debt Place (CDP) protocol constructed on BEVM and goals to offer liquidity to BTC by the SAT greenback stablecoin and lengthen the BTCFi state of affairs. This transfer frees up trillions of {dollars} of liquidity inside the Bitcoin ecosystem and offers customers a technique to keep their Bitcoin holdings whereas gaining liquidity.

The Bitcoin ecosystem is present process a renaissance. Current advances equivalent to subscription and scaling options have revitalized the ecosystem. The group at Satoshi Protocol sees the upcoming halving and launch of Rune Protocol as poised to draw a brand new wave of customers.

Nonetheless, a major problem stays: the shortage of a dependable fiat-pegged cryptocurrency that allows seamless transactions and environment friendly market pricing. That is the place Satoshi Protocol steps in. Satoshi Protocol offers a dependable liquidity answer inside the Bitcoin ecosystem by permitting customers to borrow their SATs with Bitcoin as collateral.

Satoshi Protocol Milestones

Over the previous month, Satoshi Protocol has constructed a robust neighborhood, amassing over 60,000 followers. twitter We have now over 70,000 members throughout Telegram and Discord.

Let's see what they achieved:

How does the Satoshi Protocol work?

The Satoshi Protocol makes use of a complicated system to take care of a steady $1 peg for SAT. The system combines a number of mechanisms equivalent to overcollateralization, permissionless liquidation, stability swimming pools, and arbitrage. Moreover, it additionally options OSHI, a utility token that grants the holder his 97.5% of the protocol revenues.

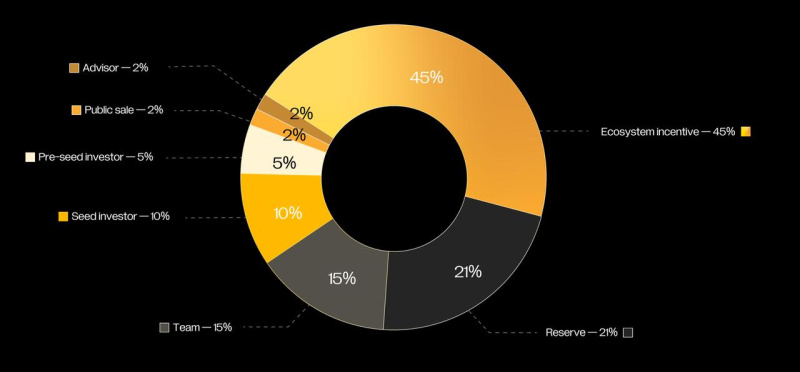

For extra details about OSHI and sOSHI, please seek advice from the official doc OSHI and sOSHI.

advisable supply

The interplay between SAT and OSHI types the core of the Satoshi protocol. Right here's the large image:

secured borrowing

When borrowing SAT, customers should keep a minimal collateral ratio (MCR) of 110%. Which means the borrowed quantity can’t exceed his 90.9% of his deposited BTC worth.

liquidation

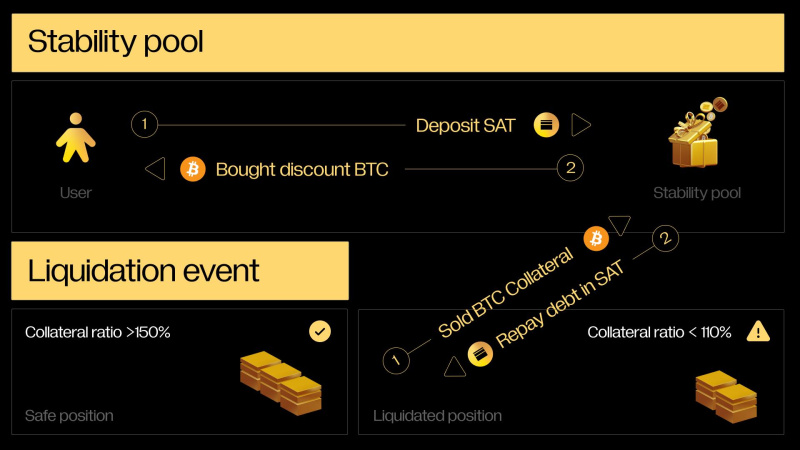

Liquidation will likely be triggered if the worth of the consumer's collateral falls under 110% (MCR) attributable to value fluctuations. A consumer's BTC collateral will likely be bought at a reduction to a steady pool supplier to repay the SAT mortgage. This mechanism protects the protocol and prevents debtors from taking over extreme debt.

Peg upkeep

A sturdy three-pronged system ensures that SAT's worth stays constantly pegged to the US greenback.

redemption: Arbitrage actions assist alter the value of SAT and preserve it inside a desired vary. If SAT falls under $1, the arbitrageur should buy his discounted SAT and redeem it for $1 value of his BTC from the protocol. Conversely, if the SAT exceeds $1.1, the consumer can borrow his SAT at his MCR (110%), promote it at a premium value on a decentralized trade (DEX), and pocket the earnings. Masu.

Overcollateralization: As talked about earlier, overcollateralization (MCR 110%) acts as a security internet. This protocol deters debtors from defaulting by demanding larger collateral values and protects in opposition to value fluctuations.

Stability pool: This pool acts as a closing security measure. If a consumer's collateral ratio falls under his MCR, the soundness pool will execute a liquidation occasion and supply the required liquidity to take care of the soundness of the protocol.

Satoshi Protocol x BEVM Airdrop (with Binance Pockets)

BEVM and Satoshi Protocol just lately partnered with Binance Web3 Pockets to supply complete. $10.5 million BEVM and 500k $OSHI Token Airdrop.

For those who use Binance Pockets to finish duties equivalent to bridging to BEVM and create positions on the Satoshi protocol, you can be eligible to share the rewards.

interval: 2024/04/04-2024/05/04

reward: 10,500,000 BEVM and 500,000 OHSI

job:

- Utilizing Binance Pockets

- Bridge BTC to BEVM (0.0004 BTC, ~$25)

- Create a place with Satoshi Protocol (no less than 10 SAT)

Take part in Binance Pockets Airdrop Marketing campaign

The best way to take part on this marketing campaign

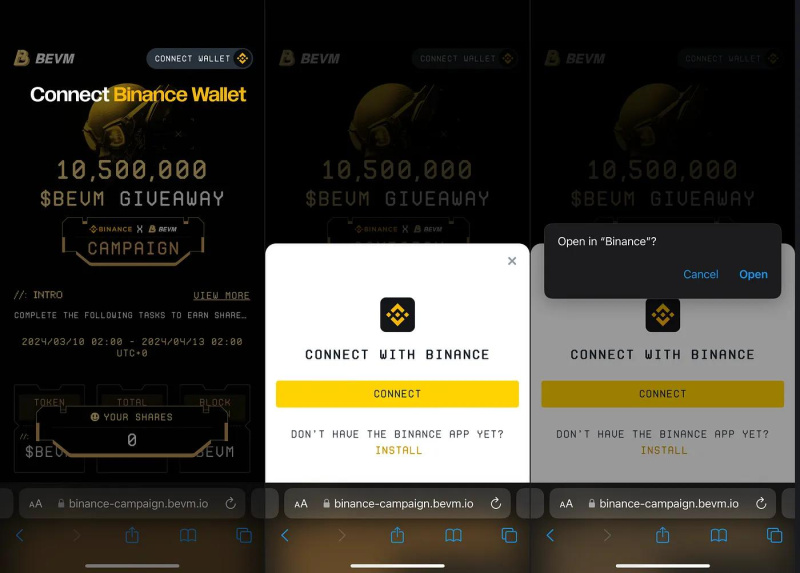

Step 1: Customers should go to the marketing campaign touchdown web page and join their Binance pockets

Step 2: Withdraw your BTC and bridge it to BEVM

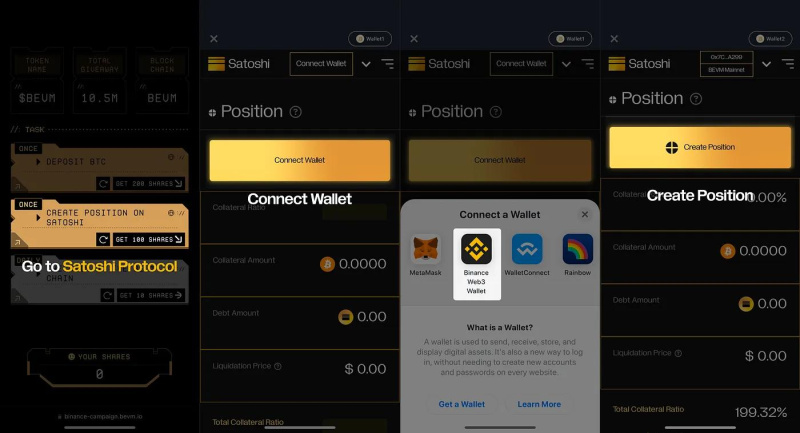

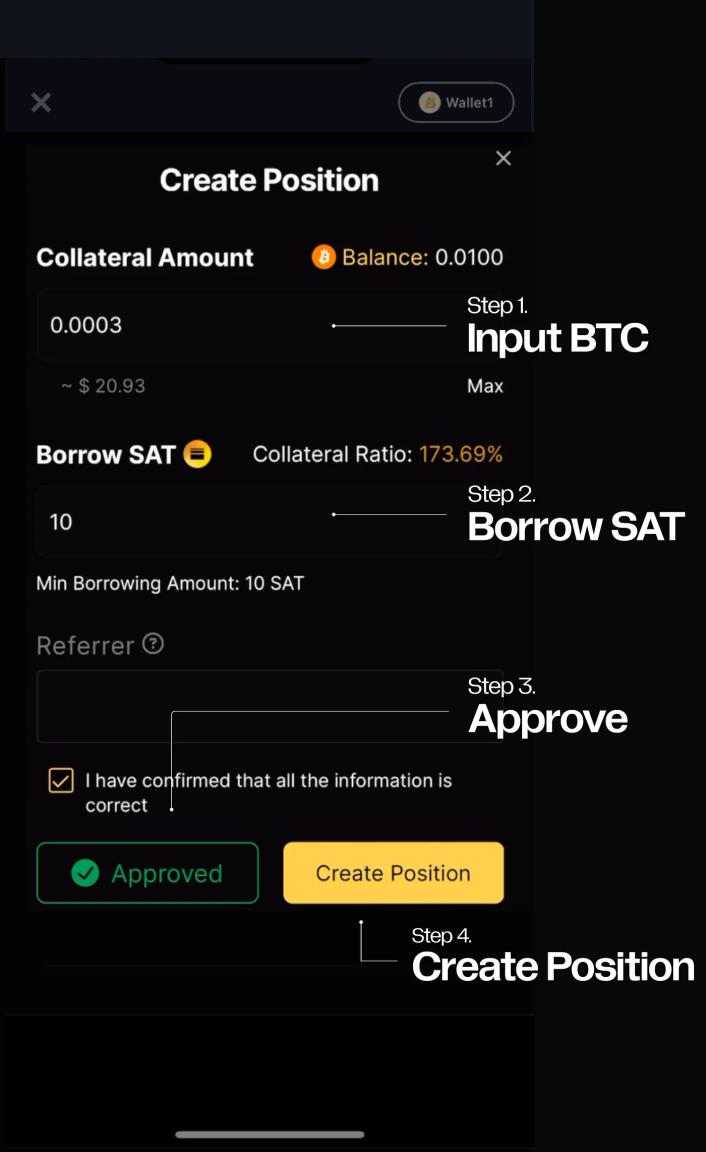

Step 3: Consumer must go to Satoshi Protocol and create a Place.

Customers ought to go to Satoshi Protocol and Join Pockets.

- Enter BTC quantity

- Borrow SAT (no less than 10 SAT)

- (Elective) Earn 150+ factors by getting into your referrals

- Click on “Approve”

- Click on “Create place”

Binance Pockets Cell Tutorial: Create a place utilizing Binance Web3 pockets

After finishing all these steps, the consumer will likely be eligible for BEVM and OSHI airdrop.

Bridge to the Future: Satoshi Protocol and Binance Pockets Airdrop Marketing campaign

The Satoshi Protocol affords a glimpse into the way forward for Bitcoin finance. By leveraging BEVM and a strong CDP mannequin, customers can borrow their BTC-backed stablecoin SAT and develop the potential of the Bitcoin ecosystem.

Binance Pockets launches airdrop marketing campaign with complete quantity of 10.5 million yen $BEVM,500K $oshi For many who wish to bridge BTC to BEVM and create positions on the Satoshi protocol. That is additionally the primary integration of Binance Pockets with a Bitcoin Layer 2 answer. BTCFi is heading west.

About Satoshi Protocol

Constructed on BEVM, it’s the first CDP protocol to unlock the true potential of Bitcoin. Unlock unprecedented liquidity by SAT, a stablecoin designed to supercharge the burgeoning BTCFi market.

To study in regards to the Satoshi Protocol, please observe these steps:

contact

advertising

hugo

satoshi protocol

(e-mail protected)