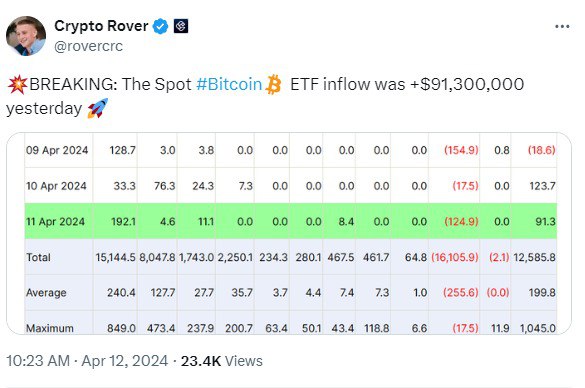

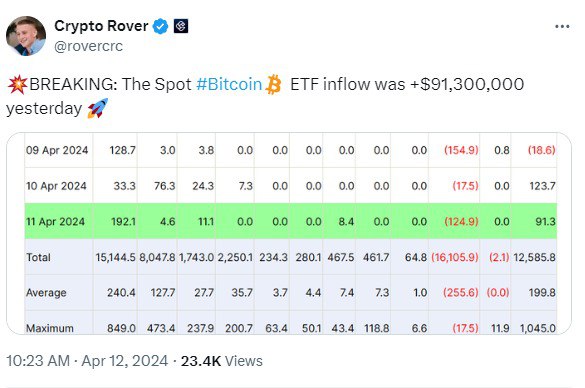

- Bitcoin ETF inflows hit an astounding $91.3 million on April eleventh, sustaining robust momentum.

- Complete internet inflows into the Bitcoin ETF market reached a formidable $1.5 billion.

- black rock Outflows on April 11 had been offset by inflows of $192.1 million.

Bitcoin ETF inflows surpassed a staggering $91 million on April 11, 2024, and continues to keep up robust momentum. Analyst Crypto Rover shared an X-post revealing huge inflows into Bitcoin ETFs totaling $12.5 billion.

In response to the report, the Spot Bitcoin ETF's $91.3 million inflows on April 11 had been a lot decrease than its $123.7 million inflows on April 12. Nevertheless, this quantity contributes considerably to the general optimistic circulation of the Bitcoin ETF.

On April eighth and ninth, the Bitcoin ETF confirmed adverse flows, with whole outflows exceeding inflows. The Bitcoin ETF recorded outflows of $18.6 million on April 9, in comparison with $223.8 million on April 8.

WhalePanda, a distinguished voice within the cryptocurrency house, sat down with X to share his insights on the optimistic developments within the Bitcoin ETF market. In response to WhalePanda's put up, BlackRock's staggering $192.1 million inflows utterly offset outflows.

Grayscale GBTC is reportedly experiencing a rise in outflows. From an outflow of $17.5 million on Wednesday, GBTC reached a large $124.9 million on Thursday. WhalePanda mentioned Grayscale's outflow is instantly proportional to market energy.

Moreover, WhalePanda revealed that Grayscale's Bitcoin holdings are reducing. In response to Grayscale's official web site, their BTC holdings have decreased to 316,000, and based on Arkham Intelligence, GBTC's BTC holdings have decreased to 321,000.

In the meantime, Bitcoin has hovered above the numerous $70,000 level, approaching its long-awaited halving.As of this writing, Bitcoin is ready at $70,972, displaying a slight enhance

It’s outstanding at 0.35% in 1 day and 6.35% in 7 days. Nevertheless, over the previous month, Bitcoin has skilled a slight decline of 1.26%.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.