Bitcoin's fourth halving launched a long-term halving. brief shift The miner's income construction is BTC Miners are rewarded 50% for every block mined, immediately impacting miner incentives and, in flip, the broader Bitcoin economic system.

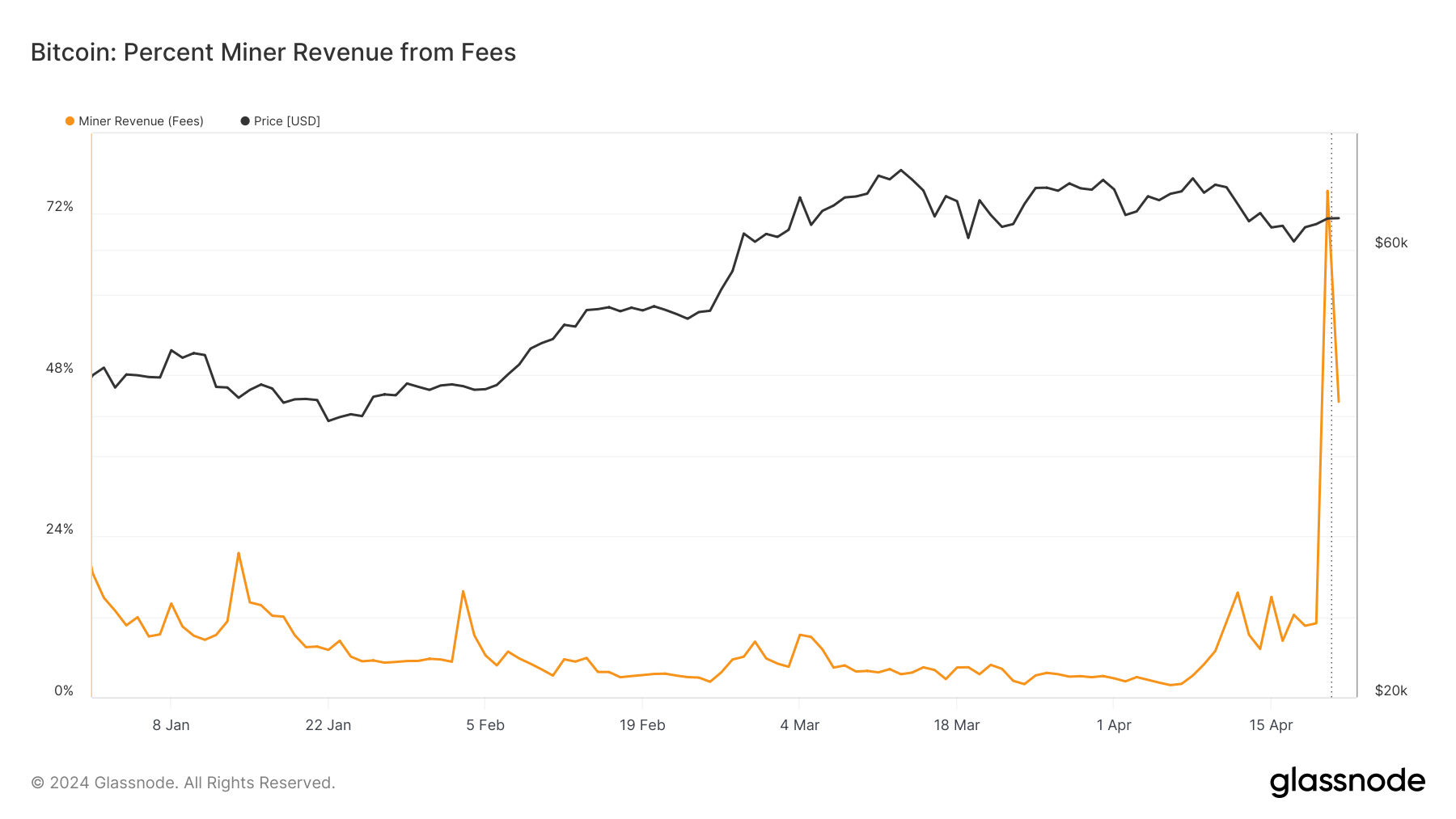

On April 19, simply earlier than the halving, transaction charges accounted for 11% of miners' whole income, and this quantity remained comparatively secure all year long. Nonetheless, the April twentieth halving occasion triggered a significant change, with buying and selling charges hovering to greater than 75% of miner income.

The rise in charges could also be as a consequence of a mix of varied components. First, a good portion of the market could have rushed to settle trades earlier than the halving, which pushed up buying and selling charges.

Second, the demand for transactions appears to be growing, with customers eager to be included within the halving block itself. Most of this demand is probably going coming from Ordinals, because the coveted 840,000 block inscription could also be value extra on the secondary market.

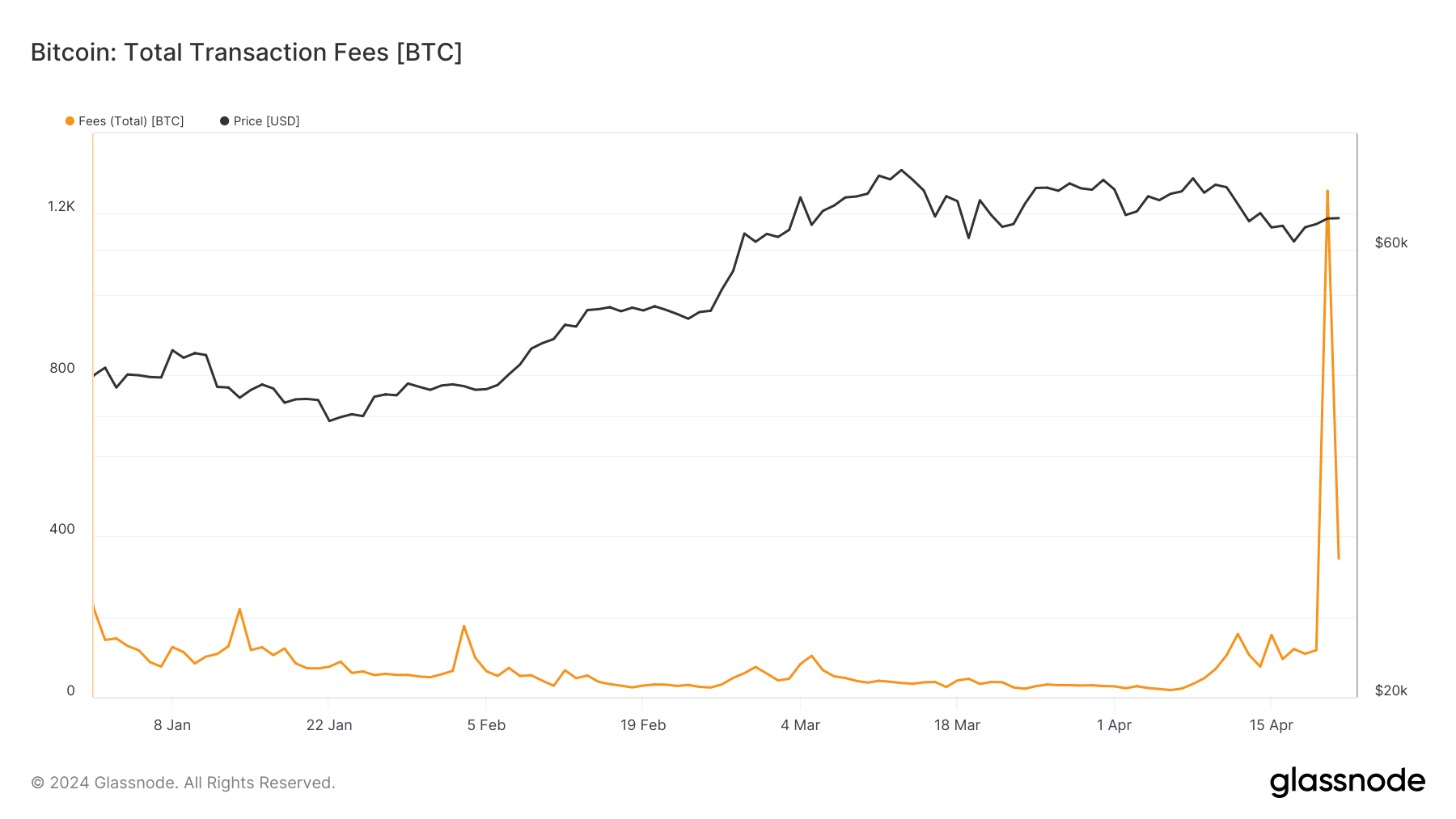

This demand for restricted block area led to transaction charges reaching historic highs, with 1,257 BTC paid to miners on the day of the halving. On April 19, the day earlier than the halving, the entire charges paid to miners was 116 BTC, displaying how dramatically transaction prices have elevated.

Charges then fell to 344 BTC on April twenty first, however have been nonetheless considerably greater than their pre-halving ranges, indicating that the market had normalized and began adapting to the brand new mining economic system.

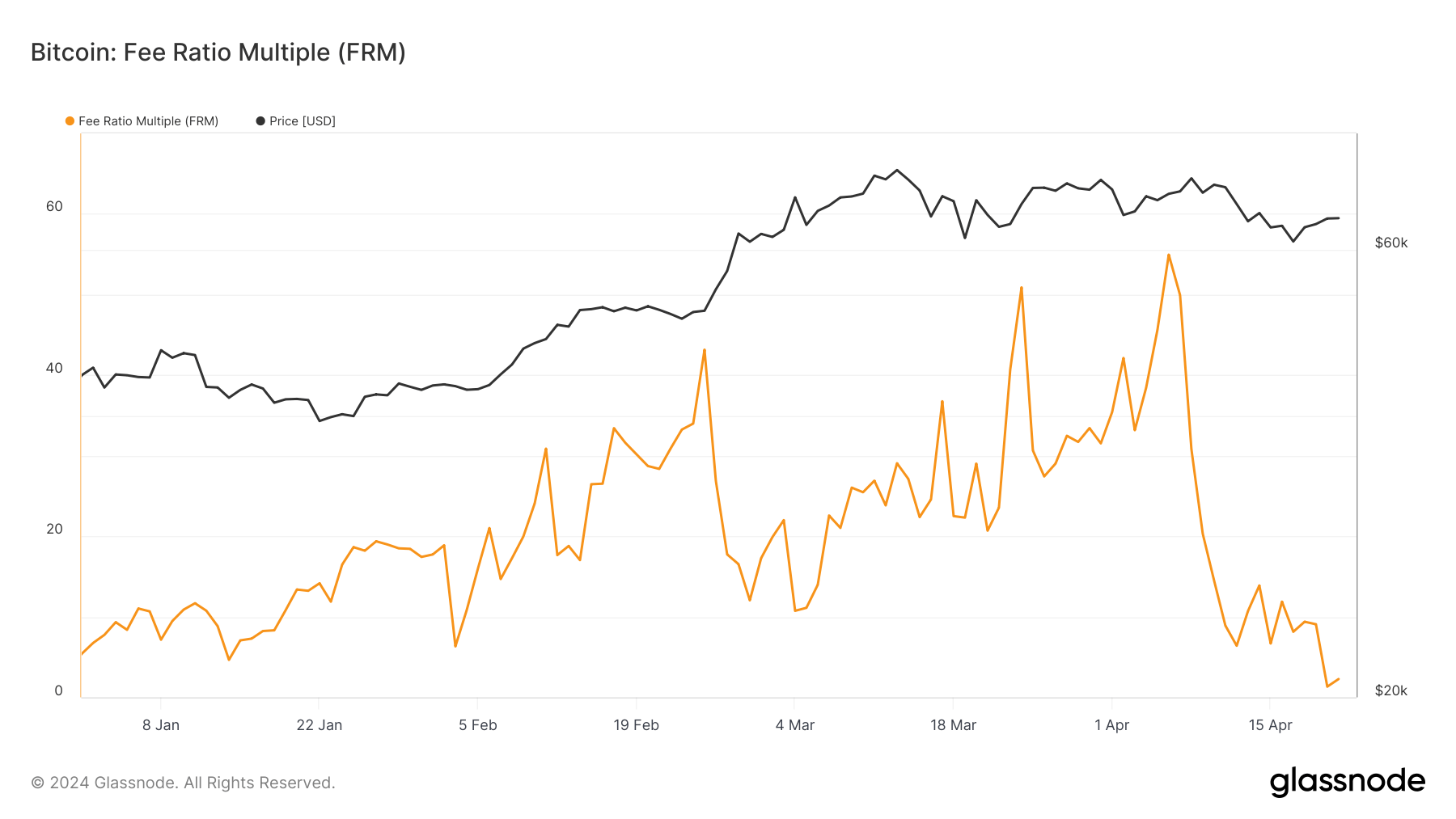

The Payment Ratio A number of (FRM) clearly reveals the affect of those payment will increase. This metric is used to evaluate the financial safety of blockchains, particularly when shifting from block reward-based miner rewards to transaction fee-based rewards for principals. FRM is calculated by dividing a miner's whole income, which consists of block rewards and transaction charges, by transaction charges.

This metric helps assess how a lot of mining income is derived from transaction charges relatively than block rewards, offering perception into the sustainability of a blockchain as soon as block rewards are not a major issue. To do.

On April nineteenth, the day earlier than the halving, FRM was 9.01. Which means miners' whole revenue is roughly 9 occasions the quantity earned from transaction charges alone, indicating that almost all of miners' revenue continues to be closely depending on block rewards.

FRM dropped to 1.325 as block rewards have been lower in half and transaction charges elevated. This reveals how dramatic the shift to reliance on charges has been. As block rewards lower, transaction charges grow to be a a lot bigger proportion of a miner's whole income, lowering FRM worth.

A low FRM worth implies that the blockchain is theoretically approaching a state the place it may be sustained primarily by transaction charges. That is essential for long-term safety and viability, as block rewards will proceed to be halved till stopped.

Nonetheless, this will have a detrimental affect on giant elements of the community. If transaction charges start to make up a big portion of miners' income, they could enhance prices for customers, impacting how transactions are prioritized and influencing consumer habits. This could result in even greater charges throughout peak demand durations.

The put up Publish-Bitcoin Transaction Charges Surge to Account for 75% of Miner Revenues Publish-Halving appeared first on currencyjournals.