Monitoring modifications within the provide held by firms with completely different Bitcoin balances supplies perception into investor conduct and potential value actions. From particular person retail traders to giant establishments, every class of holders performs a unique function within the cryptocurrency ecosystem, and their collective actions can have a big influence on the general market.

Adjustments in provide distribution throughout completely different pockets sizes generally is a sturdy indicator of market sentiment. For instance, small entities accumulating BTC typically sign elevated retail curiosity or bullish sentiment amongst retail traders who consider present costs are enticing for entry and funding enlargement. are doing. Redistribution by bigger firms can signify a wide range of methods and market responses, comparable to revenue taking, portfolio rebalancing, and responding to regulatory or financial modifications. This exercise is crucial as a result of it may mirror the attitude of institutional and skilled traders and generally is a bellwether of broader market actions.

When Bitcoin turns into concentrated in giant wallets or dispersed amongst a wider vary of small holders, it impacts market liquidity and volatility. Focus in a small variety of wallets can result in elevated volatility if these entities resolve to maneuver a big portion of their holdings. Conversely, a extra dispersed base of small and medium-sized holders can enhance market stability and liquidity, as shopping for and promoting is much less more likely to considerably influence costs.

Understanding which market segments are rising or shrinking supplies perception into how exterior elements have an effect on various kinds of traders.

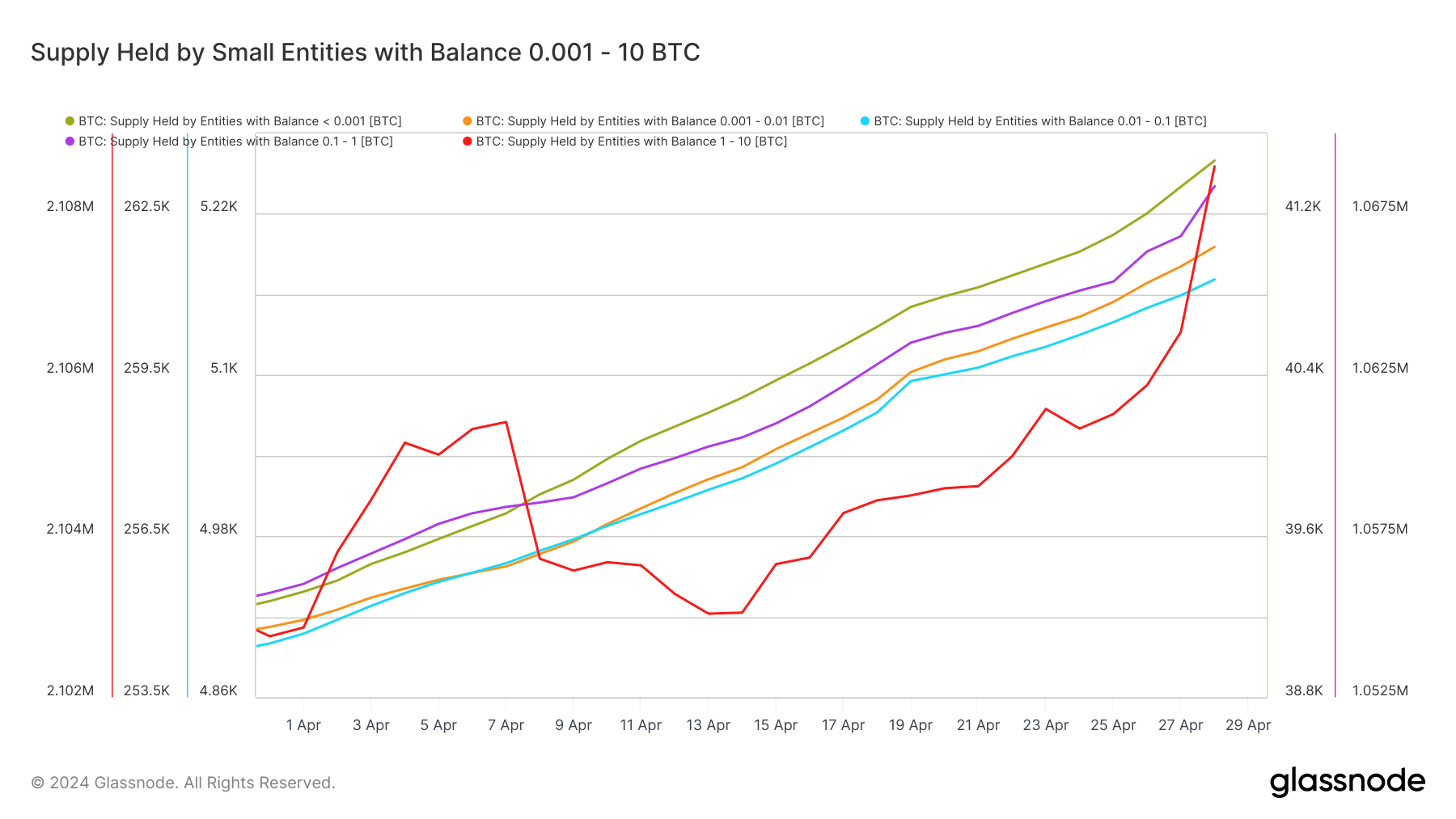

Knowledge from Glassnode confirmed a rise within the provide of Bitcoin held throughout all classes of small entities, from entities with balances of lower than 0.0001 BTC as much as balances of as much as 10 BTC. Corporations with balances between 0.01 and 0.1 BTC noticed the biggest enhance of their Bitcoin holdings. The provision of this group elevated from 254,503.7 BTC to 261,281.4 BTC. This represents a rise of 6,777.7 BTC, probably the most absolute enhance amongst small entity teams noticed prior to now 30 days.

This important enhance is because of people who find themselves thought of “informal” traders – those that are usually not solely dipping their toes into the Bitcoin market, but in addition doubtlessly utilizing Bitcoin as a significant factor of their crypto holdings. It might point out elevated belief between people. The rise in all these entities signifies that they’re accumulating. Bitcoin's value has fallen from $73,000 to $63,000 over the previous month, and the timing suggests these traders are shopping for on the dip, seeing the lows as a horny entry level. It confirms that. This conduct is attribute of retail traders and small market individuals who could understand long-term worth at cheaper price factors.

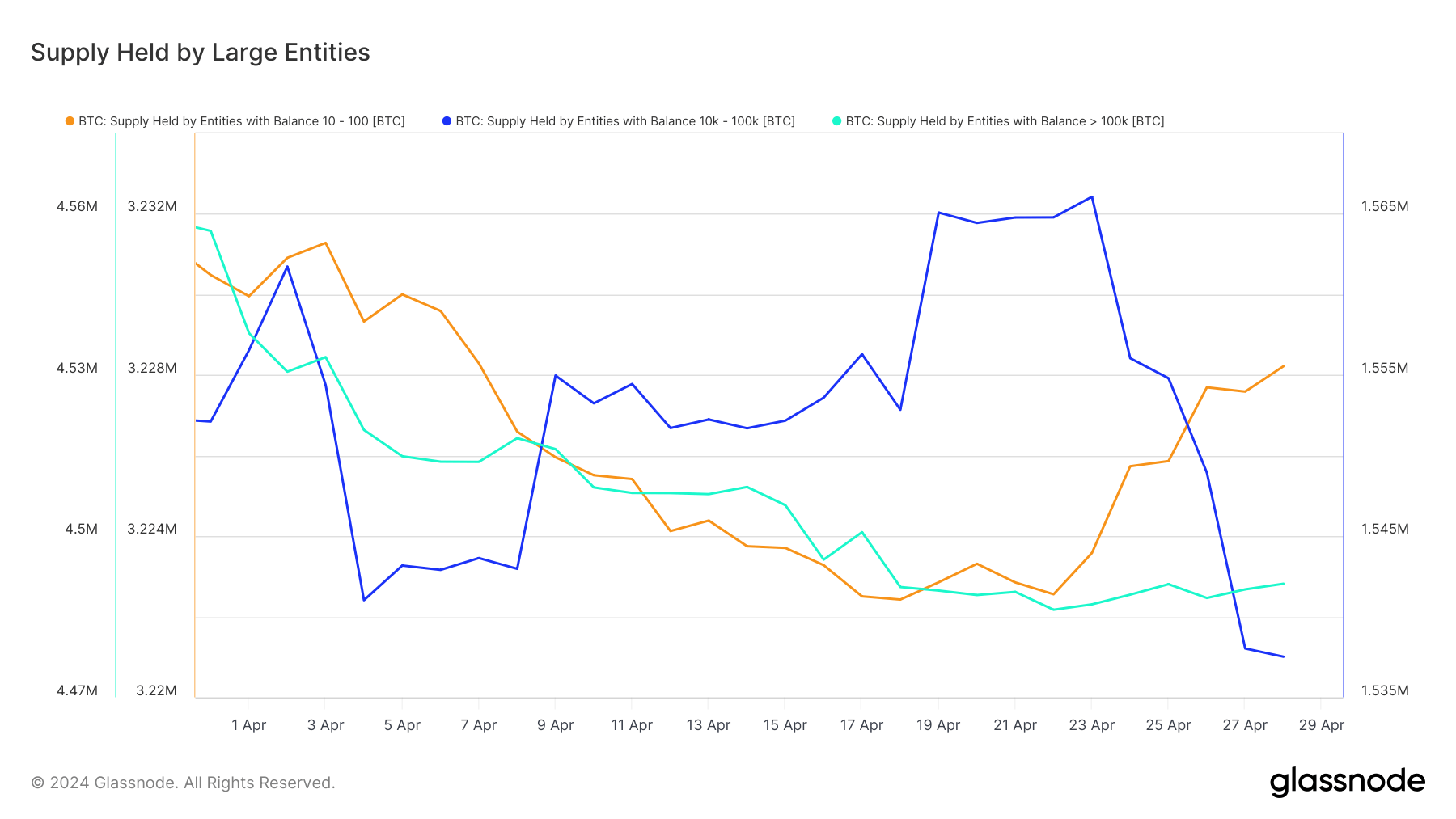

Conversely, bigger firms confirmed blended modifications of their balances, with most exhibiting a decline over the previous 30 days.

The decline in main firms' holdings is because of a number of elements, together with promoting strain from ETF outflows, significantly from merchandise comparable to GBTC, and miners promoting their holdings to understand earnings and canopy working prices in a low value setting. That is regarded as as a consequence of a number of elements. Massive steadiness actions are in step with institutional investor conduct, and changes to holdings could also be strategic or a response to market circumstances.

The put up Small Bitcoin holders are accumulating whilst costs fall appeared first on currencyjournals.