- Uniswap's worth hit a excessive of $10.99 on Might 25, rising by greater than 20% in 24 hours.

- UNI rose amid whale exercise, developments within the Ethereum ecosystem, and Uniswap Labs' response to the SEC's Wells Discover.

- From a technical perspective, a breakout can be recommended that might ship the UNI worth as much as $15.40 and even $2.

Uniswap's worth rose greater than 20% in 24 hours to commerce at $10.99, its highest degree since early April.

The bullish outlook means that elevated shopping for strain might ship UNI rally in the direction of the highs of $15.40 recorded in March.

Uniswap Value and the ETH Ecosystem

UNI is the native token of a serious DEX platform and one of many prime beta performs for spot Ethereum ETF approval.

On Friday, Uniswap costs defied the general market consolidation whereas Ethereum (ETH) costs remained above $3,700. With most altcoins making an attempt to bounce off key help ranges, UNI costs rose by greater than 20% to hit a multi-week excessive of $10.95.

This comes as an rising variety of whales have been withdrawing UNI from exchanges, with one such whale withdrawing $1.96 million value of UNI from Binance amid a worth surge, in line with on-chain particulars shared by X's Lookonchain.

Uniswap's upward momentum additionally strengthened with the announcement of ERC-7683. This new token normal is a collaboration between Uniswap Labs and Throughout Protocol, and goals to streamline cross-chain buying and selling via a “unified framework for cross-chain intent techniques.”

UNI Soars Following Uniswap's Response to SEC

The breakout above the essential $10 degree additionally comes amid rising bullish sentiment surrounding Uniswap’s regulatory prospects.

Earlier this week, Uniswap Labs reiterated its readiness to defend in opposition to a possible SEC lawsuit following the latest Wells Discover.

Based on Uniswap, the SEC's allegations that the DEX platform is an unregistered securities trade and broker-dealer are “false.” The assertion that UNI is a safety can be false, and the SEC's idea concerning UNI is “weak,” Uniswap mentioned in its response to the regulator.

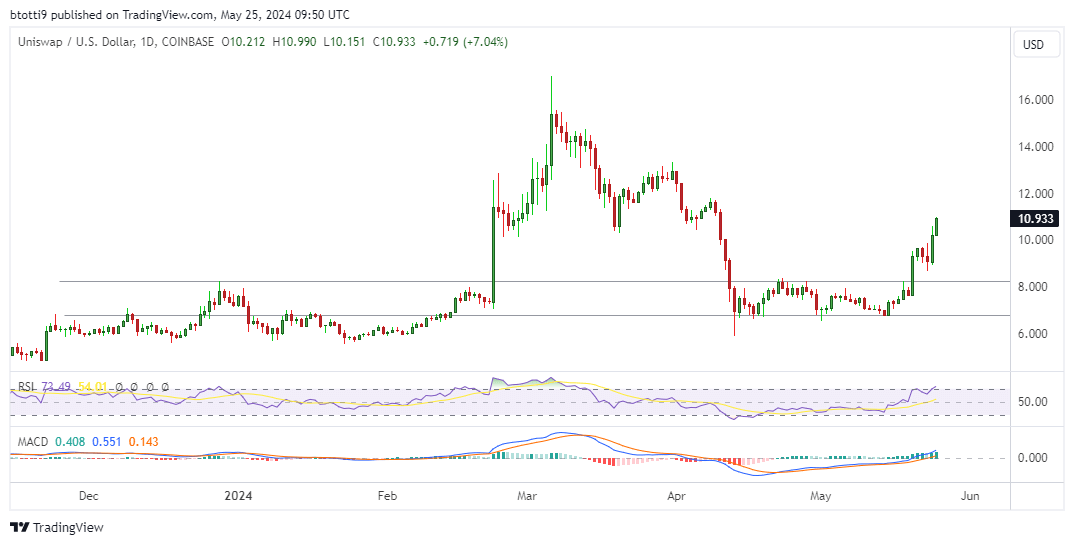

Uniswap Value Chart

Uniswap’s surge over the previous 24 hours has seen UNI get away of a consolidation part that had stored the value under $8.

Elevated whale exercise and the present prognosis for the ETH ecosystem favors UNI bulls.

Technicals additionally counsel that the upside might proceed. On this case, the RSI and MACD indicators on the day by day chart counsel that the bulls have the higher hand.

If this outlook holds, the value of UNI can goal the important thing resistance ranges of $12.96 and $15.40, with the important thing short-term goal being $2.