When analyzing the Bitcoin market, it’s simply as essential to grasp the habits of the varied market individuals as it’s to grasp the technical foundation of Bitcoin's worth fluctuations. In on-chain evaluation, we incessantly analyze short-term and long-term holders, as their habits is inherently totally different. Nonetheless, as Bitcoin has matured, a whole lot of establishments have entered the market and change into dominant forces in it, permitting us to tell apart between massive and small organizations.

Bigger firms are inclined to make strategic strikes based mostly on long-term views and thorough market evaluation. In distinction, smaller firms, sometimes particular person buyers, are extra reactive and pushed by short-term hypothesis and emotion.

The relative exercise of small and huge firms is an efficient indicator to tell apart between these two cohorts. Counting on this metric alone has limitations, corresponding to oversimplifying the complicated habits of various buyers, nevertheless it nonetheless gives a transparent, dichotomous test on the state of the market. Glassnode's metric distinguishes between the common buying and selling quantity of small firms and the common buying and selling quantity of huge firms to disclose tendencies which will counsel potential modifications available in the market.

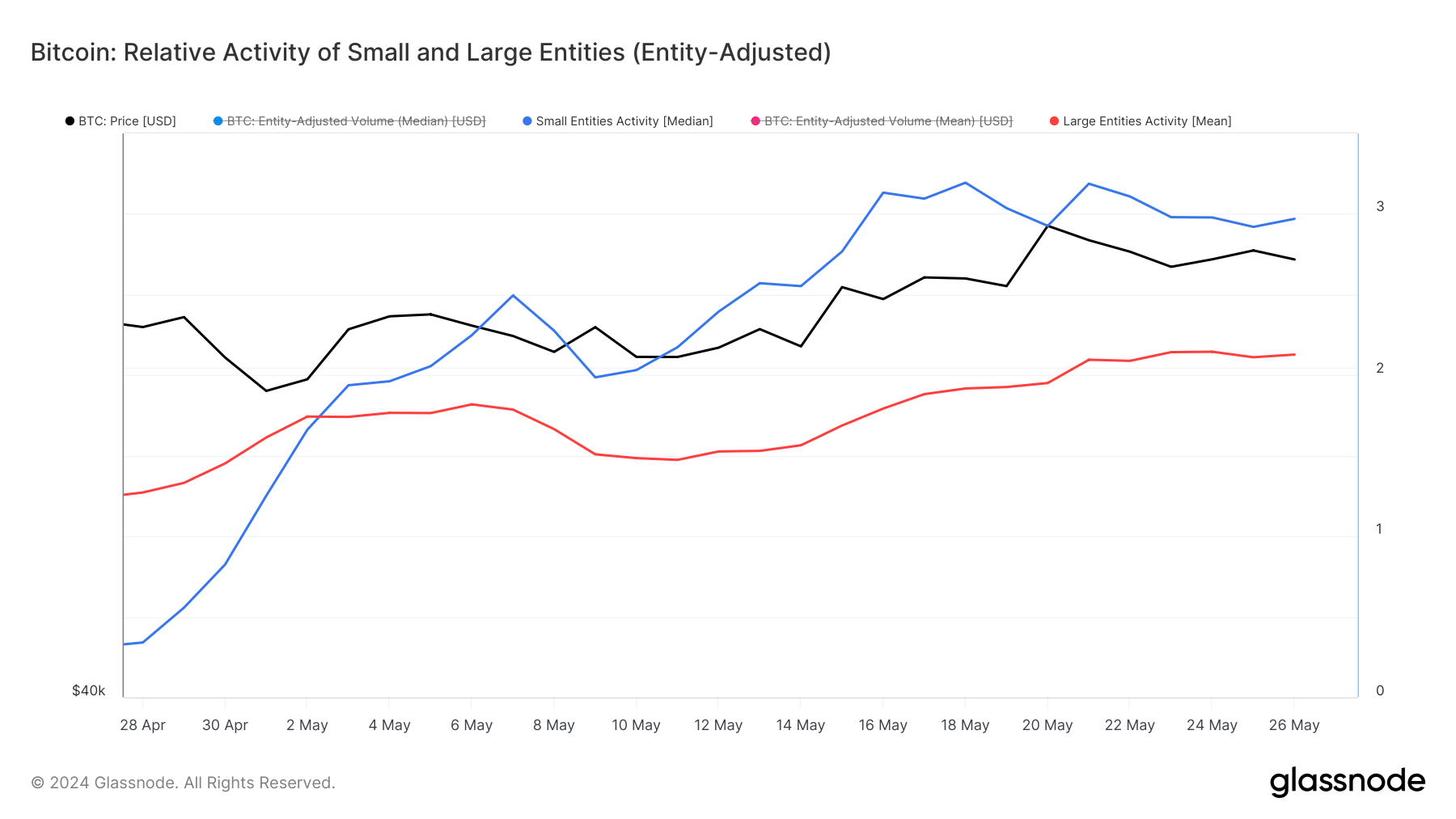

Since Might 3, exercise ranges of small entities, as measured by median buying and selling quantity, have persistently exceeded exercise ranges of bigger entities.

A skewed buying and selling quantity, i.e. the common commerce measurement (median) is bigger than the standard commerce measurement (median), signifies frequent small trades. This sample is frequent within the Bitcoin market and signifies robust involvement of retail buyers who sometimes commerce in small quantities. When retail investor exercise is increased than massive investor exercise, it normally means the market is being pushed by retail investor pleasure and hypothesis, which is commonly seen firstly of a bull market. Alternatively, if this exercise decreases, it may counsel that retail curiosity is fading and the market could also be stabilizing or consolidating.

On Might 18, the median buying and selling quantity for smaller entities reached a peak exercise ratio of three.194, whereas the common buying and selling quantity for bigger entities was 1.916. This divergence signifies a a lot bigger base of smaller trades, signaling elevated retail investor demand and speculative exercise.

The continued enhance in small operator exercise, particularly throughout important worth actions just like the $71,400 peak on Might twentieth, signifies important retail investor enthusiasm. Such retail-driven demand usually will increase market volatility, as small buyers react extra shortly to market modifications than bigger institutional buyers. Information from Glassnode on Might twenty sixth additional helps this development, with small operators sustaining a excessive exercise ratio of two.969, in comparison with 2.127 for bigger operators, regardless of the value correction to $68,500.

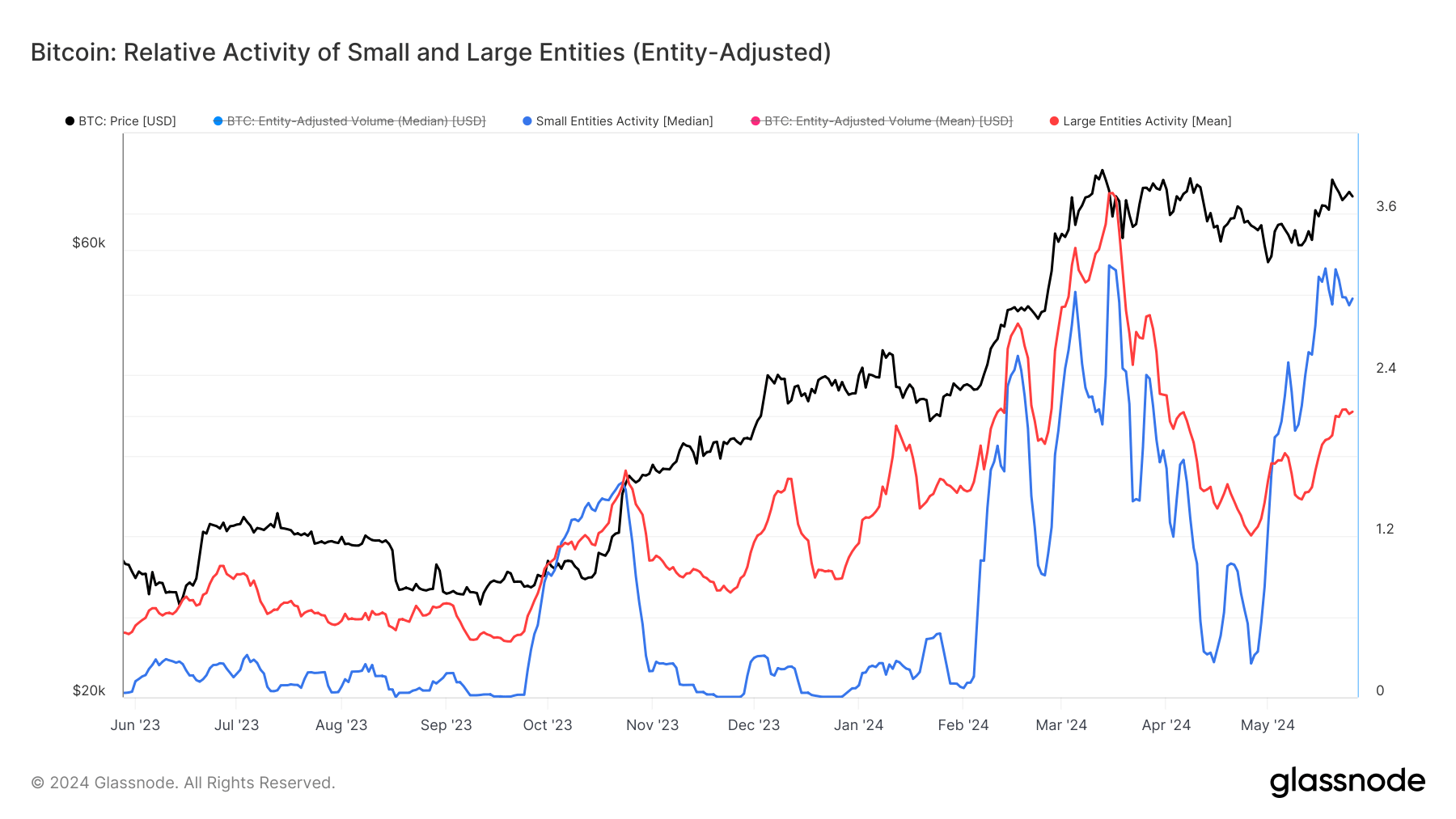

Contemplating that is the primary time since October 2023 that exercise from smaller firms has outpaced exercise from bigger firms, it's truthful to say the market is getting extra bullish.

The rise in small entity exercise signifies robust grassroots help for Bitcoin worth motion and is prone to maintain upward momentum within the quick to medium time period. A lower in massive entity exercise presently can be a warning signal because the market is pushed solely by retail hypothesis. Unbelievably Unstable and unstable.

Nonetheless, there has additionally been a continued enhance in massive investor exercise. Pushed by the recognition and accessibility of spot Bitcoin ETFs within the U.S., massive buyers have flowed into the house, protecting exercise at persistently excessive ranges. The truth that small investor exercise has been excessive over the previous month signifies that many of the volatility is coming from retail buyers. In the meantime, underlying progress was pushed by establishments.

The publish Retail Exercise Dominates Bitcoin, Overshadowing Institutional Strikes appeared first on currencyjournals