The cryptocurrency market is present process a serious correction as traders pulled $584 million from crypto-related funding autos final week, in response to a brand new report from CoinShares.

Moreover, international buying and selling quantity in crypto ETPs fell to its lowest degree because the U.S. Securities and Change Fee accredited the launch of a number of Bitcoin spot exchange-traded funds (ETFs) in January, totaling simply $6.9 billion this week.

The decline continued a pattern from the earlier week, when traders withdrew about $600 million, bringing complete outflows over the 2 week interval to almost $1.2 billion.

James Butterfill, head of analysis at CoinShares, commented:

“We consider it is a response to investor pessimism concerning the prospects for the Fed to chop rates of interest this yr.”

Bitcoin and the US lead the exodus

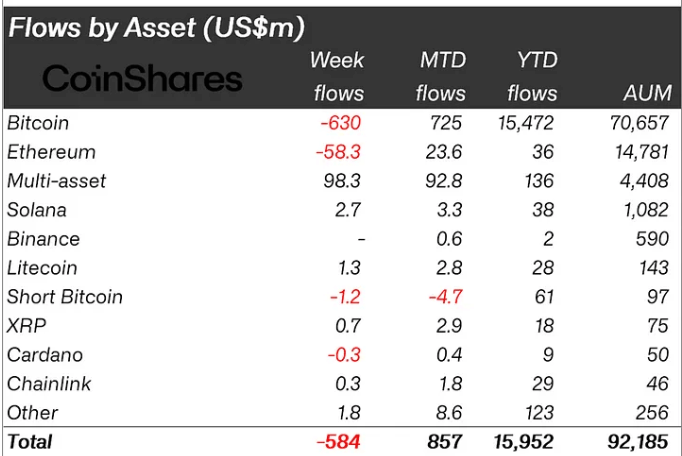

Bitcoin funding merchandise noticed the most important outflows, totaling $630 million. Bitcoin ETPs noticed their sixth consecutive day of outflows within the U.S., primarily from the Grayscale Bitcoin ETF and Constancy's FBTC.

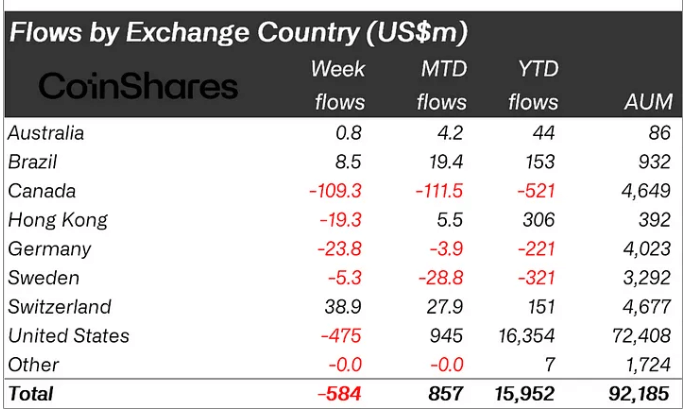

Canada additionally noticed giant outflows from crypto ETPs, withdrawing $109 million, adopted by Germany and Hong Kong, with $24 million and $19 million respectively.

Conversely, Switzerland and Brazil recorded inflows of $39 million and $48.5 million respectively, serving to to offset the general outflows.

Bearish traders pulled about $1.2 million from bitcoin quick gross sales.

In the meantime, Ethereum additionally joined the outflow pattern, seeing its first withdrawals in weeks at round $58 million, lowering its outflows to date this month from $82 million to round $23 million.

Altcoins are engaging

Regardless of the outflows from main digital property, multi-asset funding autos and a few altcoins noticed important inflows.

In line with CoinShares, the multi-asset product raised greater than $98 million, with Solana, Litecoin and Polygon elevating $2.7 million, $1.3 million and $1 million respectively.

Butterfill defined that the influx of funds signifies that new traders are turning their consideration to altcoins.

“[These inflows]counsel that traders are viewing the weak spot within the altcoin market as a shopping for alternative.”