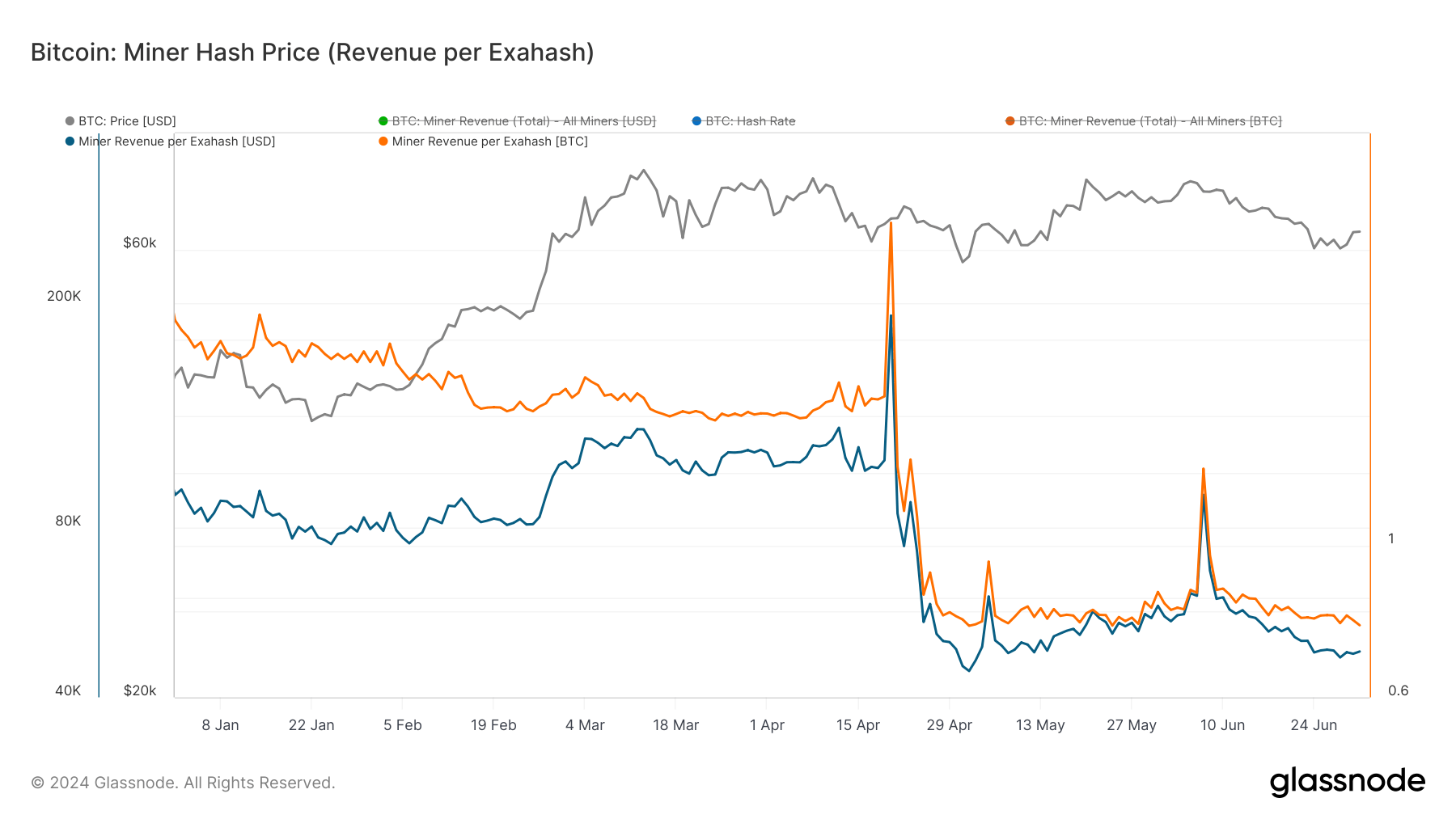

Miner Income per Exahash measures a miner's day by day revenue relative to their contribution to the community's hashrate, displaying how a lot miners earn per unit of computing energy they contribute. This metric is necessary as a result of it displays the profitability and financial viability of Bitcoin mining and immediately influences choices relating to useful resource allocation, investments, and operational methods. Given the scale of the Bitcoin mining sector and the efficiency of public mining corporations, these metrics turn out to be much more necessary.

Since Bitcoin's fourth halving on April 20, miner income per exahash has been declining sharply. Though this decline was anticipated and miners had been ready for it, it has put numerous monetary strain on miners. Initially, miner income per exahash on April 20 was $190,620 or 2.96 BTC. Nonetheless, by Might 2, miner income per exahash had plummeted to an all-time low of $44,538 or 0.76 BTC.

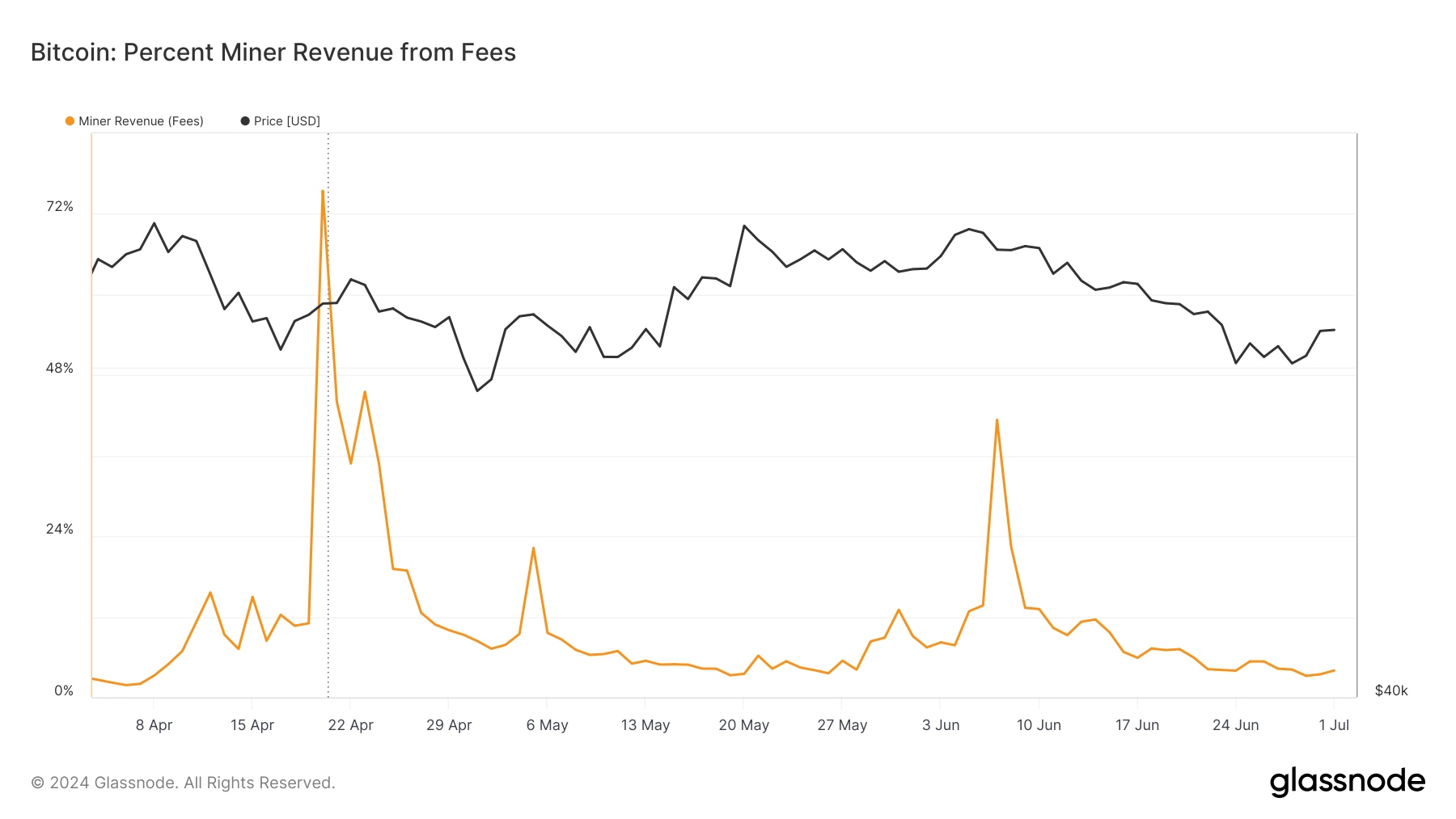

In response to Glassnode knowledge, revenues recovered briefly, peaking at $91,774, or 1.29 BTC per exahash, on June 7. This momentary enhance was attributable to a big spike in transaction charges attributable to community congestion. These charges accounted for 41.335% of miner revenues on that day, up considerably from simply 7% three days prior. This peak illustrates occasional spikes in miner revenues attributable to community exercise and highlights the significance of transaction charges as a supplemental revenue supply for miners, particularly when block rewards decline.

As of July 1, miner income per exahash was $48,230 or 0.76 BTC, indicating a decrease degree of stability than pre-halving figures. A chronic interval of declining revenues will pose challenges, particularly for miners with increased operational prices or these utilizing much less environment friendly {hardware}.

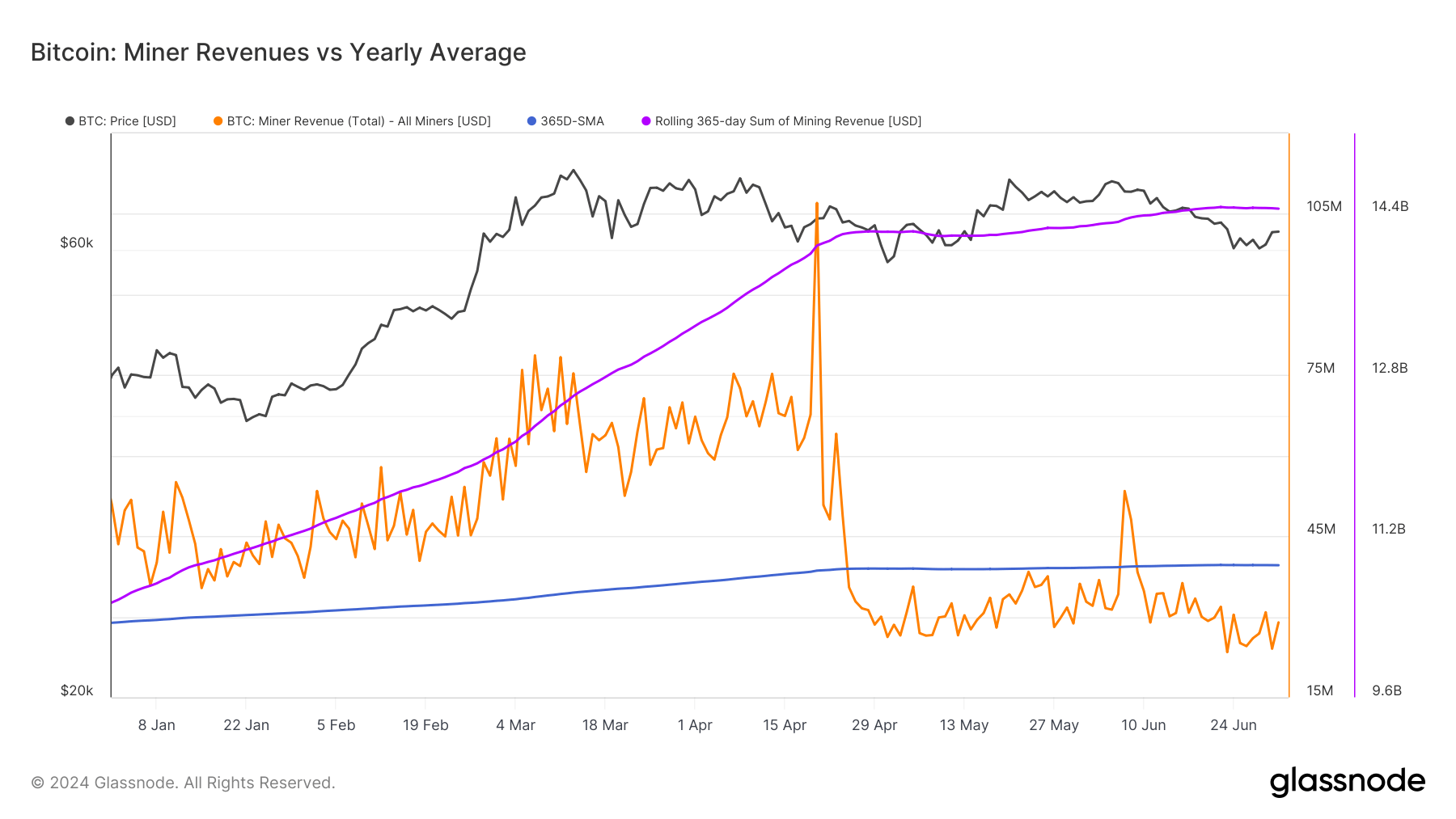

Evaluating miner income to the annual common, we see that complete day by day income paid to Bitcoin miners in USD has been beneath the 365-day easy transferring common since April 25, except a spike on June 7. This notable development marks a departure from the earlier 15 months, when miner income was usually above the annual common. Sustained income drops beneath the annual common counsel a interval of declining miner profitability, which may have broader implications for the mining business and the Bitcoin community.

The decline in income in comparison with the annual common highlights elevated volatility and potential monetary pressure on miners. In response to those financial pressures, Bitcoin miners are implementing varied methods to mitigate the impression of declining income. CleanSpark's acquisition of GRIID Infrastructure for $155 million demonstrates that corporations are consolidating to leverage economies of scale. Bitdeer's announcement of a 570 MW enlargement in Ohio demonstrates the identical strategic method of accelerating operational capability to extend total output and mitigate the impression of declining income per unit of hashpower.

Marathon's diversification into mining altcoins like Caspar is one other instance of miners looking for different income streams. By not relying solely on Bitcoin, Marathon Digital is avoiding Bitcoin's inherent market threat and broadening its income base. Core Scientific's $3.5 billion take care of CoreWeave to diversify from Bitcoin mining into AI-related actions marks a brand new shift in technique.

A slight lower in Bitcoin's mining problem signifies that many miners are discovering it tough to proceed working. This problem adjustment helps rebalance the community, permitting remaining miners to profit from a slight discount in competitors and probably elevated income if the worth of Bitcoin or transaction charges rise.

Nonetheless, confidence within the mining sector seems to be rising. Shares of U.S.-listed bitcoin miners rose considerably final week, bringing their market capitalization to a document excessive of $22.8 billion. This means that traders are optimistic concerning the long-term prospects of bitcoin mining corporations, probably attributable to strategic diversifications and the potential for future income progress as community congestion and transaction price fluctuations take maintain.

The publish Bitcoin Miners Look to Diversify and Consolidate to Survive Falling Revenues appeared first on currencyjournals