Miners kind the muse of the Bitcoin market, and their habits is among the greatest indicators of market well being and can be utilized as a gauge of market sentiment.

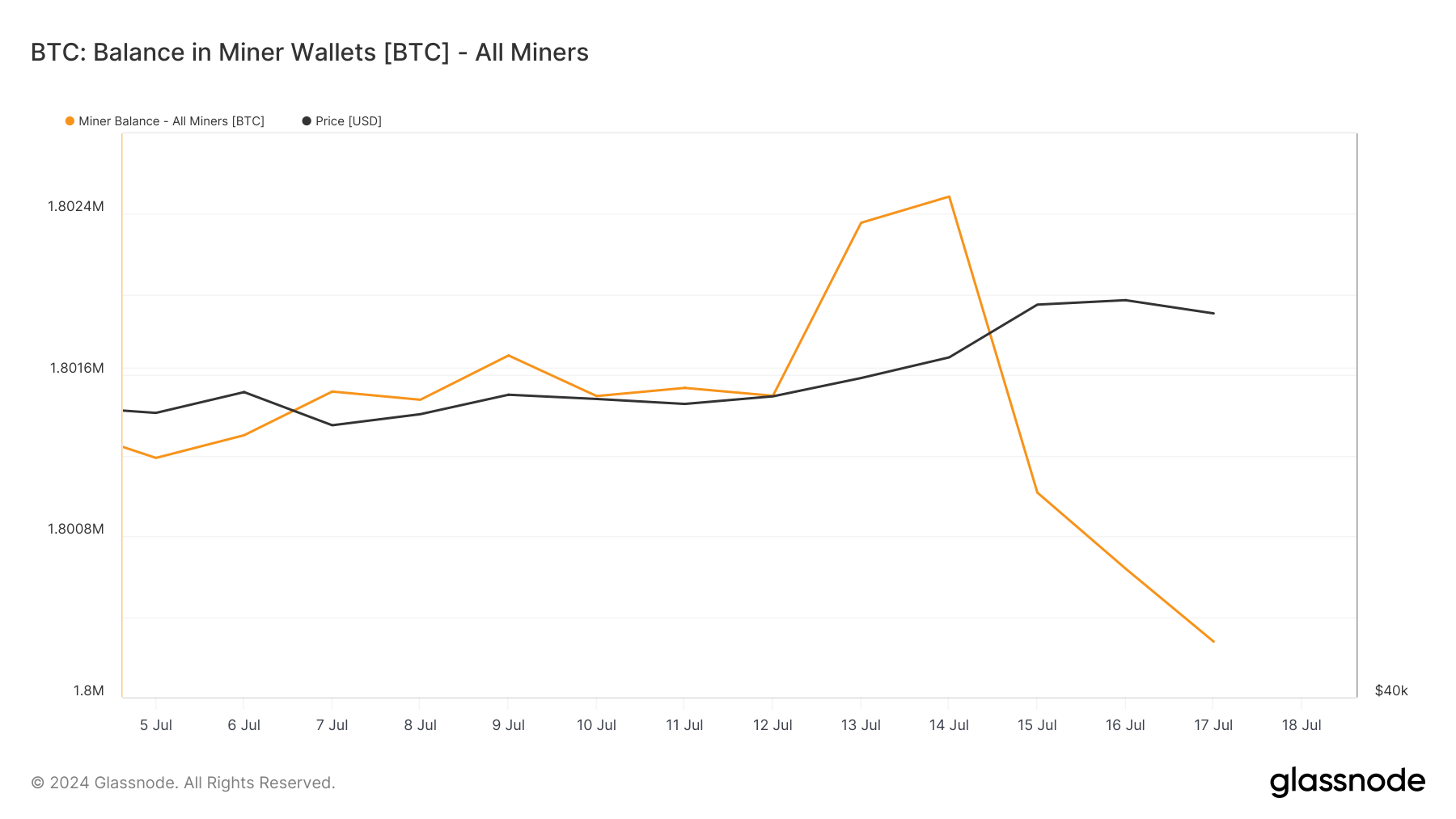

Miner stability displays the overall quantity of BTC held by miners. It serves as one of many main indicators of promoting strain, as miners promote ceaselessly because of the must cowl operational prices.

Nonetheless, as a result of miners compete to maintain making as a lot revenue as doable, they sometimes don’t promote or distribute their holdings if the worth of Bitcoin is just too low. Miners holding on to Bitcoin could also be an indication of confidence in a future worth improve. Conversely, miners promoting Bitcoin signifies that they’re making an attempt to make a revenue whereas the worth continues to be excessive or that they’re anticipating a worth drop.

Miner balances fell by roughly 1,260 BTC final week. This decline continues a long-term development of downward motion in miner balances, which have been declining since October 2023. Miner balances are actually at ranges not seen since April 2019. And whereas the decline over the previous week is no surprise, it displays a broader sample of miners step by step decreasing their holdings.

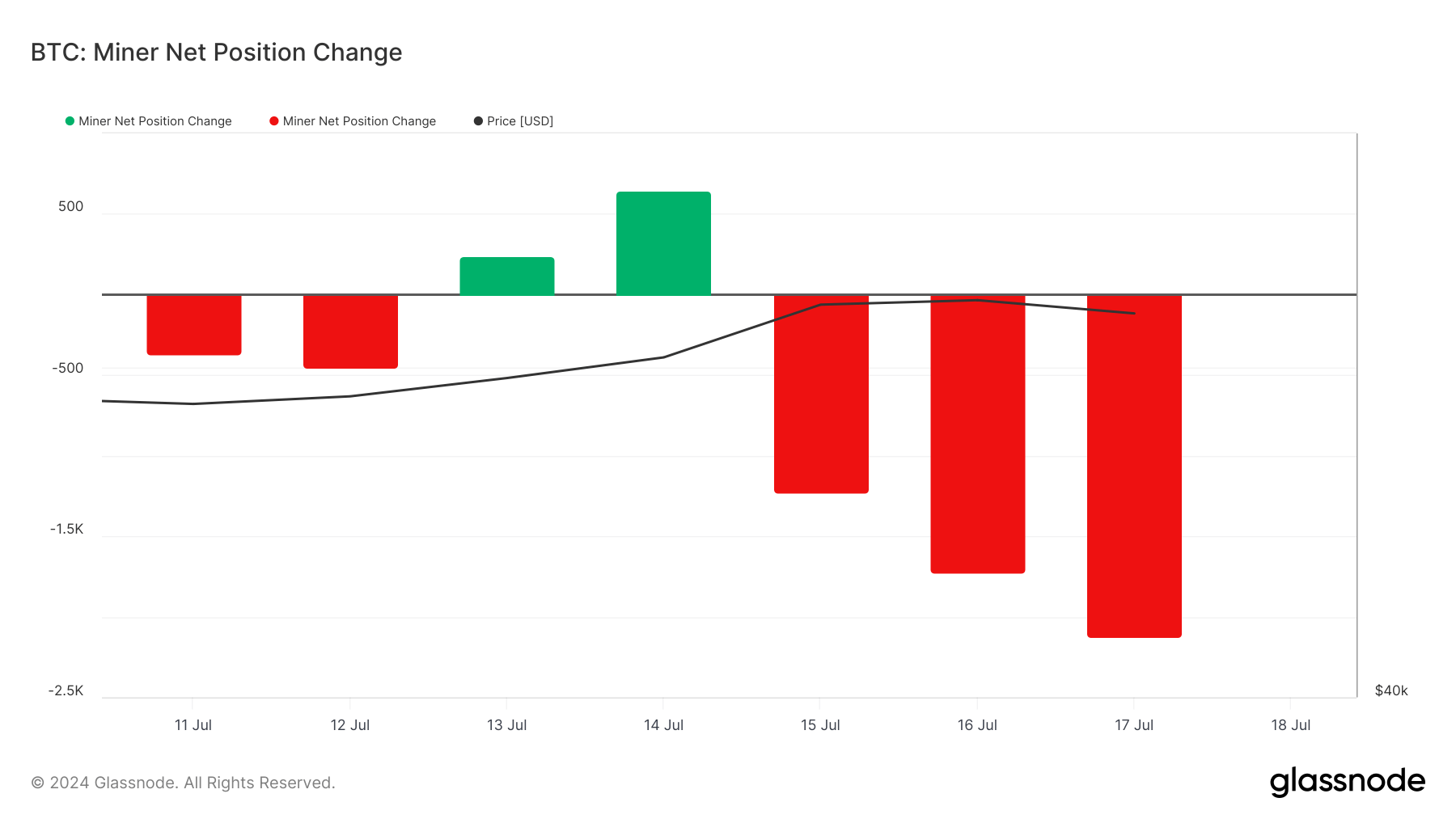

Taking a look at modifications in miners’ web positions, we are able to see some fluctuations over the previous week. Breaking a three-month development of web outflows, July thirteenth and July 14th noticed short-term accumulations with web inflows of 241 BTC and 645 BTC, respectively.

A major web outflow adopted, with miners promoting 2,126 BTC on July 17. This surge in gross sales over the previous few days correlated with a notable improve in Bitcoin's worth, which peaked at $65,172 on July 16 earlier than falling barely to $64,120 the next day.

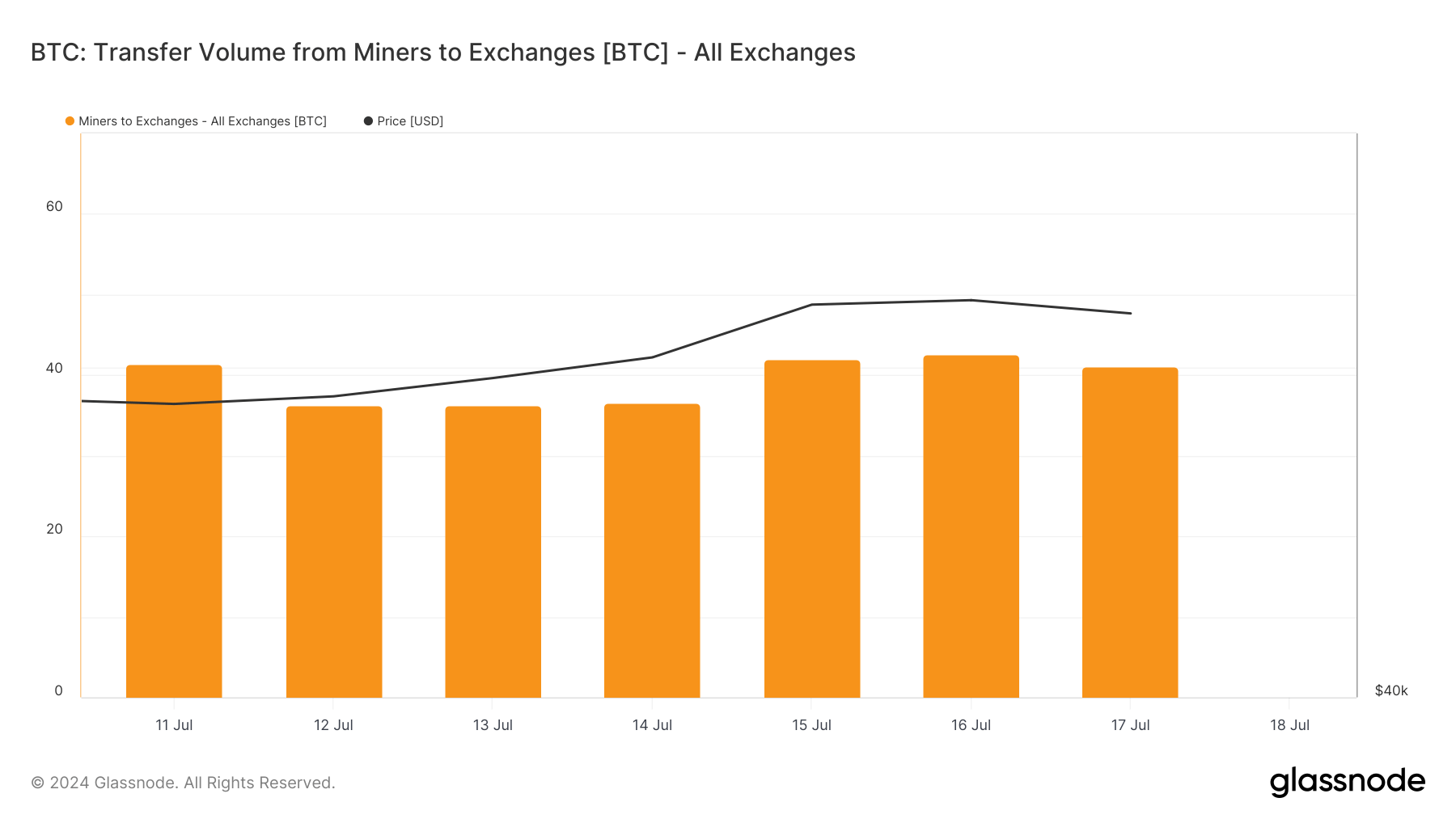

The quantity of remittances from miners to exchanges has remained comparatively steady, starting from 36 to 42 BTC per day. This stability means that regardless of a rise in total miner outflows, direct gross sales to exchanges haven’t elevated considerably.

The best quantity of transfers to exchanges up to now three months was 262 BTC on June 13, indicating latest switch volumes are inside regular ranges. The mix of declining miner balances and comparatively low switch volumes to exchanges means that miners could also be promoting Bitcoin by over-the-counter (OTC) transactions fairly than on public exchanges.

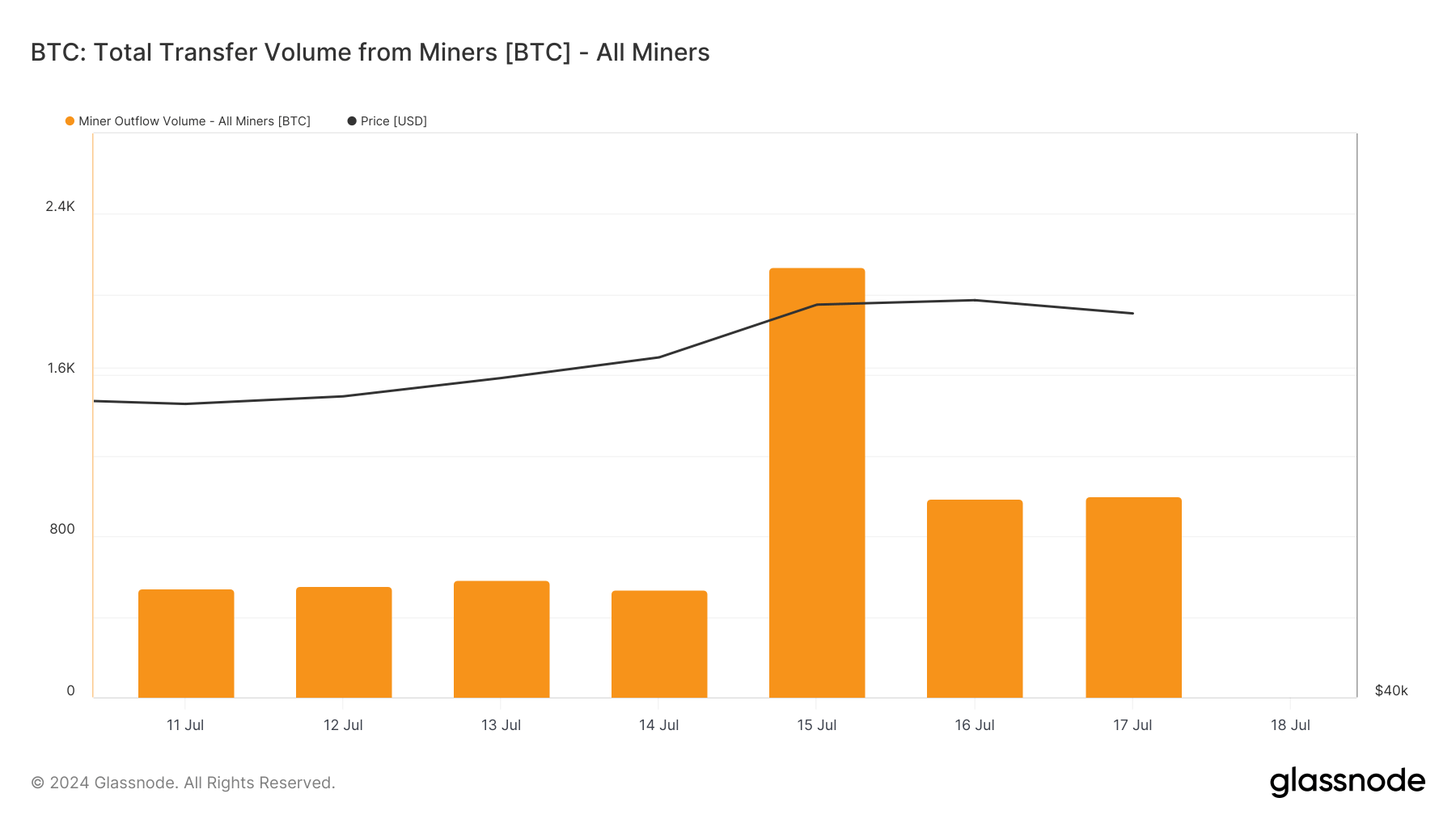

Miner remittance volumes have been extremely risky, with a spike of two,136.10 BTC on July fifteenth, the second highest up to now 30 days. This spike coincided with a pointy rise in worth, indicating miners have been profiting from the worth improve to maneuver massive quantities of BTC. Outflows of 985.60 BTC on July sixteenth and 1,001.63 BTC on July seventeenth additional assist this development.

The info means that mining firms are decreasing their total holdings to maximise income during times of rising costs. This strategic sale will contribute to market liquidity and should affect short-term worth fluctuations.

The article “Minutes Cut back Holdings Amid Rising Costs” first appeared on currencyjournals.