After months of hypothesis and regulatory uncertainty, the spot Ethereum ETF posted a strong buying and selling debut in the USA on July 24.

The ETF noticed a staggering $1.11 billion in quantity on its first day of buying and selling, led by $266.5 million in inflows from BlackRock. Inside 90 minutes of opening, the ETH ETF noticed $361 million in quantity, reflecting sturdy curiosity and confidence in Ethereum.

Whereas the Ethereum ETF's first day buying and selling quantity was solely a few quarter of the Bitcoin ETF's launch quantity, it's nonetheless an enormous improvement for ETH. Along with a short lived surge in spot costs, the elevated curiosity within the ETF can be impacting the derivatives market.

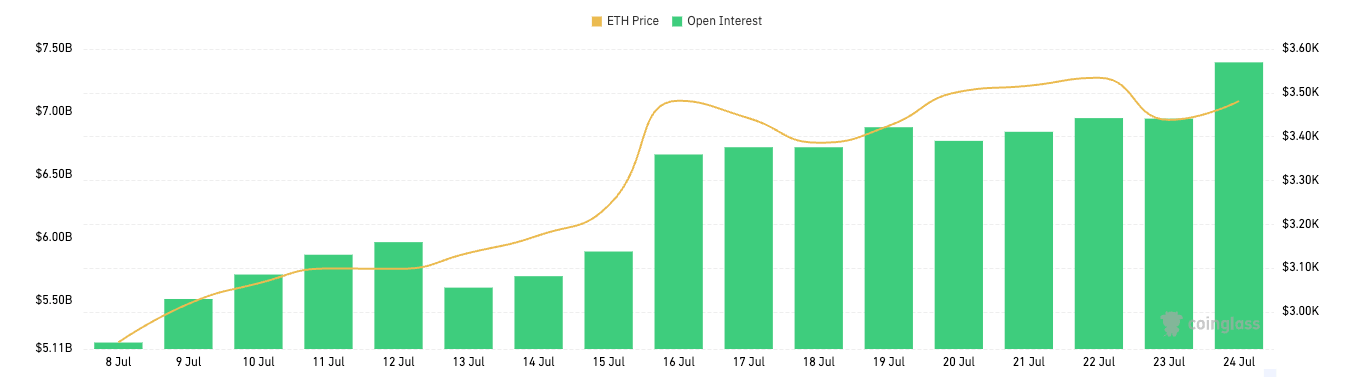

Ethereum derivatives noticed a unstable June, however a comparatively calm July. The general derivatives market noticed modest however notable development over the previous week, which seems to have accelerated after the ETF launch. Based on information from CoinGlass, choices open balances have been steadily rising, particularly as of July 24, reaching $7.39 billion.

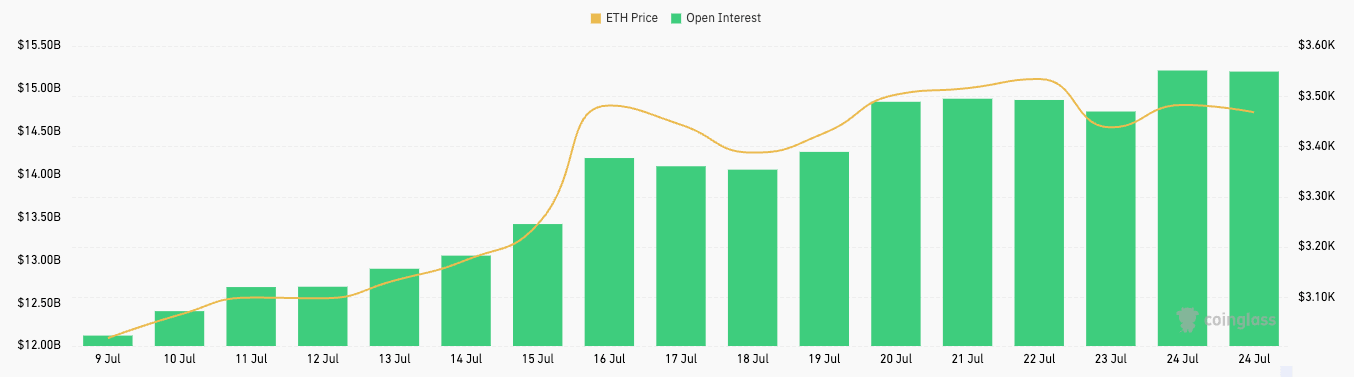

Ethereum futures confirmed an analogous pattern, though the $460 million improve in open curiosity didn't seem as important because of the bigger market dimension.

The rise in open curiosity is critical because it brings elevated liquidity and buying and selling quantity, making Ethereum’s market construction stronger. As ETH ETF buying and selling exercise picks up within the coming weeks, the derivatives market is predicted to proceed its upward pattern.

The rising institutional curiosity in ETH ETFs might also be mirrored in derivatives buying and selling: Institutional and complicated traders might begin adopting foundation buying and selling methods, resulting in a rise in OI and buying and selling quantity in derivatives buying and selling.

Foundation buying and selling is a classy technique that takes benefit of worth variations between spot and futures markets. It has change into a major a part of the Bitcoin market, particularly for the reason that launch of the Bitcoin ETF. Earlier currencyjournals evaluation discovered that Bitcoin foundation buying and selling has had a major influence in the marketplace, resulting in flat worth fluctuations that counter the inflows and buying and selling quantity seen in spot ETFs. With the introduction of an Ethereum ETF, one thing related may occur within the ETH market.

Whereas this buying and selling technique reduces important worth fluctuations, it may bode properly for Ethereum by rising OI and making a extra liquid and lively derivatives market that may improve worth discovery and threat administration capabilities.

Nonetheless, a increase in foundation buying and selling, together with Ethereum ETFs and derivatives, may have a destructive influence in the marketplace. Probably the most important threat for Ethereum is the potential of market manipulation, the place massive institutional traders exploit worth discrepancies to control the worth.

Furthermore, if foundation trades change into too crowded, the technique might change into much less worthwhile and result in sudden exits, triggering a pointy correction. Given the scale of Ethereum's DeFi market, this might show to be particularly harmful for the coin.

The submit Ethereum Open Curiosity Will increase as Market Hype Round Spot ETFs Grows appeared first on currencyjournals.