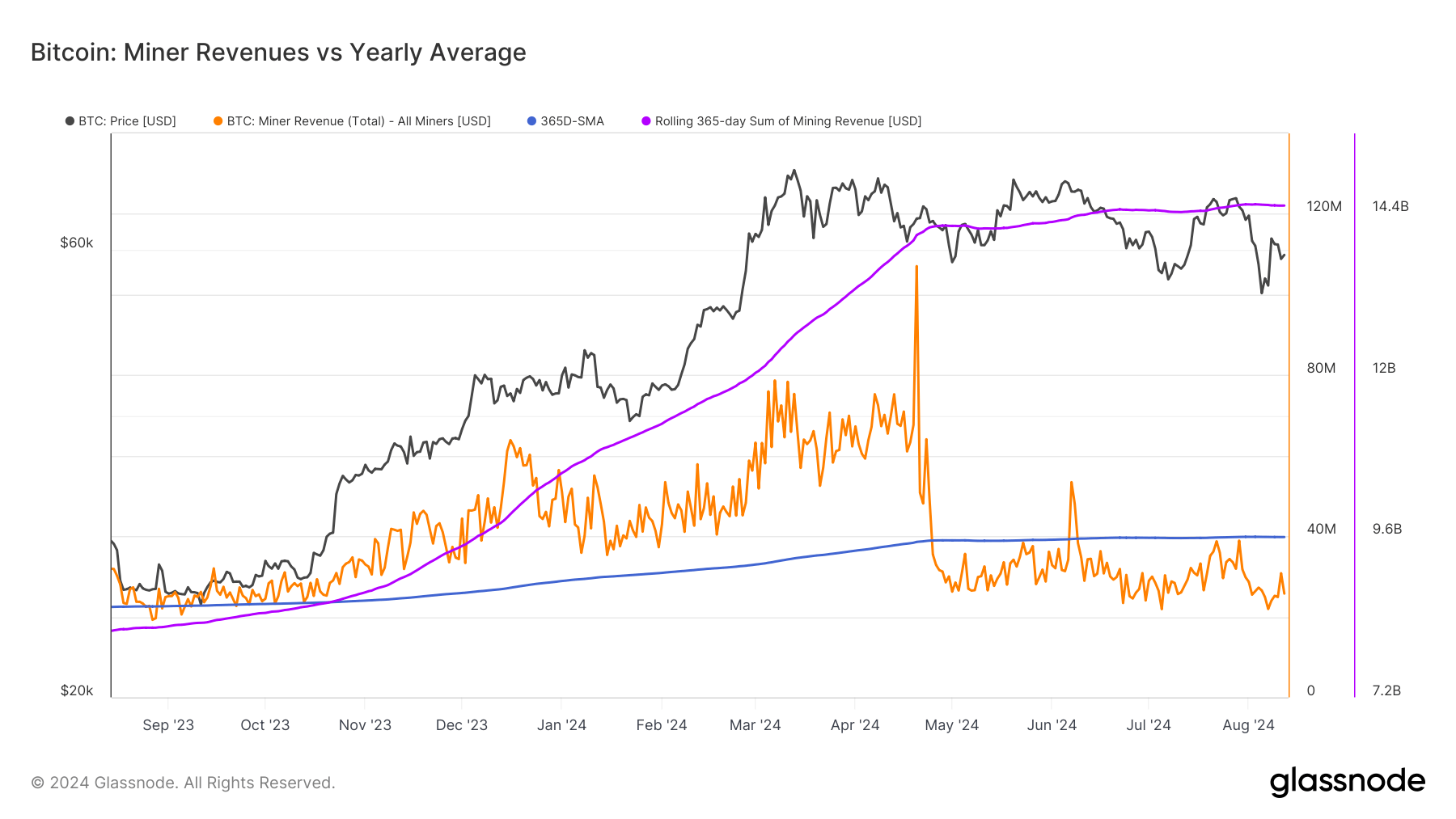

Miner income serves as a barometer of the general well being of the Bitcoin ecosystem, reflecting the fragile stability between mining prices, Bitcoin worth, and community problem. Since April 24, miner income has persistently been under its 365-day easy transferring common (SMA), with two temporary exceptions in early June.

This lengthy interval of below-average income culminated on Aug. 7, when miner income plummeted to its lowest degree since September 2023. This sustained weak point will be attributed to quite a few elements, however final week's drop was pushed by a major drop in Bitcoin's worth.

Bitcoin has seen important volatility in August, dropping from $65,360 initially of the month to under $50,000 on August 5, solely to partially get well to $54,000 inside 24 hours. Such giant worth fluctuations immediately affect miners' revenues because the US greenback worth per mined Bitcoin decreases together with the worth.

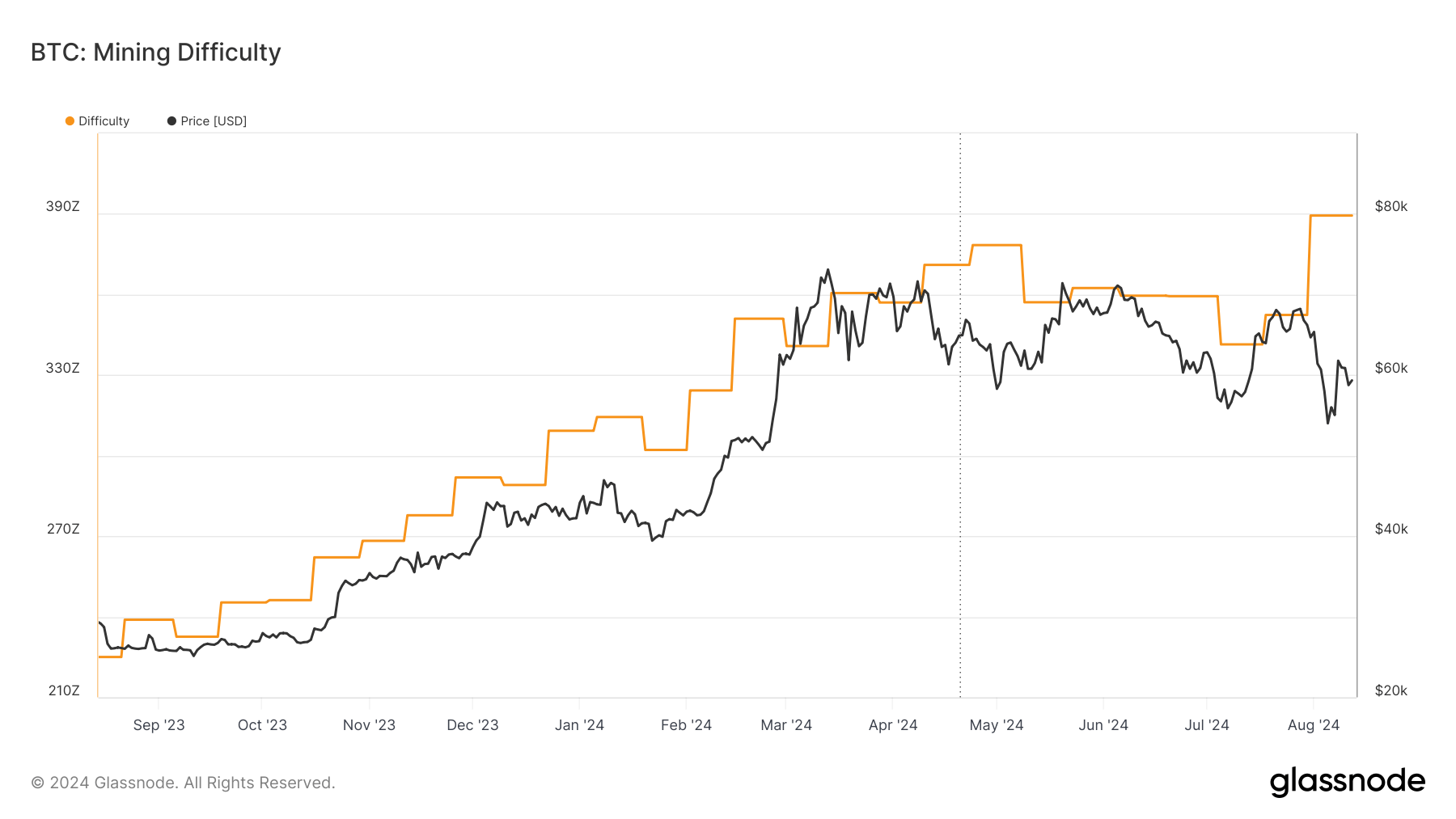

Bitcoin mining problem has additionally elevated this month, requiring extra computing energy to mine one bitcoin, additional squeezing revenue margins.

This short-term volatility is a part of a longer-term pattern that started with Bitcoin's halving in April, which lowered the block reward from 6.25 BTC to three.125 BTC and halved the variety of new Bitcoins in circulation. This tectonic shift is impacting miners' revenues and profitability, forcing the trade to adapt to new financial realities whereas coming to phrases with short-term volatility.

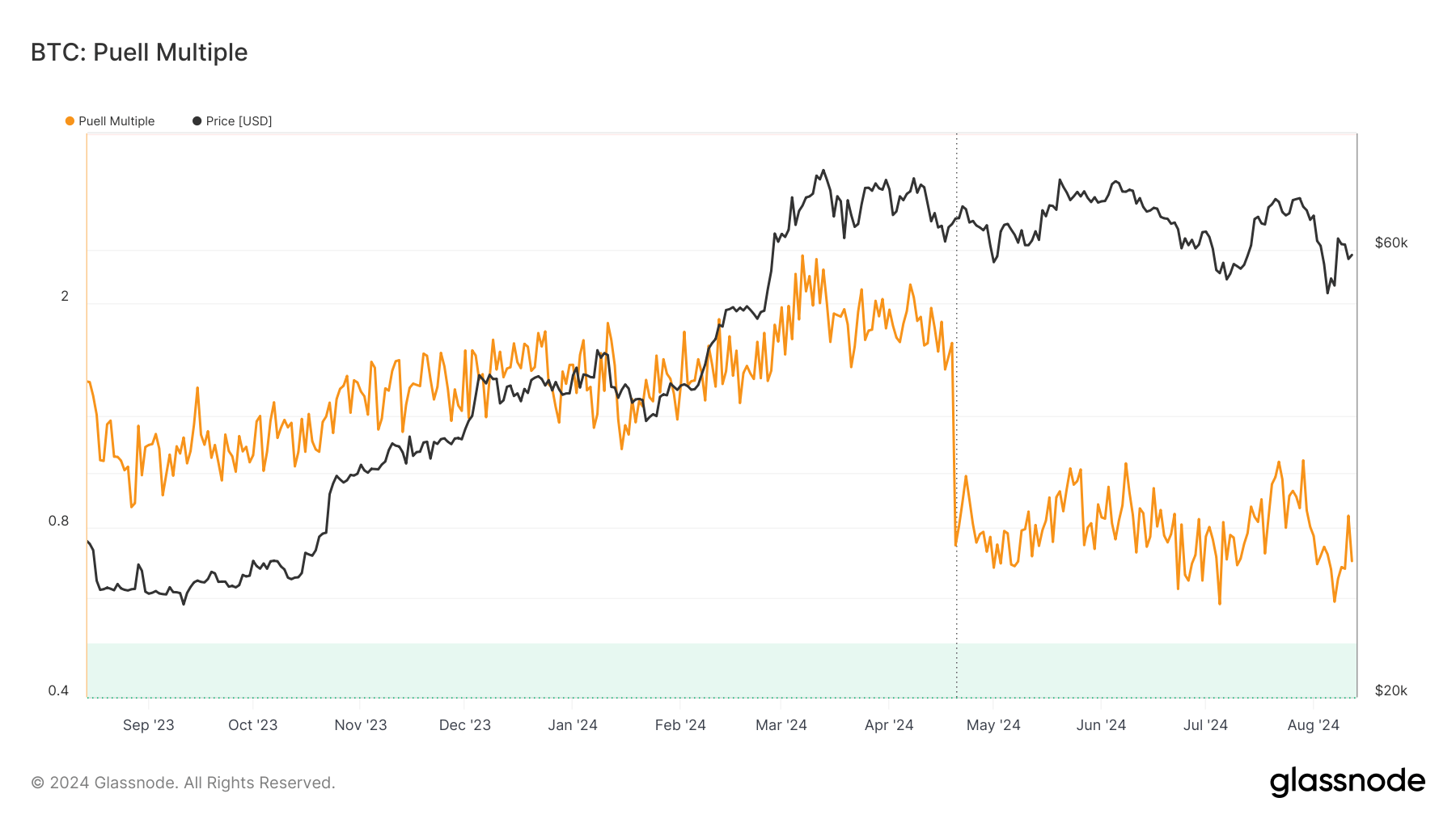

To raised perceive the affect of those adjustments, we will flip to the Puell A number of, a metric that helps assess miner profitability and market situations. The Puell A number of is calculated by dividing Bitcoin's each day issuance in USD by the 365-day transferring common of each day issuance. This metric will help establish durations of stress for miners and potential market turning factors.

On August 5, the Puel a number of fell to 0.5910, its lowest degree since January 3, 2023. The sharp drop from 1.0525 on July 29 signifies that each day issuance was nicely under the annual common. An much more dramatic drop occurred instantly after the halving, with the a number of plummeting from 1.6999 on April 19 to 0.7441 on April 20.

Traditionally, a Puell A number of under 0.5 signifies the market has bottomed out, creating a lovely shopping for alternative for buyers. The present worth of 0.7, whereas not but under this threshold, means that miners are below important strain and the market could also be nearing a backside. Nevertheless, it is very important needless to say the latest halving occasion might have essentially modified issuance, impacting the interpretation of the Puell A number of within the quick time period.

The mixture of under common income and low Puell multiples signifies important stress within the Bitcoin mining trade. Miners at the moment are incomes much less income per Bitcoin mined, making inefficient operations unprofitable. The discount in rewards after the halving has elevated competitors between miners for obtainable Bitcoin, growing the hash charge and mining problem.

If this case continues, the market might expertise one other capitulation occasion, forcing miners to promote giant parts of their holdings or stop operations altogether. This situation might result in elevated market volatility as miners liquidate their holdings to cowl operational prices, however it might additionally spur higher effectivity throughout the trade as miners search cheaper power sources and improve to extra environment friendly {hardware}.

From a market perspective, the present state of miner earnings and Puell multiples has a number of implications. As beforehand talked about, durations of miner stress and low Puell multiples usually characterize good shopping for alternatives for long-term buyers. Moreover, miners working at or close to breakeven ranges are much less inclined to promote their Bitcoin holdings, which might scale back total market provide and drive costs decrease.

Stress on the mining ecosystem might result in a extra environment friendly and resilient trade in the long term, a pattern we’re already starting to see amongst giant publicly traded mining corporations. As much less environment friendly operations are pushed out of the market, people who stay are prone to be higher geared up to climate future market volatility.

The publish Puell A number of Drops as Miner Revenues Hit 10-Month Low appeared first on currencyjournals.