Disclaimer: The data offered on this article is a part of sponsored/press releases/paid content material and is for promotional functions solely. Readers are suggested to train warning and conduct their very own analysis earlier than taking any motion associated to the content material or firm on this web page. Coin Version will not be answerable for any loss or harm incurred because of or in reference to using the content material, services or products talked about.

CoinEx Analysis has launched a complete report on the cryptocurrency marketplace for July, highlighting huge fluctuations, notable recoveries, and main traits all through the month.

Market Fluctuations and Restoration

The cryptocurrency market skilled vital volatility in July. Bitcoin's worth initially fell to $53,500 attributable to German authorities promoting, however has since proven outstanding resilience. Costs shortly recovered, reaching as excessive as $70,000 following President Trump's assassination. By the top of the month, Bitcoin fluctuated between $64,000 and $66,000. This worth volatility alerts Bitcoin's maturity as an asset and highlights market individuals' confidence in its long-term worth.

Sturdy inflows into ETFs

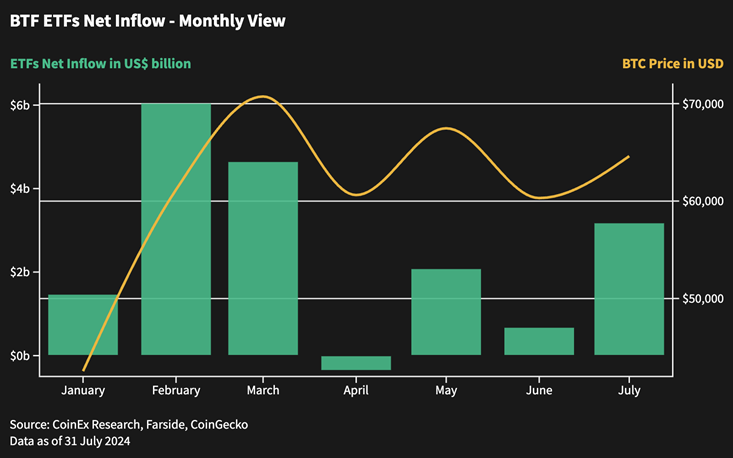

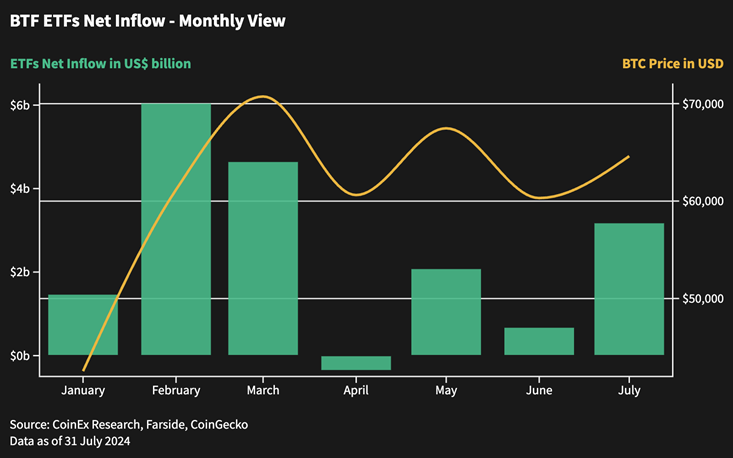

Bitcoin ETFs carried out very effectively in July, reaching $3.1 billion in web inflows, up considerably from $666 million in June. The info displays rising institutional curiosity in Bitcoin and alerts an accelerating convergence between conventional monetary and cryptocurrency markets. Sturdy inflows into ETFs will assist convey extra liquidity and stability to the Bitcoin market, mitigating short-term worth volatility and laying the muse for future worth will increase.

Impression of German bond gross sales

The German authorities's sale of roughly 50,000 Bitcoin created vital provide stress available on the market, leading to outflows of roughly $3 billion. Nevertheless, the market demonstrated wonderful absorption capabilities; this sell-off didn’t result in a market crash and helped set up a robust assist stage for Bitcoin within the brief time period. Concurrent web inflows of $1 billion into ETFs additional offset this stress, highlighting institutional investor confidence in Bitcoin and an general enchancment in market liquidity.

Mt. Gox Distribution Problem

Because the Mt. Gox chapter proceedings progress, the market is dealing with a brand new wave of provide stress. At present, 59,000 Bitcoin (out of a complete of 142,000 Bitcoin) has been distributed to collectors by Kraken and Bitstamp exchanges. This can be a trigger for concern, however given how effectively the market absorbed the German authorities's large-scale selloff, trade specialists usually consider that this new provide stress can even be successfully managed. Furthermore, the distribution course of will happen over a number of months, which can unfold out the impression and cut back the quick shock to the market.

Political affect

The Bitcoin Convention in Nashville in July was one other spotlight of the month, with speeches from presidential candidates Donald Trump and Robert F. Kennedy Jr. garnering widespread consideration. Trump proposed the institution of a strategic Bitcoin reserve for the nation, whereas Kennedy prompt the Treasury Division buy 550 Bitcoins every day till the U.S. has a reserve of 4 million Bitcoins. These proposals mirror the rising visibility of cryptocurrencies within the political sphere and, if applied, might create a extra favorable regulatory atmosphere and appeal to extra institutional traders.

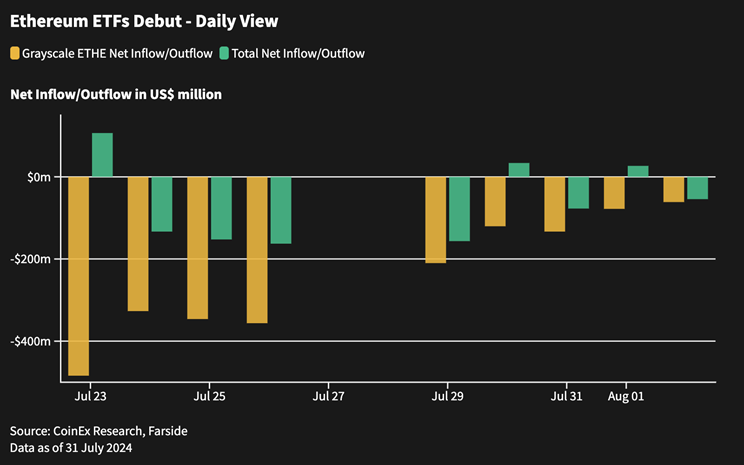

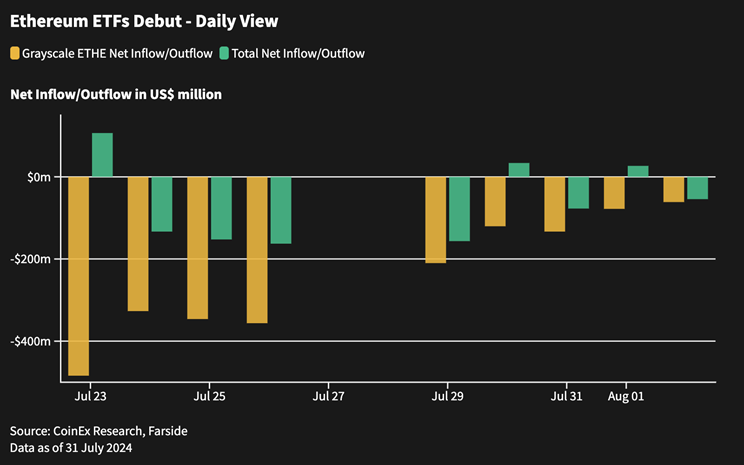

Ethereum ETF Launch

Following the approval of a Bitcoin ETF in January this yr, 9 spot Ethereum ETFs started buying and selling on July 22, marking one other essential milestone within the cryptocurrency trade and regulatory atmosphere. Nevertheless, web outflows reached $542 million within the first week of buying and selling, with Grayscale's ETHE fund alone seeing $1.97 billion outflow. This early efficiency triggered the value of Ethereum to fall from round $3,500 earlier than the ETF's launch to round $3,000 by the top of July. Analysts anticipate that if the present outflow price continues, the outflow stress from Grayscale's ETHE might ease inside one to 2 months.

The Rise of Solana

Solana has been a standout performer on this bull market, with its ecosystem pushed primarily by the meme token sector. The Pump.enjoyable platform emerged because the winner, minting over 1.5 million meme tokens and producing income of 510,000 SOL. On-chain knowledge exhibits that Solana has surpassed Ethereum in every day energetic customers and every day transactions, and in July it additionally surpassed Ethereum in DEX buying and selling quantity for the primary time, though a few of this quantity is probably going attributable to “wash buying and selling.” This development displays the variety and pace of innovation within the cryptocurrency ecosystem, whereas additionally highlighting the rising competitors between numerous public chains.

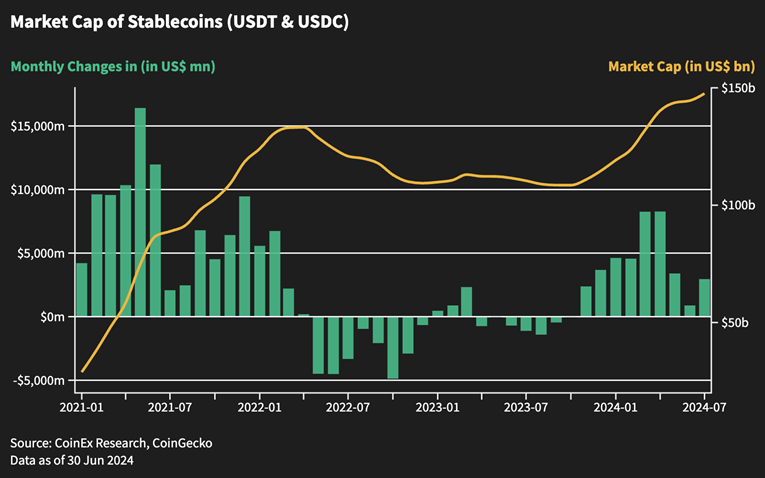

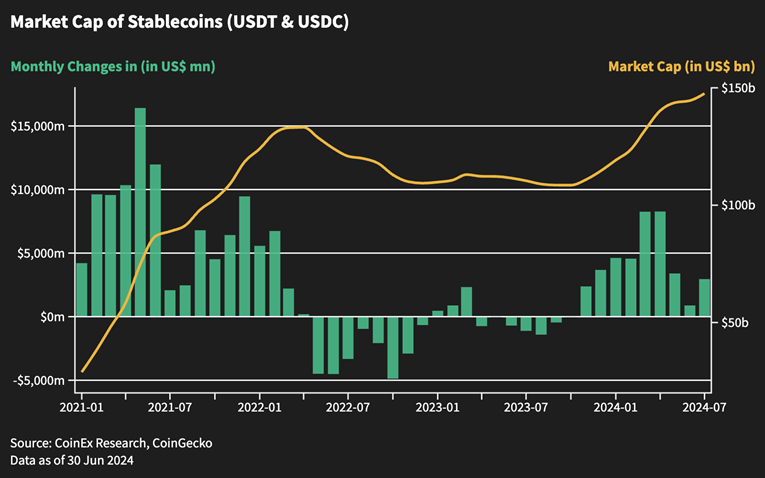

Growing stablecoin inflows, enhancing market liquidity

Stablecoin inflows started to get better in July, with web issuance reaching roughly $290 million, approaching the extent of December final yr. This progress signifies improved market liquidity and should sign the start of the subsequent wave of market progress. In comparison with August 2021, when stablecoin inflows continued to extend after a two-month correction, boosting subsequent market progress, trade insiders anticipate stablecoin inflows to additional improve in August and September this yr, which can convey additional liquidity and upward momentum to the market.

Conclusion

Regardless of the challenges and volatility skilled in July, the cryptocurrency market, and Bitcoin particularly, has demonstrated outstanding resilience and maturity. Sturdy inflows into ETFs, improved liquidity, and rising institutional curiosity level to a constructive image for Bitcoin. Nevertheless, traders ought to stay vigilant to ongoing elements such because the Mt. Gox distribution and broader financial traits. The cryptocurrency market continues to evolve, and main developments such because the rise of Solana and the launch of an Ethereum ETF level to a dynamic and aggressive atmosphere forward.

About CoinEx

Based in 2017, CoinEx is a worldwide cryptocurrency change dedicated to simplifying buying and selling. The platform presents a variety of providers, together with spot and margin buying and selling, futures, swaps, automated market makers (AMM), and treasury administration providers to over 5 million customers in over 200 international locations and areas. Based with the unique purpose of making a good and respectful cryptocurrency atmosphere, CoinEx is dedicated to breaking down conventional monetary limitations by offering easy-to-use services and products to make crypto buying and selling accessible to everybody.

CoinEx Analysis stays dedicated to offering in-depth evaluation and insights into the evolving cryptocurrency market and serving to traders navigate the complexities and alternatives forward.