The availability of Bitcoin held by long-term holders has elevated considerably over the previous month, arguably reversing the downward pattern that started earlier this 12 months. The availability of long-term holders is a really helpful indicator for understanding the sentiment of the extra subtle elements of the market. Investor habits They’re much less prone to promote their shares in response to short-term worth fluctuations.

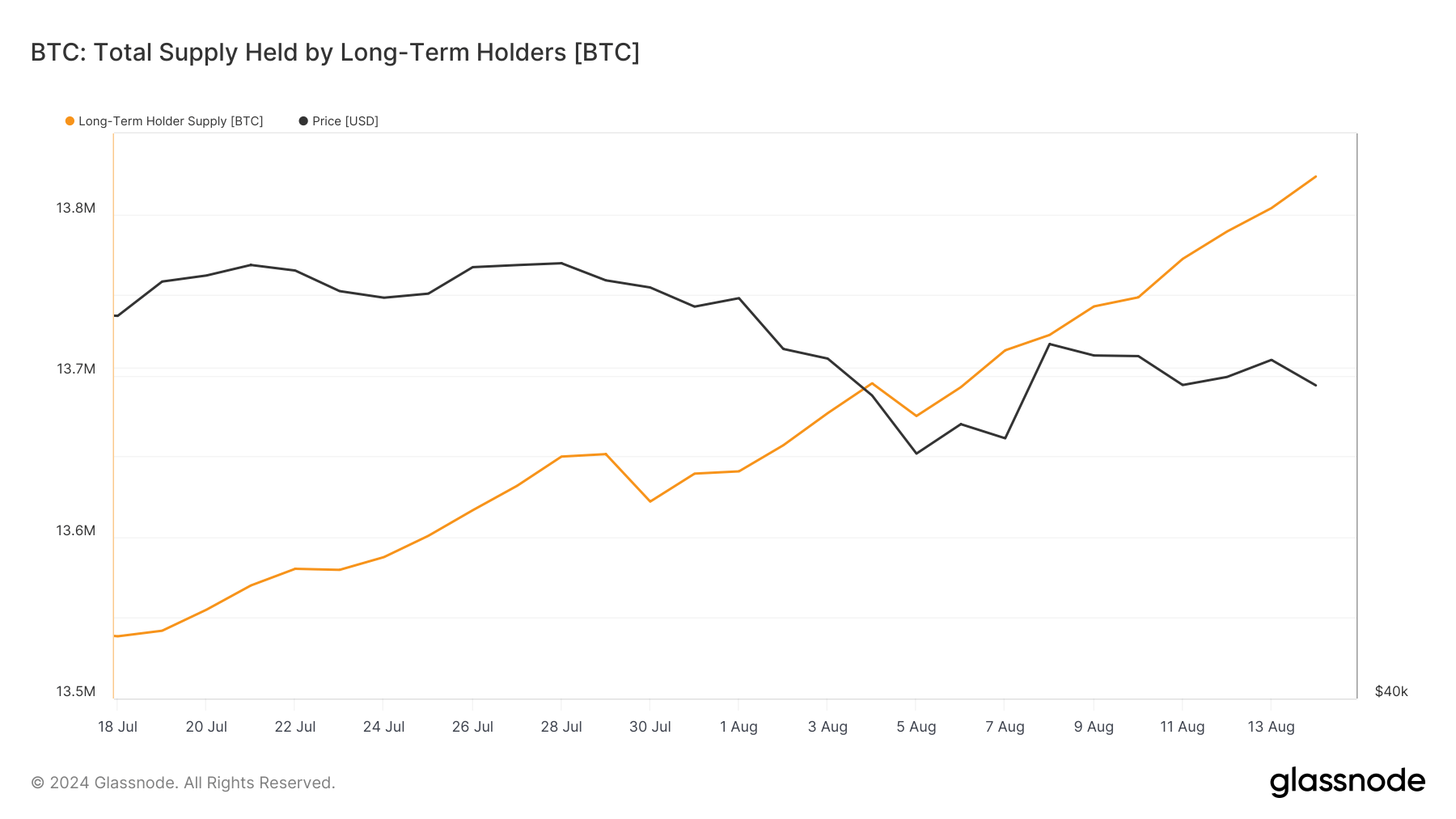

Between July 18 and August 14, long-term holder provide elevated from 13,538,543 to 13,823,283 million. BitcoinThis represents a big improve of 284,740 BTC. This improve is notable in itself, however is much more important as a result of it occurred after a interval of great discount in LTH provide earlier this 12 months.

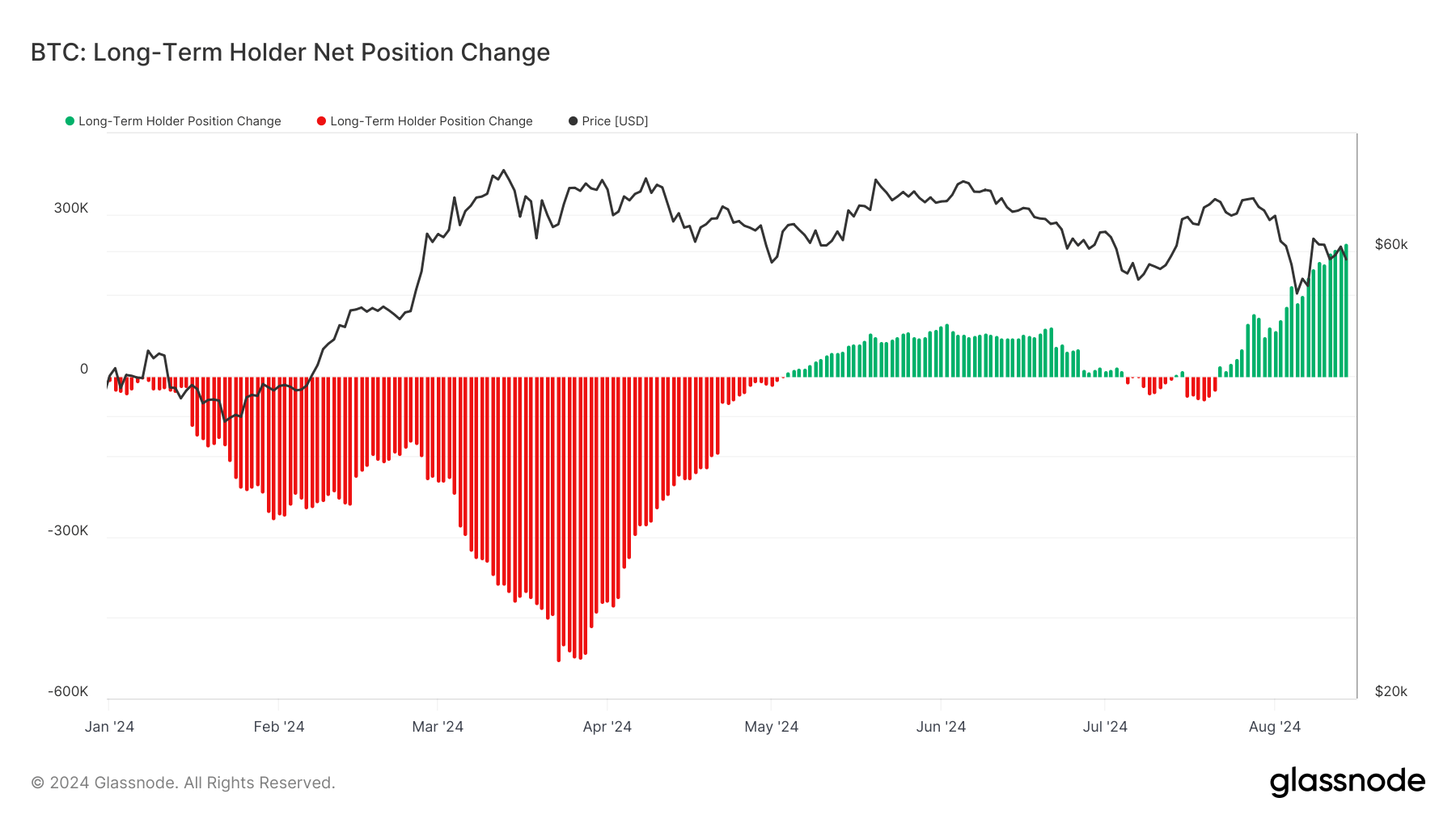

The pattern reversal started on Could 4th and continued for 2 months, adopted by a two-week interval of decline in LTH provide in correlation with Bitcoin worth will increase.

Monitoring the LTH provide is vital because it offers useful perception into attainable future worth fluctuations. Long run holders are usually thought of to be extra dedicated buyers who’re much less prone to promote their Bitcoin in response to quick time period worth fluctuations. Consequently, a rise within the LTH provide usually signifies a lower within the quantity of Bitcoin accessible for buying and selling, which might result in much less market volatility and extra worth stability.

The current surge in LTH provide, particularly the addition of 246,196 BTC on August 14th, the biggest 30-day fluctuation recorded, is a vital growth that warrants additional evaluation. This improve signifies rising confidence amongst buyers selecting to carry Bitcoin for longer durations regardless of worth volatility.

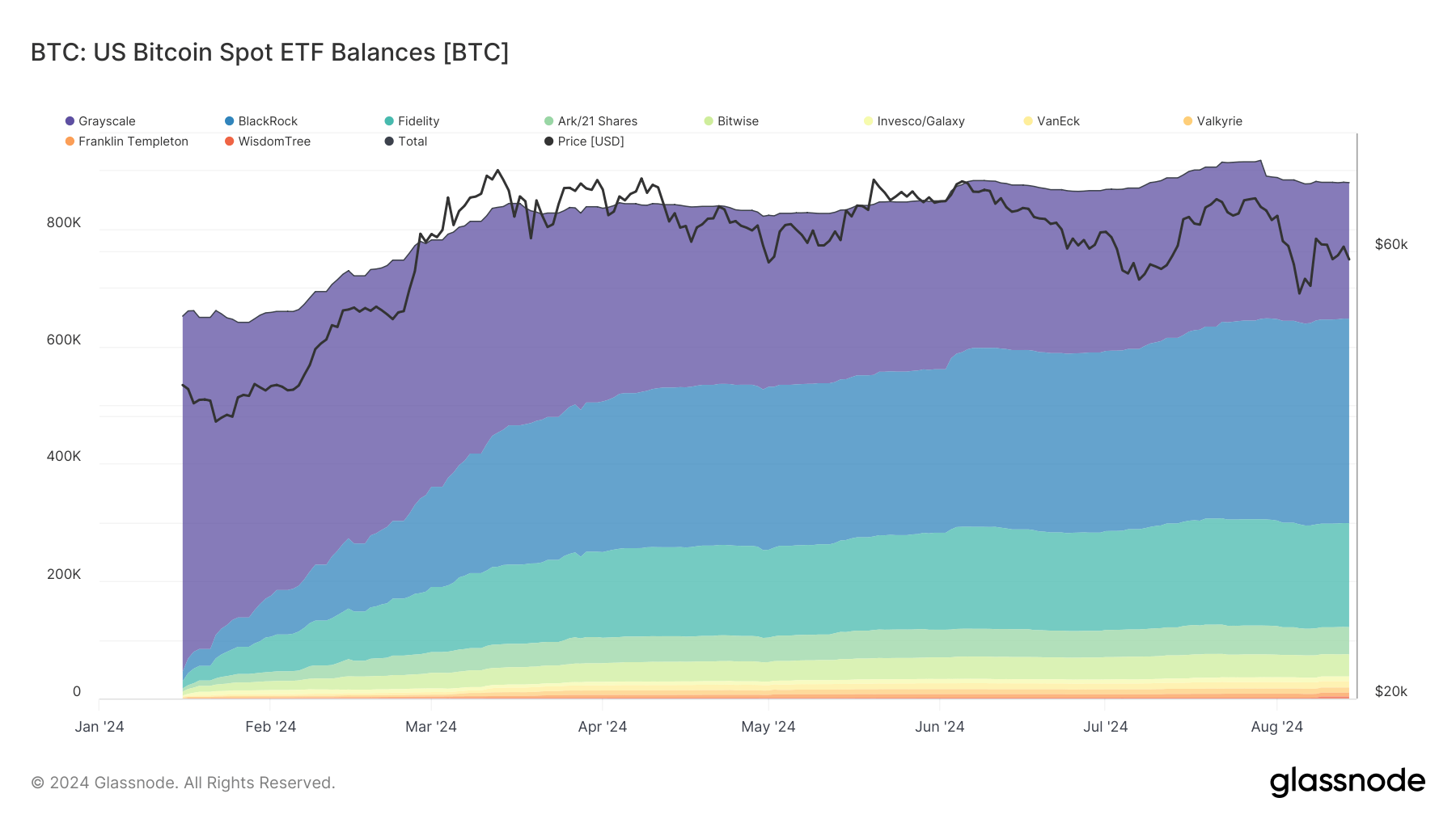

One cause for this improve in LTH provide may very well be the maturation of BTC held by spot ETFs. The methodology for calculating LTH provide considers Bitcoin that has not moved for greater than 155 days as a part of the availability held by long-term holders. On condition that the stability of US Bitcoin Spot ETFs has elevated from 651,641 BTC on January 16 to 879,799 BTC on August 14, a big portion of those holdings are actually above the 155-day threshold, contributing to the rise in LTH provide.

This rationalization is per the timing of the rise, with most of the ETF inflows earlier this 12 months simply hitting the 155-day mark. The large improve in ETF holdings because the begin of the 12 months has reached roughly 228,158 BTC, roughly coinciding with the rise in LTH provide.

that is, Institutional Buyers The corporate is embracing a long-term Bitcoin funding technique by means of a spot ETF, and the market seems to be viewing this as an indication of confidence in Bitcoin’s future. TradFi MarketThis might encourage different massive buyers to comply with go well with.

Moreover, the rise in LTH provide might create a provide scarcity out there. If long-term buyers and ETFs maintain extra BTC, each will probably be much less prone to promote shortly and aggressively, lowering the quantity accessible for energetic buying and selling. If this discount in circulating provide continues, it might theoretically result in elevated worth strain when the subsequent rally happens.

The resilience proven by long-term holders within the face of the current worth decline can be noteworthy. Regardless of the Bitcoin worth decline, LTH balances elevated considerably. This means that long-term holders and institutional buyers are sustaining their positions by means of ETFs and could also be viewing the present market circumstances as a possibility to purchase somewhat than a cause to promote. Nonetheless, it should take one other three months or so for belongings bought throughout this worth decline to mature and be thought of as long-term provide and mirrored in on-chain metrics.

The publish Bitcoin Provide Hits File Excessive for Lengthy-Time period Holders appeared first on currencyjournals