- Coinbase CEO Brian Armstrong and Elon Musk have blamed extreme authorities spending for the present inflation in the USA.

- Armstrong means that Bitcoin gives a test and steadiness towards extreme inflation.

- He argues that purchasing Bitcoin is a strategic transfer towards inflation.

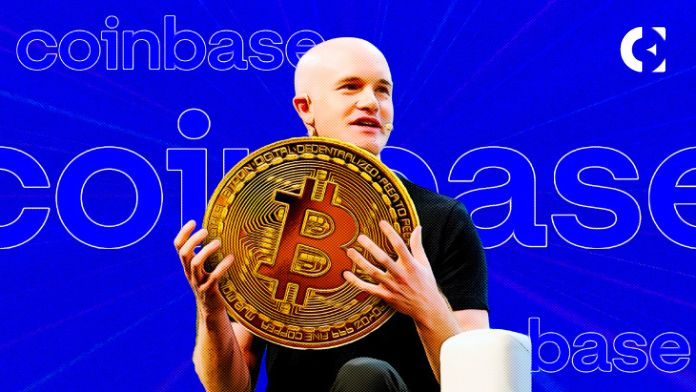

Coinbase CEO Brian Armstrong has weighed in on the controversy relating to inflation in the USA, echoing Elon Musk’s views.

In a latest tweet, Armstrong argued that inflation is primarily brought on by extreme authorities spending, which forces governments to print more cash, which he careworn results in inflationary pressures that erode the worth of conventional currencies.

Armstrong's feedback have been in response to a tweet from Elon Musk, who additionally blamed authorities spending for inflation, and careworn the significance of chopping wasteful authorities spending to curb inflation.

This dialog occurred at a time when inflation in the USA is exhibiting indicators of moderating. As of July 2024, the U.S. inflation charge was recorded at 2.89%, down from 2.97% in June 2024. This marks a continued decline from earlier years when inflation charges have been considerably greater, corresponding to 3.70% in September 2023.

Armstrong took the argument a step additional, constructing on Musk's views, suggesting that Bitcoin is the last word test and steadiness towards such inflation: “Bitcoin is a test and steadiness towards extreme inflation. Shopping for Bitcoin is a vote towards inflation,” Armstrong tweeted.

This view stems from the truth that Bitcoin's fastened provide of 21 million cash makes it proof against the inflation dangers related to conventional currencies. In consequence, Bitcoin is more and more seen as a secure haven and retailer of worth throughout instances of financial uncertainty.

As governments world wide proceed to grapple with rising inflation, Armstrong's proposal for Bitcoin as a hedge towards forex devaluation highlights a rising perception inside the crypto neighborhood that cryptoassets can act as a hedge towards conventional monetary dangers.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. This text doesn’t represent any type of monetary recommendation or counsel. Coin Version isn’t liable for any losses incurred because of using the content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to our firm.