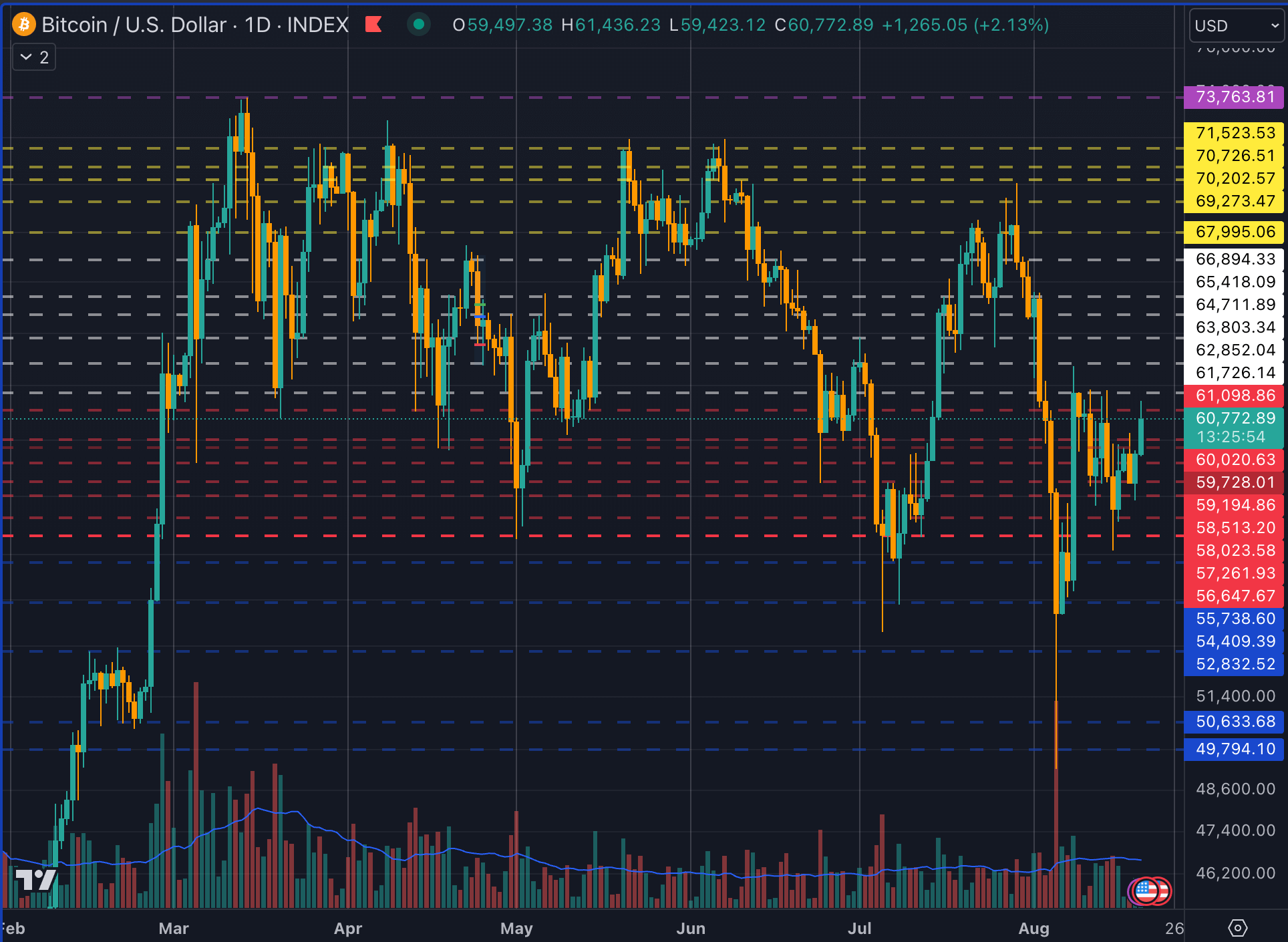

Via evaluation of leveraged Bitcoin futures, spot market order books, and psychological buying and selling ranges, I’ve created a set of channels which have confirmed remarkably sturdy over the previous six months.

I’ve not day traded cryptocurrencies since 2021 and as an alternative concentrate on dollar-cost averaging into Bitcoin on daily basis. Eradicating the emotional side of buying and selling has allowed me to concentrate on the info with out projecting private emotions onto my trades and evaluation.

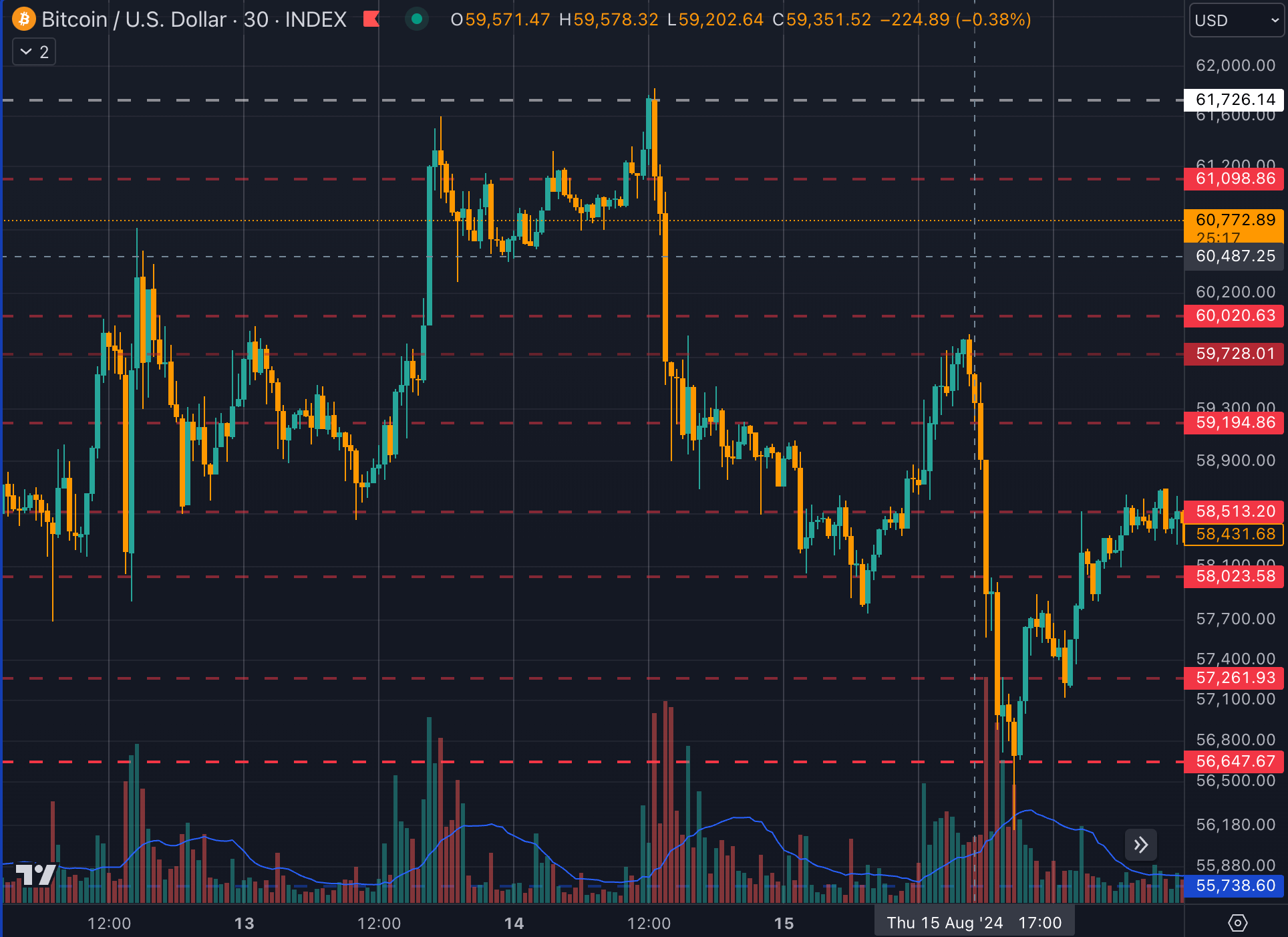

We checked out simply the 30-minute Bitcoin worth chart and drew horizontal strains in keeping with repeated closes to establish the place merchants had been seeking to place cease losses. We then in contrast these ranges to Coinglass liquidation ranges to see which of them corresponded to excessive leverage. Lastly, we appeared on the order e book on the Binance spot market and analyzed the place giant quantities of purchase and promote orders had been being positioned outdoors of the present mid-point.

Primarily based on this seemingly easy evaluation, I created 4 channels in February and March, to not predict the market, however to establish the place I anticipate help and resistance to be. Over the previous six months, these channels have coincided with native bottoms and highs on a number of events.

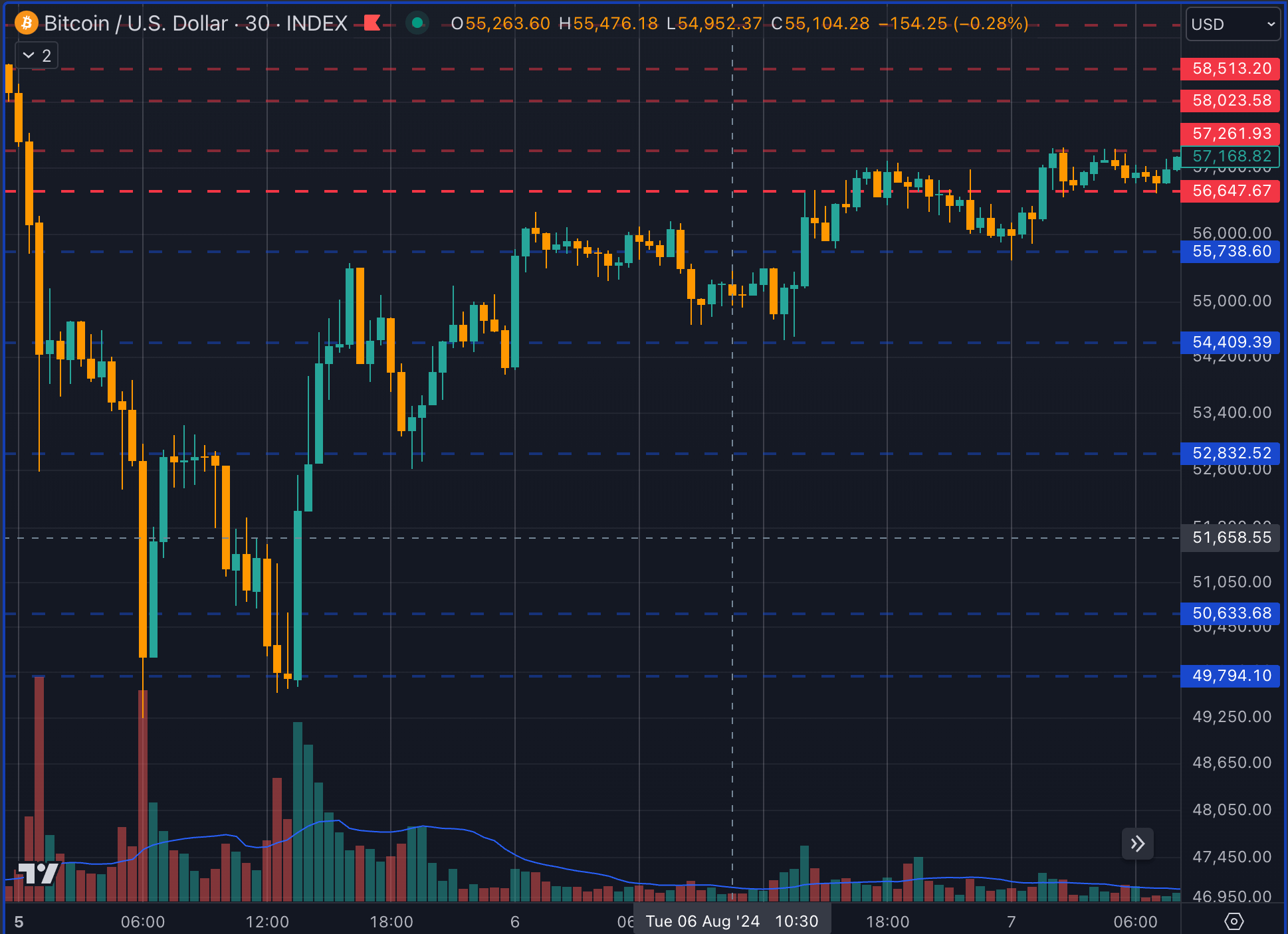

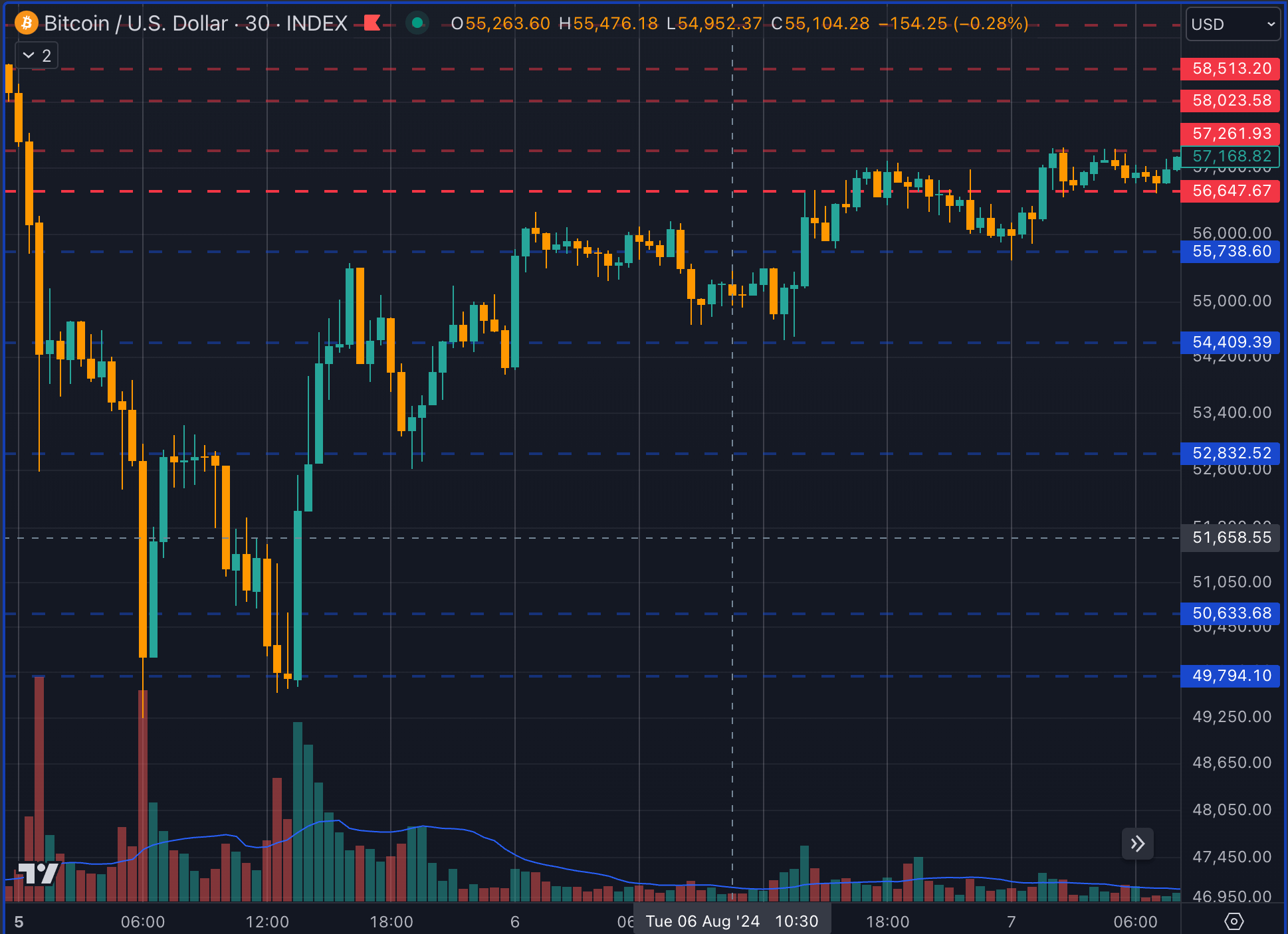

Moreover, Bitcoin’s drop to $49,000 coincided completely with the final line of my backside channel. I assumed {that a} drop under this worth would uncover a brand new lower cost, opening up the opportunity of a brand new lower cost. Nonetheless, Bitcoin rebounded from the underside channel earlier than hitting resistance on the high of the channel.

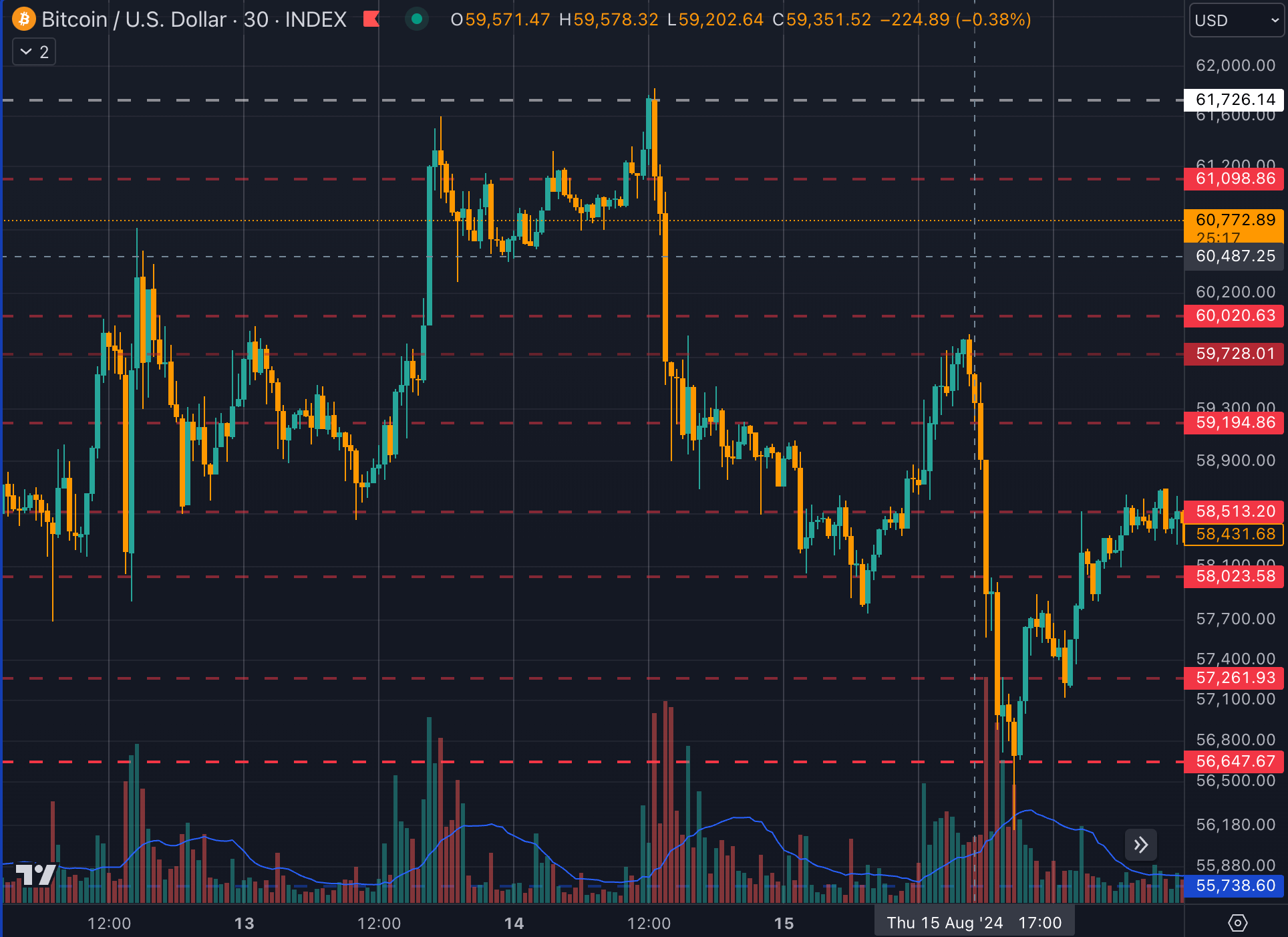

From August 12 to August 16, Bitcoin bounced off the underside of the white channel earlier than dropping to the underside of the purple channel, the place it once more discovered help.

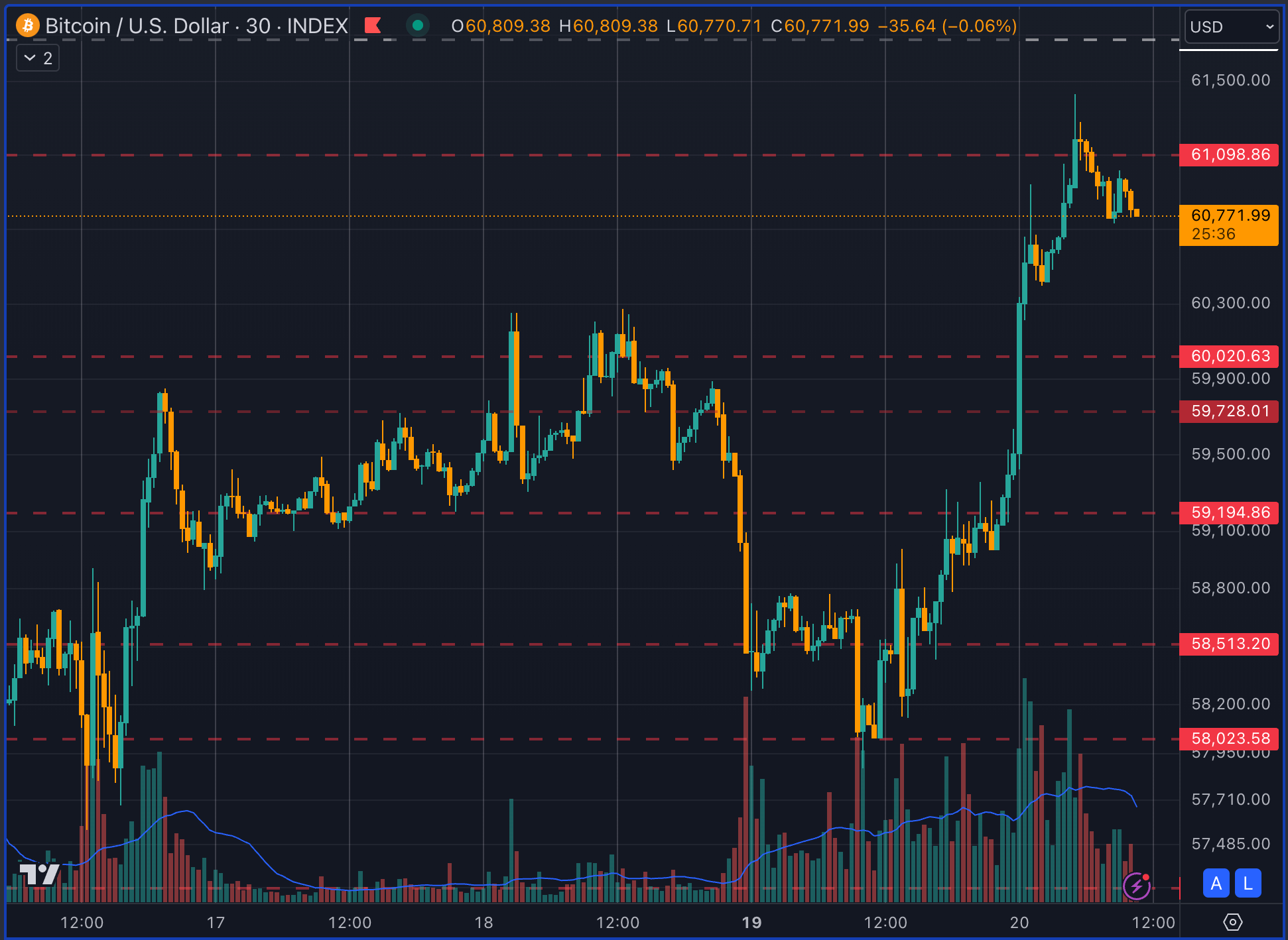

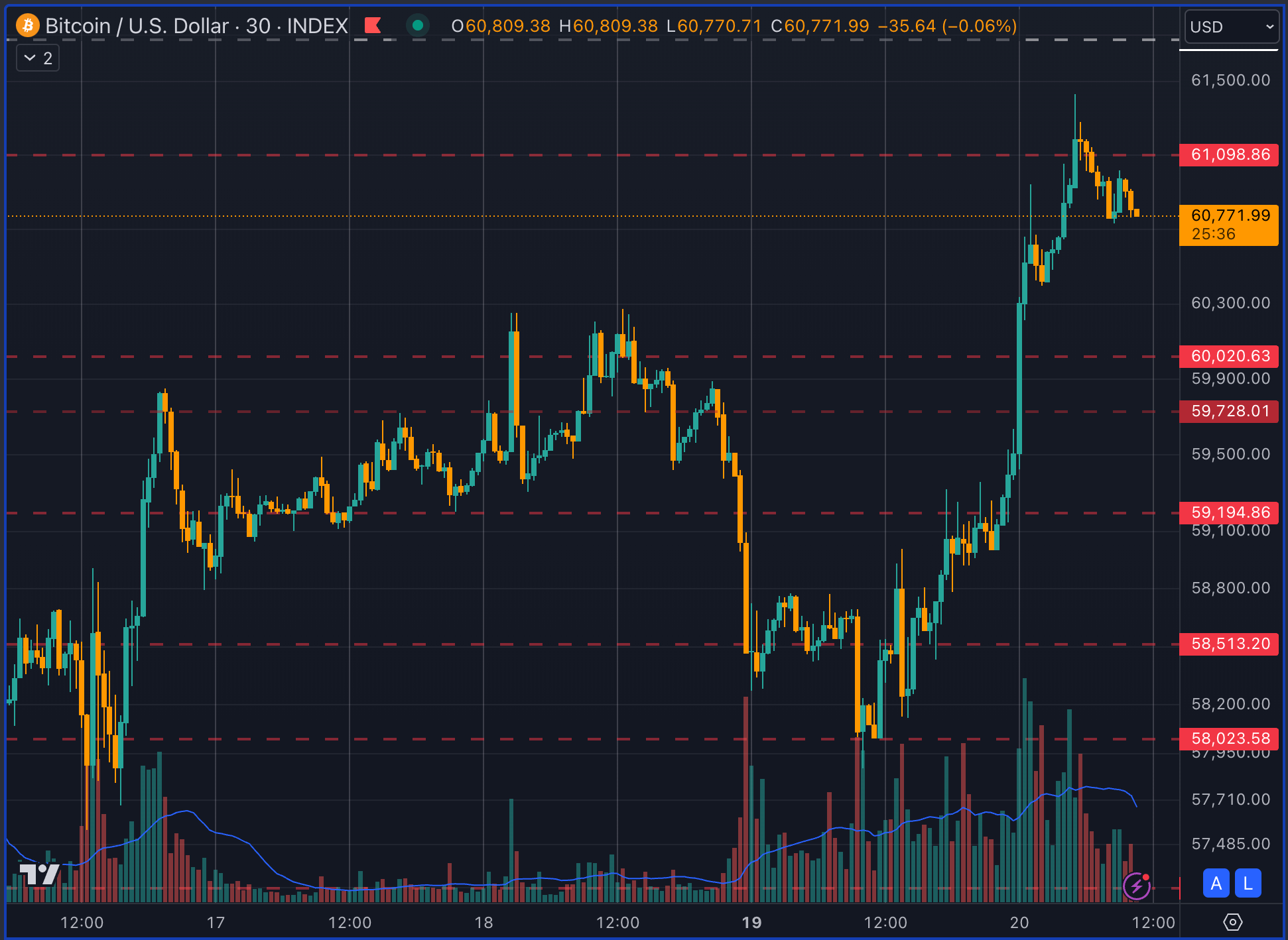

At the moment, Bitcoin is displaying power and has rebounded to the highest of the purple space, which is the second-lowest channel in our evaluation. Bitcoin might rise above the purple and fail to retest the highest of the channel at $61,000 and enter the white earlier than climbing again to the subsequent stage of $60,000.

Whereas I don't consider in buying and selling utilizing technical evaluation, there are numerous others who do. In consequence, I see worth in figuring out areas the place different merchants are putting orders to foretell the place a market reversal is anticipated. In the end, charts are solely a small think about figuring out Bitcoin worth, alongside regulation, geopolitical occasions, financial situations, social sentiment, and on-chain transactions.

I don't declare to have the ability to predict Bitcoin's worth every day, however these channels are extremely influential in figuring out the stress that Bitcoin wants to maneuver above or under a selected worth stage.

For instance, with the numerous Bitcoin FUD presently being generated by institutional traders transferring giant quantities of Bitcoin on-chain, it might take vital social sentiment stress to push Bitcoin under $56,600. Equally, the bullish sentiment generated by rate of interest cuts and elevated market liquidity would must be substantial to interrupt above $66,800 and enter the higher yellow channel.

We are going to submit this evaluation on our on-chain social media platform, Lens Protocol.and new SlateCast episodes on our official currencyjournals account. This evaluation shouldn’t be thought of private monetary recommendation, and as talked about above, I’d not commerce at these ranges myself.I consider in shopping for Bitcoin frequently and persistently, whatever the worth on any given day.

Bitcoin Market Knowledge

At time of writing 12:21 PM, August 20, 2024 (UTC)Bitcoin is ranked primary by market capitalization and its worth is above 4.26% Bitcoin's market capitalization within the final 24 hours $1.2 trillion 24 hour buying and selling quantity $27.95 billionBe taught extra about Bitcoin ›

Cryptocurrency Market Overview

At time of writing 12:21 PM, August 20, 2024 (UTC)the worth of the whole cryptocurrency market is $2.14 trillion Buying and selling quantity per 24 hours $62.22 billionBitcoin dominance now 56.02%Be taught extra in regards to the cryptocurrency market ›