Coinbase's newly launched bitcoin-wrapped product, cbBTC, has seen speedy adoption and a market cap approaching $100 million inside 24 hours of its launch.

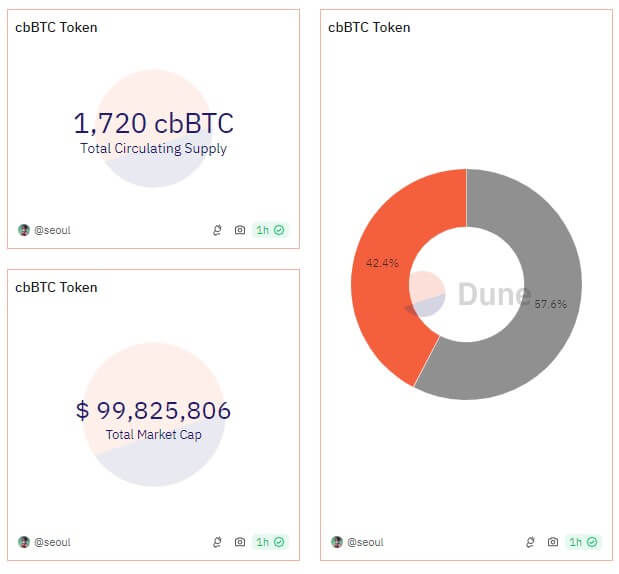

Based on information from Dune Analytics, cbBTC’s circulating provide has reached 1,720 tokens, valued at $99.8 million, of which 43% is in Base and 57% is in Ethereum.

Base’s DeFi Development

Business analysts word that the expansion of Coinbase's cbBTC may result in a major improve in DeFi exercise on the change's layer-2 community, Base.

Moonwell DeFi contributor Luke Youngblood highlighted the product's influence, noting that cbBTC might be suitable with Bitcoin on Coinbase, permitting over $20 billion in retail BTC holdings and over $200 billion in institutional BTC holdings to seamlessly combine with Base's on-chain ecosystem.

Nansen CEO Alex additionally praised the token’s speedy adoption and predicted a major improve in complete property on the Base community.

Moreover, he stated that Coinbase at the moment holds about 36% of the availability, with market maker Wintermute being one of many high holders.

“(Apparently) Wintermute is the No. 1 market maker. (Wintermute) goes to be a strong enterprise for them.”

Solar FUDs cbBTC

Regardless of cbBTC's early success, not everyone seems to be optimistic.

TRON founder Justin Solar expressed skepticism, calling cbBTC “central financial institution BTC” because of the lack of proof-of-reserve audits and the potential for presidency intervention.

He stated:

“cbbtc has no reserve proof, no audits, and might freeze anybody's balances at any time. It mainly simply says 'belief me'. With a US authorities subpoena they’ll seize your whole BTC. There's no higher instance of central financial institution bitcoin. It's a darkish day for BTC.”

Solar additional argued that integrating cbBTC into DeFi may pose safety dangers, as a authorities subpoena may instantly freeze any on-chain Bitcoin, undermining decentralization.

“I’m buddies with many DeFi protocol founders, however integrating CBBTC would pose an enormous safety threat to decentralized finance. One authorities subpoena may immediately freeze all on-chain Bitcoin, making decentralization a joke.”

Some have prompt Solar’s criticism could stem from issues that Coinbase’s cbBTC may eat into the market share of BitGo’s wBTC.Tasks that Solar is related to, notably his involvement with WBTC, have sparked debate inside the crypto neighborhood, with some now exploring alternate options.