- Sui (SUI) achieved a TVL of $1 billion, indicating sturdy upward momentum and market curiosity.

- Sei (SEI) has rebounded sharply and the value is approaching a key resistance stage at $0.52.

- Each SUI and SEI technical indicators level to a doable short-term bullish pattern.

Sui (SUI) and Sei (SEI) have been roughly excellent performers within the crypto market, displaying important value momentum and investor curiosity. Each tokens have seen notable spikes in value and buying and selling quantity.

Notably, Sui achieved a notable milestone by reaching $1 billion in Complete Worth Locked (TVL) lower than two years after its mainnet launch. This has led to elevated curiosity in each tokens, with merchants carefully monitoring key value ranges and indicators.

Sui’s Regular Rise: Key Ranges and Momentum Indicators

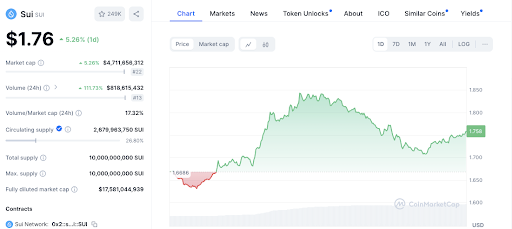

Sui (SUI) has been on a robust uptrend over the previous few days, with the present value hovering at $1.75, a rise of 5.07% previously 24 hours. The token fell to a low of $1.6686 earlier than rapidly rebounding and rising to a excessive of $1.85 earlier than stabilizing. This value restoration is supported by a surge in buying and selling volumes (up 108.96%), indicating sturdy shopping for curiosity.

SUI assist ranges stay necessary for merchants. A key level was the $1.6686 stage, which noticed sturdy shopping for strain in the course of the latest decline. Moreover, $1.70 may type one other necessary assist stage, with the value consolidating after the rally.

Additionally Learn: Unlocking SUI Token’s $106 Million Large: Catalyst for Development or Plunging Worth?

On the resistance facet, $1.85 is the fast barrier as the value was rejected at this stage in the course of the latest rally. If the value maintains its upward momentum, $1.90 may emerge as the following resistance stage primarily based on the earlier pattern.

Taking a look at technical indicators, SUI's Relative Energy Index (RSI) is 77.10, indicating overbought situations. Nonetheless, the Shifting Common Convergence Divergence (MACD) above the sign line signifies near-term bullish momentum and reinforces the constructive pattern.

Sei on the Rise: Analyzing Costs and Market Exercise

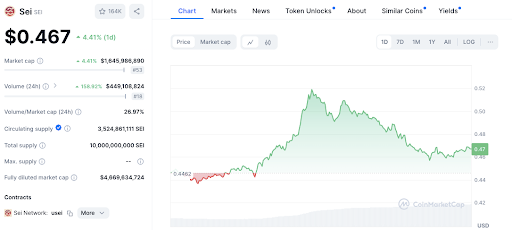

Sei (SEI), one other top-performing altcoin, additionally confirmed a powerful value improve of 5.28% previously 24 hours and is presently buying and selling at $0.4698. Sei fell to $0.4462, then rebounded sharply, reaching a excessive of $0.52 earlier than falling again. The 154.75% spike in buying and selling quantity signifies growing market curiosity as a result of growing shopping for strain.

Assist for SEI is situated close to $0.4462, and whereas the value has recovered after the latest decline, one other potential assist lies at $0.46. On the upside, the important thing resistance stage to observe is $0.52. If SEI breaks above this stage, the following goal may very well be $0.55 primarily based on previous market efficiency.

Sei's technical indicators point out that the RSI is approaching overbought situations because it approaches 69.82, whereas the MACD stays constructive and is buying and selling above the sign line, indicating potential bullish momentum going ahead. It means that it reveals.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be liable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.