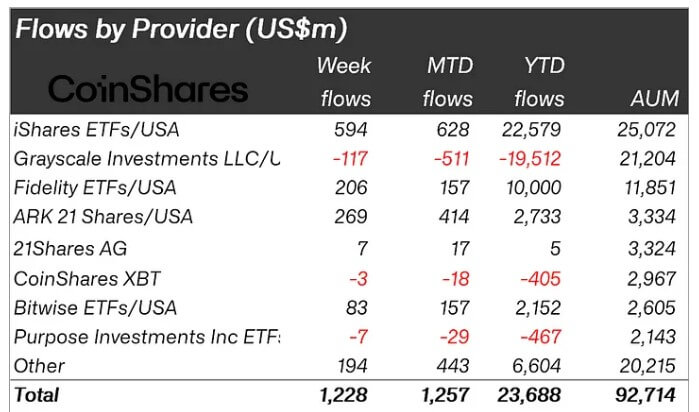

Inflows into crypto-related funding merchandise continued for the third consecutive week, with $1.2 billion flowing into the sector, in keeping with the report. coinshares Newest weekly report.

James Butterfill, head of analysis at CoinShares, stated the massive inflows had been as a consequence of expectations of dovish financial coverage within the US and optimistic market momentum. On account of these components, complete property below administration elevated 6.2% to $92.7 billion.

US inventory change Committee permitted Choices buying and selling for BlackRock's Spot Bitcoin ETF additionally boosted market sentiment. Regardless of this influx, the sector's weekly buying and selling quantity fell by 3.1%.

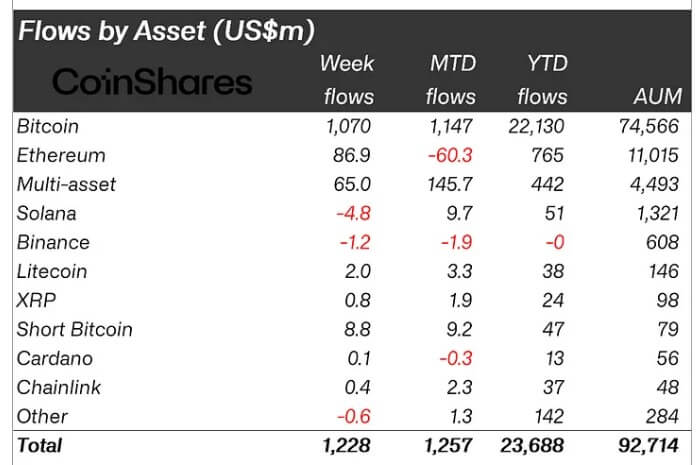

Bitcoin's dominance continues

A CoinShares report confirmed that Bitcoin continues to dominate flows, with traders pouring $1 billion into BTC-related funding merchandise.

This may very well be associated to its stable value efficiency and improved inflows to identify Bitcoin ETF merchandise over the previous week. Particularly, funds managed by Bitwise, BlackRock, Constancy and Ark 21 Shares all carried out effectively in the course of the reporting interval.

Nevertheless, Grayscale's crypto fund continued its web outflow pattern, with complete property declining to $21.2 billion.

In the meantime, $8.8 million inflows into quick Bitcoin merchandise accelerated as some traders anticipated the present bull market to weaken, with BTC lately trending increased close to $65,000. .

Regionally, opinions had been divided. The US topped the checklist with $1.2 billion in inflows, adopted by Switzerland with $84 million. In distinction, Germany and Brazil had outflows of $21 million and $3 million, respectively.

Ethereum breaks the unfavorable chain.

Ethereum-related merchandise ended a five-week streak of outflows, bringing in $87 million, the most important influx since early August.

In response to information from SosoValue, the Spot Ethereum ETF’s weekly flows had been the second highest since its launch in July.

In the meantime, outcomes for large-cap various digital property had been combined. Litecoin and XRP recorded inflows of $2 million and $800,000, respectively. In the meantime, Solana and Binance confronted outflows of $4.8 million and $1.2 million.