- Bitcoin's 21% rally in September was largely because of China's financial stimulus.

- Market gamers are dissatisfied because the Chinese language authorities's financial stimulus bundle didn’t meet expectations.

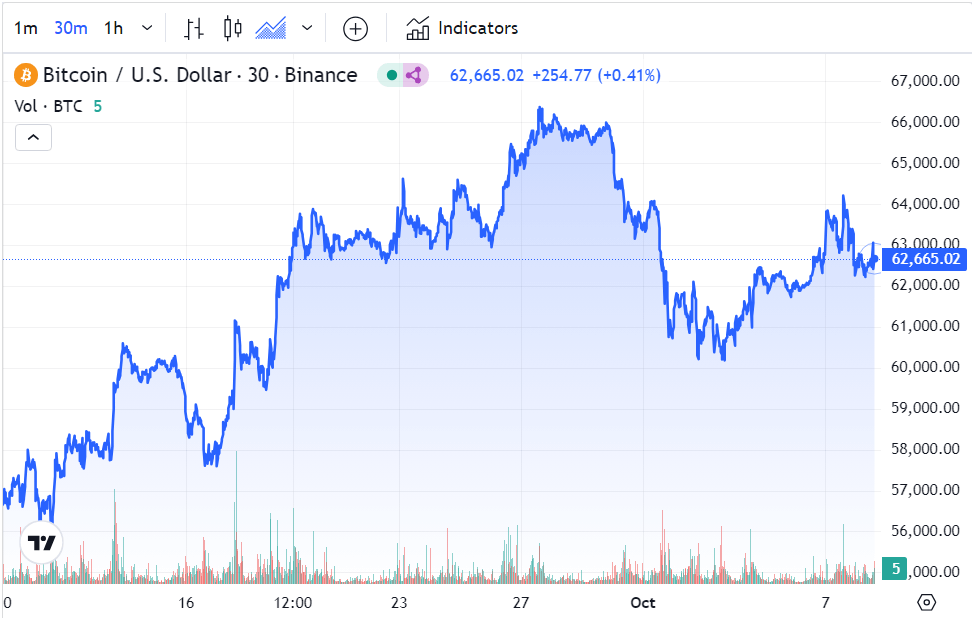

- Regardless of the “Uptober” prediction, Bitcoin did not rise above $64,000 because the market appears for a catalyst.

Bitcoin's latest rally, which started in early September and is believed to be pushed primarily by China's financial stimulus, is beginning to lose momentum. The biggest cryptocurrency by market capitalization briefly crossed the $66,000 mark on September 27, however was unable to maintain the features. As of October 2, it has fallen to $60,000 and is buying and selling at $62,700.

china stimulus

September is traditionally a bearish month for cryptocurrencies, however Bitcoin carried out nicely final month, largely because of the Individuals's Financial institution of China's stimulus program in response to slowing financial progress and the Federal Reserve's rate of interest cuts.

The Individuals's Financial institution of China reduce medium-term lending and seven-day repo charges to spice up financial exercise, a transfer identified to enhance sentiment in direction of threat property. Mortgage rates of interest and minimal down fee necessities for every type of houses had been additionally lowered to assist China's housing market.

Expectations remained that the federal government meant to proceed to stimulate the economic system by means of a multi-trillion yuan spending plan. Nonetheless, the federal government introduced that it could convey ahead 100 billion yuan from the 2025 finances and inject one other 100 billion yuan to assist the development business, which was a far cry from expectations.

Catalyst of uptrend in crypto market

The concentrate on China's stimulus comes at a time when crypto markets are ready for a catalyst to spur a rally. The Fed's 50bps rate of interest reduce in September is anticipated to usher in a rally, however institutional funding in US Bitcoin (and Ethereum) spot ETFs has declined as Bitcoin struggles to interrupt above the $64,000 stage. The scenario in October has been uninteresting because of a decline within the influx of funds from households.

Bitcoin fell about 1% after the federal government's stimulus announcement, however recovered barely in London buying and selling.

(tag to translate) market