- The surge in SUIs and market FOMO could also be drawing consideration away from ADA's potential.

- Cardano technicals point out that ADA is near assist ranges, suggesting a shopping for alternative.

- Regardless of the current downturn, ADA's long-term prospects stay sturdy attributable to its scalability.

Cardano ($ADA) has been quiet currently, particularly with all of the hype surrounding $SUI, which has been rising in value and recognition. Whereas buyers are shopping for $SUI, $ADA has been quietly falling in opposition to Bitcoin ($BTC), leaving individuals questioning if this could possibly be a shopping for alternative.

Market sentiment and FOMO: How the recognition of $SUI impacts $ADA

The rise in $SUI signifies the sturdy affect of market sentiment and concern of lacking out (FOMO). Traders have a tendency to purchase trending property, and $SUI's current value motion suggests it’s gaining the eye of merchants.

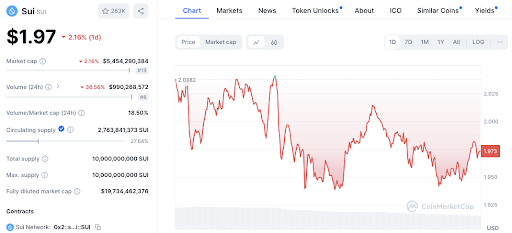

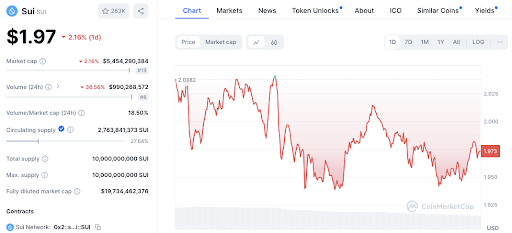

With a current excessive of $2.04 and a market capitalization of $5.47 billion, $SUI's fast value adjustments point out excessive volatility. Though the necessary assist round $1.95 stays, buying and selling quantity is down 35.03%, which may imply that circumstances are cooling down.

This focus on $SUI could also be drawing consideration away from $ADA, which is having a short-term value battle. Nonetheless, for many who need to accumulate Cardano at decrease ranges, this could possibly be a shopping for alternative.

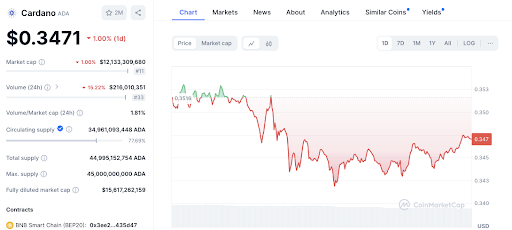

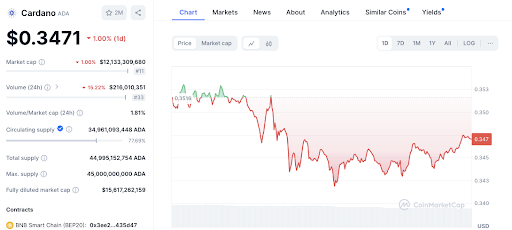

$ADA is at present buying and selling at $0.3475, down 1.31% prior to now 24 hours, exhibiting resilience round assist ranges. Lowering quantity and resistance at $0.3516 recommend that $ADA might retest assist at $0.344 quickly.

Cardano's long-term outlook: Is $ADA nonetheless a powerful contender?

Regardless of the current value droop, Cardano stays a major participant within the crypto market. With a market capitalization of $12.15 billion and a circulating provide of $34.96 billion ADA, the Cardano ecosystem continues to develop. The corporate's blockchain know-how focuses on scalability, safety, and sustainability, which may assist in the long term.

Though short-term technical indicators for $ADA are bearish, the broader development exhibits resilience. The cryptocurrency has struggled to interrupt above $0.35, however constant assist close to $0.344 signifies consumers are getting into at decrease ranges. Additionally, the continued improvement of Cardano's community may assist it do properly sooner or later.

Worth volatility comparability: $ADA vs $BTC

When evaluating $ADA and $BTC, the volatility is clear. $ADA was extremely risky, dropping roughly 4% earlier than recovering.

Additionally learn: ADA vs. Bitcoin: Analysts predict 90% drop in Cardano

Alternatively, $BTC has been comparatively steady, hovering between 0% and 1%. Though $ADA has underperformed in comparison with $BTC, its increased volatility generally is a good factor for merchants in search of short-term earnings.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t liable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.