- Visa mentioned Coinbase customers can deposit funds into their Coinbase accounts utilizing eligible Visa debit playing cards.

- The announcement got here as Bitcoin costs traded close to March all-time highs on Tuesday.

Coinbase and Visa have teamed as much as present clients with real-time account funding, growing flexibility within the cryptocurrency area.

The Visa announcement, which is obtainable to clients within the U.S. and Europe, comes as Bitcoin costs practically reached March's all-time excessive of $73,700 on Tuesday. CoinMarketCap information exhibits that Bitcoin is buying and selling at $72,500 on the time of publishing this text.

The Visa Direct integration permits Coinbase clients to fund their Coinbase account utilizing an eligible Visa debit card. In line with Visa, this integration will give Coinbase customers extra flexibility in a “dynamic crypto setting.”

“By providing real-time account funding utilizing Visa Direct and eligible Visa debit playing cards, we acknowledge that Coinbase customers with eligible Visa debit playing cards can make the most of buying and selling alternatives day or night time. ” mentioned Yanilsa González Ole, head of Visa Direct. , Visa North America.

Along with real-time deposits, Coinbase customers can use their Visa debit card to money out cash from their Coinbase account in real-time.

develop vary

The addition of real-time deposits joins the Visa debit card that Coinbase gives to US-based clients.

In October 2020, the cryptocurrency platform introduced the launch of a Visa debit card that permits customers to make purchases on-line and in shops. Moreover, customers can withdraw money at ATMs.

The launch of the U.S. Coinbase card adopted the Coinbase Visa debit card for patrons within the UK and EU in 2019.

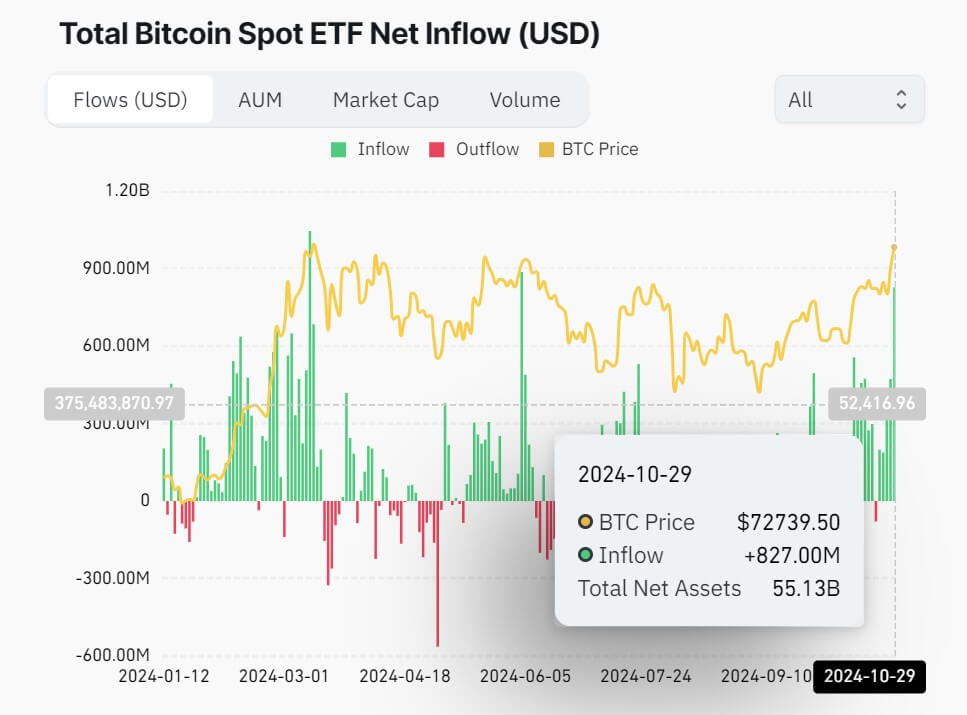

Bitcoin ETF influx

The true-time deposits got here as inflows into bodily Bitcoin exchange-traded funds (ETFs) reached $827 million yesterday, in line with information from CoinGlass.

“FOMO confirmed,” Bloomberg ETF analyst Eric Balciunas mentioned in a submit on Ta.

FOMO confirmed (that is from Monday's exercise, it gained't present up within the move in the present day till tmrw night time) https://t.co/jc0kyHJuqc

— Eric Balchunas (@EricBalchunas) October 30, 2024

Balciunas added, “The final two days have seen a rise in quantity for all main BTC ETFs, so it’s not simply IBIT, however it’s probably the most traded ever.”

(Tag Translation) Market