- Addresses linked to the Celsius community are conducting large-scale Ethereum transfers to FalconX, sparking curiosity.

- The joint Ethereum transfer alerts a shift in institutional-level belongings away from Celsius.

- Ethereum indicators are displaying barely bullish alerts with steady worth actions and a impartial RSI.

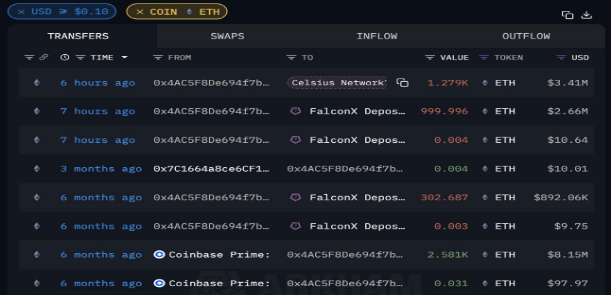

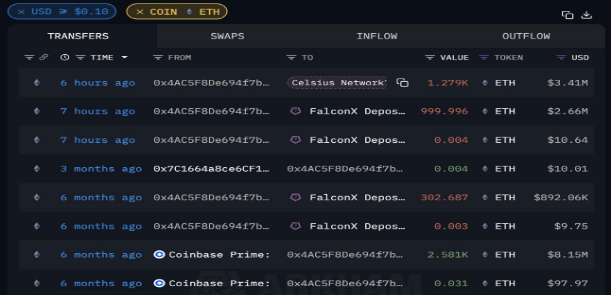

A notable Ethereum (ETH) transaction at an tackle believed to be associated to the lately bankrupt crypto financier Celsius Community has been gaining consideration within the crypto market. This tackle transferred 2,278 ETH price roughly $6.07 million to digital asset buying and selling platform FalconX.

This transaction befell twice, with the primary deposit and the second three months later, with the second switch displaying a worth of $2,664 per ETH.

Over the previous six months, an tackle linked to Celsius reportedly acquired 2,581 ETH from Coinbase Prime, and every switch was linked to this tackle. Arkham-marked addresses related to Celsius look like on the middle of those giant transactions, suggesting coordinated flows of belongings moderately than remoted transactions.

Giant ETH trades point out institutional exercise

The info exhibits a number of ETH transactions with addresses linked to Celsius. The biggest of those transactions occurred six hours in the past and was a switch of 1,279 ETH price roughly $3.41 million to the Celsius Community.

Further transfers embody 1,000 ETH valued at $2.66 million and a smaller 302.7 ETH (valued at $892,060) directed to FalconX deposits.

Ethereum market efficiency displays steady exercise

Following these trades, Ethereum's market efficiency has proven a slight uptick. On the time of writing, the asset was buying and selling at $2,652.06, marking a 0.38% worth enhance. As well as, Ethereum's market capitalization was $319.33 billion and buying and selling quantity was $21.67 billion, a rise of 6.56% from yesterday.

In line with technical indicators, Ethereum’s motion is displaying combined alerts. The MACD line is above the sign line, suggesting doable bullish momentum. Nonetheless, the histogram is comparatively flat, indicating a decline in shopping for strain.

Moreover, with an RSI of 56.99, ETH is in a impartial place with no indicators of overbought or oversold.

Associated:

Understanding the authorized challenges of cryptocurrency chapter

Ethereum plummets as Celsius sends 13,000 ETH to Coinbase and FalconX

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.