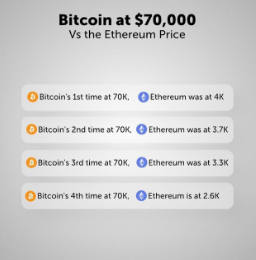

- Bitcoin hit $70,000 for the fourth time, whereas Ethereum fell sharply to $2,600.

- Ethereum's worth has fallen for every of Bitcoin's $70,000 peaks, reflecting the altering dynamics.

- The pattern divergence highlights Bitcoin's resilience, whereas Ethereum faces declining investor assist.

Bitcoin has reached the $70,000 degree a number of instances, however Ethereum's worth has fallen every time. This pattern signifies a change within the relationship between the highest two cryptocurrencies. Bitcoin's continued excessive worth stands in distinction to Ethereum's declining efficiency over time.

Bitcoin reached $70,000 for the primary time whereas Ethereum was buying and selling at $4,000. On the time, the 2 property had been performing extra equally, with Ethereum exhibiting robust progress. Market enthusiasm was excessive, with Ethereum buying and selling close to all-time highs.

When Bitcoin reached $70,000 for the second time, Ethereum had already fallen to $3,700. This decline signifies a divergence in market efficiency. Whereas Bitcoin maintained its worth, Ethereum started to regularly decline. This variation signaled a cooling of Ethereum in comparison with Bitcoin.

On the third $70,000 mark, Ethereum was even decrease at $3,300. The hole between the 2 property continued to widen. Bitcoin's resilience at $70,000 highlighted its energy, whereas Ethereum's decline raised questions on Bitcoin's place available in the market.

Now, Bitcoin has reached $70,000 for the fourth time, and Ethereum has fallen additional to $2,600. This can be a large distinction from earlier ranges. Ethereum's present worth displays a 35% decline from Bitcoin's preliminary peak of $70,000. In the meantime, Bitcoin's stability at this worth vary has attracted the eye of traders.

Altering tendencies within the cryptocurrency market

This pattern highlights altering tendencies within the cryptocurrency market. Whereas Bitcoin has simply reached $70,000 a number of instances, Ethereum has struggled to keep up its earlier highs. The truth that Bitcoin is exhibiting additional consolidation as a retailer of worth means that Ethereum's worth proposition is altering.

As traders take into account these strikes, they’re keeping track of how Bitcoin and Ethereum react to varied market pressures. Bitcoin's constant worth may sign widespread confidence in its function as digital gold. Alternatively, Ethereum could face challenges in adapting to market calls for.

Each cryptocurrencies play totally different roles available in the market. Nonetheless, Bitcoin's repeated success on the $70,000 degree highlights its resilience. Ethereum's decline in worth signifies a change in market notion. Buyers are carefully monitoring each property for future modifications on this dynamic.

Associated:

Crypto liquidation surge: Bitcoin, Ethereum, Dogecoin merchants hit

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be liable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.