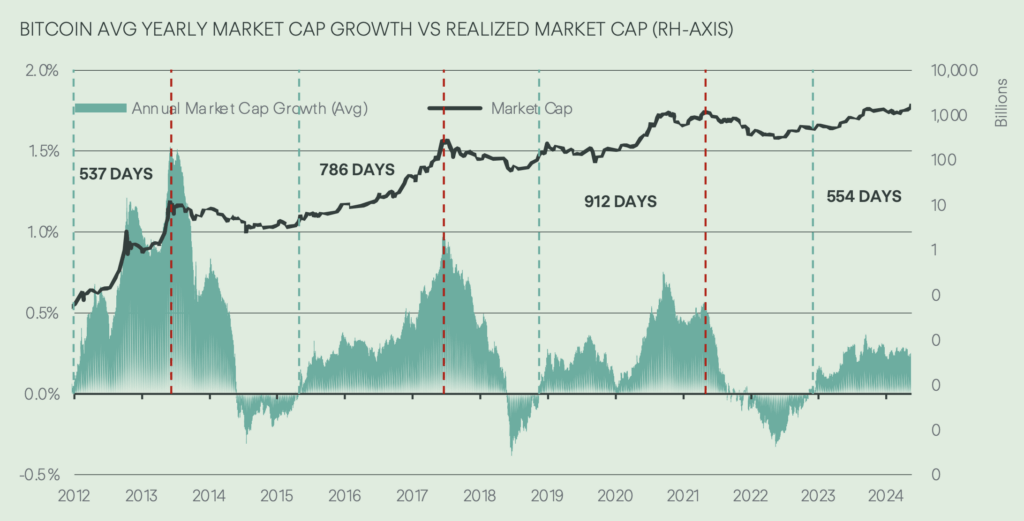

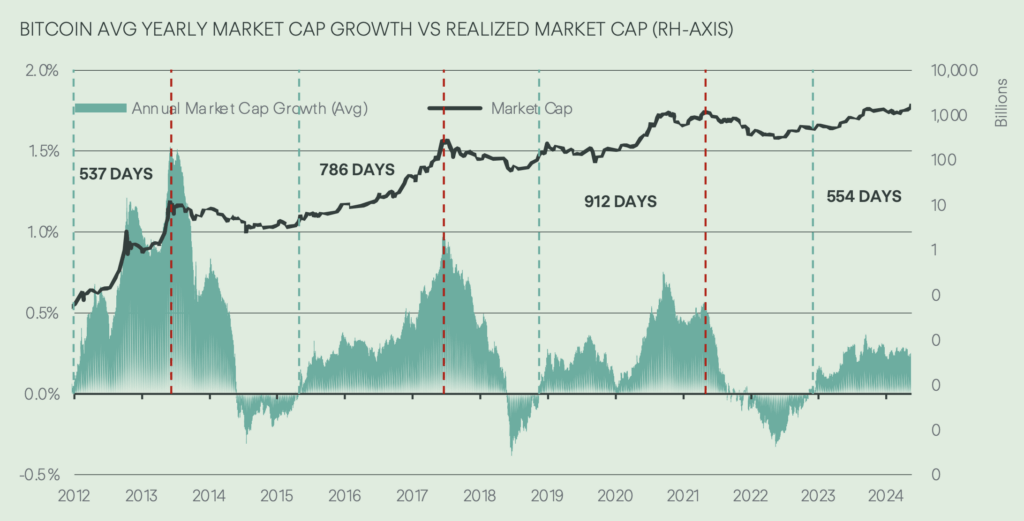

Bitcoin's present market cycle signifies it may peak in about 200 days, which is in step with predictions that the U.S. might be in recession by mid-2025. In line with current analysis from Copper.co, this consistency emerges when Bitcoin reaches day 554 of its cycle..

Traditionally, Bitcoin's market cycle has averaged 756 days from the time the common annual progress fee of market capitalization turns optimistic to the time it reaches its peak value. Copper.co says:His present cycle started round mid-2023, simply earlier than BlackRock filed for a Bitcoin exchange-traded fund. If this sample holds, Bitcoin may peak round mid-2025, about 200 days from now.

Copper.co makes use of JPMorgan's estimate of a forty five% likelihood of a US recession occurring within the second half of 2025 to indicate that Bitcoin's peak and recession predictions could overlap, including additional complexity to market expectations. is added. Buyers could discover this intersection essential when contemplating portfolio methods amid macroeconomic uncertainty.

Bitcoin's realized volatility is presently 50%, reflecting the usual deviation of returns from the market's common return. Implied volatility, which measures market expectations for future volatility, just lately reached its highest stage this 12 months. This means continued market turmoil as 2025 approaches, and a bullish undertone may affect buying and selling conduct.

Bitcoin's Relative Power Index (RSI) is 60, nicely beneath earlier bull market highs. The Copper.co report highlights:By extending the RSI lookback interval to 4 years (a interval that reduces short-term noise), we see that this indicator has vital room for progress. This indicator means that Bitcoin may achieve momentum heading into the brand new 12 months and attain increased valuation ranges.

Amid report costs, the availability of inactive Bitcoin, which represents cash held with out transferring for lengthy durations of time, is rising. Though this development signifies that long-term holders are holding on to their positions, we suggest warning. If these traders start to maneuver property round, it may sign a change in market forces and profit-taking exercise.

In line with Copper.co's evaluation, these components mixed paint a nuanced image of Bitcoin's trajectory. The interaction between market cycles, volatility indicators, and macroeconomic forecasts exhibits the significance of monitoring a number of indicators.

(Tag Translation) Bitcoin