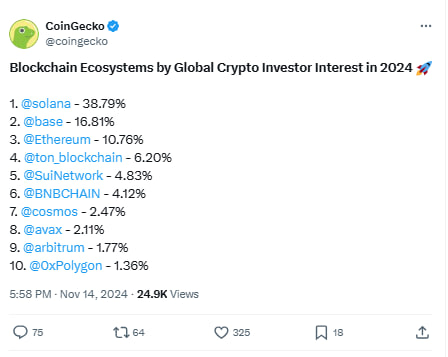

- Solana leads investor curiosity with a market share of 38.79% regardless of the worth drop.

- Base Protocol and Ethereum signify a risky and rising curiosity in decentralized finance.

- Rising gamers comparable to Toncoin and Sui are gaining momentum within the blockchain ecosystem.

Investor curiosity within the blockchain house is continually altering, with completely different networks gaining traction. In line with knowledge from Coingecko, massive gamers like Solana, Ethereum, and Base Protocol are at the moment main the way in which, however different gamers like BNB Chain and Avalanche are additionally seeing vital exercise.

These altering dynamics present helpful perception into how investor confidence and market sentiment will form the way forward for decentralized finance.

Solana attracts vital investor consideration

Solana stays the clear frontrunner in world investor curiosity, accounting for 38.79% of the market share. Regardless of a 2.60% drop in worth and at the moment buying and selling at $210.56, Solana continues to draw consideration.

The community's pace and scalability, coupled with its vibrant ecosystem, proceed to draw investor consideration. Moreover, Solana's buying and selling quantity of over $10 billion previously 24 hours displays continued demand and confidence from merchants.

Curiosity within the fundamental protocol and Ethereum is rising however unstable

After Solana, Base Protocol has attracted vital investor curiosity of 16.81%. Base is buying and selling at $1.17, down 3.44%, sustaining constant development regardless of market fluctuations. The rising adoption of Layer 2 options and Base's seamless integration with the Ethereum community additional enhances its enchantment.

Additionally learn: Will Solana comply with Ethereum’s lead? After ETF approval, influencers witness meme coin growth

Holding 10.76% of the market share, Ethereum continues to be the cornerstone of the decentralized ecosystem. Ethereum was $3,113.88 per token, down 5.72% in worth, however its robust ecosystem and DeFi dominance proceed to drive investor engagement. Its 24-hour buying and selling quantity of over $42 billion highlights its vital affect available on the market.

Rising gamers achieve momentum

Whereas established networks dominate, new opponents comparable to Toncoin and Sui are making waves. Toncoin worth fell 3.48% to $5.23, accounting for six.20% of worldwide buyers' consideration. Interoperability and excessive throughput potential make it a horny choice for future development.

Sui elevated its worth by 0.76% to $3.27, securing a market share of 4.83%. Traders are centered on revolutionary approaches to scalability and consensus mechanisms.

BNB Chain stays a significant participant regardless of a 2.11% drop in worth. It’s buying and selling at $621.90 and continues to achieve traction as a consequence of its strong DeFi infrastructure and energetic consumer base.

Different notable blockchain ecosystems embrace Cosmos, Avalanche, Arbitrum, and Polygon. Cosmos, priced at $4.97, is going through a 4.37% decline, whereas Avalanche is anticipated to say no 6.58% to $31.95. Each chains are actively growing revolutionary options for scalability and interoperability.

Arbitrum and Polygon, buying and selling at $0.59 and $0.36 respectively, have skilled steeper worth declines however stay necessary elements for layer 2 scaling on Ethereum.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.