Digital asset funding merchandise noticed $2.2 billion in inflows final week, reflecting a broader market uptrend pushed by Donald Trump's victory within the just-concluded US presidential election.

Inflows reached $3 billion within the first half of the week, and complete property underneath administration (AUM) reached a file excessive of $138 billion. Nevertheless, Bitcoin's file value efficiency over the identical interval resulted in outflows of roughly $866 million, with web inflows of $2.2 billion.

The influx brings the entire for the reason that September fee reduce to $11.7 billion, and the year-to-date complete to $33.5 billion, in line with CoinShares.

James Butterfill, Head of Analysis at CoinShares, defined:

“This current surge in exercise seems to be pushed by a mix of simple financial coverage and the Republican Social gathering's landslide victory within the current US elections.”

US Bitcoin ETF continues to dominate

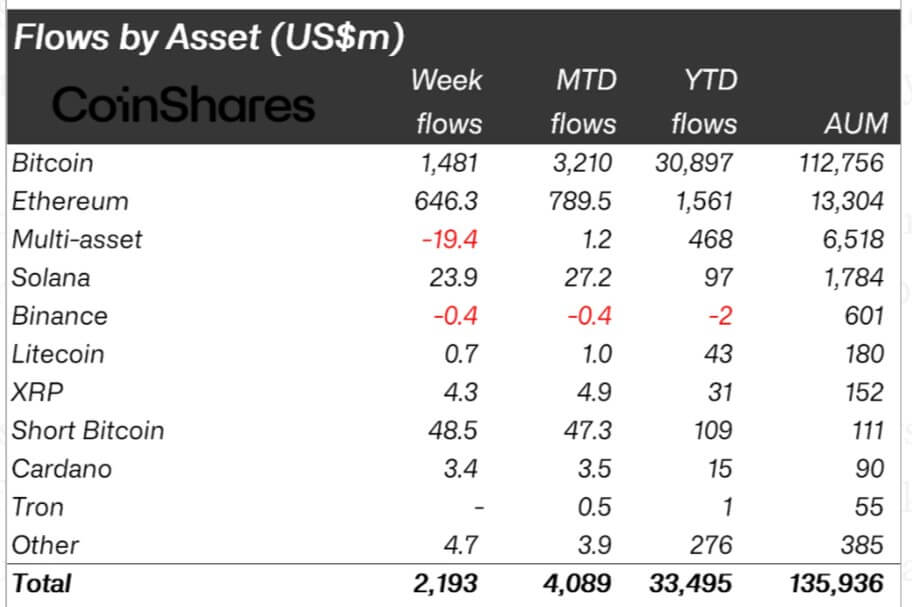

Bitcoin's dominance stays sturdy, with $1.48 billion in inflows. This massive stream could also be associated to the spectacular efficiency of U.S.-based spot exchange-traded fund (ETF) merchandise, which proceed to draw vital consideration from retail and institutional merchants.

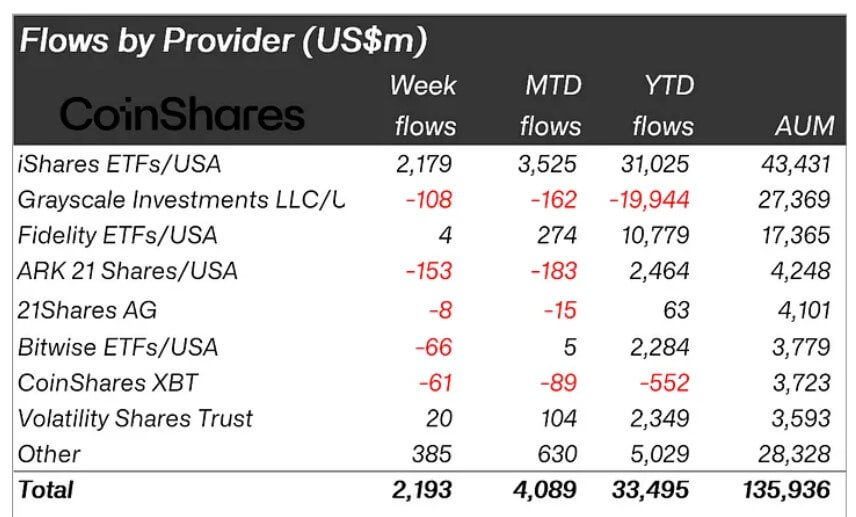

BlackRock’s IBIT and Constancy’s FBTC had inflows of $2.1 billion and $4 million, respectively, in line with CoinShares information. In the meantime, outflows from the Ark 21 Inventory Fund totaled $153 million, exceeding Grayscale's $108 million outflow for a similar week.

In the meantime, Bitcoin's file value efficiency above $90,000 attracted bearish merchants, who invested $49 million in brief Bitcoin merchandise.

Moreover, bullish market sentiment seems to have influenced curiosity in Ethereum, which additionally attracted vital inflows of $646 million (representing 5% of property underneath administration). Butterfill tied this inflow to the election outcomes and proposed upgrades to the Beam Chain community.

Different property comparable to Solana, XRP, and Cardano noticed extra modest inflows of $24 million, $4.3 million, and $3.4 million, respectively.

talked about on this article

(Tag translation) Bitcoin