- Simplified crypto guidelines adjust to securities legal guidelines, assist readability, and foster innovation.

- Decentralization metrics in token regulation create ambiguity and threat authorized conflicts.

- The FIT21 revision may strengthen enforcement by eradicating decentralization as a defining criterion.

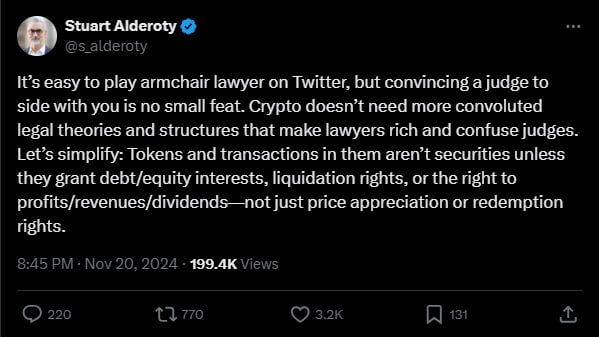

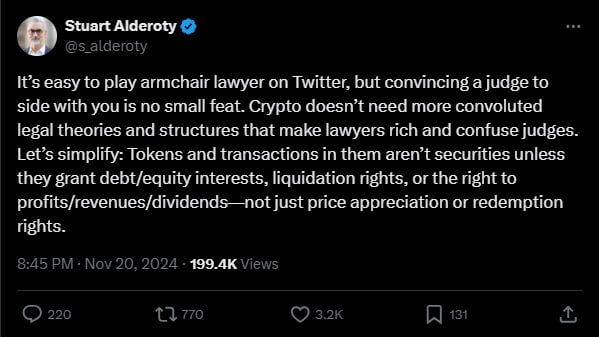

Cryptotokens being labeled as securities is a scorching matter within the digital asset house. As a substitute, Ripple Chief Authorized Officer Stuart Alderroti advocates a simplified method to crypto regulation. He argues that solely tokens with fairness or income rights needs to be labeled as securities. This method reduces authorized ambiguity, he says.

Alderoty believes this focused method will higher align with established securities legal guidelines and supply readability for all concerned.

Such circumstances come up when the token embodies financial rights, resembling fairness, curiosity on debt, rights to income or liquidation proceeds. Simplifying these requirements reduces authorized ambiguity and helps innovation with out creating pointless authorized entanglements.

Reevaluating decentralization as a defining metric

As additional identified by MetaLawMan, cryptocurrency regulation usually depends too closely on subjective metrics resembling decentralization. Utilizing decentralization to find out the authorized standing of a token creates ambiguity in a framework that needs to be predictable.

The result’s uncertainty, permitting attorneys to benefit from unclear guidelines, and leaving judges and regulators to take care of pointless complexity. In consequence, builders and buyers face dangers from inconsistent authorized interpretations. Simplifying these definitions will scale back litigation prices, foster belief, and encourage accountable use of blockchain know-how.

Consistency with established securities legal guidelines

U.S. securities regulation, refined over a century, gives clear precedent for figuring out what constitutes a safety. Tokens that grant rights to dividends, income distributions, or liquidation proceeds are just like conventional securities and needs to be regulated accordingly.

Nevertheless, tokens that solely provide worth appreciation or redemption rights lack these necessary traits. Making use of established ideas subsequently ensures that regulatory choices are according to previous follow, offering a strong basis for each new and skilled market members. Masu.

authorized adjustment proposal

The present draft of the Monetary Innovation and Expertise for the twenty first Century Act (FIT21) depends on decentralization metrics to categorise tokens. Nevertheless, this method must be modified to replicate a extra sensible and constant framework.

Moreover, eradicating decentralization as a defining criterion would make rules clearer and simpler to implement. In consequence, this alignment reduces pointless authorized disputes and permits stakeholders to deal with significant innovation quite than compliance uncertainties.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.