The next is a visitor put up from Shane Neagle, Editor-in-Chief of The Tokenist.

Bitcoin has pushed the boundaries of economic innovation in lots of instructions. As a distributed digital ledger, it has expanded the scope for transparency and supplied a viable different to banking. Bitcoin relied on its proof-of-work algorithm to determine digital shortage. Though digital, it’s nonetheless anchored within the bodily world of {hardware} property and vitality necessities.

All of that is achieved whereas being open supply. And the open supply nature of Bitcoin has led to over 100 laborious forks. Since these are ledgers managed below a distinct algorithm, they don’t seem to be suitable with earlier blocks, ensuing within the creation of a brand new model of the blockchain.

New variations of Bitcoin are born when new laborious forks are created, pushed by totally different visions of P2P cash and incentives. When it comes to market capitalization, the biggest ones are Bitcoin Money (BCH), Bitcoin SV (BSV), Bitcoin XT (BTCXT), and Bitcoin Gold (BTG). Though none of those measures can match Bitcoin's (BTC) market capitalization of $1.47 trillion, they inject many concepts associated to Bitcoin's future.

What’s a Bitcoin fork?

From the start of Bitcoin mainnet's launch in January 2009, the primary genesis block mined made it clear that modifications had been wanted to create Bitcoin. peer-to-peer digital money system Simply as Satoshi Nakamoto initially supposed.

For this sort of imaginative and prescient to work in a world of near-instant on-line funds, Bitcoin's community might want to carry out on par with Visa and Mastercard's networks. The issue is that these networks depend on centralized databases (ledgers), equivalent to VisaNet, and prioritize effectivity in transaction processing above all else.

In any case, in distinction to the Bitcoin imaginative and prescient, Visa has little interest in monetary sovereignty of any type, as a cash middleman between banks.

However how is that attainable in a decentralized laptop community? To take care of this, every transaction have to be verified by different nodes to succeed in a proof-of-work consensus . Bitcoin's present efficiency is round 7 transactions per second, because it takes 10 minutes to substantiate every block full of transactions (3,347 transactions (at the moment per block).

This strategy has a number of implications for ledger administration.

- Bitcoin transaction charges will enhance as transactions enhance. This friction arises as a result of Bitcoin miners can set new ranges of charge prioritization. Out there Bitcoin Reminiscence Pool Housebecause the demand for Bitcoin mining networks will increase.

- The rise in transaction charges on account of Bitcoin's recognition makes it a poor substitute for “on a regular basis cash” and ideally ought to have minimal friction in large-scale adoption.

- If the apparent answer of accelerating the block measurement of transactions is applied, the Bitcoin community will turn into extra centralized, as extra computing and storage is required to course of transactions.

In different phrases, Bitcoin laborious forks have been primarily involved with balancing block sizes. As a working example, in August 2015, when Mike Hahn introduced Bitcoin XT as a fork of Bitcoin Core, he introduced that this model of Bitcoin would enhance block measurement from 1 MB to finally 8 MB. , and might additional double each two years.

Taking a look at different Bitcoin laborious forks, we see the same sample of failure.

How are laborious forks created?

A Bitcoin laborious fork is created by the introduction of a brand new Bitcoin Enchancment Proposal (BIP). Together with bug fixes, these are preliminary steps for brand spanking new options. Nevertheless, these new options will solely be applied as soon as an activation threshold is reached and can represent as much as 95% of minor help.

Successfully, the final 2,016 blocks (about 2 weeks of mining) are required to point out help for the brand new BIP implementation.

When Mike Hahn and Gavin Anderson launched them; BIP101 A proposal to extend the utmost block measurement from 1 MB to eight MB did not move the activation threshold. This was controversial, as Hahn declared that “Bitcoin has failed,” however BIP 101 was the one one which failed. The ensuing laborious fork, Bitcoin XT, is a discontinued model.

Such forks result in new cash. totally different from token – The latter is commonly created on high of an current blockchain. Subsequent, what adopted from Bitcoin XT was Bitcoin Traditional (BXC), because the block measurement was modified again to 2 MB from XT's 8 MB. Once more, this reveals that the Bitcoin laborious fork reveals a block measurement balancing act.

These “block wars” additionally led to the emergence of Bitcoin Money (BCH) in August 2017, with its block measurement finally growing to 32 MB. Of all of the laborious forks, BCH stays essentially the most profitable, with a present market capitalization of $7.26 billion.

Such reasonably profitable splits even have their very own forks. Australian entrepreneur Craig Wright launched a BCH fork known as Bitcoin Satoshi Imaginative and prescient (BSV) a yr later in November 2018. Claiming to be the person behind the pseudonym 'Satoshi Nakamoto', he was later cleared for fraud within the UK Excessive Court docket and had entry to a variety of funds. Forgeries and authorized ways in opposition to critics.

Solid within the crucible of adversity

Contemplating Gavin Anderson was as soon as a key member of Bitcoin Core, Bitcoin's important framework, it may be stated that even the failed BIP contribution within the type of a tough fork served its objective.

Though the Block Dimension Wars in the end sided with the “small blockers,” a contested dialogue resulted within the implementation of Segregated Witness (SegWit) as a mushy fork, which was activated in August 2017 on block 477,120.

By way of BIP 91, 141, and 148, SegWit made Bitcoin transactions extra environment friendly by separating monitoring metadata from the primary transaction. This launched block weights, successfully growing block measurement and quadrupling the variety of transactions per block.

Most significantly, SegWit enabled Schnorr signatures, thus paving the way in which for Bitcoin's personal Layer 2 scaling answer, the Lightning Community. These not solely allow atomic multi-pass funds (amplifier) LN splits giant funds into smaller bits, however minimizes the on-chain information footprint with extra environment friendly and smaller signatures.

AMP performance additionally permits customers to optimize cost routing by means of LN channels, because the payer solely must know the recipient's public key. In any case, what began as a collection of Bitcoin laborious forks largely failed to achieve traction and fueled a distinct sort of Bitcoin scaling.

The mix of easy scaling and good contracts enabled by LN futures contract Not directly, as a result of it requires such velocity and deeper fluidity. Even the Federal Reserve Financial institution of Cleveland acknowledged that the Lightning Community is bringing Bitcoin nearer to “on a regular basis cash.” paper of the title Lightning Community: Flip Bitcoin into Cash.

“Our findings recommend that the Lightning Community’s off-chain netting advantages may assist Bitcoin develop and enhance its performance as a way of cost. It doesn't appear to be an enormous enchancment, however the proportion of low-fee transactions could enhance.”

Within the area of funds, specialised laborious forks could discover a area of interest. all the time required on-line bill factoring or acquiring commerce credit score for small and medium-sized companies (SMBs).

Nevertheless, the truth that Bitcoin maintained a modest block measurement whereas including LN as a scaling answer is just not all that stunning in hindsight.

Safety dangers and community vulnerabilities

Within the early phases of Bitcoin's improvement and adoption, as a serious financial novelty, it was essential to take care of a conservative strategy. For the lots to understand Bitcoin as sound cash, it wants to take care of its core performance and never be a joke.

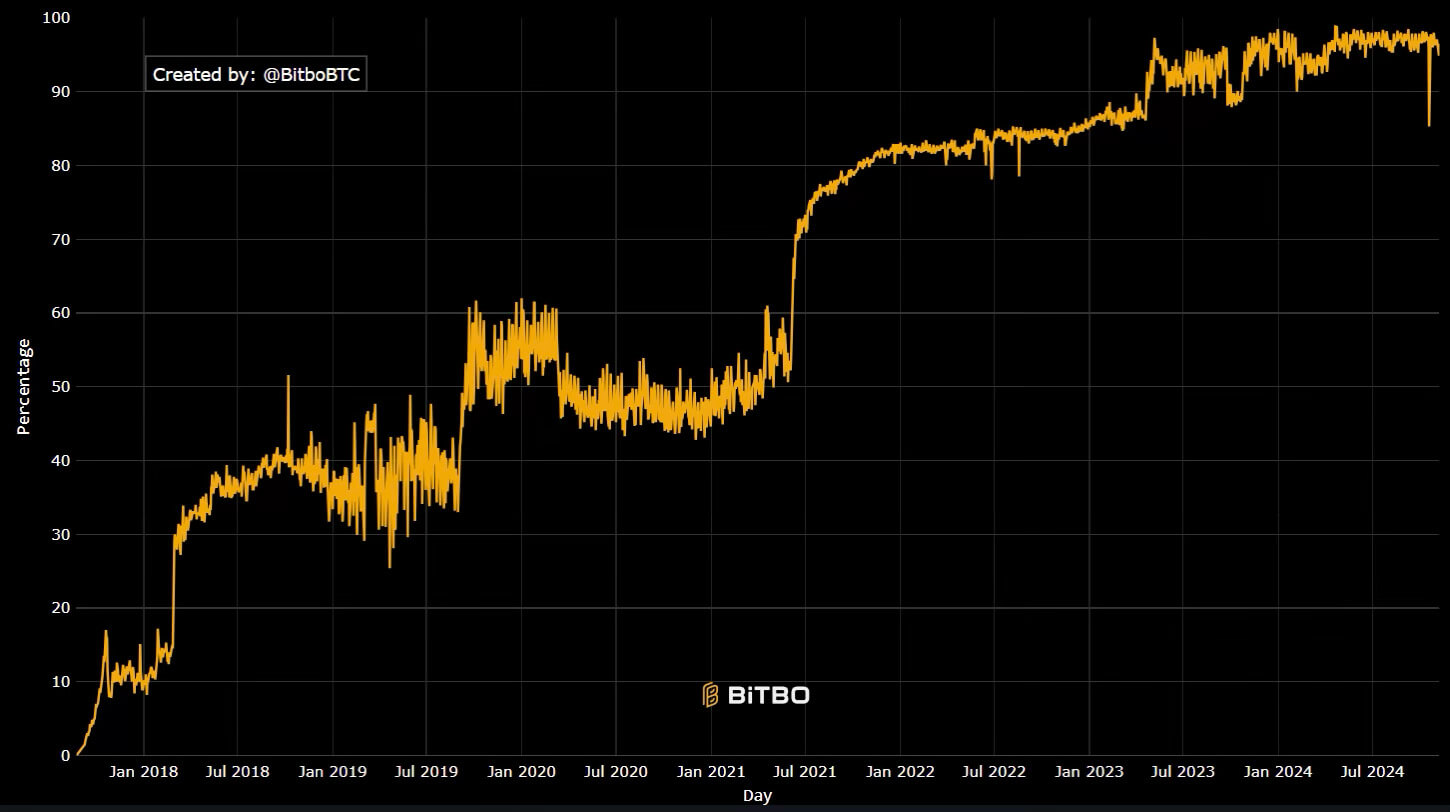

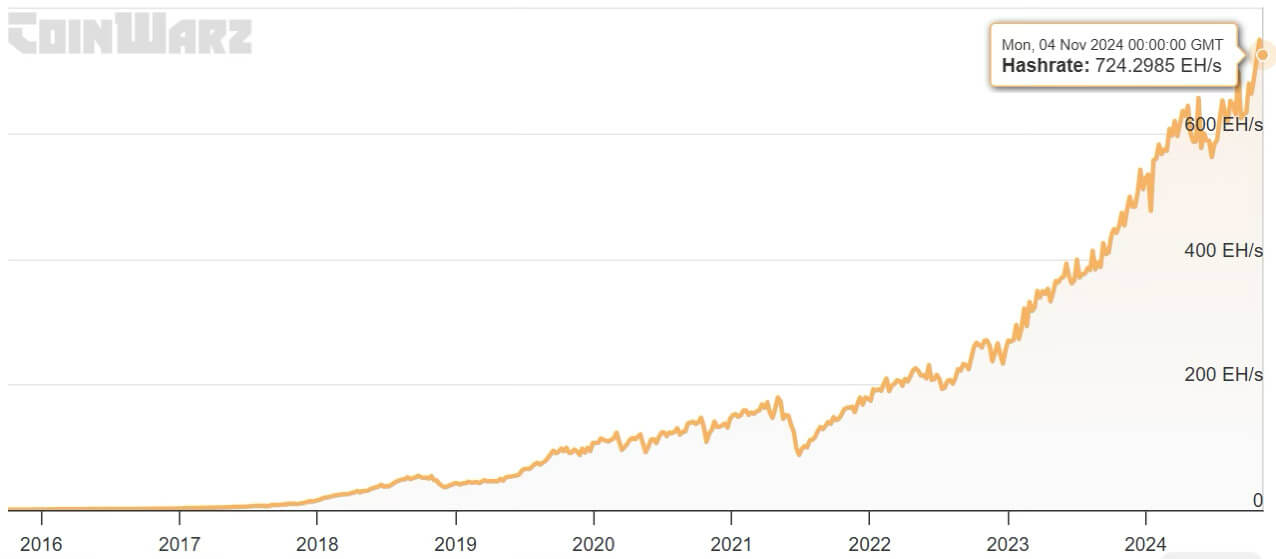

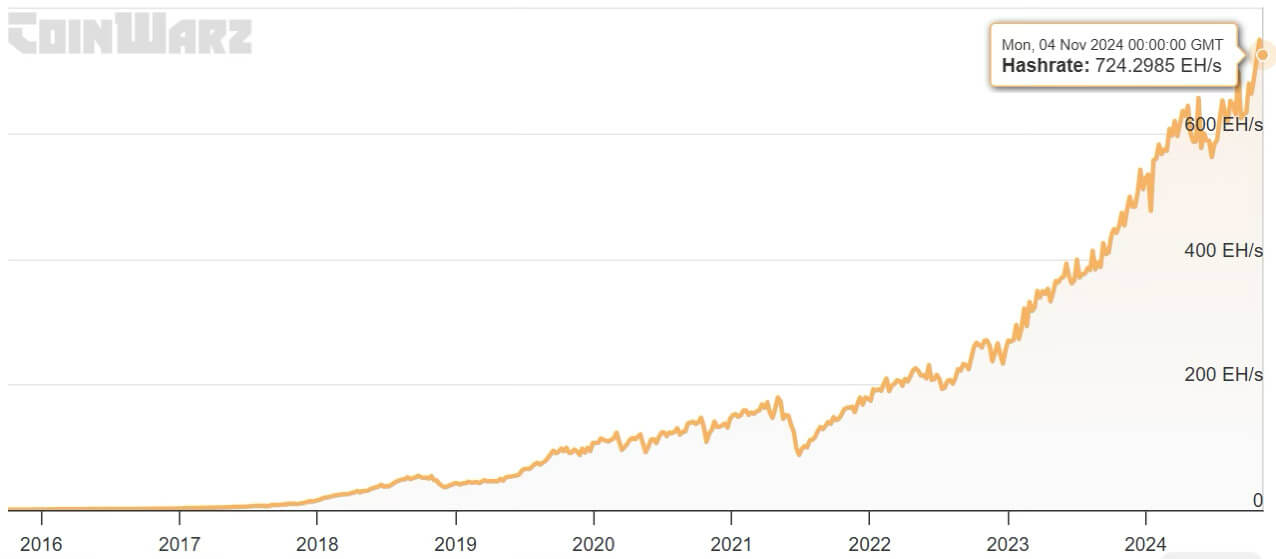

Basically, laborious forks introduce safety vulnerabilities by weakening the hash charge. Bitcoin's underlying worth comes from the ability of the mining community's hash charge. It is a measure of the computations required for a mining rig to resolve cryptographic puzzles and add legitimate transaction blocks in trade for BTC as a block reward.

On this mining competitors, these with a better hashrate have a better likelihood of successful BTC. And as extra computing energy is added to the community, Bitcoin's community problem routinely adjusts each 2,016 blocks, or roughly each two weeks.

Conversely, when the ability of hashrate decreases, 51% community assaults attempt to succeed. Not solely do new laborious forks siphon computing energy, however this divergence and dilution can create situations that enhance danger in the course of the rollout of recent variations.

Because of this Bitcoin miners are biased in direction of community safety fairly than innovation.

In any case, even when there have been even one revealed case of a profitable hack of the Bitcoin community, this is able to act as a everlasting depreciating pressure. And if that occurs, any innovation will likely be placed on the backburner. Due to this fact, Bitcoin's hashrate has just one trajectory: up.

In the meanwhile, the computing energy of the Bitcoin mainnet is so plentiful that even a major drop within the BTC worth is just not a vulnerability. In such a situation, some mining operations could happen. depart the community The issue of mining finally decreases as losses happen.

Nevertheless, on account of its earlier conservative strategy and bias in direction of safety, the Bitcoin community will survive it.

Market volatility and investor sentiment

Seven years in the past, the aforementioned Bitcoin Money (BCH) hit an all-time excessive of $4,355, marking essentially the most profitable laborious fork launch. It began in August 2017 and peaked on the finish of the identical yr. This sample is well-known, following the destiny of many altcoins, together with Bitcoin SV.

- Early speculative increase.

- A peak of worth seems that’s additional away from the earlier peak and has a fair lower cost.

Notably, each laborious forks mirrored a surge in 2020 and 2021 throughout which the Federal Reserve elevated M2 cash provide by greater than $6 trillion in tandem with stimulus checks. Nevertheless, as soon as the liquidity spigot was shut with the beginning of the speed hike cycle in March 2022, BSV and BCH returned to excessive risk-off territory.

This is smart contemplating the next components:

- In complete, there’s a restricted quantity of capital accessible for circulation.

- Within the area of cryptocurrencies, capital is even scarcer.

- As a novelty in digital forex, cryptocurrencies are perceived to be riskier than shares.

Consequently, many of the capital beneficiaries will find yourself in Bitcoin, the unique and most safe cryptocurrency.

conclusion

As this valuation sample turns into extra obvious, it’s extremely unlikely that any future Bitcoin laborious forks, or current laborious forks, will achieve any momentum over Bitcoin. Within the eyes of traders, altcoins are juxtaposed to shares primarily based on firms with laborious property and revenues.

The unique Bitcoin is an exception right here, exactly as a result of its huge computing community leverages laborious property. Arduous forks tried one thing related, however they pale compared, placing them on par with typical proof-of-stake altcoins.

Inside that ecosystem, highly effective firms like Ethereum are the mainstay of capital. A Bitcoin laborious fork could at finest end in a brief enhance in worth on account of its decrease market capitalization in comparison with Bitcoin. This has the potential for speculative income, however the identical is true for the altcoin ecosystem as an entire.

talked about on this article

(Tag translation) Bitcoin