- Binance leads in Bitcoin reserve share with 40% as belief and market demand will increase.

- Bitcoin is nearing $100,000, growing institutional adoption and Binance's market management.

- Regulatory oversight has additionally did not gradual Binance's development as crypto adoption accelerates.

The cryptocurrency market is seeing a shift in energy with Binance rising because the dominant participant within the world trade community.

Regardless of challenges reminiscent of regulatory oversight and market volatility, Binance has consolidated its place and elevated its share of the Bitcoin reserve market amongst proof-of-reserve (PoR) exchanges. I’m.

Binance’s Bitcoin reserve market share has grown since 2017

Information from CryptoQuant founder Ki Younger Ju highlights Binance’s development from mid-2017 to late 2024. Beginning with a small share in 2017, Binance quickly expanded and reached round 10% of the market share by early 2018.

After a interval of decline from 2018 to 2020, exchanges started to rise in dominance in 2021, coinciding with a surge in world crypto adoption.

Since mid-2021, Binance's market share has steadily elevated, reaching over 40% in 2024. This development displays the corporate's capability to draw customers via broad liquidity, a rising consumer base, and aggressive companies.

The rise of Binance additionally comes amidst intense market competitors and rising demand for clear reserve administration.

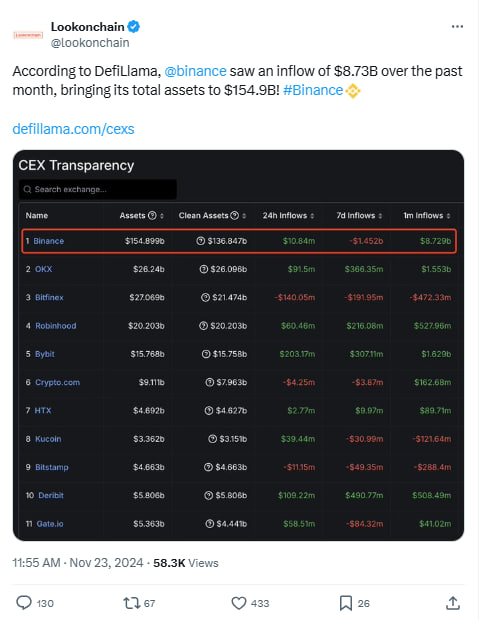

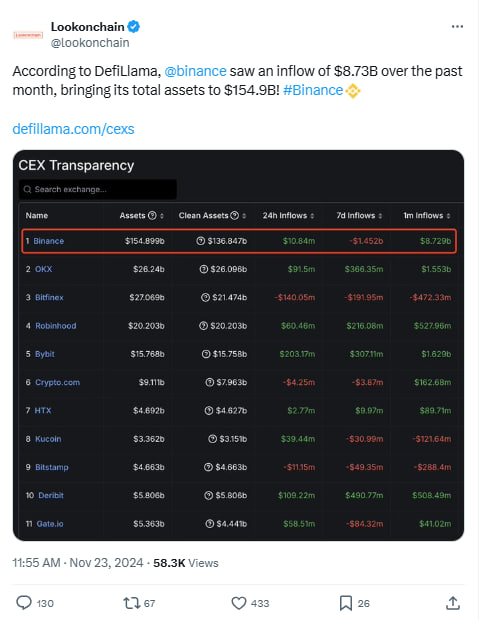

Binance data $8.73 billion asset influx in 2024

In November 2024, Binance recorded asset inflows of $8.73 billion, growing its complete holdings to $154.9 billion. Amid financial uncertainty, customers are transferring to platforms that supply trusted options, and Binance is reportedly attracting customers with companies reminiscent of staking, crypto loans, and institutional asset administration. are.

Additionally learn: Bitcoin soars, CZ launched, Binance gaining momentum!

The corporate attributes its development to its various product lineup tailor-made to the wants of crypto buyers. Regardless of going through regulatory scrutiny, Binance stays a number one alternative for digital asset administration.

In the meantime, analysts stay constructive about Bitcoin's efficiency and consider that Bitcoin may attain $500,000. This upward outlook is fueled by elevated institutional adoption and Bitcoin's status as a uncommon asset in excessive demand.

On the time of writing, the value of Bitcoin (BTC) was $97,808.07 with buying and selling quantity of $58.52 billion. The worth has declined by 0.47% previously 24 hours, however is up 7.93% over the previous week, reflecting continued investor curiosity.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.