2024 was a landmark 12 months for the crypto market. It was a 12 months when markets matured, obstacles to the institutional investor world fell, and worldwide rules started to pave the way in which for digital currencies to enter the mainstream world monetary system.

The market grew considerably because the president-elect was eager to make america a worldwide crypto hub. As cryptocurrencies change into extra fashionable, extra customers are investing in cryptocurrency platforms and ETFs. 2024 was a transformative expertise for the cryptocurrency market and the blockchain know-how that underpins it.

Most of the people, buoyed by constructive sentiment and rising crypto costs, rushed to DeFi platforms to obtain the primary wallets. Many of those new customers ended up on the extremely trusted cryptocurrency model Binance.

Because the business continues to mature, Binance CEO Richard Teng has carried the function by way of important progress in 2024. Commenting on his management and future, Teng mentioned, “Since our inception, we have now continued to place our customers' greatest pursuits first, lead business requirements, and responsibly form the way forward for our business.” I commented.

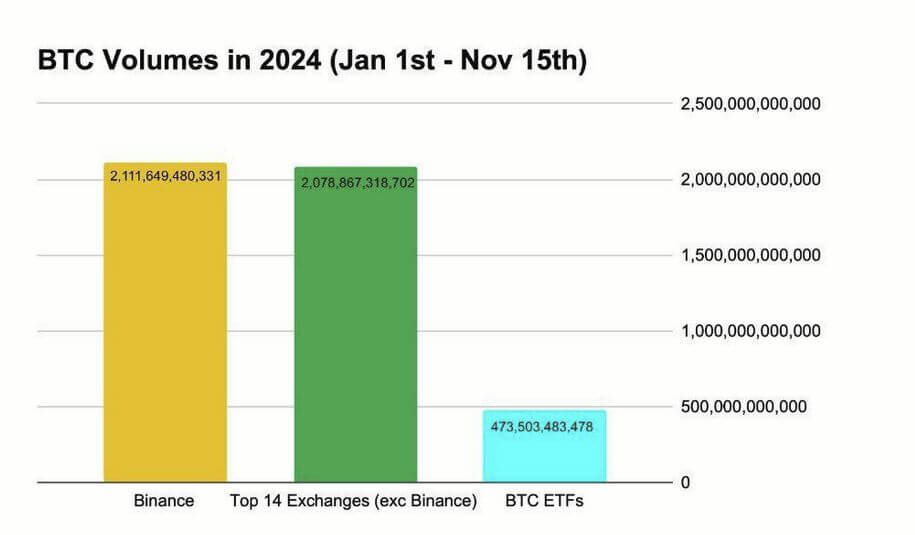

Binance accounts for about 50% of the world's whole buying and selling quantity. This quantity simply elevated from January to November 2024. Throughout the week of the 2024 US presidential election, Binance acquired $7.7 billion of the $20 billion in whole inflows throughout all exchanges. Mix this with the main cryptocurrency alternate reaching a brand new milestone with over 200 million customers and over $130 billion in consumer belongings secured.

Due to this fact, 2024 will probably be an thrilling time for the crypto business because of many efforts. This 12 months's highlights embrace:

Institutional involvement and widespread adoption

In 2024, BlackRock launched the Spot Bitcoin ETF IBIT, which subsequently introduced choices to the desk on November 19, 2024. broke all data On the primary day, 354,000 contracts had been traded with a notional quantity of $1.9 billion. This was a landmark second for the crypto business, however it got here on the finish of a 12 months for institutional traders.

Pension funds, hedge funds and sovereign wealth funds have been onerous at work creating cryptocurrencies this 12 months, hoping to capitalize on the expansion potential and shield themselves from the issues of fiat currencies. They be part of Goldman Sachs, Morgan Stanley, and Constancy Investments, all of which provide Bitcoin as a part of their wealth administration providers.

Bitcoin has emerged as a technique to hedge towards inflation this 12 months, as institutional traders curb market volatility. New regulatory readability, improved custody options, and superior danger administration frameworks have all given monetary establishments the boldness to be among the many first to enter crypto in 2024.

The rise and rise of DeFi

Decentralized finance (DeFi) is altering the world we stay in and providing an actual various to conventional banking. The world's unbanked poor and privacy-conscious rich alike have found the enjoyment of downloading cryptocurrency wallets and sending cash for low charges and no questions requested.

World DeFi market needs to be beneficial, in response to a current research Roughly $440 billion in 2030up from simply over $20 billion in 2023.

It’s now potential to tokenize and enhance liquidity of any asset, from actual property and artwork to automobiles and shares, with out the assistance of conventional banks. This opens up new methods to borrow, save, lend, and earn curiosity, placing energy in folks's arms.

Unbanked people world wide can entry primary monetary providers reminiscent of sending and receiving cash to family and friends with out hefty charges. We’re additionally seeing an ecosystem of liquidity swimming pools and borrowing capabilities opening up that has the potential to alter the world of finance.

Retail market consolidation

The rationale for that is that the Web3 know-how that underpins the cryptocurrency market is well-established not solely in retail and e-commerce, but additionally in DeFi platforms. Blockchain know-how is now the muse of provide chain administration, healthcare suppliers, and quite a few company processes. If blockchain continues to take over companies and public life, the tokenized crypto ecosystem must associate with it.

Retailers are more and more counting on blockchain, with Starbucks utilizing it to hint its espresso from farm to cup and Nike utilizing it to trace its espresso on the Swoosh platform to make sure authenticity and traceability. Tokenizing sneakers.

In October 2023, Ferrari joined Tesla, PayPal, Shopify, Microsoft, and others to start accepting cryptocurrency funds for its luxurious sports activities automobiles. It has been a sluggish course of, however cryptocurrencies have slowly gained the social proof wanted to interrupt by way of with mainstream retailers. Blockchain, which varieties its basis and is changing into mainstream, has been an surprising bonus.

Regulatory framework: From confusion to readability

Fragmented rules that change from nation to nation are horrible for the cryptocurrency business, and 2024 is the 12 months the cryptocurrency business lastly will get its system collectively. Monetary Stability Board, Worldwide Financial Fund, and world financial discussion board This helped information disparate international locations towards one normal observe for digital foreign money taxation, anti-money laundering compliance, and shopper safety. A easy basis of regulation that works throughout borders can do wonders for the business. We’re not there but, however we’re getting nearer.

Technological advances drive maturity

It’s not simply the political local weather that has needed to change to present the cryptocurrency market an opportunity for mass adoption. Attributable to actual technical points with early blockchain techniques, they had been handled as a distinct segment curiosity quite than an on a regular basis incidence.

Blockchain congestion, sluggish transactions, excessive power consumption, and scalability had been all actual points. Ethereum 2.0 and Layer 2 options imply Ethereum, probably the most ubiquitous blockchain up to now in terms of dApps and Web3 know-how, will change into extra scalable, have decrease charges, and cut back blockchain congestion . Different blockchains like Solana and BNB Sensible Chain additionally supply various options with blockchain bridges that seamlessly join networks.

The mixing of AI is already altering the world of buying and selling, analytics, danger administration, and provide chain administration. Synthetic intelligence can additional enhance the efficiency of Web3 know-how, automate advanced processes, and streamline nearly any enterprise.

conclusion

All of those elements have mixed to create a market that’s prepared, keen, and ready for mass adoption. Institutional adoption, regulatory readability, cultural acceptance, and technological enhancements are all serving to the cryptocurrency business transfer from sideshow to heart stage in 2024. We haven't seen something but, however subsequent 12 months may very well be the most important but.

(Tag Translation) Evaluation