Bitcoin’s value motion over the previous week has been exceptional, that includes an increase above the milestone of $100,000.

Though this monumental stage was short-lived and BTC rapidly corrected to round $91,000 after which recovered to round $97,000, it stays a big achievement. Since first breaking the milestone, Bitcoin has handed by way of the $100,000 mark a number of instances, indicating that it’s not performing as assist or resistance. The market's capability to take care of such excessive ranges is proof of sturdy underlying demand for BTC.

The truth that Bitcoin hasn't seen a pointy decline or return to sub-$90,000 value ranges after failing to consolidate above $100,000 means that the promoting strain is prone to be stronger, if not stronger. can be a robust indicator that it’s being countered by sturdy shopping for curiosity. At this stage, demand stays sturdy sufficient to counter makes an attempt to decrease costs. The value close to $94,000 represents sturdy assist and several other wicks fell to this stage earlier than rebounding.

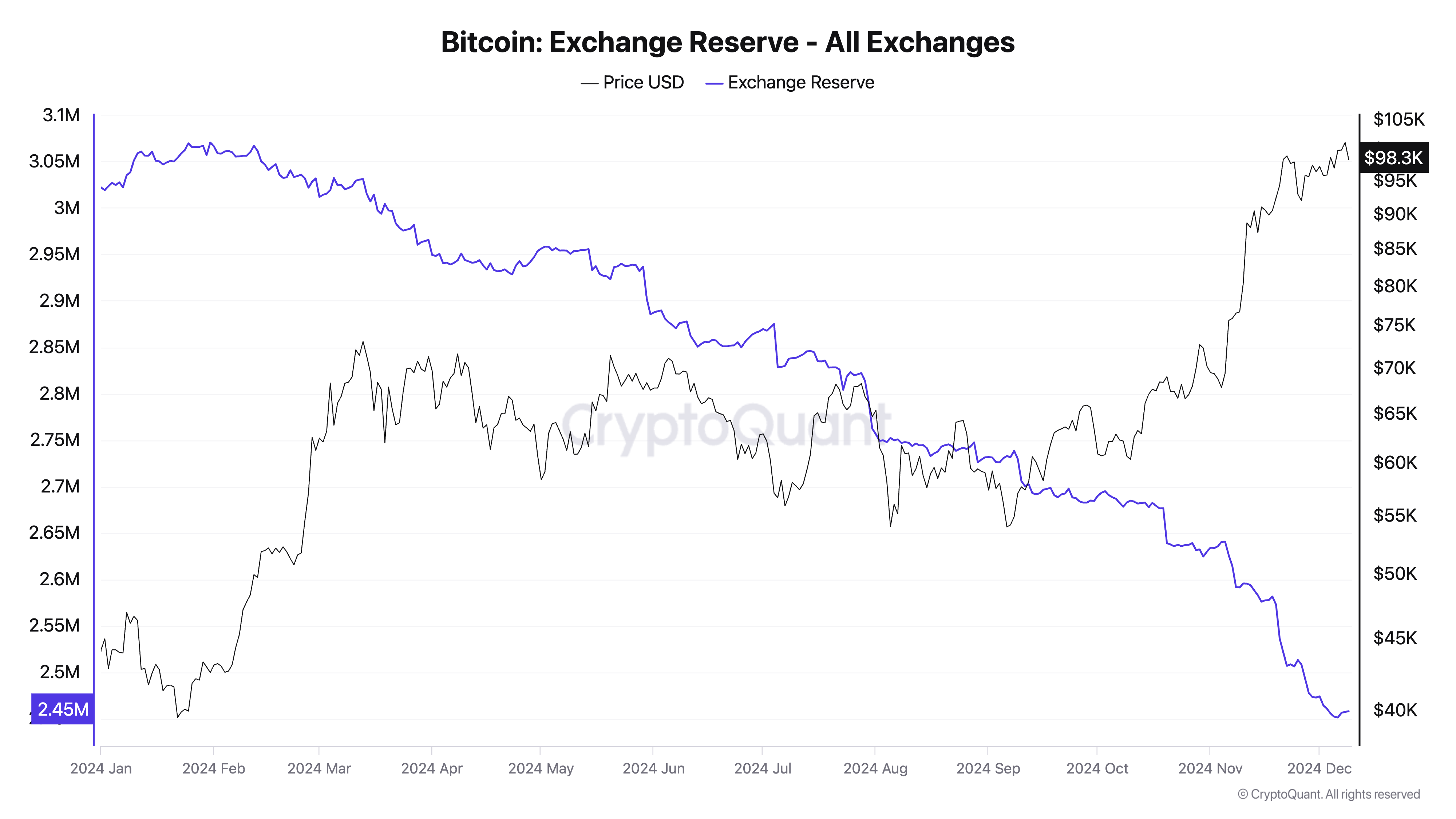

This steadiness between provide and demand turns into clear after we study the connection between overseas trade reserves and internet overseas trade flows. Alternate reserves (Bitcoins held on centralized platforms) have been steadily lowering over time and presently stand at roughly 2.45 million BTC.

This development displays a transparent choice amongst market individuals to maneuver Bitcoin into private wallets or chilly storage, demonstrating confidence in Bitcoin's long-term worth. Declining reserves cut back the provision of Bitcoin obtainable for speedy sale, which generally helps secure or rising costs.

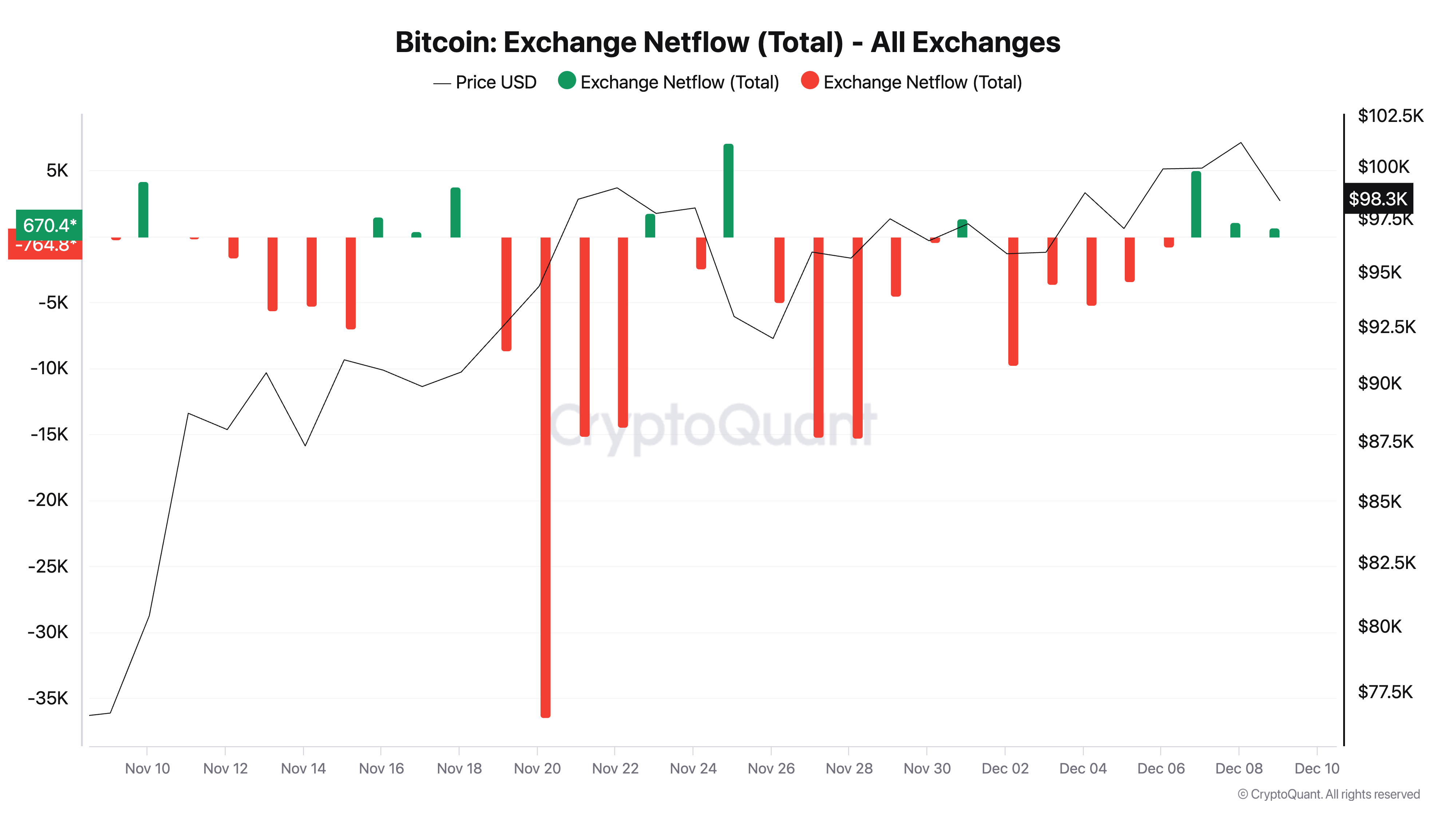

In distinction, trade internet flows paint a barely completely different image within the brief time period. NetFlow, which measures the distinction between Bitcoin inflows and outflows to exchanges, has proven occasional spikes in inflows over the previous week. These spikes counsel that some traders are seemingly returning their Bitcoin to exchanges to e book income or hedge their positions following current value will increase.

Nonetheless, these capital inflows haven’t put vital downward strain on costs. This matches the earlier one crypto slate The evaluation revealed {that a} vital quantity of the downward value motion comes from the derivatives market.

Because of this a lot of the Bitcoin deposited on exchanges is absorbed by patrons, stopping a big value decline. The distinction between declining long-term reserves and sporadic short-term inflows highlights a balanced market the place the forces of demand and provide are equal.

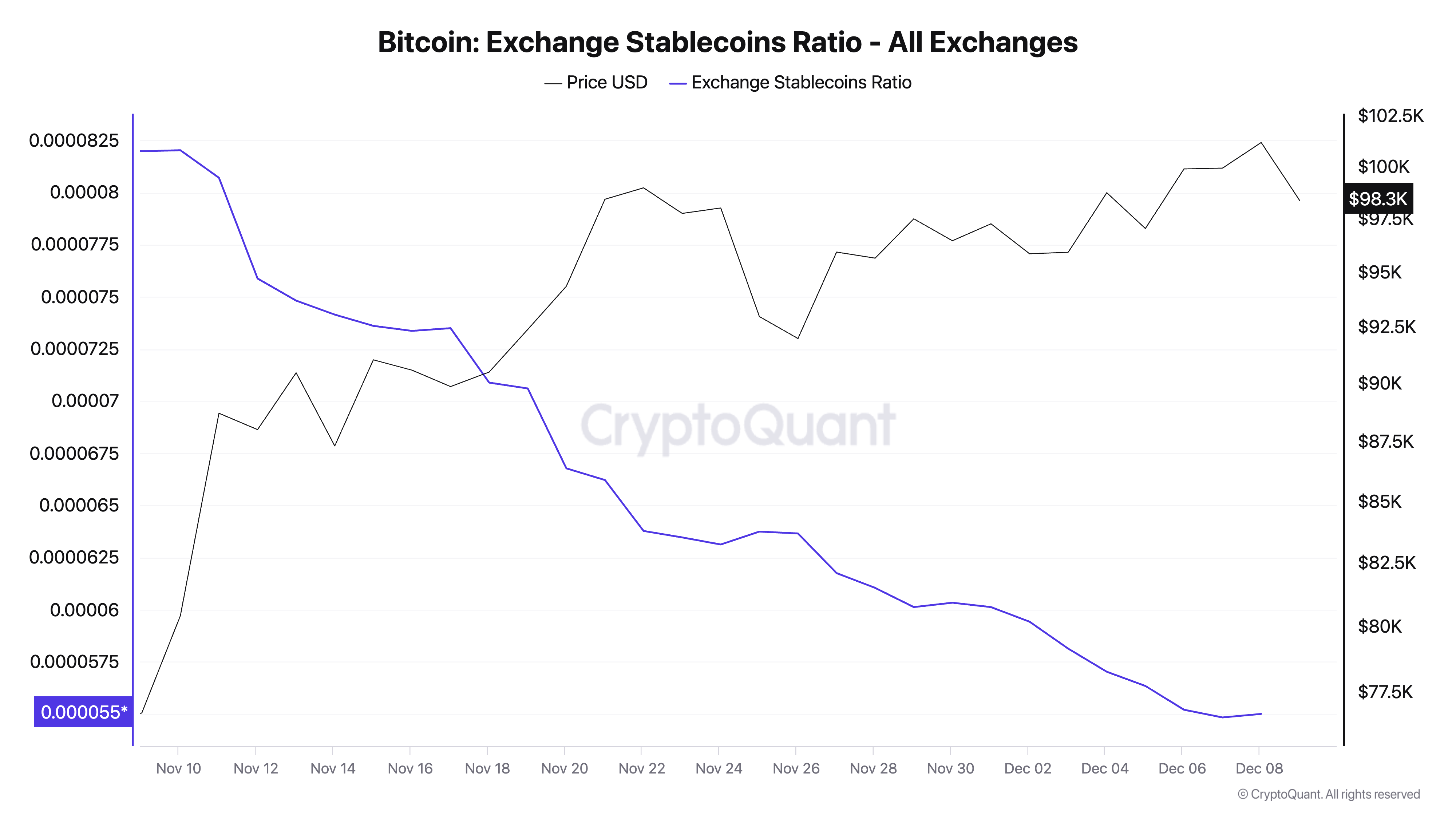

Wanting on the trade’s stablecoin ratio additional confirms that there’s adequate shopping for strain. beforehand analyzed crypto slateThis metric measures the quantity of Bitcoin reserves relative to stablecoin reserves held on exchanges. The decrease the ratio, the upper the proportion of stablecoins, which implies the trade has extra buying energy.

At present, trade stablecoin ratios are at an all-time low, indicating that the market is brimming with liquidity and able to take in promoting strain from exchanges. With a big variety of stablecoins obtainable on exchanges, the market is prone to keep demand for Bitcoin even within the face of elevated promoting exercise just like the one seen when BTC crossed $100,000. You may.

The low stablecoin ratio enhances traits in overseas trade reserves and internet flows. Reserves point out a structural decline in obtainable Bitcoin, and internet flows spotlight short-term promoting makes an attempt, however stablecoin abundance stays sturdy sufficient to soak up this promoting. This confirms that vital funds are on the sidelines.

Taken collectively, these indicators paint an image of a market that’s effectively supported by liquidity whereas weathering the profit-taking interval. This liquidity is probably going maintaining Bitcoin between $95,000 and $99,000, regardless of not having the ability to recuperate $100,000 for now.

A decline in overseas trade reserves signifies a decline in promoting liquidity over the long run, creating a possible provide squeeze. On the similar time, the existence of a stablecoin signifies that not solely is there shopping for curiosity, however there may be sufficient quantity to counter any promoting makes an attempt.

Internet flows function a real-time measure of short-term sentiment, and the truth that inflows haven’t translated into decrease costs is additional proof of the power of demand. This creates a suggestions loop the place the liquidity supplied by stablecoins eases promoting strain, whereas even small demand can have a big affect on costs as a result of diminishing reserves.

The submit Bitcoin Absorbs Promoting Strain and Stabilizes Close to $100,000 appeared first on currencyjournals.