- Yesterday, Bitcoin's fall from $101,000 to a each day low of $93,000 led to $750 million in liquidations and brought on the cryptocurrency market to say no by 6.48% (roughly $240 billion).

- Main cryptocurrencies are beginning to recuperate, with some already posting double-digit value will increase.

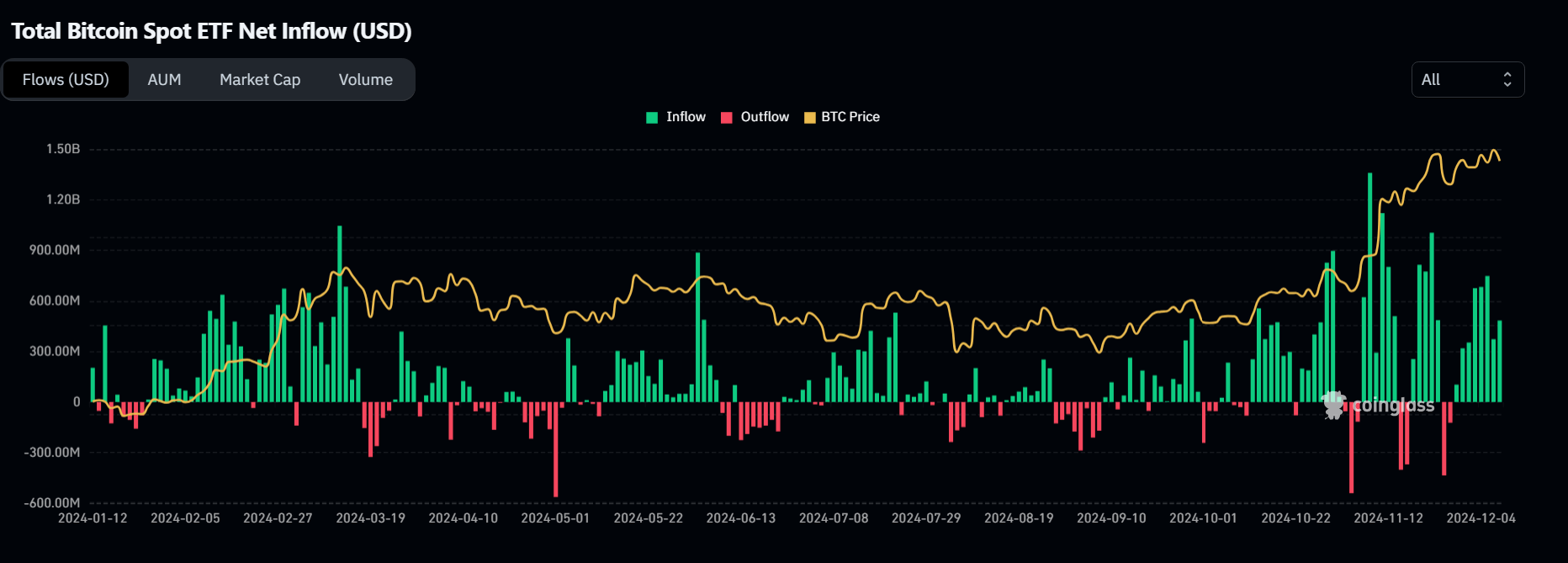

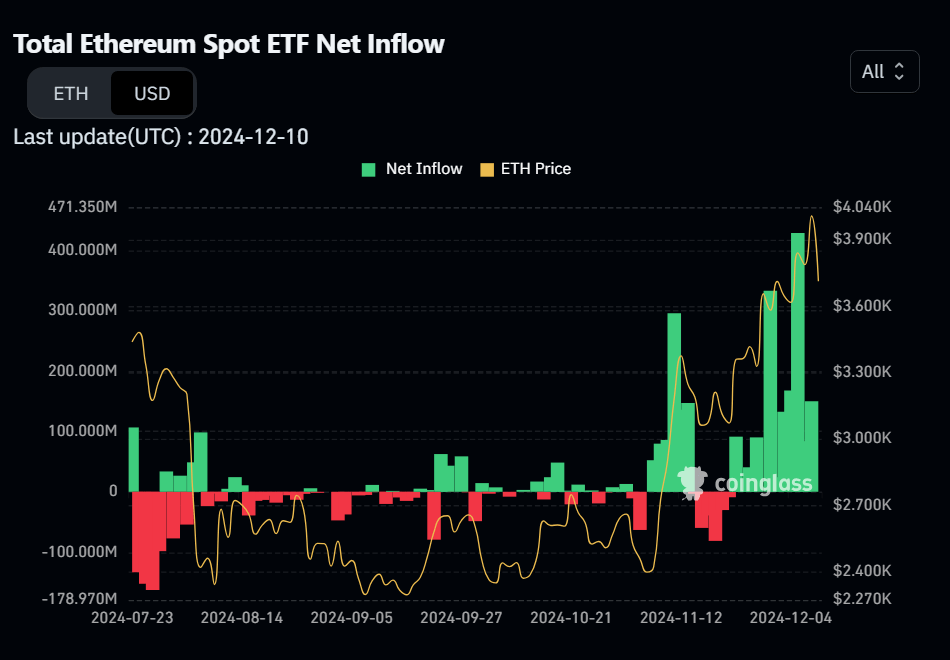

- In the meantime, Bitcoin and Ethereum spot ETFs proceed to report constructive inflows.

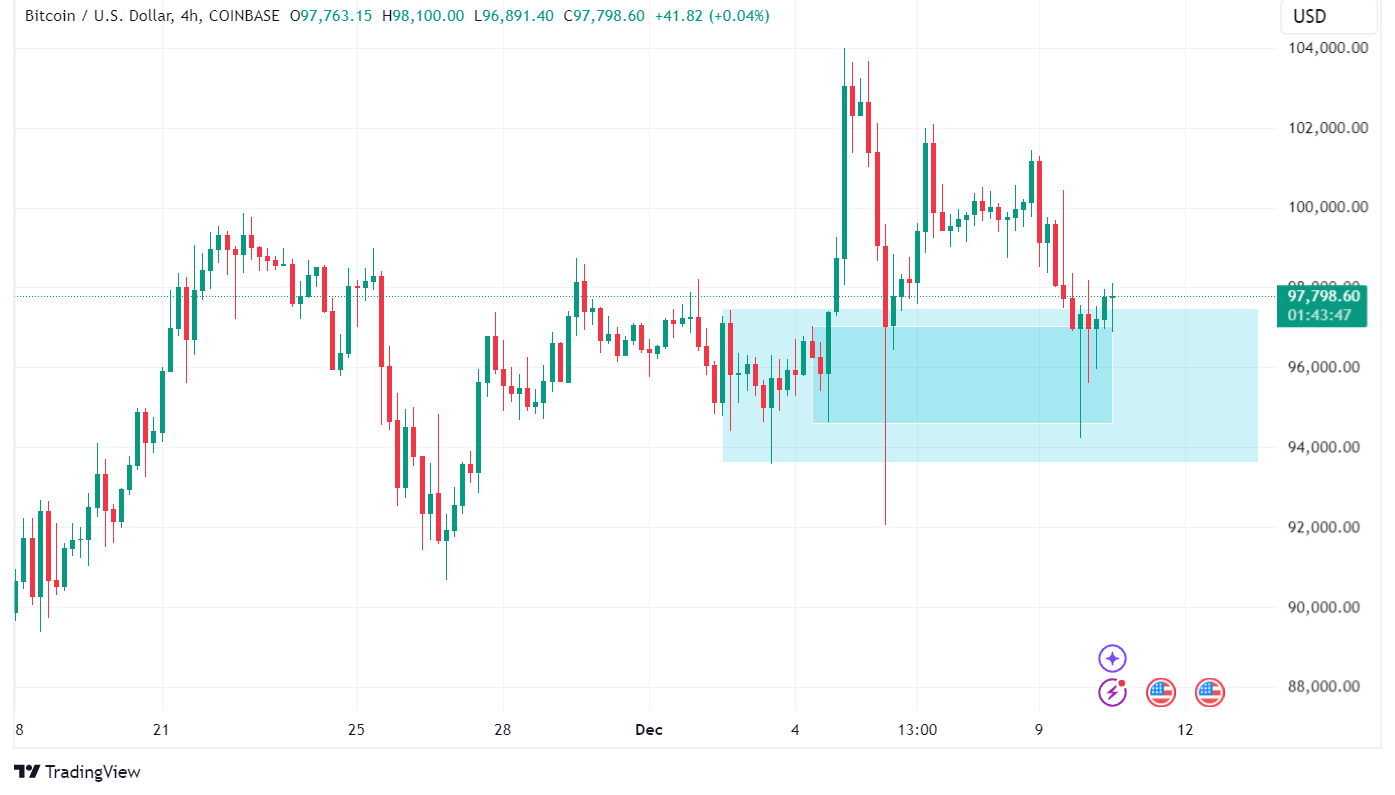

Bitcoin took an enormous hit in yesterday's buying and selling session, dropping from a gap value of $101,151 for the day to a low of $94,270 in U.S. afternoon buying and selling, earlier than closing at a excessive of $97,314. With a market energy of over 56%, the most important cryptocurrency by market capitalization weighed on the general market whereas main altcoins recorded double-digit losses.

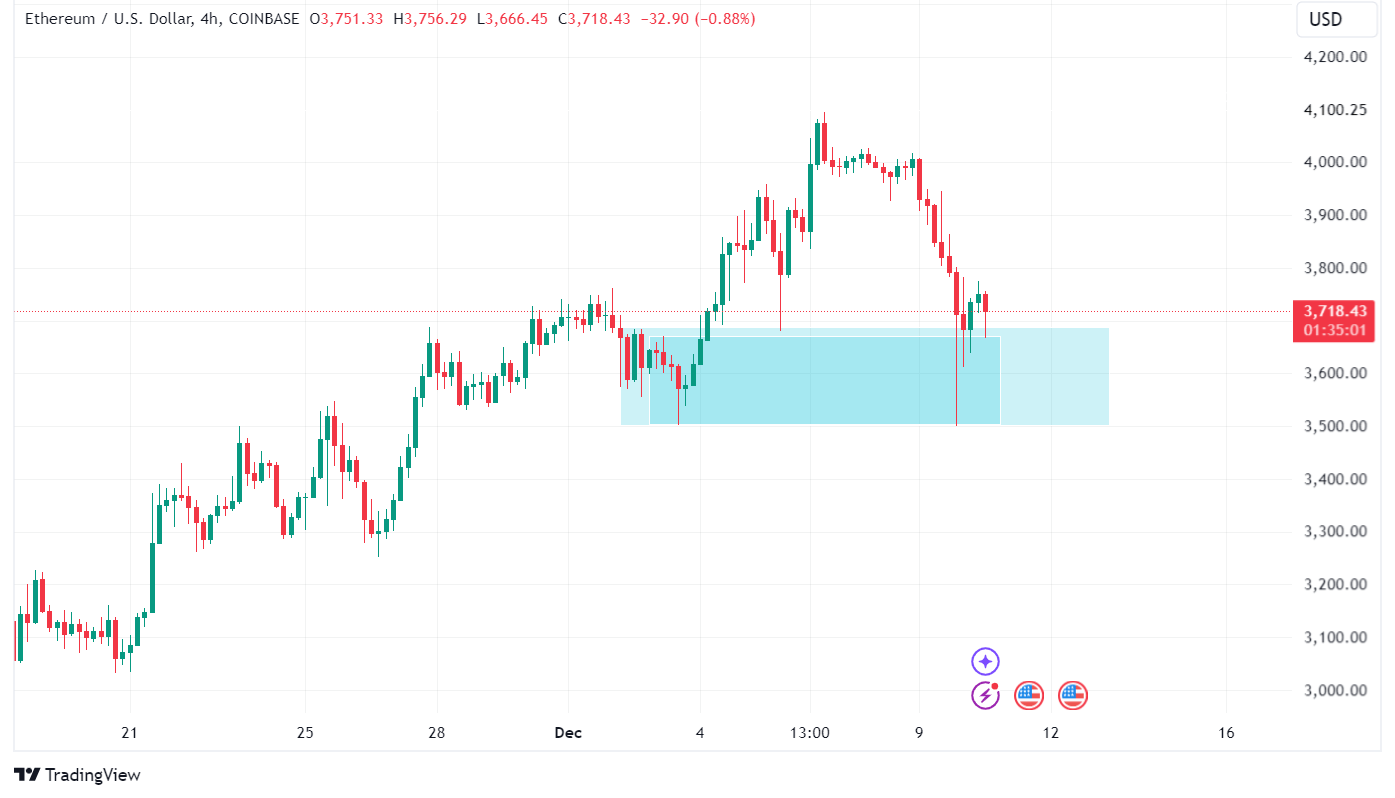

Nevertheless, a number of main altcoins seem to have discovered help initially of US buying and selling at this time. Ethereum hit an intraday low of $3,506 yesterday and is up 5% from that stage on the time of writing, whereas Solana is up 6.9% from yesterday’s low.

Has the sale ended?

Bitcoin value has fallen to the higher help zone of $97,463 and many of the promoting strain appears to have subsided, however the value continues to be hovering round help as no decisive initiative shopping for transfer has occurred but. There’s.

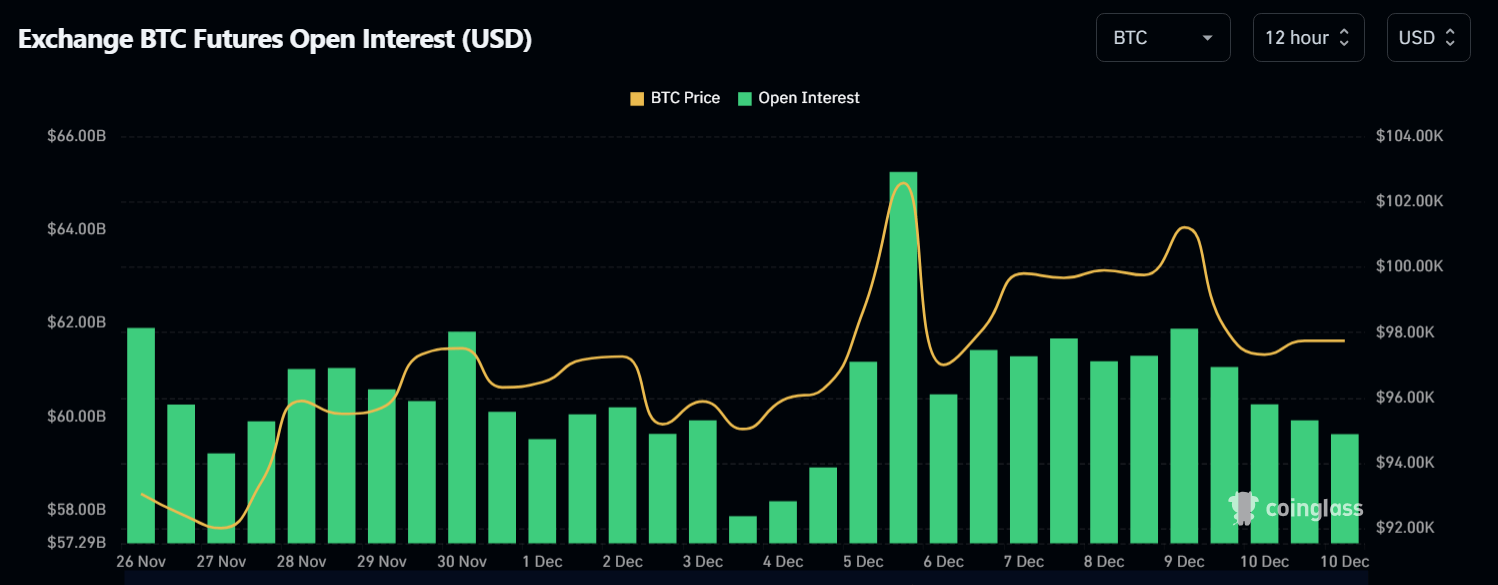

Open curiosity has been trending downward since yesterday as extra positions have been closed as a consequence of liquidations and revenue taking. Nevertheless, a transparent signal of a resumption of the uptrend is a rise in open curiosity mixed with constructive value motion, indicating that new positions are being opened.

Ethereum's value motion is just like that of the second-largest cryptocurrency by market capitalization, which is hovering round help ranges, ready for both a dominant shopping for motion to push the value up or sellers to maneuver the value decrease.

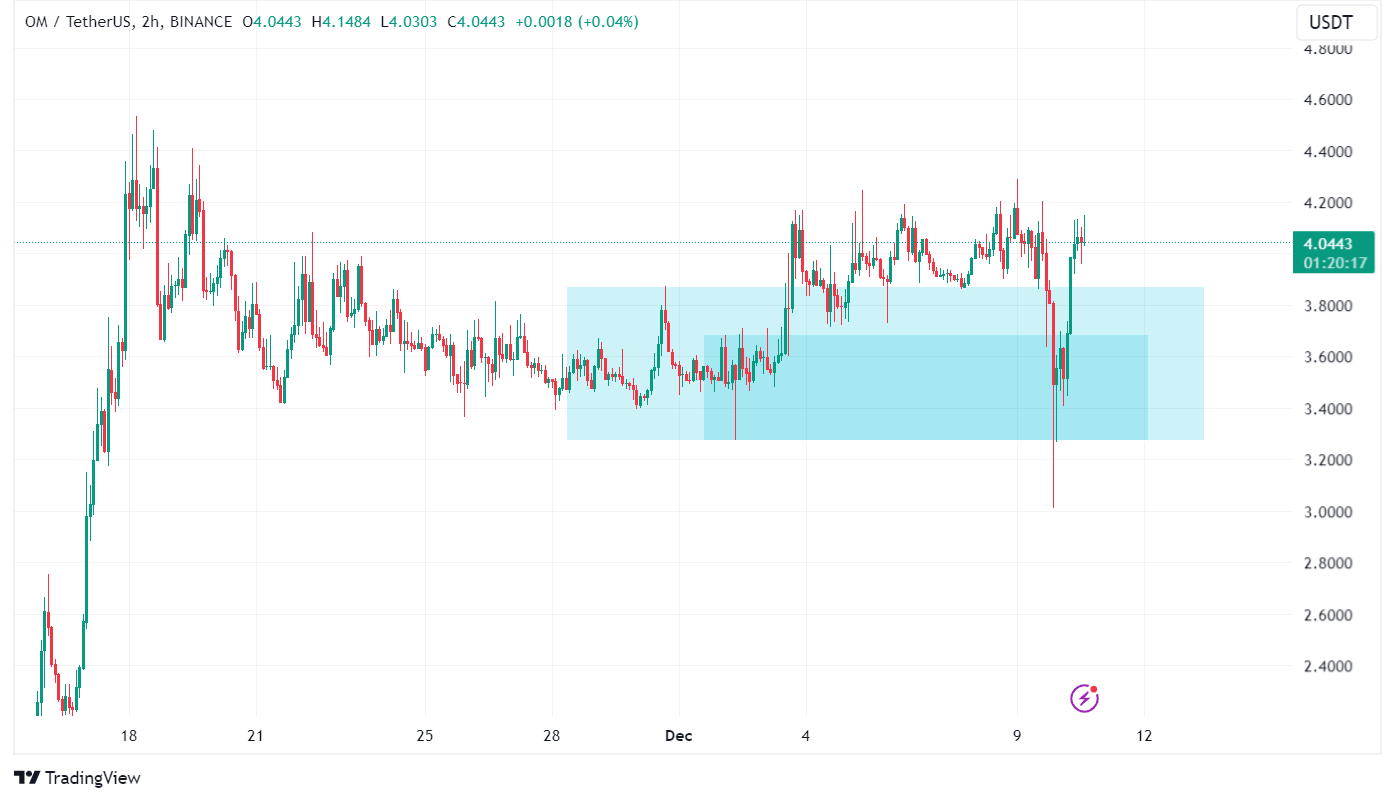

Elsewhere, some altcoins have virtually utterly escaped yesterday's stoop and are posting double-digit each day features on the time of writing. Mantra is a superb instance, with its value on the time of writing up 14.11% from yesterday's closing value.

Spot crypto ETF inflows stay steady

Yesterday's weak point doesn’t point out rising bearish sentiment, as inflows into US crypto spot ETFs stay constructive. The US Spot Bitcoin ETF recorded inflows of $2.77 billion final week and $483.6 million yesterday.

The Ethereum ETF adopted the same sample, posting weekly inflows of $836.8 million and $149.8 million yesterday.

Bitcoin is buying and selling at $97,900 on the time of publication, whereas Ethereum is buying and selling at $3,600.

(Tag Translation) Evaluation