Choices are sometimes main market indicators that mirror merchants' expectations for worth course and volatility. This dynamic is particularly true for Bitcoin, as the scale of the derivatives market has traditionally exceeded spot buying and selling.

In contrast to futures, that are a quite simple buying and selling car, choices buying and selling incorporates methods to hedge dangers and speculate on costs. and Volatility. The complexity of this buying and selling instrument implies that any adjustments out there, together with open curiosity, quantity, and the ratio of choices to futures OI, can have a major impression on the value of Bitcoin.

As choices change into a dominant pressure within the derivatives market, it is very important perceive how choices have an effect on intervals of elevated worth volatility.

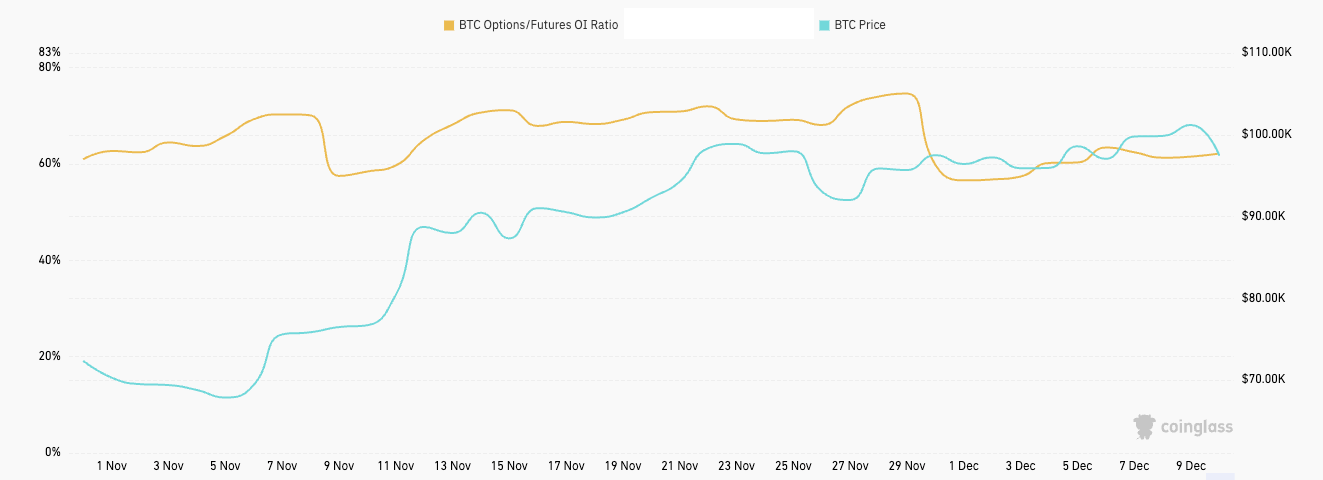

The choices/futures open curiosity ratio reveals how a lot affect choices merchants have on futures and perpetual contracts. As of December, this ratio remained in a comparatively modest vary, indicating that choice hedging conduct was influencing Bitcoin costs.

As Bitcoin reached an all-time excessive above $103,000, choices merchants ramped up hedging exercise to handle delta threat, which can have amplified worth volatility. The rise on this ratio signifies that choices weren’t only a secondary market, however performed an necessary position in worth discovery.

Nonetheless, as costs started to fall, the moderation of this ratio means that the affect of perpetual bonds and futures buying and selling strengthened once more. Nonetheless, the results of earlier hedging remained and should have exacerbated the value decline.

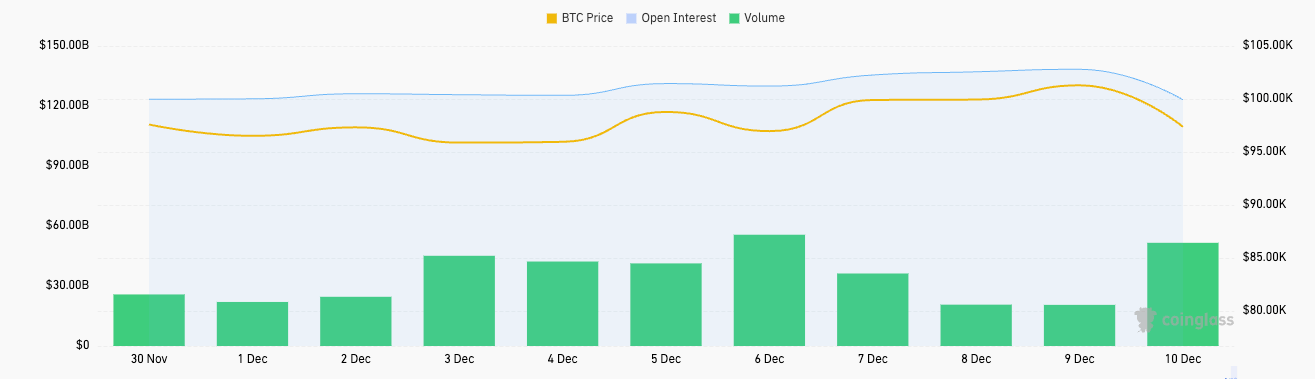

CoinGlass' open curiosity and buying and selling quantity knowledge additional helps this. Open curiosity elevated steadily in December after a short contraction following the ATH in late November. This regular progress signifies elevated market exercise as Bitcoin approaches its ATH.

This progress doubtless includes a mix of directional merchants speculating on continued worth will increase and volatility merchants focusing on increased implied volatility. The spike in quantity seen over the previous week follows a rise on this ratio, indicating important buying and selling exercise in choices. Nonetheless, as Bitcoin fell from its Dec. 9 ATH of $101,200, OI and quantity declined, exhibiting a pointy decline in participation.

The unwinding of those positions doubtless pushed the value down as demand for BTC decreased and promoting stress elevated as choice merchants who had beforehand hedged their delta exposures began exiting their trades.

The impression was additional exacerbated by decrease buying and selling volumes. Decrease quantity means much less liquidity, making costs extra delicate to giant trades. That is in step with the choices/futures ratio, which stays at a stage the place hedging exercise has a really important impression, particularly in illiquid environments. As choices merchants adjusted their positions to mirror the value decline, their hedging exercise doubtless included promoting Bitcoin futures and spots, placing additional downward stress on costs.

All of this knowledge factors to the truth that choices markets play an enormous position throughout instances of volatility. Open worth ratios mirror the rising affect of choices, exhibiting that choices at the moment are central to cost discovery. December confirmed how this impact can amplify worth will increase and reduces, particularly when liquidity is low.

The article “Choices have a big effect on Bitcoin volatility” was first printed on currencyjournals.