Bitcoin's all-time excessive of $107,000 displays the market's sturdy bullish sentiment over the previous two months.

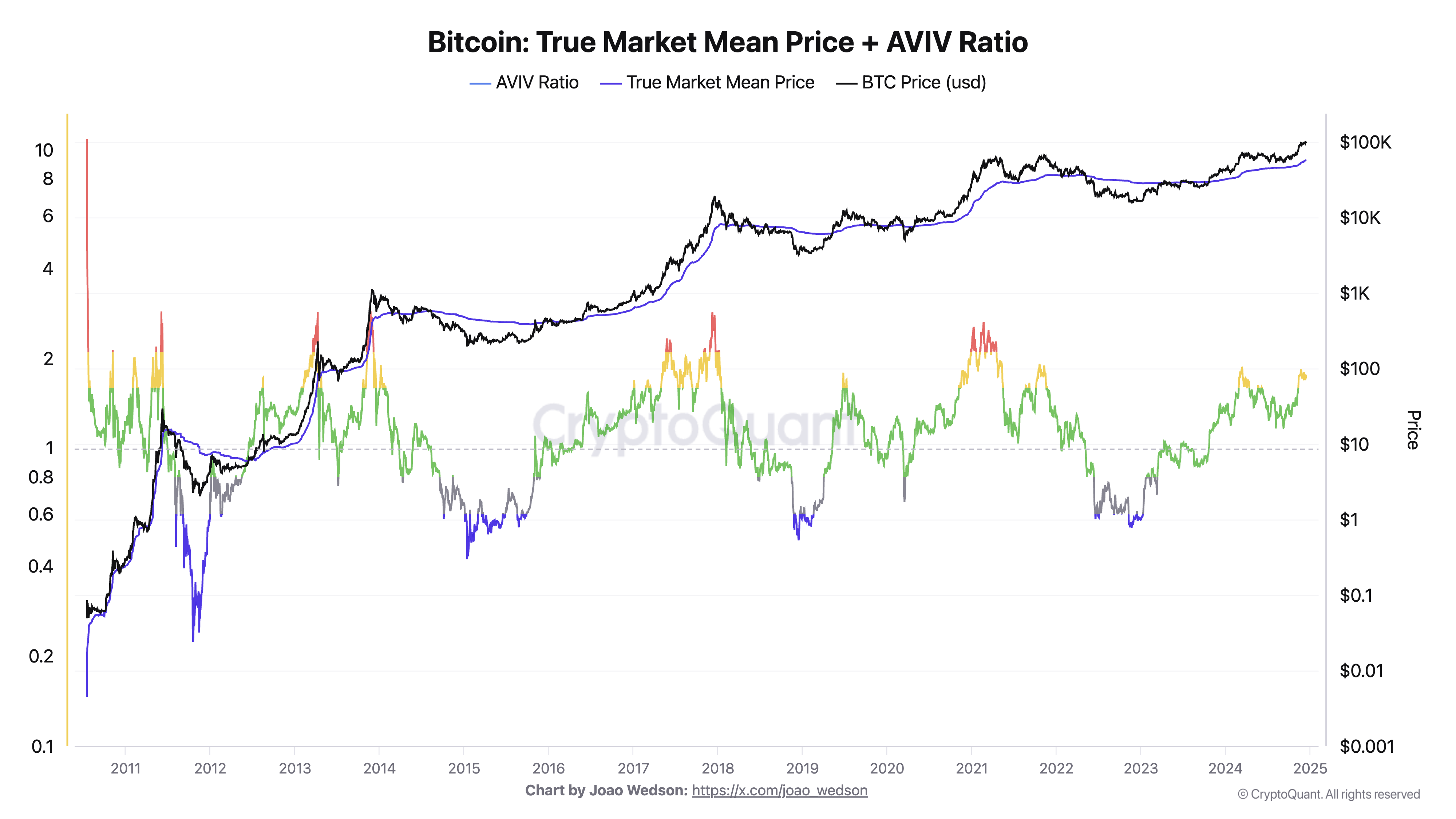

To grasp the reason for this yr's sustained upward momentum, we are able to check out the true market common worth (TMMP) and AVIV ratios. These on-chain metrics make clear investor conduct and supply perception into cost-based tendencies.

The true market common worth (TMMP) is the market's common acquisition value and is calculated by dividing the investor's ceiling by the efficient provide. Miner revenue realization is excluded to isolate investor-driven acquisition tendencies and measure Bitcoin's value base throughout the secondary market. The AVIV ratio is commonly analyzed in parallel with the TMMP and represents the ratio of precise market valuation to realized valuation. Measures how far present market costs deviate from their realized value base, indicating potential overbought or oversold circumstances. The AVIV ratio is commonly used to establish profit-taking alternatives and dangers throughout worth fluctuations.

TMMP has at all times been on a gentle upward pattern, however modifications within the tempo of enhance may help make clear market actions. As Bitcoin's worth has elevated, the true market common worth has progressively elevated all year long. The correlation between worth will increase and TMMP implies that worth will increase have been supported by sustained market curiosity. Because the yr progressed, the distinction between Bitcoin's worth and TMMP widened considerably, indicating vital unrealized positive factors for buyers. This growth has traditionally been noticed in mature bull markets, previous durations of elevated volatility or correction.

The AVIV ratio at first of 2024 is at a reasonable degree, in keeping with the market being in an accumulation section. By mid-year, this ratio had elevated as the worth of Bitcoin rose, reflecting elevated investor returns and a strengthening market. In December, this ratio reached a degree that has traditionally been related to overheating market circumstances, much like the sample seen in 2013, 2017, and 2021. Such a spike within the ratio happens when Bitcoin's market worth considerably exceeds its realized valuation, indicating that the market could also be approaching native ranges. peak.

CryptoQuant's information exhibits an fascinating sample. In 2024, the AVIV ratio and TMMP are comparatively secure in comparison with the earlier yr. This means that the market is maturing and changing into extra environment friendly, and acquisition prices have gotten much less risky. Traditionally, giant swings within the AVIV ratio and TMMP have typically adopted sharp worth actions that precede bear markets. Nonetheless, the decline in AVIV ratio and TMMP volatility all through 2024 signifies that investor conduct is extra secure and helps a extra resilient market construction.

Whereas the rise in TMMP signifies long-term investor confidence, the rise within the AVIV ratio highlights short-term correction dangers. Traditionally, durations of AVIV ratios above 2 have been adopted by profit-taking pressures weighing in the marketplace and worth retracements. December 2024 displays these historic tendencies, with rising AVIV ranges and vital deviations from TMMP indicating a potential cooling section forward. Nonetheless, the persistent curiosity of institutional buyers and the expansion of the derivatives market counsel that this cooling section is unlikely to final lengthy and is unlikely to be notably energetic.

Investor conduct in 2024 helps this evaluation. The constant enhance in TMMP means that buyers are accumulating Bitcoin at greater costs, elevating the general market value normal. On the similar time, the year-end spike within the AVIV ratio signifies profit-taking because the market soars to new highs. This mix of accumulation and realized positive factors displays a wholesome bull market construction, however raises warning about the opportunity of a short-term correction.

The put up How Put up-AVIV Ratio Surges as Bitcoin Reaches New ATH appeared first on currencyjournals.