- Bitcoin examined the $92,000 degree yesterday after falling from a weekly excessive of $102,000 amid mounting promoting stress.

- Macroeconomic elements are elevating doubts about market power amid issues about persistent inflation.

- Giant outflows have been recorded from spot crypto ETFs on Wednesday following the discharge of the Fed assembly memo.

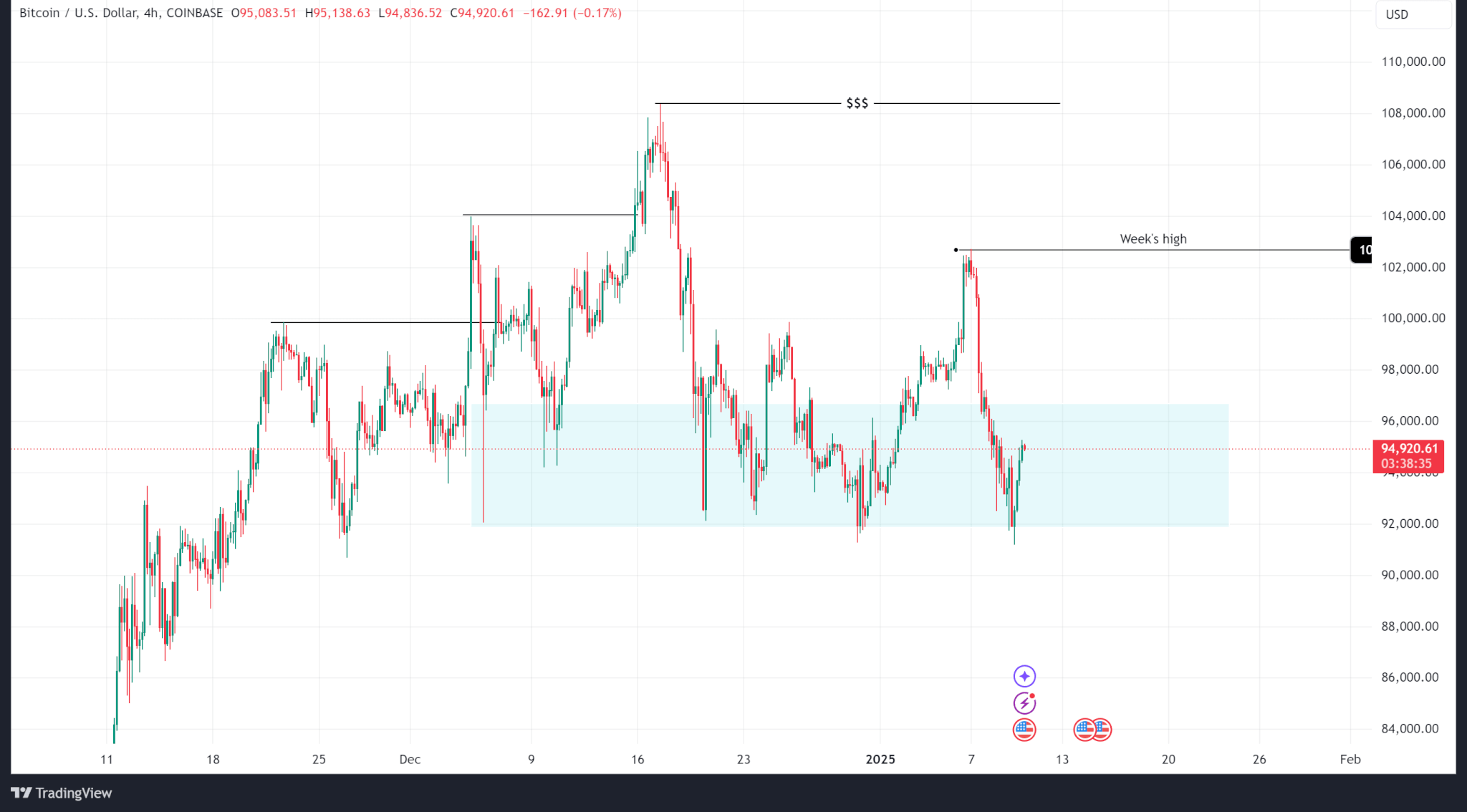

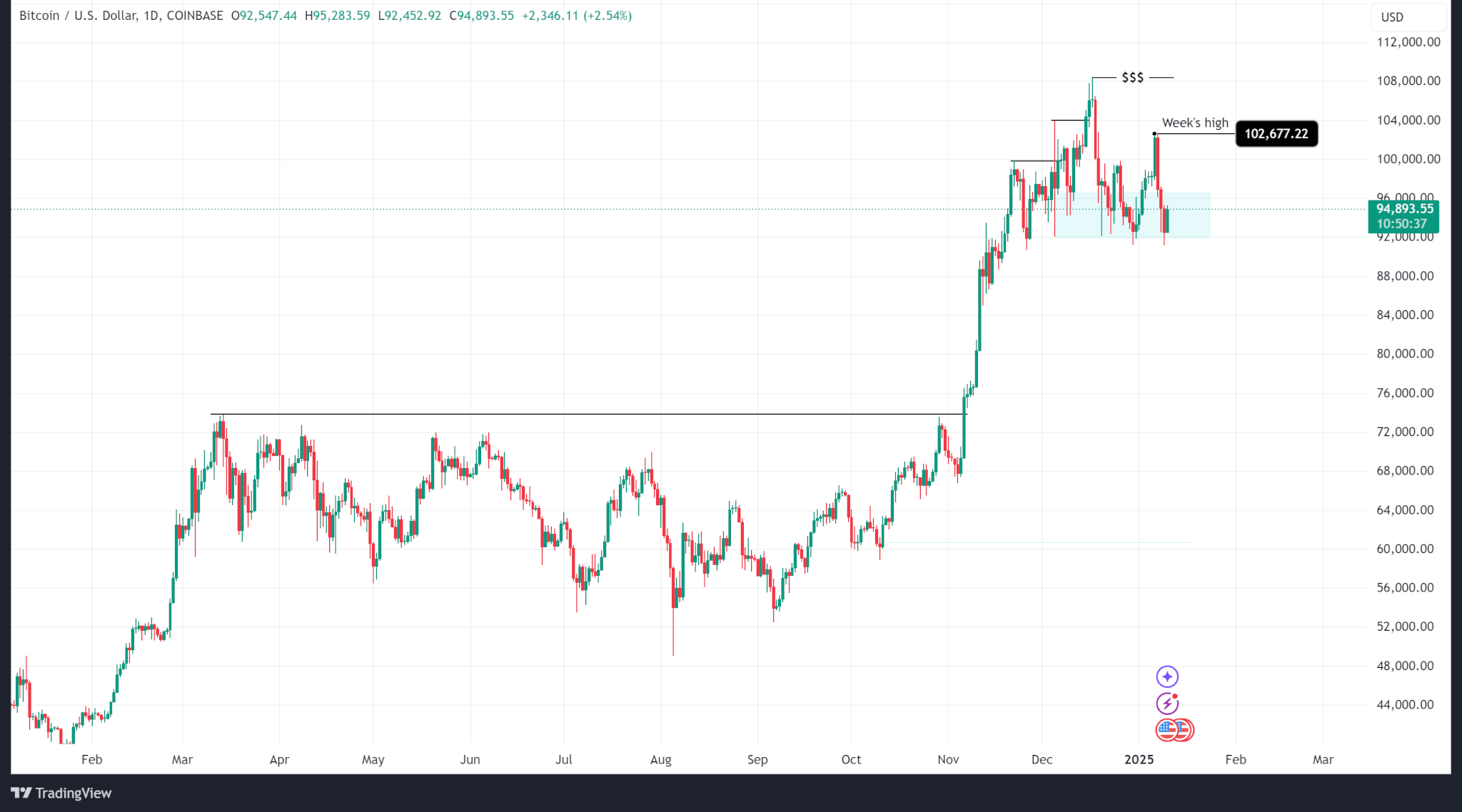

Bitcoin value has fallen from its all-time excessive of $102,667 on Tuesday, January seventh to $94,890.00 on the time of publication, however stays throughout the final H4 demand zone.

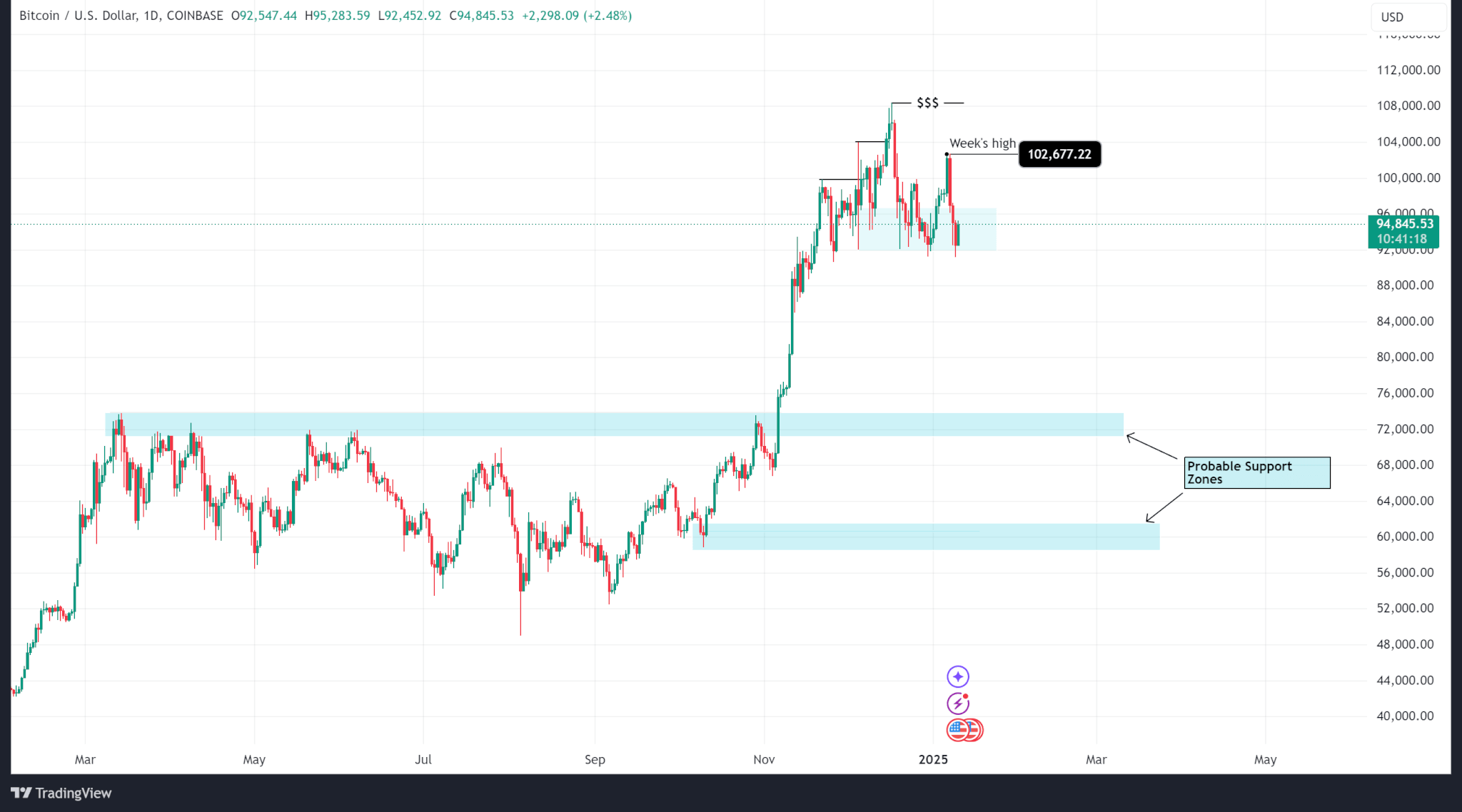

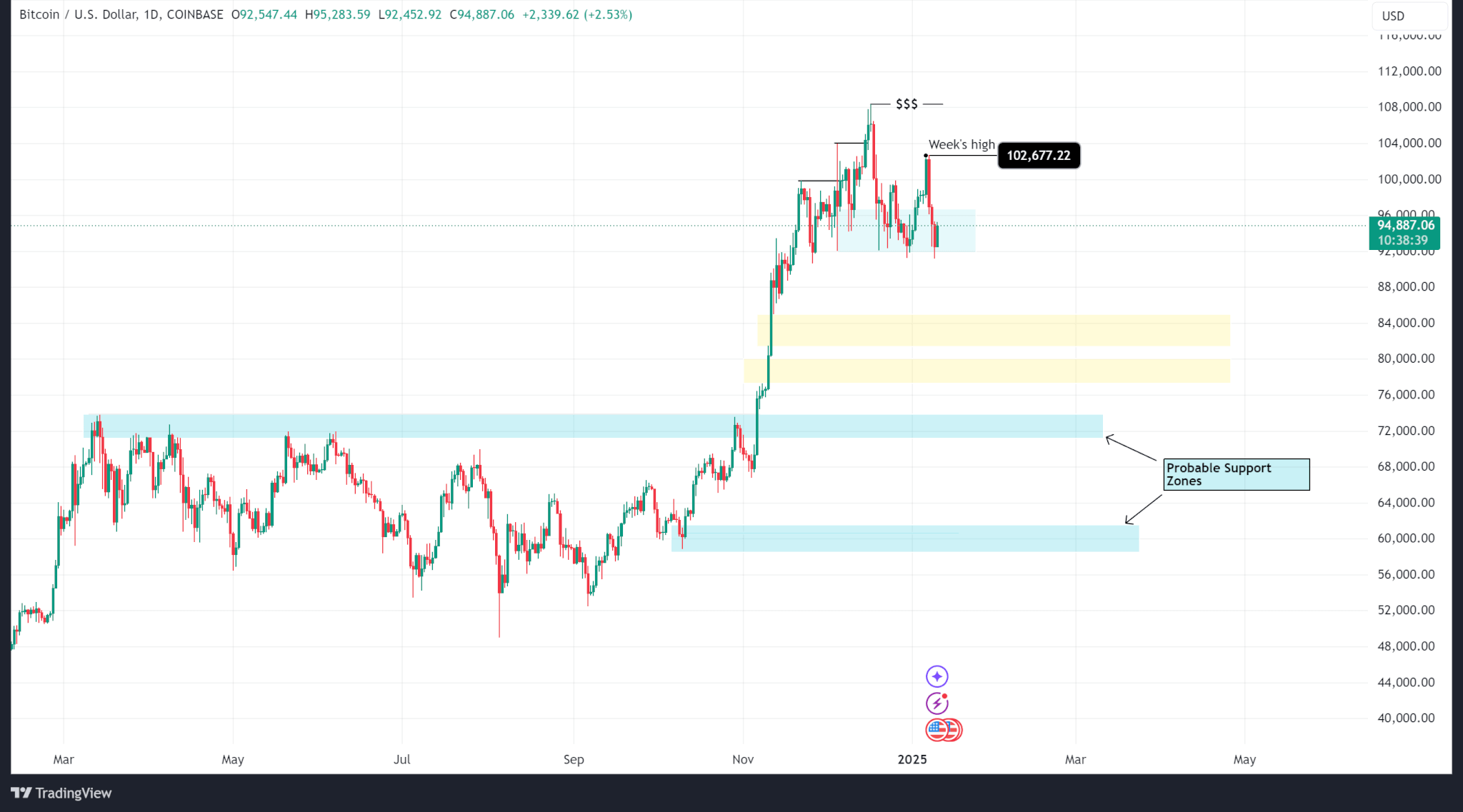

Whereas the demand zone between $92,000 and $97,000 could possibly be the ultimate assist degree on the H4 timeframe, a broader have a look at the market exhibits that BTC is in a premium zone on the every day timeframe. Due to this fact, even beneath $92,000, the value stays in bullish territory total.

The most effective technical purchase degree will probably be both the final break of the every day timeframe construction or the 50% Fibonacci degree from the low to the break.

There are two truthful worth gaps to which costs can react. Though these aren’t main zones, they might assist a continued return to the $108,000 exterior excessive or a brief reduction rebound earlier than a continued sell-off into the primary doable assist zone. .

That is all assuming Bitcoin falls beneath the $91,000 degree.

In the meantime, spot crypto ETFs recorded outflows on Wednesday, January 9, after the discharge of Fed assembly minutes exhibiting the Fed is cautious about inflation and the impression of Trump's subsequent coverage.

On Wednesday, the BTC ETF misplaced $568.8 million, whereas the ETH ETF misplaced $159.4 million with the most important outflow from Constancy (BTC $258.7 million, ETH $147.7 million). greenback).

(Tag translation) Evaluation